An agent that signed a financial POA needs to help the principal with the following responsibilities:

- Filing taxes

- Paying for health care, utility, and other bills

- Making investments

- Collecting debts

- Managing their property

- Applying for public benefits, such as Medicaid or veterans benefits

Why do I need a financial power of attorney?

Three Main Roles of a POA (Power of Attorney)

- Making decisions on the behalf of someone who has lost their mental capacity

- Handling legal and financial matters on behalf of the principal

- Making medical decision on behalf of the principal

What is a general financial power of attorney?

What Is a General (Financial) Power of Attorney? A general (financial) power of attorney is used by people who wish to assign someone to handle and decide on financial matters on their behalf. But unlike a durable power of attorney, a general (financial) power of attorney loses validity and effect on the following reasons.

Is a power of attorney responsible financially?

After the expiration of a power of attorney, the executor of the estate becomes responsible for legal and financial matters on behalf of the deceased principal. The executor of the estate is usually named by the will and is bound by its provisions. Essentially, while a power of attorney represents a principal while they are alive, the executor ...

Do I need a financial power of attorney?

The most common need for a power of attorney is potential incapacity. If you are incapacitated and cannot pay your bills or deal with your personal affairs, you need someone to take care of those tasks to transact in your name.

What is a power of attorney?

In short, a power of attorney has the authority to take legal action on behalf of another person–the principal. Let’s take a look at what that means for both of you.

What are the two types of power of attorney?

The two primary types of power of attorney are financial power of attorney and medical power of attorney . While the financial power of attorney ’s role concerns legal and financial affairs, the medical power of attorney handles health and medical decisions. For the purposes of this article, we’ll focus on financial power of attorney.

What is the job of a tax accountant?

Matters pertaining to taxes, including dealing with the IRS and revenue departments, in addition to preparing, signing, and filing tax returns

Can a power of attorney be limited?

Most power of attorney documents are drawn up in that way. It’s possible that the scope or duration of your power may be limited under the power of attorney document, but if not specified, then your authority and duration are unlimited.

What is a financial power of attorney?

Naming a person as your financial power of attorney (agent) is an integral part of a comprehensive estate plan. This selection allows the agent to make important financial decisions on your behalf during times of potential incapacity. But what does it mean FOR the person named? There are certain duties and obligations assigned to your agent, and it is important that both parties understand these duties and obligations.

When accepting the authority granted under a financial power of attorney, a fiduciary relationship is established with the?

When accepting the authority granted under a financial power of attorney, a fiduciary relationship is established with the principal (the person represented) and the agent. This is a special legal relationship that imposes duties which continue until the agent resigns or the power of attorney is terminated, suspended, or revoked by the principal or by operation of law.

What is a complete account of receipts, disbursements, and other actions of you as agent?

a complete account of receipts, disbursements, and other actions of you as agent that includes the source and nature of each receipt, disbursement, or action, with receipts of principal and income shown separately;

Why is it important to name an agent?

By doing so it is possible to avoid long drawn-out court processes when it comes time to pay bills, access bank accounts, etc. during times of emergency. Just remember – power of attorney documents CEASE to have power when the principal passes away. Contact Crain & Wooley if you have questions or concerns regarding naming an agent or being named AS an agent.

How to disclose your identity as an agent?

disclose your identity as an agent when you act for the principal by writing or printing the name of the principal and signing your own name as “agent” for that person.

What a Financial Power of Attorney Can Do

A financial power of attorney is a document that in regards to your financial matters can give as little or as much responsibility as you wish to your designee.

Is a Financial Power of Attorney All or Nothing?

The wonderful thing about a financial power of attorney is that it includes only what you want it to.

What If My Financial Situation Changes?

There is what is referred to as a springing power of attorney. With this type of financial power of attorney, you can give your designee the ability to make decisions only when you are incapacitated, or at some other time or event to occur in the future.

Let Us Help With your Financial Power of Attorney

If you have questions about setting up a power of attorney of any type, the experienced staff at Atlanta Wills + Trusts Law Group by Refeca Law LLC are here to help answer them.

Who should be named in a power of attorney?

It must be someone who you can trust implicitly and who is also willing to take on the responsibilities.

