What are the powers of a durable power of attorney?

May 23, 2019 · For most people, a spouse is there first choice for their DPOA. While this might be the right choice for you, keep in mind that as we age, there may come a time to appoint an adult child as an alternate or even a the primary Durable Power of Attorney. When choosing an individual, be sure to communicate why you chose this person to your family.

What should I consider when choosing a power of attorney?

Apr 01, 2020 · A durable financial power of attorney allows you to name an agent. This is the person who has the legal power to manage your finances if you can’t do so, such as the result of a serious injury or illness. You can choose almost anyone as your agent, but search for someone who has these traits: Trustworthy; Reliable; Good communication skills

Why do I need a power of attorney agent?

Oct 07, 2019 · Due to the nature of these tasks, choosing your agent is the most important step in creating a power of attorney. However, people often choose their agents for the wrong reasons. Trust is a top priority. When choosing your agent, the most important consideration is trust. People often choose a spouse or adult child to serve as their agents.

How do I make a financial power of attorney?

Sep 24, 2018 · For example, many people choose a spouse or adult child to act as their agent. They trust this person to make the right decisions, so they can confidently name them as the agent of their durable financial power of attorney. Choose an agent who is young and healthy, as you don’t want this person to pass on before you.

Who is the best person to assign power of attorney?

Most people select their spouse, a relative, or a close friend to be their power of attorney. But you can name anyone you want: Remember that selecting a power of attorney is not about choosing the person closest to you, but rather the one who can represent your wishes the best.Mar 14, 2020

What qualities should you look for when appointing someone as an agent via a power of attorney and or a durable power of attorney?

Since your power of attorney potentially will be handling your legal and financial affairs, you'll want to choose someone who either has some experience in these fields or has the personality and financial savvy to handle the decisions that may fall to him or her.Aug 10, 2020

What is the most powerful power of attorney?

A general durable power of attorney both authorizes someone to act in a wide range of legal and business matters and remains in effect even if you are incapacitated. The document is also known as a durable power of attorney for finances.Jul 13, 2021

