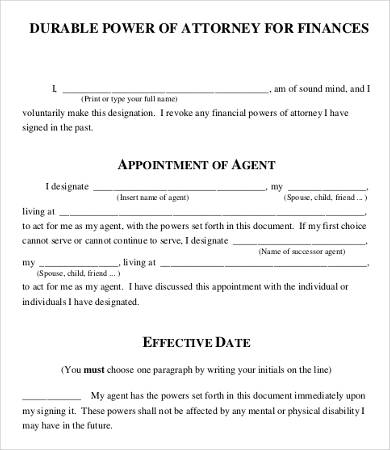

A general durable power of attorney is a legal document that appoints an agent (sometimes referred to as an “attorney-in-fact”) to represent you in your personal, financial, and business dealings. A power of attorney is the grant of legal rights and powers by a person, the “principal,” to another, the “agent.”

What is the difference between durable and power of attorney?

Nov 15, 2017 · A general durable power of attorney grants a named individual (called the "attorney-in-fact" or "agent") the authority to act on your behalf with respect to whatever matters are designated in the document. This in turn means that the document needs to be clear, concise and carefully crafted to meet your needs.

What does General Durable Power of attorney mean?

The durable power of attorney is a legal procedure that gives authority to a named individual to make important decisions about your possessions, healthcare, finances, and other vital areas of your life. It’s a means of managing your affairs if you are disabled. Our Q&A answers questions we have received concerning durable power of attorney.

What is the purpose of a durable power of attorney?

May 02, 2022 · When power of attorney is made durable, it remains intact if you cannot make decisions for yourself. A power of attorney (POA) authorizes someone else to handle certain matters, such as finances or health care, on your behalf. If a power of attorney is durable, it remains in effect if you become incapacitated, such as due to illness or an accident. Durable …

What are the benefits of a durable power of attorney?

Apr 13, 2018 · One way is with a Durable Power of Attorney. A Durable Power of Attorney is one of the most important documents anyone can have in place in the event they are unable to care for themselves. A Durable Power of Attorney acts as a permission slip, giving authority to a third party to do things on behalf of someone else who cannot do it for themselves.

What is the advantage to executing a durable power of attorney?

What does durable mean in power of attorney?

What three decisions Cannot be made by a legal power of attorney?

What is the best power of attorney to have?

What Is Power of Attorney

A power of attorney is a document that grants legal authority to one person, known as the agent or “attorney in fact,” to act on behalf of another, the principal, when they are unable to do so themselves.1 While the word attorney might make one assume these responsibilities are reserved for lawyers, the agent can actually be any person the principal trusts enough to make decisions in their best interest or as directed, ranging from financial to healthcare matters.2.

When to Use a General (Financial) POA

Let’s use a hypothetical to outline one example of how and when a general power of attorney can be useful:

When to Use a Durable (Financial) POA

Under the same hypothetical situation, how or when would a durable power of attorney be necessary?

Why do we need a durable powers of attorney?

Durable powers of attorney help you plan for medical emergencies and declines in mental functioning and can ensure that your finances are taken care of. Having these documents in place helps eliminate confusion and uncertainty when family members have to make tough medical decisions.

What is a power of attorney?

A power of attorney allows someone else to handle your legal, financial, or medical matters. General powers of attorney cover a wide range of transactions, while limited powers of attorney cover only specific situations, such as authorizing a car dealer to register your new vehicle for you.

What does POA stand for in power of attorney?

When power of attorney is made durable, it remains intact if you cannot make decisions for yourself. A power of attorney (POA) authorizes someone else to handle certain matters, such as finances or health care, on your behalf. If a power of attorney is durable, it remains in effect if you become incapacitated, such as due to illness or an accident. ...

What is a power of attorney for healthcare?

A healthcare power of attorney, on the other hand, names someone to make medical decisions any time you are unable to do it yourself, even if you are expected to make a full recovery.

What is the purpose of a durable POA?

The purpose of a durable POA is to plan for medical emergencies, cognitive decline later in life, or other situations where you're no longer capable of making decisions.

Can a POA be effective if you are incapacitated?

The POA can take effect immediately or can become effective only if you are incapacitated. The person you appoint is known as your agent, or attorney-in-fact, although the individual or company doesn't have to be a lawyer. An attorney-in-fact can handle many types of transactions, including: Buying and selling property.

What can an attorney in fact do?

An attorney-in-fact can handle many types of transactions, including: Buying and selling property. Managing bank accounts, bills, and investments. Filing tax returns. Applying for government benefits. If you become incapacitated and don't have a general durable power of attorney, your family may have to go to court and have you declared incompetent ...

What is a durable power of attorney?

A Durable Power of Attorney acts as a permission slip, giving authority to a third party to do things on behalf of someone else who cannot do it for themselves. If done properly, the Durable Power of Attorney may very well prevent you from having to be declared incompetent in court if you something bad happens to you.

Is a power of attorney valid for a long time?

A traditional Power of Attorney is only valid as long as you have your wits about you. In other words, when your mind goes, so does the Power of Attorney. Contrasted with a traditional Power of Attorney, a Durable Power of Attorney, if designated so, will either become effective or continue to be in effect if you become mentally incapacitated.

What happens if you don't have a power of attorney?

Without a Durable Power of Attorney in place, you will most likely have to seek what is commonly called a guardianship over them. That means going to court, filing the paperwork, publicly serving your loved one, and hauling him or her into court.

