Why You Need A Tax Attorney: Your Guide To Complex Legal Matters

- An Experienced Representative. .There is no shortage of tax return preparer’s, enrolled agents, CPA’s and others who try and handle a tax controversy matter.

- Credibility Counts. There are a number of “mill operations” that profess to save you “pennies on the dollar”. ...

- Confidential Communications. ...

- Call for a Free Consultation with a Tax Lawyer. ...

Full Answer

What does it cost to hire a tax attorney?

Why Do You Need a Tax Attorney? Our Tax Attorney Can Provide Help With IRS Tax Problems in Washington. A tax attorney, such as Lana Rich at the Bellevue, Washington, law firm of Lana Kurilova Rich PLLC, understands the complex state and federal laws that need to be followed in order to keep individuals and businesses in compliance.

What are the requirements to be a tax attorney?

You definitely need a tax attorney if: Estate law. If you have or will have a taxable estate, need to make complex estate planning strategies, or need to file an estate tax return. A tax attorney will help you preserve assets for your children by lowering the amount of taxes your estate may have to pay. Business formation.

When should I get a tax attorney?

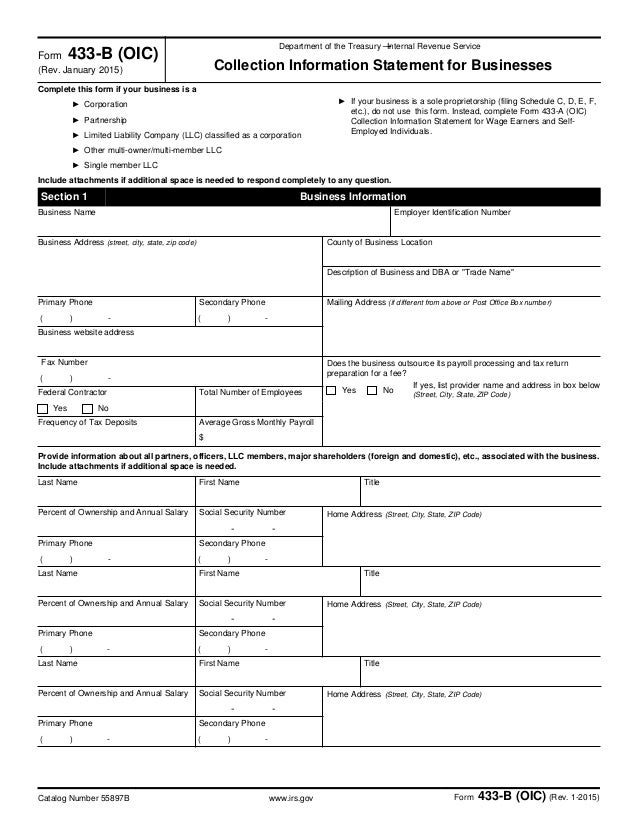

Feb 17, 2020 · A tax lawyer can help in getting the IRS to accept an offer in compromise. To make this determination, the IRS looks at your income and assets to determine your “reasonable collection potential.”. You must provide detailed information about your financial situation on IRS Form 433-A, Collection Information Statement.

What do tax attorneys do and cases they handle?

Oct 02, 2018 · If you do consult with a tax attorney, however, you'll want to make sure they have a lot of experience in estate planning. Generally, you …

Why is a tax attorney important?

A tax lawyer will be able to give you the best advice since a tax problem can affect your finances, your assets, criminal charges, and possibly business problems for years to come. With this much of your life at stake, it's important to make your choices carefully.

Will the IRS settle with me?

Yes – If Your Circumstances Fit. The IRS does have the authority to write off all or some of your tax debt and settle with you for less than you owe. This is called an offer in compromise, or OIC.

Do you need a lawyer for a tax audit?

In truth, the only time you really need a tax attorney for an audit is when the audit accuses you of a crime like tax evasion or fraud. ... So if an audit ever goes to that level of severity, by all means hire an attorney. But up until that point, you really can handle most issues an audit might throw at you by yourself.

Who qualifies for tax forgiveness?

In order to qualify for an IRS Tax Forgiveness Program, you first have to owe the IRS at least $10,000 in back taxes. Then you have to prove to the IRS that you don't have the means to pay back the money in a reasonable amount of time. See if you qualify for the tax forgiveness program, call now 877-788-2937.

Does IRS forgive tax debt after 10 years?

Yes, indeed, the length of time the IRS is allowed to collect a tax debt is generally limited to ten years, according to the statute of limitations on IRS collections. When the ten years are up, the IRS is required to write the debt off as a bad debt, essentially forgiving it.Nov 18, 2021

Can you go to jail for lying on your taxes?

Penalty for Tax Evasion in California Tax evasion in California is punishable by up to one year in county jail or state prison, as well as fines of up to $20,000. The state can also require you to pay your back taxes, and it will place a lien on your property as a security until you pay.

How do you win a tax audit?

We take a strategic approach to help you win an audit.Audit-beating strategy 1: Take the high ground. ... Audit-beating strategy 2: Show the IRS the error of their ways. ... Audit-beating strategy 3: Keep the IRS on the straight and narrow path. ... Audit-beating strategy 4: Challenge the Examination Report.

How do you survive a tax audit?

Checklist: How to Survive a Tax AuditDelay the audit. Postponing the audit usually works to your advantage. ... Don't host the audit. Keep the IRS from holding the audit at your business or home. ... Have realistic expectations. ... Be brief. ... Don't offer other years' returns. ... Reconstruct records. ... Negotiate. ... Know your rights.More items...

