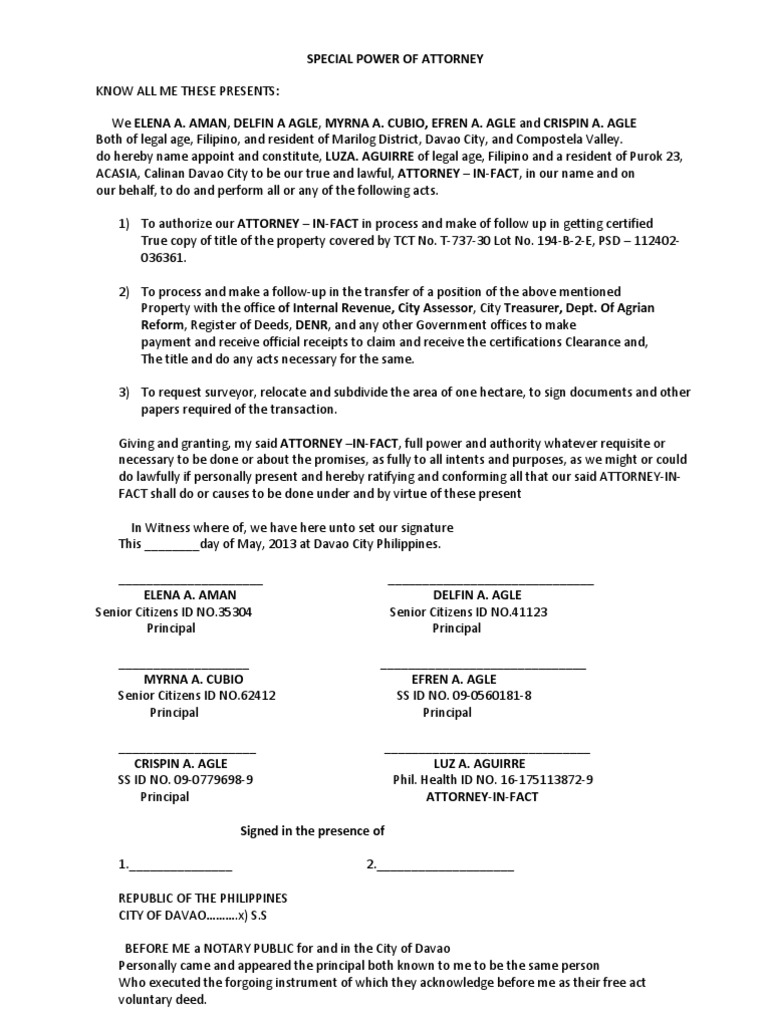

A special power of attorney is often used to sell property when the buyer or seller is unable to attend the closing in person. In a special power of attorney you can set limitations and conditions under which your agent is authorized to act. You can have multiple special powers of attorney, depending on your situation.

How to make a special power of attorney?

Jan 13, 2021 · A special power of attorney is a legal document outlining the scope of authority given to an agent, known as “an attorney in fact,” by the principal. Under the special power of attorney, an agent is given the powers to act on behalf of the principal to make specific legal or financial decisions. It is also referred to as Limited Powers of Attorney (LPA) and is used as …

What does a power of attorney allow you to do?

Mar 02, 2021 · A special power of attorney allows a person (the principal) to authorize another individual (the agent) to make legal decisions on their …

What can you do with a power of attorney?

May 24, 2021 · The Special Power of Attorney (SPOA) allows Ignite Funding, as the broker and loan servicer, to perform the following services on behalf of investors: 1) Receive payments from the borrower that are due to investors for the loan obligation. 2) Disburse borrower payments to each investor on the loan.

What is power of attorney and how does it work?

Apr 30, 2021 · Certain circumstances may trigger the desire for a power of attorney (POA) for someone over the age of 18. For example, someone in the military might create a POA before deploying overseas so that...

Why would someone do a specific or limited power of attorney?

How do you use special power of attorney?

- The name and address of the principal.

- The ID, physical address, and agent's details.

- A reason to get the SPA.

- Date and the place where one will sign that form.

- The principal's signature.

- The principal's name, identification number, and the ID expiry date.

What is the point of a power of attorney?

Who will make the special power of attorney?

What is the difference between power of attorney and special power of attorney?

Does a special power of attorney need to be notarized?

What are the disadvantages of power of attorney?

- Fraud – with access to information about your finances and bank account, your attorney could use their authority to commit fraud against you.

- No direct oversight – your attorney might make mistakes while acting on your behalf. ...

- After death – LPA's don't continue after you die.

What three decisions Cannot be made by a legal power of attorney?

What are the 3 types of power of attorney?

- Specific Power of Attorney. A specific power of attorney is the simplest power of attorney. ...

- General Power of Attorney. A general power of attorney is used to give a very broad term of use to the attorney. ...

- Enduring Power of Attorney. ...

- Durable Power of Attorney.

How long is a special power of attorney valid?