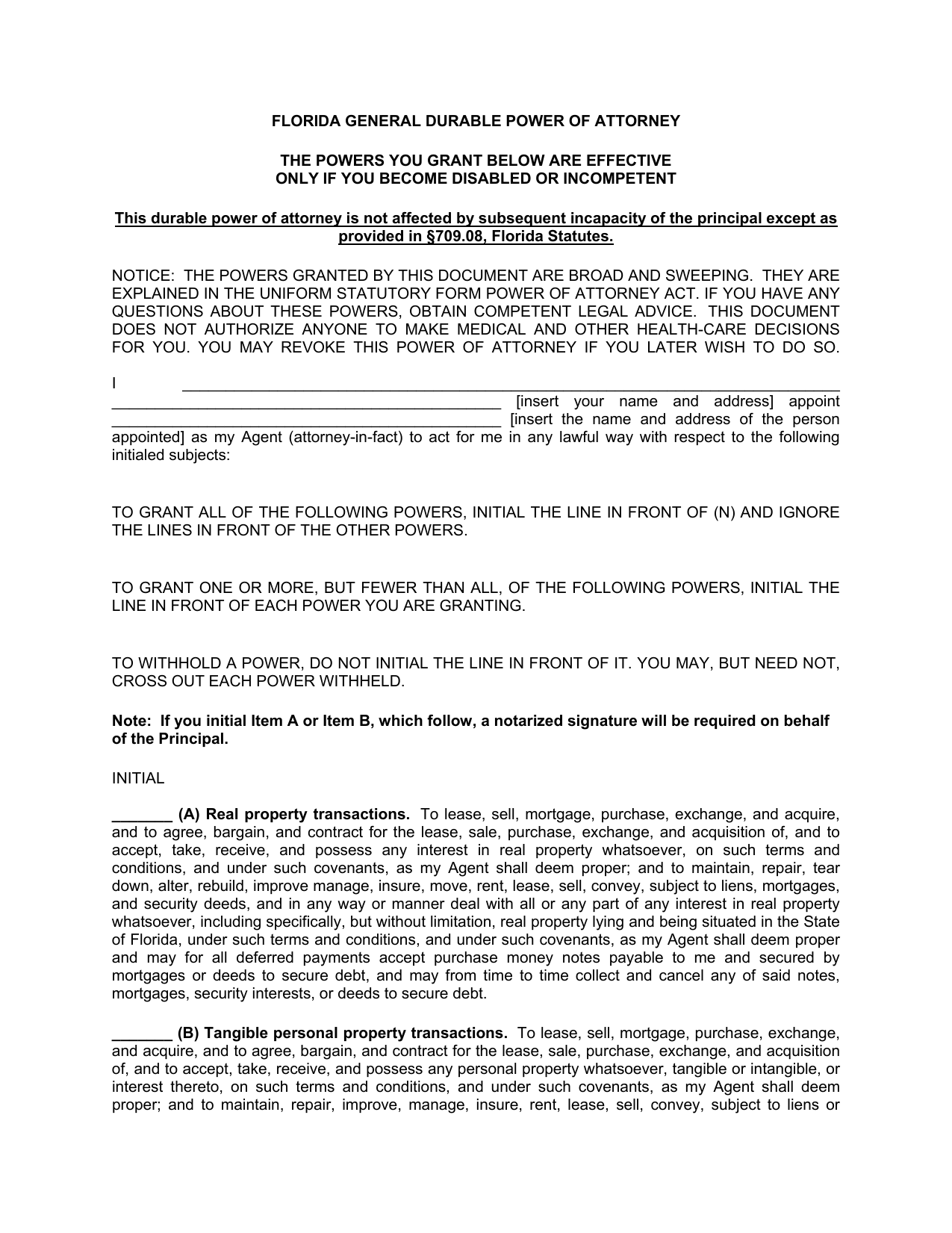

How do I fill out a durable power of attorney in Florida?

How to Fill Out a Florida DPOA FormStep 1: Designate an agent. First, choose someone you trust to be your agent. ... Step 2: Grant authority. Then, mark on the form which areas of your life you want to give the agent legal power over. ... Step 3: Ensure your form is durable. ... Step 4: Sign and date the form.

What three decisions Cannot be made by a legal power of attorney?

You cannot give an attorney the power to: act in a way or make a decision that you cannot normally do yourself – for example, anything outside the law. consent to a deprivation of liberty being imposed on you, without a court order.

Who makes decisions if no power of attorney?

If you have not given someone authority to make decisions under a power of attorney, then decisions about your health, care and living arrangements will be made by your care professional, the doctor or social worker who is in charge of your treatment or care.Mar 30, 2020

What is the difference between a power of attorney and a lasting power of attorney?

An ordinary power of attorney is only valid while you have the mental capacity to make your own decisions. If you want someone to be able to act on your behalf if there comes a time when you don't have the mental capacity to make your own decisions you should consider setting up a lasting power of attorney.Mar 7, 2022

What is the difference between special power of attorney and general power of attorney?

Difference Between General And Special Power Of Attorney A General power of Attorney is very much different from a Special power of Attorney. The GPA always confers a general power of performing while the Special power of Attorney confers only a specific power to perform any particular act or task.

What are the 2 types of power of attorney?

Generally speaking, there are three main types of POA: Ordinary power of attorney. Lasting power of attorney. Enduring power of attorney.Jun 4, 2019

Who can witness a durable power of attorney in Florida?

A power of attorney must be signed by the principal, by two witnesses to the principal's signature, and a notary must acknowledge the principal's signature for the power of attorney to be properly executed and valid under Florida law.

Does a durable power of attorney need to be recorded in Florida?

A Power of Attorney, like a Trust, does not need to be registered or recorded in the public records in order to be effective. It does have to be in writing, signed, witnessed and notarized.Apr 22, 2011

How much does a power of attorney cost in Florida?

between $100 and $300How Much Does a Power of Attorney Cost in Florida? Attorneys in Florida charge anywhere between $100 and $300 for a financial power of attorney. Most estate planning attorneys also offer a power of attorney as part of an estate plan package that includes a will and trust.Jan 25, 2022

When A Financial Power of Attorney Takes Effect

A financial power of attorney can be drafted so that it goes into effect as soon as you sign it. (Many spouses have active financial powers of atto...

Making A Financial Power of Attorney

To create a legally valid durable power of attorney, all you need to do is properly complete and sign a fill-in-the-blanks form that's a few pages...

When A Financial Power of Attorney Ends

Your durable power of attorney automatically ends at your death. That means that you can't give your agent authority to handle things after your de...

When does a power of attorney become effective?

Conventional powers of attorney become effective as soon as they are signed and filed with the courts.

Why do you need a power of attorney?

Because your power of attorney agent will conduct regular banking and other financial and legal transactions on your behalf, consider choosing someone who lives close to you. The farther away from you the agent lives, the more likely it is that she will not be able to handle your pertinent business matters in a timely fashion. Someone who lives close to you will also be familiar with the local and state laws applicable to your personal business endeavors.

What is an attorney in fact?

Your agent, also known as an attorney-in- fact, can handle financial and legal matters on your behalf in the event that you become physically or mentally incapacitated. Because your agent can handle a wide variety of personal matters on your behalf including handling banking and credit issues, it is important that you choose ...

Who is Rhonda Campbell?

Rhonda Campbell is an entrepreneur, radio host and author. She has more than 17 years of business, human resources and project management experience and decades of book, newspaper, magazine, radio and business writing experience. Her works have appeared in leading periodicals like "Madame Noire," "Halogen TV," "The Network Journal," "Essence," ...

What are the different types of powers of attorney?