Why do you need a tax attorney?

But since tax impacts all law, Tax Attorneys are best for handling complex technical and legal issues in many fields of law. Tax attorneys must have a Juris Doctor (J.D.) degree and must be admitted to the state bar. Plus have additional training in tax law. If you are facing a complex accounting, business or legal matter, an attorney who is also a Certified Public Accountant is often essential.

What is estate law?

Estate law. If you have or will have a taxable estate, need to make complex estate planning strategies, or need to file an estate tax return. A tax attorney will help you preserve assets for your children by lowering the amount of taxes your estate may have to pay.

What can a tax lawyer do for the IRS?

Your tax lawyer can reassure the IRS that you’re taking its investigation seriously, work with the IRS in an effort to help you avoid criminal charges and represent you in court if you are charged with a tax crime.

What is tax representative?

Tax representatives are trained, licensed and experienced to handle the technicalities involved in the tax resolution and settlement process. Most taxpayers feel a chill about dealing with the IRS. It’s likely worse today than a few months back.

How long does it take to accept an offer in compromise?

The IRS has up to two years to accept or reject an Offer in Compromise and the higher your total amount owed, the less likely the IRS is to accept your settlement offer.

What to do if IRS notifies you of audit?

Most tax disputes arise in the form of an audit of one or several past tax returns. If the IRS notifies you of an audit, you should hire a tax attorney immediately. Your tax relief attorney can communicate with the IRS on your behalf, be present during your audit and help negotiate a settlement, if necessary.

Do tax laws change yearly?

Tax laws and codes are complex and many times change yearly. In addition, there are many programs available a troubled taxpayer can use to settle or reduce the amount of tax liability owed but only an experienced tax attorney will know how to qualify you and to determine both the best program to use.

Can the IRS accept OIC?

The IRS will accept your OIC only if you convince it that: you aren’t able to pay the full amount in a reasonable time, either as a lump sum or over time through a payment agreement. there is doubt as to the amount of your tax liability (unusual), or.

What happens if you pay your taxes in full?

due to exceptional circumstances, payment in full would cause an “economic hardship” or be “unfair” or “inequitable”– for example, you can’t work due to health problems, or you’d be left with no money to pay your basic living expenses if you sold your assets to pay your tax bill in full.

What to do if you owe money?

But if you owe a significant amount of money, you might want to hire a tax attorney to help you work out a formalized agreement with the government , according to Brian Thompson, a certified public accountant and tax attorney in Chicago.

Is a C corp taxed?

For instance, if you make your business an S-corp, the business itself isn't actually taxed. You would report the income on your personal tax returns. Conversely, with a C-corp, the business is taxed. And if you make your business an LLC, you'll be protected from personal liability if somebody would want to sue your business.

What can a tax lawyer do?

Tax lawyers can work in both law and accounting firms, as well as with the federal and state government. They can also serve as in-house counsel for businesses too. That all adds up to lots of job prospects. 3. You’ll have a better work-life balance.

How much do tax lawyers make?

Tax lawyers see strong, consistent earnings. According to Glassdoor, the average annual base pay for tax lawyers in the United States is $133,580. Granted, where you end up practicing will heavily impact your earnings.

What are the different types of tax lawyers?

As a tax lawyer, you might focus your practice on: 1 Audits and appeals 2 Compliance 3 Corporate tax 4 Employee benefits 5 Estate planning 6 International tax law 7 Litigation 8 Mergers and acquisitions 9 Real estate or other transactional work 10 State and local tax 11 Tax exempt organizations

When do tax lawyers take vacation?

Tax lawyers report working fewer and more consistent hours than their peers in other legal specialties. The only exception to this might be tax season (February to mid-April). They also say it can be easier to take vacations as a tax lawyer…though probably not around April 15.

What can a tax lawyer do for you?

Tax lawyers will help you work out a formal agreement with the government. They can help you set up installment payments or even negotiate with IRS to lower your amount owed. However, anxious taxpayers need to avoid common scams targeting taxpayers. 2. When You're Being Audited.

How long does it take to become a tax lawyer?

The certification process to become a tax lawyer in incredibly stringent and includes hundreds of hours of practice and continuing education before one can even get certified. Take a look at some of the things they learn that you should also be aware of. 1. Not All Tax Changes Are Permanent.

What is IRS field audit?

It is a thorough investigation of your tax records. There are three types of audits: Field audits are the most invasive and occur when the IRS sends an actual IRS agent to your home or business to perform the audit.

How long is a tax refund valid?

However, that refund has an expiration date and will only be valid for three years.

What is tax court?

Tax Court is a place where citizens can go to refute any claims, allegations, or charges accrued by the IRS. In the event of small claims for relatively low amounts of money, a tax lawyer probably isn’t necessary.

What happens if you don't pay taxes?

At this point, if you don’t pay, the IRS will send you a final notice, giving you 30 days to request a hearing with a settlement officer.

Why don't people file taxes?

Most people who don’t file their taxes fail to do so because they know or suspect they’re going to owe money to the IRS and don’t want to pay it.

Popular Posts:

- 1. how to withdraw as attorney of record nevada

- 2. how do i get power of attorney over my mom

- 3. how do i get full power of attorney

- 4. what is the proper way to do a power of attorney signature

- 5. who is the del norte county district attorney

- 6. how to sue the attorney general of texas

- 7. what line of schedule a do you put attorney fees

- 8. what if someone abuses power of attorney

- 9. attorney against your employer for falsley telling you vb you have medical benefits when you dont

- 10. how often is the attorney general of texas elcted