Can a power of attorney make changes to a pod?

Jan 23, 2006 · Those relationships are undisturbed. A principal could still name the AIF as a POD beneficiary after the AIF was appointed, but the AIF cannot name himself as a POD beneficiary unless the power of attorney specifically provides for it. …

Can a PoA be used by a bank employee?

Jun 26, 2019 · At Weisinger Law Firm, PLLC, our Texas estate planning attorneys have deep experience handling the full range of issues related to power of attorney. We provide compassionate, fully personalized legal guidance to our clients. For a free review of your case, contact our law firm today (210) 201-2635.

Can a Bank refuse to recognize an old power of attorney?

Jun 04, 2012 · Answer: A basic rule of powers of attorney is that the attorney-in-fact cannot add, change or remove POD beneficiary designations without specific stated authority within the power of attorney. As to changing the title of the account, I don't see the need for it. The attorney-in-fact's name doesn't need to be included in the account's styling, so I suspect that your bank …

When is a power of attorney (POA) no longer valid?

Jun 21, 2013 · A Power of Attorney (POA) is only effective during the principal's lifetime. It terminates when the principal dies. So if the principal is alive, and if the POA grants the agent the power to do so, the agent can change the beneficiaries who would receive the remaining account at the owner's death.

What three decisions Cannot be made by a legal power of attorney?

You cannot give an attorney the power to: act in a way or make a decision that you cannot normally do yourself – for example, anything outside the law. consent to a deprivation of liberty being imposed on you, without a court order.

What are the disadvantages of power of attorney?

What Are the Disadvantages of a Power of Attorney?A Power of Attorney Could Leave You Vulnerable to Abuse. ... If You Make Mistakes In Its Creation, Your Power Of Attorney Won't Grant the Expected Authority. ... A Power Of Attorney Doesn't Address What Happens to Assets After Your Death.More items...•Sep 4, 2018

Can power of attorney override will?

If your loved one made an Advance Decision (Living Will) after you were appointed as their attorney, you can't override the decisions made in their Advance Decision.

What are the 4 types of power of attorney?

AgeLab outlines very well the four types of power of attorney, each with its unique purpose:General Power of Attorney. ... Durable Power of Attorney. ... Special or Limited Power of Attorney. ... Springing Durable Power of Attorney.Jun 2, 2017

Who can override a power of attorney?

The Principal can override either type of POA whenever they want. However, other relatives may be concerned that the Agent (in most cases a close family member like a parent, child, sibling, or spouse) is abusing their rights and responsibilities by neglecting or exploiting their loved one.Nov 3, 2019

On what grounds can a power of attorney be revoked?

The death, incapacity or bankruptcy of the donor or sole attorney will automatically revoke the validity of any general power of attorney (GPA). GPAs can be revoked by the donor at any time with a deed of revocation. The attorney must also be notified of the revocation or the deed of revocation won't be effective.

Does power of attorney affect a will?

A will protects your beneficiaries' interests after you've died, but a Lasting Power of Attorney protects your own interests while you're still alive – up to the point where you die. The moment you die, the power of attorney ceases and your will becomes relevant instead. There's no overlap.Mar 26, 2015

Can a power of attorney see a will?

The terms of a Power of Attorney indicates when it takes effect and the scope of an Attorney's powers. As mentioned above, a Donor can expressly deny Attorneys the right to see the Donor's Will. However, terms which expressly allow Attorneys to see the Will are not required.

Can a will be changed if someone has dementia?

A person with dementia can still make or change a will, provided you can show that you understand its effect. Unless your will is very simple, it's advisable to consult a solicitor who specialises in writing wills.

What is the most powerful power of attorney?

General Durable Power of Attorney Definition A general durable power of attorney both authorizes someone to act in a wide range of legal and business matters and remains in effect even if you are incapacitated. The document is also known as a durable power of attorney for finances.Jul 13, 2021

What is the difference between a power of attorney and a lasting power of attorney?