When does a power of attorney expire?

When does a Power of Attorney expire? The POA ends upon the death of the principal. After the principal dies, the executor (in the case of a will) or trustee (in the case of a trust) takes over from that point forward.

What powers are given to the person who becomes the agent?

What powers are given to the person who becomes the agent? In some POAs, there are limits placed on the person, but in most cases the power is “general.” In these cases, the agent can do whatever the principal would do with respect to his or her own property. That includes opening bank accounts, buying and selling property, managing investments, filing taxes, cashing checks and closing accounts. An agent is a considered a fiduciary of the principal, which means that he has a legal duty to act in the principal’s best interest.

What is an agent in real estate?

An agent is a considered a fiduciary of the principal, which means that he has a legal duty to act in the principal’s best interest.

What is the person who signs a POA called?

The person who signs the POA is called the “principal” and the person to whom authority is given is referred to as the “attorney in fact” or the “agent.”. What powers are given to the person who becomes the agent? In some POAs, there are limits placed on the person, but in most cases the power is “general.”.

When is a POA effective?

A POA that is drafted to be immediate is effective the moment it’s signed by the principal.

Who signs a POA?

The person who signs the POA is called the “principal” and the person to whom authority is given is refer. The concept of a Power of Attorney (POA) sounds simple, but there is a lot to know about this important part of an estate plan, says the Rushville Republican in “Financial power of attorney responsibilities.”.

What is an enduring power of attorney?

The enduring power of attorney agreement gives the appointed attorney the abilities of a power of attorney in the case that the person becomes incapable of doing so. If the person never becomes mentally incapable, the power of attorney agreement essentially does nothing.

What is a POA?

As people get older, it is generally recommended that they appoint a power of attorney (POA). Without fully understanding the extent of the duties and responsibilities, people often accept the role, intending to be as helpful as possible during difficult times in their loved one’s life. Generally speaking, the power of attorney is responsible for making financial and legal decisions on the person’s behalf, in the case where they become incapable of doing so themselves. Usually, the attorney can make any financial or legal decision the person could have made themselves. Before accepting the role of the Power of Attorney, it is important to understand the role (what you might be expected to do) and the rights you have available to you as the person’s attorney.

What is the job of a prescribed record?

Keep prescribed records and produce the prescribed records for inspection and copying at the request of the adult.

Can a power of attorney make a will?

The power of attorney is sometimes in a position where they must do a lot of the estate planning for the incapable person and often times this means gift giving before their death. It’s important to understand that a power of attorney does not have any authority to make a will or change an existing will on the incapable person’s behalf, though the attorney can handle some estate related financial tasks.

Can an adult invest in power of attorney?

Unless the enduring power of attorney states otherwise, invest the adult’s property only in accordance with the Trustee Act;

Is it hard to have a power of attorney?

In the end, the role of a power of attorney can be a difficult task at times. It can be stressful managing one’s own financial and legal affairs, let alone a second person’s. If you are unclear of the role/responsibilities of a power of attorney, contact an experienced estate lawyer today. We can help ensure that you are properly prepared to take on the position as a person’s power of attorney.

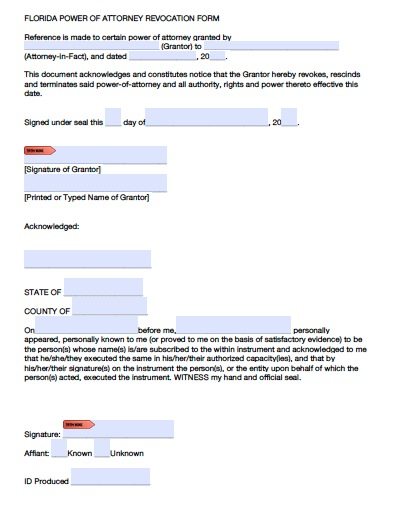

Can an attorney resign as a power of attorney?

In some cases, the attorney no longer wishes to continue in this position as the person’s attorney. At any time, the attorney is able to resign as the power of attorney and relieve themselves of all the duties of the power of attorney. To do so, a letter of resignation must be given to the person and any other people acting as a power of attorney.

How Does a Power of Attorney for Finances Work?