Who can do for or in the shoes of the principal?

Some are limited to what authority the agent or attorney-in-fact, may do for or in the shoes of the principal, or person who has signed over the power of attorney.

What is the most important decision to make in the preparation of a durable power of attorney?

The selection of your agent is the most important decision you must make in the preparation of a durable power of attorney. The person must be someone in whom you have complete confidence. Confidence, however, is not enough.

What is a durable power of attorney?

A general durable power of attorney is a legal document that appoints an agent (sometimes referred to as an “attorney-in-fact”) to represent you in your personal, financial, and business dealings. A power of attorney is the grant of legal rights and powers by a person, the “principal,” to another, the “agent.”.

When was the Durable Power of Attorney introduced?

The new solution is a durable power of attorney which was first introduced in Virginia in 1954. Today, all 50 states and the District of Columbia recognize general durable powers of attorney.

What happens to a fiduciary when you have a power of attorney?

As a fiduciary, the agent must use your assets for your benefit unless your power of attorney authorizes the agent to make another use of your assets. Your agent’s authority under a power of attorney terminates upon your incapacity unless you specifically state that the authority remains effective after your incapacity. ...

When does a springing power of attorney take effect?

A “springing” power of attorney takes effect only when the event described in the instrument itself takes place. Typically, this is the incapacity of the principal as certified by one or more physicians.

What to do if you have possession of a DPA?

If you have possession of the originals of the DPA, you should destroy all of them. If your agent has possession of the DPA, you should notify the agent of the revocation by certified mail and request that he or she return all originals of the DPA to you.

What is the best time to assign a Statutory Durable Power of Attorney?

One of the crucial aspects associated when setting up a Statutory Durable Power of Attorney is when someone is mentally sound. However, a power of attorney will not be accepted if it is signed by a person who is psychologically incompetent.

What is the difference between a durable and general power of attorney?

The main difference between the general power of attorney and the statutory durable power of attorney is that a general power of attorney remains effective within the principal’s life like providing assistance in legal matters and a helping hand in the day-to-day tasks. Once you become incapacitated, a general power of attorney becomes void.

Types of Power of attorneys

There are different types of power of attorneys because each one of them entails a different situation and is formed depending on the current situation one may have. What are they, know about them in detail.

Conclusion

No matter what power of attorney you opt for granting specific powers to your agent, it always depends on the needs and circumstances of the principal. It is undoubtedly a helpful tool in assisting people in making financial, medical, specific decisions when they are incapacitated or unable to perform.

What does DPOA stand for in a power of attorney?

If you’re appointed as the agent through a Durable Power of Attorney (DPOA), you’ll be given legal authority to act on your parents’ behalf. You’ll have agency to care for them even if they become suddenly incapacitated, until the day they pass away.

What is the difference between a POA and a DPOA?

The key differentiation between DPOA vs POA is simple: incapacitation. As a General POA, your agency ends the moment your parents become incapacitated. This means that if they suddenly become unable to make decisions for themselves, you will no longer be able to make important decisions for them.

What is POA in estate planning?

A POA is a powerful estate planning tool, and there are a few different categories of powers, used in difference scenarios. Two types to consider are General Power of Attorney and Durable Power of Attorney. They’re equally important in the legal authority field, but there’s one key difference between them.

What is a GPOA?

A General Power of Attorney (GPOA) is a similar legal document that allows your parents to appoint you as their agent. As a GPOA, your duties will end if your parents ever became incapacitated.

Do you have to file a POA with the court system?

Generally, a POA does not have to be filed with the court system. Rather, your Power of Attorney is a document you include with your other estate planning documents. You’ll want to keep this safe and secured, such as through your password-protected estate planning platform.

What does GPOA mean?

As a GPOA, your duties will end if your parents ever became incapacitated. This means that your role is to support them under their general guidance or supervision , as long as they are still able to make their own decisions. Here are some examples of the tasks that you might carry out for your parents as their GPOA:

Table of Contents

What Is Power of Attorney

- A power of attorney is a document that grants legal authority to one person, known as the agent or “attorney in fact,” to act on behalf of another, the principal, when they are unable to do so themselves.1While the word attorney might make one assume these responsibilities are reserved for lawyers, the agent can actually be any person the principal...

When to Use A General (Financial) Poa

- Let’s use a hypothetical to outline one example of how and when a general power of attorney can be useful: John has accepted a new contract job that will require him to live overseas for two years. Since he’s currently not married, there’s nobody on the homefront to assist him with the financial matters of the rental property he purchased as an investment five years ago. Suddenly, …

When to Use A Durable (Financial) Poa

- Under the same hypothetical situation, how or when would a durable power of attorney be necessary? Let’s say near the end of John’s time overseas, he’s involved in a near-fatal car accident and his injuries are so severe that John can’t assume care for his property anytime soon. If he enacted a durable power of attorney before leaving, his brother’s agency will continue, eve…

Sources

Popular Posts:

- 1. how to fill out customs power of attorney notary form

- 2. how do i challenge a court document without an attorney?

- 3. attorney who's who

- 4. who is schoharie county district attorney

- 5. if an attorney provised legal services to an organizaton where he is a member, is it in kind?

- 6. divorce attorney who give a free consult

- 7. 1099 misc what are gross proceeds paid to an attorney

- 8. why should sessions be attorney general

- 9. florida, how to register your power of attorney

- 10. how does a ca attorney get admitted to the state bar of ar