An ordinary power of attorney is only valid while you have the mental capacity to make your own decisions. If you want someone to be able to act on your behalf if there comes a time when you don't have the mental capacity to make your own decisions you should consider setting up a lasting power of attorney.Jan 13, 2022

Can power of attorney keep family away?

In most cases, an adult child who has power of attorney cannot use power of attorney to limit others' access to their parent. If there is a reason to limit access, the child serving as power of attorney could obtain a court order on the parent's behalf.

What does "pod" mean in a will?

The POD (pay on death) trumps any will. POD designations avoid probate, the account does NOT become part of the estate for probate. Usually with the presentation of a death certificate the financial institution will pay the proceeds to the person named on the POD designation...

When does a POA terminate?

It terminates when the principal dies. So if the principal is alive, and if the POA grants the agent the power to do so, the agent can change the beneficiaries who would receive the remaining account at the owner's death.

James P. Frederick

This is a huge no-no. The POA holder is a fiduciary and is not allowed to self-deal in this manner. A court will almost certainly set this aside. The agent might also be subject to sanctions for breach of fiduciary duty, conversion, and the like.

Michael G. Gorenflo

This question has a lot of variables involved. Some power of attorney instruments specifically allow for the attorney in fact to make these kind of changes, and can even authorize self dealing. However, there are usually limitations (only can self deal if AIF is a child, grandchild, spouse), but you said the AIF was the child of the deceased.

Steven J. Fromm

Retain estate litigation counsel to have her immediately removed as POA and to have an accounting and surcharge action brought against her. Call attorneys today in your area to find someone to get involved here. The longer you wait the more that will be stolen...

What does a POA mean?

Second, the POA may be “springing.” That means that it will only become effective upon the incapacitation of the principal . Incapacitation must be proven according to the terms spelled out in the POA document. For example, a generic springing POA will usually indicate that at least one physician must have examined the principal and determined they are unable to manage their affairs due to mental incapacity, etc. In such a case, the bank will want to see the POA itself, the physician’s letter (s) and any other documentation needed to satisfy the requirements for activating the POA and giving you the power to act on behalf of the principal.

What to do if a bank is acting unreasonably?

If the bank is acting unreasonably, though, hiring an attorney to place a phone call or send a strongly worded letter to an employee higher up at the bank (i.e. with more authority regarding these matters) may resolve this troublesome issue and grant you access to the appropriate accounts. If all paperwork is otherwise in order, some attorneys need only threaten legal action and the bank is suddenly very happy to cooperate.

What does "durable" mean in a POA?

Durable means that the POA continues to be effective even after the principal becomes incapacitated and is no longer able to manage their finances. Seniors and their caregivers should try to use a durable power of attorney whenever possible to avoid this problem.

How to file a POA?