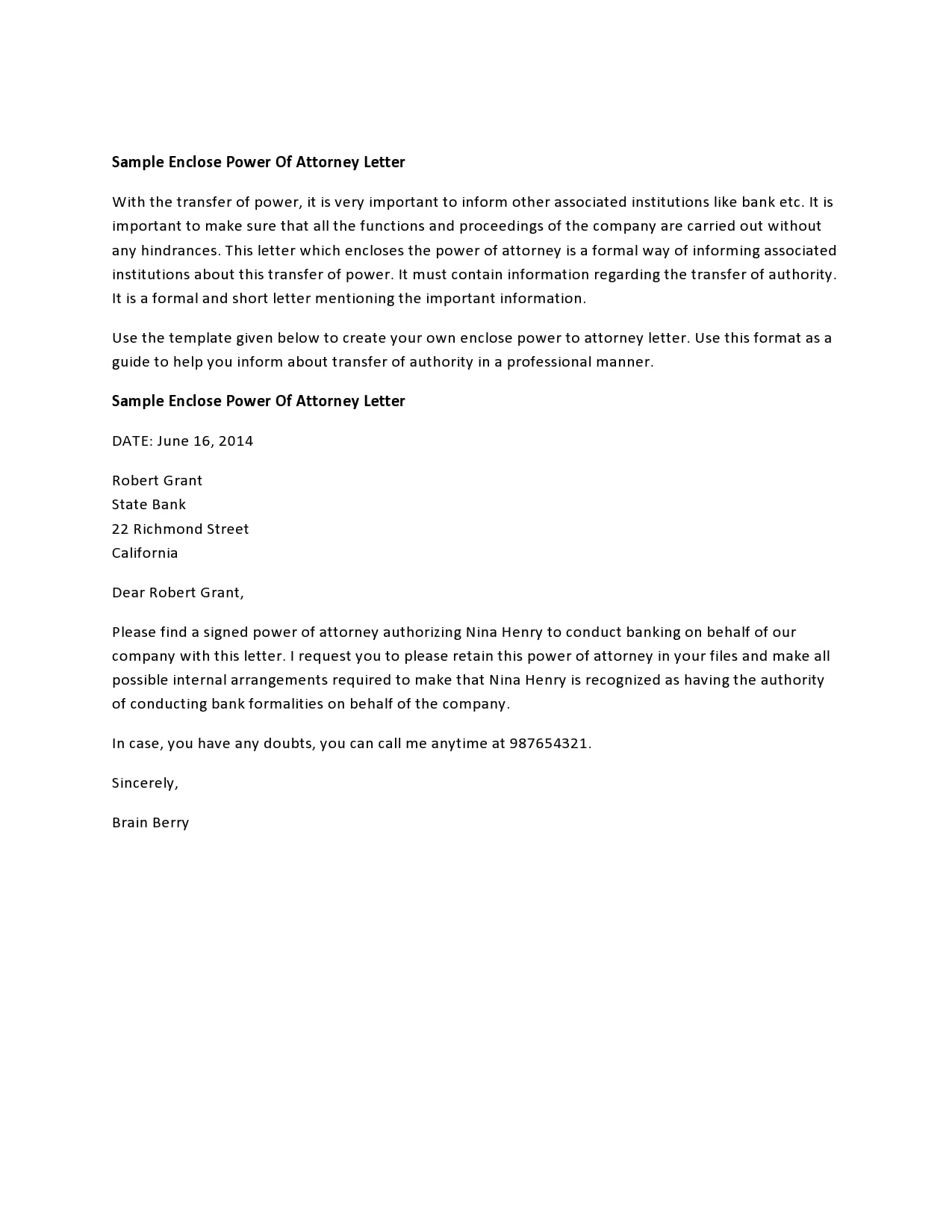

Once the power of attorney is executed, the original is given to your agent, who may then present it to a third party as evidence of your agent’s authority to act for you ( such as withdrawing money from your bank account, or signing papers for you at a real estate closing).

What Is a Financial Power of Attorney?

A financial power of attorney is a particular type of POA that authorizes someone to act on your behalf in financial matters. Many states have an official financial power of attorney form.

What Is Power of Attorney?

A power of attorney (or POA) is a legal document that authorizes someone to act on your behalf.

