Do I need an estate lawyer to protect my assets?

Feb 01, 2020 · Knowingly omitting an asset or debt of the marriage and not addressing it in the Judgment can result in unnecessary attorney fees in having to re-visit financial issues within your case and filing an Order that includes the omitted asset or debt and how it is to be divided between the parties.

What does an asset protection attorney do?

Before you do, contact the debt settlement attorney at Fullman Firm instead. We are a leading consumer protection and credit defense practice serving California residents. Backed by 40 years of combined experience, we are well-known for helping our clients resolve their debt problems. When you work with our legal team, you will have peace of ...

How can I protect my assets from creditors?

Sep 02, 2015 · Never Withhold Financial Information. Any divorce lawyer will tell you that it is never a good idea to purposefully hide or withhold financial information during a divorce. Whether a party is simply trying to be deceitful or failed to disclose information accidently, the consequences can be serious. If the judge discovers that a party’s ...

Who is responsible for your debt after you die?

Oct 31, 2020 · Debt pile-up can be a recipe for disaster. You might be forced to file for bankruptcy, and some of your assets might be liquidated to pay off debts. If you can’t seem to get out of debt, it is time to call a lawyer to get help. Below are 6 ways in which lawyers can help you get out of debt. 1. A Lawyer Can File A Bankruptcy Case For You

What are considered assets in a divorce?

The legal definition of an asset in a divorce is anything that has a real value. Assets can include tangible items that can be bought and sold such as cars, properties, furniture, or jewelry. Collectables, art, and memorabilia are frequently over looked assets because their value is often hard to ascertain.

Can my husband hide assets?

Still, it's not uncommon for a spouse to hide assets or misrepresent the values of marital property. Spouses may also understate their income or claim inflated expenses. If you're concerned that your spouse may be hiding assets, be sure to let your attorney and Certified Divorce Financial Analyst (CDFA) know.Sep 6, 2021

How do you find out if your spouse is hiding assets?

Here are six warning signs that your spouse may be hiding marital assets and/or income:#1: Overpaying Debts. ... #2: Taking Control of the Finances. ... #3: Making Expensive Purchases Without Your Knowledge. ... #4: Opening a Private Post Office Box. ... #5: Making Unknown Payments Out of Joint Accounts. ... #6: Paying Unknown Debts.More items...

Can you hide bank accounts in divorce?

Yes. If hiding the asset rises to the level of the breach of fiduciary duty, the California Family Code can even order damages against the spouse.

Is my wife entitled to half my savings?

If you decide to get a divorce from your spouse, you can claim up to half of their 401(k) savings. Similarly, your spouse can also get half of your 401(k) savings if you divorce. Usually, you can get half of your spouse's 401(k) assets regardless of the duration of your marriage.

Can I empty my bank account before divorce?

That means technically, either one can empty that account any time they wish. However, doing so just before or during a divorce is going to have consequences because the contents of that account will almost certainly be considered marital property. That means it will be equitable division in the divorce settlement.Sep 2, 2020

What if husband hides money during divorce?

If you lie during discovery or your deposition in order to hide assets, you've committed perjury (a punishable crime). If your lies are discovered by your spouse, your spouse's attorney, or a judge, you may face severe sanctions (monetary fines) or a perjury charge.

How do you prove financial infidelity?

Here are six telltale signs of financial infidelity:Hiding a purchase intentionally. ... Getting cashback without telling your spouse. ... Having a secret savings account. ... Stashing bills. ... Opening secret credit cards or new accounts. ... Playing the dollar-for-dollar game.Sep 27, 2021

Can you divorce without splitting assets?

In the absence of a divorce settlement agreement between the spouses, they retain their own separate estates and there is no sharing of assets on divorce, unless the court granting the decree of divorce orders a redistribution of assets between the parties in terms of Section 7(3) of the Divorce Act.

How can I prove my ex is hiding money?

One of the best places to get proof of hidden marital assets is the courthouse. If your spouse ever borrowed money for a mortgage company or from the bank, the records will be filed there. The loan application will also contain a list of assets they own as an estimation of their value.

How do I stop my husband from getting my assets?

Many people protect their assets by putting them into a trust before getting married. Some couples sign prenuptial agreements that detail financial obligations and distribution of assets in the event of a divorce. Sometimes, situations change and a post-nuptial agreement is signed during the marriage.Mar 29, 2021

How do I protect myself financially from my spouse?

