The easiest way to get Power of Attorney is by speaking with a power of attorney lawyer. They possess a strong command of local laws, so they’ll offer the most efficient method of getting them. However, the only way to get Power of Attorney is by being named in the document or through a formal court order.

How do you become a power of attorney?

Apr 13, 2022 · We do not know when our capacity to manage finances or make healthcare decisions will be lost. Speak with an estate planning attorney about the POA to best serve your circumstances before it is needed. Reference: Tyron Daily Bulletin (March 7, 2022) “How to get power of attorney for a loved one”

Why should I have a power of attorney?

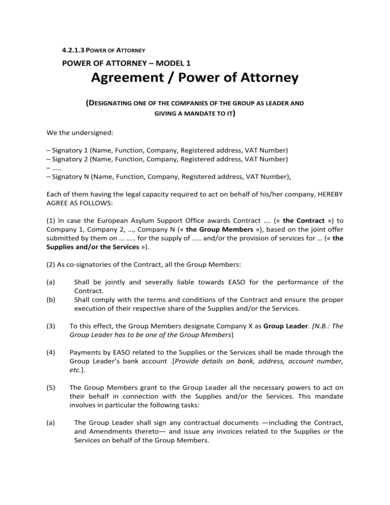

Feb 24, 2022 · A POA document is generally a written agreement between two people: (1) the principal (sometimes called the grantor) and (2) the agent (sometimes called the attorney-in-fact). The agent is the person appointed to act on behalf of the principal. So your parent (the principal) can grant you (the agent) certain powers of attorney.

What are the requirements for a power of attorney?

We recommend that you contact a legal advisor for guidance in obtaining and executing a power of attorney. Your legal advisor can prepare a power of attorney document that covers a broad range of assets and transactions and can be presented at multiple financial institutions.

Why do you need a power of attorney?

Apr 12, 2022 · To get power of attorney (POA), the person granting you that power must name you as the agent to have the powers specified in the POA document. It must be signed by the giver while s/he is sound of mind. April 12, 2022 ★ Articles Elder Law Estate Planning. How do you get a Power of Attorney?

What is a power of attorney?

A power of attorney is a legal document giving a person (known as the agent or attorney-in-fact) broad powers to manage matters on behalf of anothe...

Are there different types of power of attorney documents?

Yes. A power of attorney can be durable or non-durable. A durable power of attorney remains effective after the principal becomes incapacitated whi...

What are the most common reasons for needing a power of attorney?

Executing a power of attorney document may be helpful in a variety of ways. The power of attorney can permit an agent to act on the principal’s beh...

Is a person being a co-owner the same as that person having power of attorney?

In a joint account ownership situation,. any co-owner has full access to the account, including the ability to make withdrawals and pay bills. If o...

Is a person being a trusted contact the same as that person having power of attorney?

No. A trusted contact is an individual age 18 or older who is identified by you as someone we’re able to contact about your account for any of the...

I’m a trustee on a trust account. Can I use a power of attorney to name an agent to act on the trust...

A delegation of a trustee’s power may be subject to state laws and limitations in the trust agreement. Consult with your legal advisor to determine...

Is an account with an agent appointed in a power of attorney the same thing as an account with one o...

No. Sometimes referred to as a Totten trust or an in trust for (ITF) account, a payable on death (POD) account is an account ownership type in whic...

Does an agent have the same authority as a POD (payable on death) beneficiary?

No. Once a power of attorney document is executed and accepted by the bank and the agent is added to the account, the agent is authorized to act on...

What is financial power of attorney?

Having financial power of attorney means having the authority to access and manage another person's monetary and/or property assets. As an agent with financial POA, you have the right to make certain kinds of financial decisions on behalf of the principal (as long as they are in his or her best interests). For example, your parent might give you the authority to pay bills, file taxes, make and manage investments, transfer money between different bank accounts, handle insurance claims, collect outstanding debts, sell or rent out property, or deal with retirement pensions and government benefit programs.

What is POA in law?

A POA document is generally a written agreement between two people: (1) the principal (sometimes called the grantor) and (2) the agent (sometimes called the attorney-in-fact). The agent is the person appointed to act on behalf of the principal. So your parent (the principal) can grant you (the agent) certain powers of attorney.

When does a springing POA take effect?

Unlike most other types of POA documents, a springing POA agreement doesn't take effect until a specified date or a particular event takes place. For example, your parent may not want you to have any authority until he or she becomes incapacitated or turns a certain age.

Can you have more than one power of attorney?

However, there can be more than one person with power of attorney because your parent may decide that various responsibilities should be divided up among two or more people. (Frequently, for instance, one agent will handle financial matters, whereas another will handle healthcare issues.)

What is POA agreement?

Depending on the particular agreement, a power of attorney covers a broad or narrow set of responsibilities, usually related to financial and/or medical and caregiving matters.

Is it too late to get a power of attorney?

After all, by the time your parent becomes legally incapacitated, it's too late to get power of attorney. At that point, you have to pursue the more costly and time-consuming option of adult guardianship. That's why the issue of "capacity" is so important.

What is a POA?