When Does a Power of Attorney Become Effective?

Depending upon how it is worded, a POA can either become effective immediately, or upon the occurrence of a future event.

What Can an Agent Do?

Some people grant an agent the authority to conduct all financial matters, while others only authorize a single financial transaction (such as signing documents at a real estate closing). The official POA forms of some states list various types of financial matters, such as:

How does a POA work?

Financial Power of Attorney: How It Works. A durable financial power of attorney can avoid financial disaster in the event you become incapacitated. You can also use a POA to allow someone to transact business for you if you are out of town or otherwise unavailable. If you need to give another person the ability to conduct your financial matters ...

What happens to your agent if you revoke your authority?

The authority also ends if you revoke it, a court invalidates it, your agent is no longer able to serve and you have not appointed an alternative or successor agent, or (in some states), if your agent is your spouse and you get divorced.

Why Do You Need a Power of Attorney?

A power of attorney allows someone else to take care of your parent’s affairs. It can be temporary, for example paying bills while someone is on a long vacation, or lasting, such as making medical decisions after a car accident. As parents get older, it makes sense to be prepared for health issues that may mean they need help. A POA allows children, or another agent, to step in when the need arises. Jeter states, “Any person with an elderly parent should have the conversation with their parent about getting a power of attorney in place if one does not already exist. In my practice, I advise people not to wait when it comes to getting a power of attorney because there are just too many things that can come up in life.”

How to handle a power of attorney?

You may consider choosing clergy, a family friend or another community member as an agent. You can also hire a professional to handle the power of attorney. Banks and trust companies may take on this role, as can accountants and lawyers. Keep in mind that professionals are likely to charge fees, which can quickly become costly. If you do choose to hire a professional, interview them carefully, and make sure they understand your parent’s wishes. You may also wish to choose a professional based on what the POA is for, such as choosing an accountant to handle financial affairs.

How does a durable power of attorney work?

A durable power of attorney lasts after the principal’s incapacitation. What you can do with a durable POA is based on both the document and state laws. In some cases, you may only be able to manage the principal’s finances and will need a separate medical power of attorney to make health care decisions. These POAs are used when a person can no longer handle their affairs, and it can end in several ways. They can be revoked upon the principal’s death or when a guardian is appointed. The principal can revoke the POA if they’re no longer incapacitated. For example, if a person wakes from a coma, they can take back control of their finances. There may also be conditions in the document that, if fulfilled, end the POA. A durable power of attorney comes into effect on the day it’s signed unless otherwise specified.

What is a POA in 2021?

Last Updated: July 16, 2021. A power of attorney (POA) can be an important element of planning for your elderly parent’s future. It allows another person to take action on your parent’s behalf, ensuring bills get paid and medical decisions can be made in the unfortunate circumstance that your elderly parent is unable to do those things on their own ...

How many witnesses do you need to sign a letter of attorney?

A notary public or attorney must witness your loved one signing the letter of attorney, and in some states, you’ll need two witnesses. The chosen agent must be over 18 and fully competent, meaning they understand the implications of their decision. When filling out the form, the parent must specify exactly which powers are transferring to the agent.

What is a medical POA?

A medical POA is different from a living will , which states what medical procedures a principal does and does not want done. In the case of a medical POA, the agent can make all health care decisions for the principal. Because of this, your parent needs to make their wishes known to the agent before they’re incapacitated. The American Bar Association has detailed information available about medical powers of attorney and the process of giving someone that power.

Why do you need a power of attorney for an elderly parent?

Common Reasons to Seek Power of Attorney for Elderly Parents. Financial Difficulties: A POA allows you to pay the bills and manage the finances for parents who are having difficulty staying on top of their financial obligations.

Popular Posts:

- 1. why would i get a letter from the ohio attorney general collections enforcement agency

- 2. how to ask for attorney fees reimbursement from work

- 3. how to gain power of attorney over someone

- 4. who is in run off for louisiana state attorney

- 5. who is attorney general now

- 6. who is district attorney in washoe county nv

- 7. who is attorney eric holder

- 8. where to file estate notice with pa attorney general

- 9. what skills do you need to be a defense attorney

- 10. what will defense attorney do to witness