A financial advisor can help.Be Honest With Yourself About Their Financial Tendencies Before Marriage.Have a Heart-to-Heart With Your Spouse as Soon as Possible.Take Over Paying the Bills Yourself.Seek Financial Help and Counseling.Protect Yourself and Your Own Finances.Bottom Line.Financial Planning Tips.Feb 24, 2022

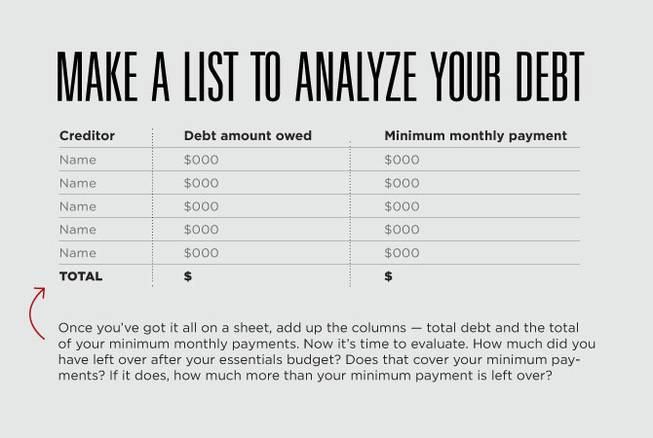

Why is listing your debts important?

It’s an emotional and confusing time as you and your spouse begin to separate personal items, as well as finances. It’s more than necessary to list your assets and debts accurately to prevent bigger problems later.

What are assets in property division?

Assets include all properties, possessions, accounts, businesses, investments, or any other items that have a cash value. Save yourself the stress and time of documenting your assets by starting a list before the property division process begins.

What are the assets that are considered high value?

High-value personal belongings, such as art, jewelry, antiques, etc. It is important to list and identify all assets that you owned prior to the marriage, assets that you inherited during the marriage, or assets that were gifted to you during the marriage, as these assets may be protected from equitable division with your spouse. ...

What happens if you don't organize your financial information?

By taking the time to organize your financial information, you’ll have a better chance of negotiating a fair divorce settlement. If you don’t, you risk the consequences of further legal action after the divorce is finalized and the possibility of being held in contempt of court.

Do you have to disclose debts during divorce?

Similar to assets, the debts you may have accumulated with your spouse are also up for division. Debts you have acquired before and during your marriage need to be disclosed during a divorce.

What You Need to Know About Debt Settlement Companies in California

You’ve probably seen advertisements by debt settlement companies making promises to settle debts for pennies on the dollar. Like the saying goes, however, ‘if something sounds too good to be true, it probably is.

How Our Debt Settlement Attorney Can Help

When you consult with our credit defense attorneys, we will explore all your debt relief options. These include:

Who is responsible for paying off debts?

The executor is responsible for using estate assets to pay off debts, says attorney Chas Rampenthal, attorney assist segment leader at LegalZoom. “There’s an order of debt priority that’s generally the same in most jurisdictions,” he says.

What is a power of attorney responsible for?

But while someone with power of attorney is responsible for major decisions on your behalf — like where your belongings go after you die — there are some things they aren’t responsible for, including much of your debt.

What is a financial power of attorney?

For instance: A service member is deployed overseas: A financial POA can manage a service member’s property and pay their bills while they’re away.

What is a power of attorney?

A power of attorney isn’t a person, but rather a document that gives someone the power to act on your behalf in case you die or become incapacitated. You can name someone to make decisions for you when you can’t.

What happens if you co-sign a loan?

If you co-signed a loan or jointly took one out, you’re each responsible for the outstanding balance. “So, if one of you dies or is unable to pay, the entire amount is still owed,” says Rampenthal. They hold a joint account with you.

Can you have a POA with someone you have never met?

Appoint someone you trust: A POA shouldn’t be with someone you’ve never met. You should create a power of attorney with a lawyer, nurse, friend or relative with mutual trust. If you’ve only known someone a short time, you might not be working with someone who has your best interests in mind.

Do spouses share debt?

In these states, spouses share equal responsibility for debts. “Under these state guidelines, spouse property is viewed as communal — both assets and debts — so you may be on the hook for debt after a loved one dies,” says Adem Selita, CEO and co-founder of The Debt Relief Company in New York City.

What documents are needed for a financial affidavit?

When creating the financial affidavit, the attorney may require you to provide supporting documents for your financial information. Supporting documents may include : Copies of deeds and mortgages. A copy of the ante- or pre-nuptial agreement, if applicable. Pay stubs or statements for the previous three months.

What are the requirements for financial disclosure?

The initial or preliminary financial disclosure will require each spouse to divulge the same information. This includes: 1 All expenses 2 Income from all sources 3 All debts 4 All assets

What happens if your spouse withholds financial information?

If your spouse or your spouse’s attorney believe that you might be withholding financial information, you may receive interrogatories and document requests – even if you are being 100% truthful.

Can you hide financial information during divorce?

Never Withhold Financial Information. Any divorce lawyer will tell you that it is never a good idea to purposefully hide or withhold financial information during a divorce. Whether a party is simply trying to be deceitful or failed to disclose information accidently, the consequences can be serious. If the judge discovers that a party’s Financial ...

Do you have to disclose financials during divorce?

Full Disclosure Is Required. Financial disclosure will be required at various stages during the divorce, and failing to divulge all of your assets or debts can land you in hot water. Financial Statements do fall under the pains and penalties of perjury, and must be complete, true and accurate. To be complete, true and accurate, you must disclose ...

Why do you need a lawyer for debt settlement?