Is special power of attorney valid after death?

Can a power of attorney transfer money to themselves?

Why is it important to have a power of attorney?

Because this type of power of attorney is limited to what has been laid out in the signed document, it is particularly important that the principal is very clear about the powers that they want the agent to have. Additionally, the principal may create more than one special power of attorney, naming a different individual in each one.

What happens to a power of attorney when the principal dies?

A power of attorney becomes ineffective if its principal dies or becomes incapacitated, meaning the principal is unable to grant such power due to an injury or mental illness. However, a special power of attorney can be made durable. A durable power of attorney is one that authorizes the agent to continue acting on behalf ...

What is a limited power of attorney?

Also known as a limited power of attorney (LPOA), a special power of attorney allows an individual to give another person the ability to make certain legal or financial decisions on their behalf.

Do you need to notarize a power of attorney?

A special power of attorney may need to be notarized to have legal authority.

Can an agent act on behalf of the principal?

The agent can act on behalf of the principal only under specific, clearly defined circumstances. A general power of attorney is broader, giving the agent the ability to make all legal and financial decisions on behalf of the principal.

Why is a special power of attorney important?

In summary, the Special Power of Attorney was mandated by state regulators as a protection to investors. As a licensed mortgage broker, maintaining the compliance of company operations to protect its investors as prescribed by the state is one of Ignite Funding’s highest priorities. This is why it is important that Ignite Funding continues ...

What is the purpose of a special power of attorney?

What is the Purpose of the Special Power of Attorney? The Special Power of Attorney (SPOA) allows Ignite Funding, as the broker and loan servicer, to perform the following services on behalf of investors: 1) Receive payments from the borrower that are due to investors for the loan obligation.

What is SPOA loan?

The SPOA allows Ignite Funding to work with the borrower and title companies, on behalf of every investor on the loan, to execute contracts, escrow instructions, conveyances, mortgages, deeds of trust and other documents necessary to complete the investment and service the loan.

How to take legal action on behalf of investors?

1) Receive payments from the borrower that are due to investors for the loan obligation. 2) Disburse borrower payments to each investor on the loan. 3) Take legal action on behalf of investors as necessary to service the loan and protect the investor’s interest on the property.

Does the SPOA give you an authorization to sign on behalf of the investor?

Additionally, the SPOA does not give Ignite Funding any authorization to sign anything on behalf of the investor for any purpose other than listed above and stated on the SPOA itself. Neither Ignite Funding, as the mortgage broker, nor the investor may alter or waive any provision of the SPOA.

Why do you need a power of attorney?

Choosing someone to hold your power of attorney and specifying that it will operate even if you lose capacity ensures that you have a plan in place for administering your financial and personal affairs if you are ever unable to do so.

Why do you need an attorney to draw up a POA?

Using an attorney to draw up the POA will help ensure that it conforms with state requirements. Since a POA may be questioned if an agent needs to invoke it with a bank or financial services company, you should ask an attorney about prior experience in drafting such powers. You want to select someone not only familiar with state requirements, but also with the issues that can arise when a power is invoked. This way, the attorney can use language that will make clear the full extent of the responsibilities that you wish to convey.

How long does a durable POA last?

A durable POA begins when it is signed but stays in effect for a lifetime unless you initiate the cancellation. Words in the document should specify that your agent's power should stay in effect even if you become incapacitated. Durable POAs are popular because the agent can manage affairs easily and inexpensively.

How does a POA work?

How a Power of Attorney (POA) Works. Certain circumstances may trigger the desire for a power of attorney (POA) for someone over the age of 18. For example, someone in the military might create a POA before deploying overseas so that another person can act on their behalf should they become incapacitated.

What is a POA in 2021?

A power of attorney (POA) is a legal document in which the principal (you) designates another person (called the agent or attorney-in-fact) to act on your behalf. The document authorizes the agent to make either a limited or broader set of decisions. The term "power of attorney" can also refer to the individual designated ...

How to get a POA?

How to Get a Power of Attorney (POA) The first thing to do if you want a power of attorney is to select someone you trust to handle your affairs if and when you cannot. Then you must decide what the agent can do on your behalf, and in what circumstances. For example, you could establish a POA that only happens when you are no longer capable ...

When does a POA come into play?

This POA comes into play only when a specific event occurs—your incapacitation, for instance. A springing power of attorney must be very carefully crafted to avoid any problems in identifying precisely when the triggering event has happened.

Why do you need a special power of attorney?

The primary reason to use special power of attorney is to make sure your finances and other legal affairs continue to be managed the way you want them to in situations where you’re not able to handle things yourself.

How to create a power of attorney?

Establishing a special power of attorney looks simple, but there are certain steps you need to follow. An estate planning attorney can walk you through the specifics and answer any questions you might have but generally, creating special power of attorney involves: 1 Choosing who will act as your agent. 2 Outlining the specific terms under which a special power of attorney will take effect. 3 Determining which authority your agent will have. 4 Naming a successor agent, if necessary. 5 Selecting an end date for the power of attorney to terminate.