There are three types of power of attorney: durable, conventional and springing. The durable power of attorney contract gives your designated agent the right to handle business and financial matters like stock portfolios, bank accounts and real estate agreements on your behalf. It becomes effective as soon as you, the principal, sign the form and remains effective throughout your lifetime unless you revoke it. Conventional powers of attorney become effective as soon as they are signed and filed with the courts. The drawback to this type is that it becomes ineffective should you become incapacitated, the very reason that many people designate someone to handle their legal affairs. Springing powers of attorney only become effective after you become incapacitated and usually last throughout a life event such as a coma. You can revoke a power of attorney at any time.#N#Read More: Types of Power of Attorney for Elderly Family Members

Can a spouse give you a power of attorney?

Spouse. If your spouse is generally in good health and someone who you trust with your finances, you could assign that person power of attorney rights. You could always select a close relative as a substitute power of attorney. Military personnel often give their spouses power of attorney rights while they are away in combat.

How to choose a power of attorney?

As you choose someone to hold power of attorney, first have a conversation with the person you have in mind and talk in detail about what the responsibility entails and your legal and financial affairs. These discussions will further help you know whether you’ve picked the right individual. During these processes, be sure you also make time to have the “Talk of a Lifetime” with your loved ones. This crucial conversation can help you get re acquainted with loved ones and get to know them in a whole new way. Learn how to get the conversation started today.

What is a power of attorney?

Simply defined, power of attorney is the authority to act in behalf of another person. When it comes to your estate planning, there are two primary power of attorney types to be aware of: “springing,” or conditional, power of attorney and “durable” power of attorney.

What is a springing power of attorney?

A springing power of attorney means your chosen agent must prove you’re incapable of making decisions before he or she is authorized to act in your behalf. A durable power of attorney allows your agent to act for you immediately, without having to prove you are incapable of making your own decisions.

How to choose a power of attorney?

When choosing your power of attorney, talk to the person you are considering. Be sure that they feel they could serve in this capacity. Encourage the person to be honest.

What is a power of attorney?

Regardless of the name, a power of attorney is someone you choose to make health and medical decisions for you if you're unable to make them for yourself. 1. For most people, having this person in place to make medical decisions when they are no longer able to do so can bring peace of mind. Some people choose to designate a power ...

Who is Sherri Gordon?

Sherri Gordon is a published author and a bullying prevention expert. Cristian Zanartu, MD, is a licensed board-certified internist who has worked for over five years in pain and palliative medicine. One of the most important healthcare decisions you will make is choosing your power of attorney.

Can you designate a power of attorney?

But really, you can designate your power of attorney anytime you want. You simply need to have an attorney draw up the paperwork. You also can specify when the duties of the power of attorney begin to take effect.

What is a durable power of attorney?

A durable power of attorney form (DPOA) allows an individual (“principal”) to select someone else (“agent” or “attorney-in-fact”) to handle their financial affairs while they are alive. The term “durable” refers to the form remaining valid and in-effect if the principal should become incapacitated (e.g. dementia, Alzheimer’s disease, etc.).

What is an attorney in fact statement?

(25) Attorney-in-Fact Declaration. The Agent who will be granted the principal powers you approved according to the conditions you set will have an acceptance statement to tend to. The printed name of the Attorney-in-Fact must be included in this statement.

What is UPOAA law?

The Uniform Power of Attorney Act (UPOAA) are laws created by the National Conference of Commissioners on Uniform State Laws (ULC) and have been adopted by 28 States since 2007. The incorporation of the laws is to bring uniformity to all 50 States and set common guidelines. Uniform Power of Attorney Act (UPOAA) Statutes (Revised 2006)

Who determines if a disability form is effective?

The principal will have to decide if the form will be effective immediately or if it will be effective upon the disability of the principal. Disability or incapacitation is usually determined by a licensed physician and usually defined under State law.

What is the meaning of section 114?

In accordance with Section 114 (page 23), the agent must act: To principal’s expectations while performing in their best interest; In good faith; Only with the scope of authority within the power of attorney. To act without a conflict of interest to be able to make decisions on behalf of the principal’s best interest;

What is an agent certification?

An agent certification is an optional form that lets an agent acknowledged their designation by the principal. The agent must sign in the presence of a notary public ( Section 302 – Page 74 ):

What is personal maintenance?

Personal and Family Maintenance – Deciding and budgeting the amount of money to pay for the principal and any family members being supported; Benefits from Governmental Programs or Civil or Military Service – To make claims for any government benefit or subsidy; Retirement Plans – To amend any retirement plan.;

Popular Posts:

- 1. how long term is mn attorney general

- 2. how district attorney updates town court for the reduction ofthecourt

- 3. where to classify fingerprinting expense for attorney

- 4. what does a state attorney do?

- 5. how to become a pharmacy attorney

- 6. how to get power of attorney for house closing in illinois

- 7. who hired garcia zarate' attorney

- 8. power of attorney lacking language of what happens after death

- 9. how to find out if spouse has power off attorney

- 10. how much is legal to pay a probate attorney fl