Why do seniors need a power of attorney?

A power of attorney can allow someone to make decisions on behalf of another person. The person enabled with decision making power is called the agent. You may wish to act as your aging parent’s agent, or there may be another relative who lives closer who may be …

When should your aging parent set up power of attorney?

Jul 16, 2021 · Common Reasons to Seek Power of Attorney for Elderly Parents. Financial Difficulties: A POA allows you to pay the bills and manage the finances for parents who are having difficulty staying on top of their financial obligations.

What are the benefits of a power of attorney for parents?

Dec 01, 2021 · Appointing a medical power of attorney is an essential step for aging parents, making things easier for you and your family in a difficult situation. Here are all the reasons choosing a health ...

What are the benefits of a durable power of attorney?

Dec 25, 2015 · Assigning durable power of attorney is one of the most important parts of a senior’s long-term planning process. Unfortunately, this is a step many aging adults and their families overlook. Before cognitive functioning and other abilities start to decrease, all seniors should work with an elder care lawyer to ensure this document is in place.

Why is having a power of attorney important?

“A comprehensive power of attorney ensures someone you trust will be in charge of important decisions and tasks, from paying bills to monitoring health care, and is a crucial part of long term planning. Powers of attorney are voluntary delegations of authority by the principal to the agent.Apr 15, 2019

What three decisions Cannot be made by a legal power of attorney?

You cannot give an attorney the power to: act in a way or make a decision that you cannot normally do yourself – for example, anything outside the law. consent to a deprivation of liberty being imposed on you, without a court order.

Do I need power of attorney for my mother?

Why do my elderly parents need power of attorney? Your parents' next of kin (a spouse, you, other siblings etc) cannot just take control of their finances or make health-related decisions. The only person who can do this legally is the nominated power of attorney.Jul 16, 2020

What are the 4 types of power of attorney?

AgeLab outlines very well the four types of power of attorney, each with its unique purpose:General Power of Attorney. ... Durable Power of Attorney. ... Special or Limited Power of Attorney. ... Springing Durable Power of Attorney.Jun 2, 2017

What are the disadvantages of power of attorney?

DisadvantagesYour loved one's competence at the time of writing the power of attorney might be questioned later.Some financial institutions require that the document be written on special forms.Some institutions may refuse to recognize a document after six months to one year.More items...

Does next of kin override power of attorney?

No. The term next of kin is in common use but a next of kin has no legal powers, rights or responsibilities.

Can I sell my mother's house with power of attorney?

Answer: Those appointed under a Lasting Power of Attorney (LPA) can sell property on behalf the person who appointed them, provided there are no restrictions set out in the LPA. You can sell your mother's house as you and your sister were both appointed to act jointly and severally.Apr 2, 2014

Who makes decisions if no power of attorney?

If you have not given someone authority to make decisions under a power of attorney, then decisions about your health, care and living arrangements will be made by your care professional, the doctor or social worker who is in charge of your treatment or care.Mar 30, 2020

What is the difference between power of attorney and lasting power of attorney?

An ordinary power of attorney is only valid while you have the mental capacity to make your own decisions. If you want someone to be able to act on your behalf if there comes a time when you don't have the mental capacity to make your own decisions you should consider setting up a lasting power of attorney.Jan 13, 2022

Do spouses automatically have power of attorney?

If two spouses or partners are making a power of attorney, they each need to do their own. ... A spouse often needs legal authority to act for the other – through a power of attorney. You can ask a solicitor to help you with all this, and you can also do it yourself online. It depends on your preference.Mar 26, 2015

What is the most powerful power of attorney?

General Durable Power of Attorney Definition A general durable power of attorney both authorizes someone to act in a wide range of legal and business matters and remains in effect even if you are incapacitated. The document is also known as a durable power of attorney for finances.Jul 13, 2021

Do you need a lawyer to get a power of attorney?

Do I need a lawyer to prepare a Power of Attorney? There is no legal requirement that a Power of Attorney be prepared or reviewed by a lawyer. However, if you are going to give important powers to an agent, it is wise to get individual legal advice before signing a complicated form.

How do I get power of attorney over my elderly parent?

The first step to getting power of attorney over an elderly parent is to research powers of attorney, understand how these documents work in your s...

What are the four types of power of attorney?

The four types of power of attorney are limited, general, durable and springing durable. Limited and general POAs end when the principal becomes in...

Can I get a power of attorney if my parent has dementia?

No, if your parent already has cognitive impairment, they can’t legally sign the documents required to set up a power of attorney. This is one reas...

What are the disadvantages of a power of attorney?

The biggest drawback to a power of attorney is that an agent may act in a way that the principal would disapprove of. This may be unintentional if...

Is power of attorney responsible for nursing home bills?

As your parent’s power of attorney, you’re responsible for ensuring their nursing home bills are paid for through their assets and income. However,...

Why do you need a power of attorney?

Common Reasons to Seek Power of Attorney for Elderly Parents 1 Financial Difficulties: A POA allows you to pay the bills and manage the finances for parents who are having difficulty staying on top of their financial obligations. 2 Chronic Illness: Parents with a chronic illness can arrange a POA that allows you to manage their affairs while they focus on their health. A POA can be used for terminal or non-terminal illnesses. For example, a POA can be active when a person is undergoing chemotherapy and revoked when the cancer is in remission. 3 Memory Impairment: Children can manage the affairs of parents who are diagnosed with Alzheimer’s disease or a similar type of dementia, as long as the paperwork is signed while they still have their faculties. 4 Upcoming Surgery: With a medical POA, you can make medical decisions for the principal while they’re under anesthesia or recovering from surgery. A POA can also be used to ensure financial affairs are managed while they’re in recovery. 5 Regular Travel: Older adults who travel regularly or spend winters in warmer climates can use a POA to ensure financial obligations in their home state are managed in their absence.