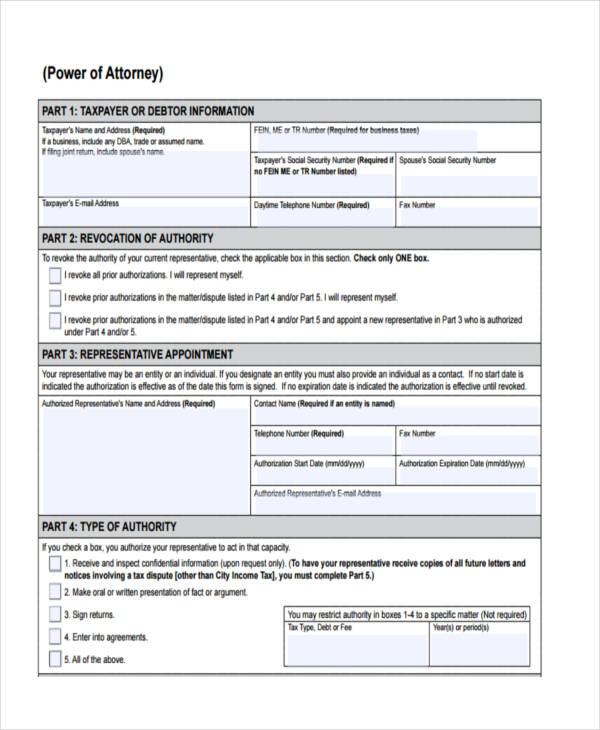

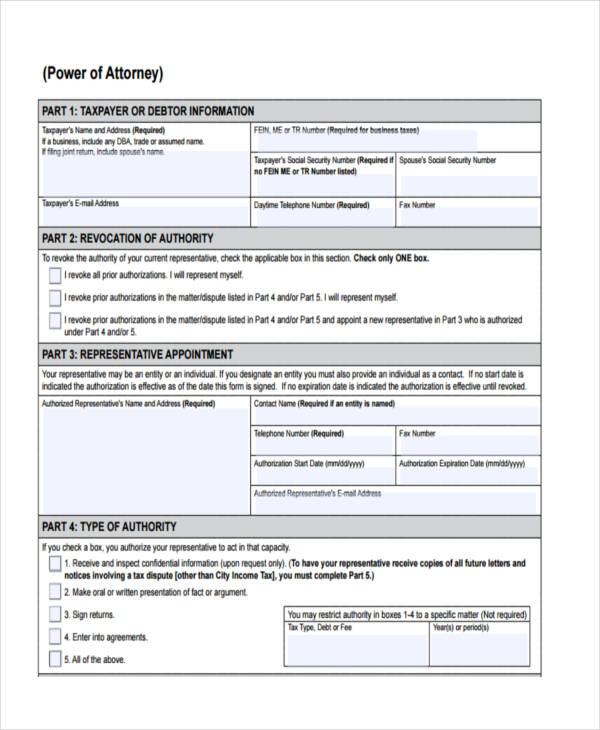

What a Financial POA Can Do: 1 Access the principal’s financial accounts to pay for health care, housing needs and other bills. 2 File taxes on behalf of the principal. 3 Make investment decisions on behalf of the principal. 4 Collect the principal’s debts. 5 Manage the principal’s property. 6 Apply for public benefits for the principal, such as Medicaid, veterans benefits, etc.

Why is POA important?

According to geriatric care manager and certified elder law attorney, Buckley Anne Kuhn-Fricker, JD, this provision is important because it gives a principal the flexibility to decide how involved they want their agent to be while they are still in possession of their faculties. For example, a financial agent could handle the day-to-day tasks of paying bills and buying food, while the principal continues to make their own investment and major purchasing decisions.

What is POA document?

POA documents allow a person (the principal) to decide in advance whom they trust and want to act on their behalf should they become incapable of making decisions for themselves. The person who acts on behalf of the principal is called the agent. From there, it is important to distinguish between the two main types of POA: medical and financial. ...

Can an appointed agent make broad decisions?

The powers of an appointed agent can be broad or narrow, depending on how the POA document is written. Here are a few examples of the kinds of decisions an agent can make with each type of POA.

What is a POA in medical terms?

A medical POA (also known as health care POA) gives a trustworthy friend or family member (the agent) the ability to make decisions about the care the principal receives if they are incapacitated. A financial POA gives an agent the ability to make financial decisions on behalf of the principal. It is common to appoint one person to act as an agent ...

What medical care does a principal receive?

What medical care the principal receives, including hospital care, surgery, psychiatric treatment, home health care , etc. (These choices are dependent on the financial means of the principal and the approval of their financial agent.) Which doctors and care providers the principal uses. Where the principal lives.

What is the POA Act?

The Uniform POA Act. Each state has statutes that govern how power of attorney documents are written and interpreted. This can complicate matters when a principal decides what powers to give to their agent and when an agent tries to determine what actions are legally within their power.

Popular Posts:

- 1. when to call a real estate attorney

- 2. how to get retainer back from attorney

- 3. who is the prosecuting attorney on my case

- 4. what happens after attorney review home seller tips

- 5. who isdeputy attorney general

- 6. what do assistant district attorney make in massachusetts

- 7. who keeps copies of power of attorney paperwork if filled out in a hospital

- 8. how a medical malpractice attorney can help you

- 9. who is holding the records of deceased attorney phil decaro in colorado

- 10. how long district attorney have to charge in wi