What happens to a power of attorney when you pass away?

One thing to keep in mind is that special power of attorney only applies during your lifetime. If you were to pass away, then the power of attorney would terminate. At that point, your assets would be managed subject to the terms of your will or trust, if you have either one.

How long does a power of attorney last?

Power of attorney remains in effect for your lifetime or until you decide to cancel it.

When does a power of attorney end?

Power of attorney begins right away and ends when you become incapacitated.

Can a power of attorney act in a specific situation?

A special power of attorney only applies to specific situations. This is also called limited power of attorney. Someone with special or limited power of attorney can only act in situations defined by your power of attorney document. For example, say a married couples buys a home. One spouse may work out of state on the closing date. Therefore, the other could establish a special power of attorney allowing them to sign the closing documents in the other’s name.

Can you have a limited power of attorney for multiple people?

Special or limited power of attorney grants someone else authority over your affairs in limited circumstances. You can set up special power of attorney for multiple people. An estate planning attorney can help determine when special or general power of attorney is more appropriate.

What is a special power of attorney?

By definition, SPA is a type of legal document that allows you to appoint and authorize a person or an organization to handle your affairs when you are unavailable, unable to do so, or in your case, while you are abroad. The person you will assign will be called attorney-in-fact or agent ...

How many witnesses are required to witness the execution of SPA?

Two witnesses of legal age, who must accompany you in the Embassy to personally witness the execution of the SPA. Take note that the witnesses must also present proof of identification showing that they are of legal age.

Can an attorney in fact sell your assets?

Your attorney-in-fact may receive the loan proceeds and sign documents on your behalf but s/he cannot sell any of your assets.

Who can be your attorney in fact?

Who can be your attorney-in-fact? The answer is anyone, as long as you can trust him or her. He or she can be your spouse, any one of your parents, child above 18 years old, or a trusted friend or relative.

Do you need a power of attorney to be notarized?

The general rule is no , the Special Power of Attorney need not be notarized to be valid; however, this rule applies ONLY when you executed the SPA in the Philippines.

Why do you need a power of attorney?

A power of attorney (POA) is a legal document in which (you) called the Principal, designates another person, called the Agent or an attorney-in fact to act on your behalf to make decisions in specified matters or in all matters. A power of attorney is in effect only ...

Why is it important to establish a power of attorney?

It is important to recognize the value of being able to assign these decision capabilities to a trusted family member or friend, especially in the case of durable powers of attorney that continue to be legally binding in cases of incapacity. These documents can save care giving family members and friends a great deal of time and frustration. For this reason, every individual should establish a power of attorney.

What is POA in medical?

Medical Decisions. If the principal has become unable to make decision due to incapacitation the POA can take effect. This can also be called an advanced care directive and it grants authority to make medical decision for the principal. This could be a specific POA for medical decision only.

What is a durable financial power of attorney?

The durable financial power of attorney is simply a way to allow someone else to manage your finances in the event that you become incapacitated and are unable to make those decisions yourself. …. More precisely, it grants someone legal authority to act on your behalf for financial issues. A financial agent can….

How many states have adopted the Power of Attorney Act?

Twenty-five states have adopted the Uniform Power of Attorney Act. Created in 2006 by the Uniform Law Commission, this law aims to create universal default rules for POA contracts across states. It determines which powers are included in the document by default, and which must be explicitly addressed in order to be bestowed on an agent.

What is POA in business?

POA’s have also evolved into a useful mechanism that allows individuals to grant authority to professions with specialized skills who can represent them in business, legal and financial arenas that require specific knowledge the individual might not have.

What happens when an attorney in fact is appointed?

You may think that once an attorney-in-fact has be appointed you lose control of any decision making and how your assets are used . This is not true… a POA only steps in if you are no longer mentally capable of running your own affairs.

What is the purpose of a power of attorney?

The purpose of a power of attorney for healthcare is to allow the designated party access to information regarding the person’s personal health information from diagnosis of an illness to clarifying billing information and even contacting the health insurance company. According to The Health Insurance Portability and Accountability Act (HIPAA) ...

Is it beneficial to understand insurance benefits?

It’s highly beneficial to understand the insurance policy’s benefits, copays, network, etc. when making these calls. There may still be times when the office representative won’t be cooperative or understand the reason a parent is calling for an adult child.

Popular Posts:

- 1. what kind of attorney does living trust

- 2. how to get a durable power of attorney overturned

- 3. who plays shiloh attorney on general hospital

- 4. "appellate attorney" "how much"

- 5. how to pick a durable power of attorney in california

- 6. right to attorney when detained or questioned

- 7. who is considered one of the best criminal attorney in columbus, oh

- 8. who is st louis county prosecuting attorney

- 9. how to power of attorney loved one

- 10. why would an attorney have you file bankruptcy 13 instead of chapter 7