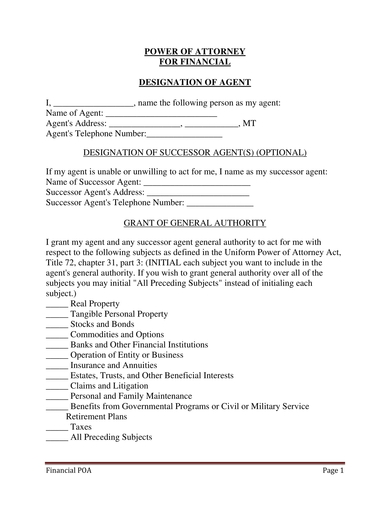

What is a POA for aging?

The first is a financial POA, which provides for decisions regarding finances and for the ability to pay bills, manage accounts, and take care of investments. The second is an Advance Healthcare Directive, which is also known as a “living will” or a “power of attorney for healthcare.” This document outlines who will be an agent for healthcare decisions, as well as providing some general guidelines for healthcare decision-making.

What is a POA in 2021?

Last Updated: July 16, 2021. A power of attorney (POA) can be an important element of planning for your elderly parent’s future. It allows another person to take action on your parent’s behalf, ensuring bills get paid and medical decisions can be made in the unfortunate circumstance that your elderly parent is unable to do those things on their own ...

How many witnesses do you need to sign a letter of attorney?

A notary public or attorney must witness your loved one signing the letter of attorney, and in some states, you’ll need two witnesses. The chosen agent must be over 18 and fully competent, meaning they understand the implications of their decision. When filling out the form, the parent must specify exactly which powers are transferring to the agent.

Who is responsible for making decisions in a POA?

One adult will be named in the POA as the agent responsible for making decisions. Figuring out who is the best choice for this responsibility can be challenging for individuals and families, and your family may need help making this decision. Your attorney, faith leader or a family counselor can all help facilitate this process. It’s a good idea to select an agent who is able to carry out the responsibilities but also willing to consider other people’s viewpoints as needed.

What is a POA?

As mentioned above, a power of attorney (POA), or letter of attorney, is a document authorizing a primary agent or attorney-in-fact (usually a legally competent relative or close friend over 18 years old) — to handle financial, legal and health care decisions on another adult’s behalf. (A separate document may be needed for financial, legal, and health decisions, however).

Is a power of attorney necessary for a trust?

Under a few circumstances, a power of attorney isn’t necessary. For example, if all of a person’s assets and income are also in his spouse’s name — as in the case of a joint bank account, a deed, or a joint brokerage account — a power of attorney might not be necessary. Many people might also have a living trust that appoints a trusted person (such as an adult child, other relative, or family friend) to act as trustee, and in which they have placed all their assets and income. (Unlike a power of attorney, a revocable living trust avoids probate if the person dies.) But even if spouses have joint accounts and property titles, or a living trust, a durable power of attorney is still a good idea. That’s because there may be assets or income that were left out of the joint accounts or trust, or that came to one of the spouses later. A power of attorney can provide for the agent — who can be the same person as the living trust’s trustee — to handle these matters whenever they arise.

Why do seniors need a durable power of attorney?

It’s hard to think about, but a day will come when your senior won’t be able to make decisions for themselves. That’s when you’ll have to step in to manage their finances or decide what kind of medical treatment they should have. If that day comes, you’ll need a durable power ...

What is a durable power of attorney?

What is a Power of Attorney? A power of attorney is a legal document that lets your senior choose someone who will have the power to act in their place. It would allow you to make decisions on your older adult’s behalf.

What is a durable POA?

A durable POA is one that stays in effect if they become unable to handle matters or make decisions on their own. As your senior’s chosen representative, you could pay their bills, manage their investments, or direct their medical care.

What happens if an elderly parent signs a will?

If your elderly parent wrote a living will granting you (or someone) a Durable Power of Attorney, then it’s well taken care of but if they did not and have now been diagnosed with dementia or Alzheimer’s, then any legal documents that they sign are invalidated.

What is the difference between conservatorship and guardianship?

Conservatorship – is used to give someone full control over another person’s financial matters. Guardianship – is used to give someone full control over their care. As I mentioned earlier – obtaining these can be expensive and time consuming.

How old do you have to be to get a birth certificate?

In most states, anyone 18 years and older can have these documents created. Some parents take the extra step to make sure that they have these documents written while they are pregnant, just to assure that if anything happens – their child will be taken care of.

Who is Esther Kane?

Esther Kane is a certified Senior Home Safety Specialist through Age Safe America. She also graduated from Florida International University with a BS in Occupational Therapy. She practiced OT in Florida, Georgia and North Carolina for 10 years. She specialized in rehabilitation for the adult population. Her expertise in home assessments and home safety issues for seniors will help you to make the best possible decisions for your elderly parent or senior that you are caring for.

Can you get a POA if you have dementia?

Unfortunately, this makes it very difficult to obtain a Power of Attorney ( POA) if the disease has progressed. If your elderly parent wrote a living will granting you (or someone) a Durable Power of Attorney, ...

Popular Posts:

- 1. what to do if you are in a car accident checklist injury attorney

- 2. how do i file a complaint against an attorney in florida

- 3. who is the montgomery county tn district attorney

- 4. who does the attorney general be impeached

- 5. instructions on how to fill out power of attorney form

- 6. what is id bumber for car power of attorney?

- 7. what are the qualifications of attorney general of oklahoma

- 8. what rule addresses attorney-in-fact in texas?

- 9. why was robert babchuck attorney disciplined

- 10. how old is matt murphy district attorney