Most people have painstakingly acquired their assets over a long time, and losing them breaks their hearts. This is why you need a lawyer to help you navigate the delicate matter of debt settlement. Even when you are threatened with foreclosure by your lender, your lawyer will step in to ensure that you retain your house. Similarly, when the creditors seek to repossess assets such as your car, art collection, or your prized electronic gadgets, your lawyer will use legal means to protect you and ensure that you retain your property. A lawyer can also prevent assets owned by your family members from being liquidated to settle your debt .

What is debt settlement lawyer?

A debt settlement attorney assesses your financial standing, debts owed, your income, and your assets. The attorney is then able to correctly determine what you can pay. Armed with this information, the debt settlement lawyer can engage your creditors and negotiate for more favorable repayment terms.

Why do people get into debt?

Sometimes people get into debt due to unpaid goods or services. If you had borrowed money to help you supply goods or services, you might get into debt if your clients fail to pay. If you exhaust all possible avenues to recover your money, you can hire a debt recovery lawyer to go after the clients.

Can creditors look for you?

With mounting debts, it is not long before creditors come looking for you. Some people may even hide to avoid the creditors and delay the debt collection process. When this happens, a creditor may forward your file to a collection agency that is tasked with looking for you and recovering the debt.

Why do not every law firm have lawyers?

Because of the sensitive and often complicated nature of asset protection, not every law firm has lawyers that specialize in it. There are laws and regulations specific to shielding your assets from creditors and creating a long-term protection plan.

What is asset protection?

The goal of asset protection is to protect wealth, property, and other assets from creditor claims. Asset protection strategies are used both by individuals and companies. They help limit creditor access to valuable assets and properties in a legal fashion.

What is the lowest tier of asset protection?

To get a better idea of how to decide what to do, the lowest tier of asset protection may include buying a homeowners or auto insurance policy. Altering the deductible and coverage level helps you create the right coverage for your personal or business property. Moving up in the asset protection continuum could include setting up a limited liability company (LLC) or corporation. An LLC may provide protection for rental property or other real estate. A corporation can own your business. The protection of an LLC or corporation comes from protecting your identity, separating you from your asset in the eyes of the creditor. Plus, it could be a good idea at this level to set up a life insurance trust to protect the cash value of your life insurance policy. A powerful strategy further up on the continuum often includes creating an asset protection trust.

When should you start an asset protection plan?

The Ideal Time to Act. Any asset protection plan should ideally begin before a lawsuit arises. The law makes it more difficult to block current creditors from accessing assets, and implementing protective measures in the middle of a lawsuit.

What does ABA stand for in estate planning?

Thus, the attorney you choose must know these laws in order to help you create a plan. The American Bar Association (ABA) suggests inquiring as to your attorney’s experience in handling estate plans. Membership in certain bar associations and organizations can show a certain level of dedication from your attorney.

Can you get sued for asset protection?

Asset protection planning might seem like something only for the super wealthy. Elder Law explains that anyone can get sued. Lawsuits can come from a variety of places, including car accidents, credit card debt, foreclosures, unhappy customers, and more.

Can a corporation own a business?

A corporation can own your business. The protection of an LLC or corporation comes from protecting your identity, separating you from your asset in the eyes of the creditor. Plus, it could be a good idea at this level to set up a life insurance trust to protect the cash value of your life insurance policy.

Why do attorneys do asset searches?

Asset searches are handy for the discovery process. An attorney can use such a search to find unreported assets, hidden businesses or entities that are holding assets, and other sources of income. Such searches can help an attorney create stronger requests and subpoenas.

Why is asset search important?

When a client has severe injuries and not enough insurance coverage, an asset search might help you find other potential sources for help. As with business due diligence, it's your responsibility to give your client the best legal advice possible. Your client expects you to help finding compensation for injuries, and an asset search can be the key to opening those avenues.

What is asset search?

An asset search is a powerful tool. Attorneys can use such a search to find hidden documents. Unlike a public record search, an asset search finds information that is not always available to the public. Such a can find a business or individual's personal property or real estate. It also can yield the status of such assets, for example, if there are any judgments or liens on those assets.

When do you consult an attorney?

This means you must do everything in your power to make sure you’re well informed. Business owners often consult attorneys before beginning new businesses, adding partners, hiring a high-profile employee, or negotiating a merger. The attorney's job is to examine the other entity's health and potential; an asset search can help a client make the best decision.

Can a spouse hide assets when divorced?

But, it doesn't always work that way. Sometimes, a divorcing spouse will try to hide assets from the other. If the other spouse doesn't find out about the assets, they won’t be included as joint assets and the sneaky spouse won’t have to share. Fortunately, attorneys have some legal tools they can use to expose these hidden assets.

Popular Posts:

- 1. how to get a general power of attorney form

- 2. attorney who used to be partner to j robert moon

- 3. what is r kelly attorney name

- 4. how do i apply for power of attorney

- 5. can a perso who is a ssi payee become a financial durable power of attorney

- 6. who can certify a copy of a power of attorney?

- 7. how much is a medical power of attorney

- 8. what questions do ask my attorney about divorce in the united states

- 9. how old is attorney richard schwartz

- 10. attorney general office is member of which branch