Also known as special power of attorney, this type of POA grants an agent the authority to handle a very specific situation on the principal's behalf. For example, your parent may grant you limited POA to represent him or her in the sale of a particular property or to manage his or her transition to a nursing home or assisted living facility. Your authority as the agent ends as soon as you've successfully completed the defined activity or reached the agreement's specified expiration date. And your powers do not extend to anything other than what is specified in the document.

What is a power of attorney?

A power of attorney is a legal document giving a person (known as the agent) broad powers to manage matters on behalf of another person (known as the principal). Under certain circumstances, Bank of America allows agents to be added to the principal's accounts ...

What happens if one of your co-owners passes away?

If one co-owner passes away, the other co-owner owns all funds in the account. With a power of attorney, the ways in which the individual can conduct transactions can be specific and limited. See what's needed to add a co-owner to your account. See what's needed to add a co-owner to your account.

What is a trusted contact?

A trusted contact is an individual age 18 or older who is identified by you as someone we're able to contact about your account for any of the following reasons: To address suspicious financial activity on your account. To confirm specifics of your current contact information. To confirm your health status.

Can a trustee be delegated?

A delegation of a trustee's power may be subject to state laws and limitations in the trust agreement. Consult with your legal advisor to determine any legal requirements (in the law or in the trust agreement) and the appropriate language for including a delegation of a trustee's power in a power of attorney.

What is a power of attorney?

Power of attorney forms are common estate-planning tools used to authorize someone else to handle some or all of your financial affairs. If you create these tools and later become incapacitated or otherwise unable to make decisions, a durable power of attorney can give a loved one or other trusted individual the authority to handle your affairs ...

Is a power of attorney dangerous?

Power of attorney forms are valuable, but they can be dangerous in the wrong hands. Before you create these forms, evaluate your options for whom to name as your attorney-in-fact (your agent). Choose someone you believe will act with your best interests in mind.

What is a power of attorney in Washington?

Create Document. A power of attorney form used by an individual (“principal”) to appoint someone else to handle their affairs (“agent” or “attorney-in-fact”). The agent is able to handle financial, medical, guardianship, or tax-related matters during the principal’s lifetime. If the form is durable, ...

What is a Durable Power of Attorney?

View and read the Types of Power of Attorney in order to get a better understanding of which form (s) are best. The most common is the Durable Power of Attorney for financial purposes and allows someone else to handle any monetary or business-related matter to the principal’s benefit.

What is an agent in fact?

An agent, also known as an Attorney-in-Fact, is the individual that will be making the important decisions on your behalf. This individual does not need to be an attorney, although an attorney can be your agent. The two (2) most important qualities you should look for in your agent is accountability and trust.

Who will keep forms after signing?

These forms are not filed with any government agency or office so it will be up to each individual to securely maintain the form until it is needed.

What is banking banking?

Banking – To be able to deposit or withdraw funds in addition to conducting any type of financial transaction that the principal could also do themselves. Upon initials being placed on this line, the agent will have the full capacity to

What is a power of attorney?

A power of attorney is a legal document that allows someone (the principal) to give another person (the agent) the legal power to make decisions on the principal's behalf. An agent is sometimes called an attorney-in-fact or a health care proxy when the power of attorney concerns health care. An agent must be an adult.

What happens if a power of attorney is not durable?

In some states, if your power of attorney does not have language that it is durable, it will be an ordinary power of attorney and your agent's power will cease if you are in a coma or lack the mental ability to make decisions for yourself.

When does a springing power of attorney become effective?

A springing power of attorney only becomes effective if the principal becomes incapacitated. If you want your agent to have powers over your finances or health care only when you cannot make your own decisions, you could use a springing power of attorney.

Is a durable power of attorney nondurable?

In some states, it is assumed your power of attorney is durable unless otherwise stated. In other states, a power of attorney is nondurable by default.

What kind of attorney should I speak to about my estate?

Because there are many different powers you can grant an agent, you should speak with a skilled estate planning attorney. An attorney can draft a power of attorney for you or review a form power of attorney that you filled out. An attorney can advise you about specific laws in your state to ensure your power of attorney is valid.

Can you use a power of attorney for health care?

Power of Attorney for Health Care. If you want someone to make decisions about your health care when you are incapacitated, you can use a power of attorney for health care. This is different from a living will and does not allow your agent to make decisions that contradict your living will. A living will tells doctors what treatment you want at ...

Can a financial power of attorney be used to make decisions?

If you want someone to make financial decisions for you , you can create a financial power of attorney. You can give your agents broad powers to handle all your finances, or you can limit their powers to specific financial decisions.

How to choose a power of attorney?

Step 1 – Choose an Agent. Select and ask someone that you trust if they would like to be your “Agent” or “Attorney-in-Fact”. Especially for a durable power of attorney, the agent selected should be someone you have trusted most of your life.

What is a power of attorney?

Power of attorney is a legal document that allows an individual (known as the “Principal”) to select someone else (“Agent” or “Attorney-in-Fact”) to handle their business affairs, medical responsibilities, or any decision that requires someone else to take over an activity based on the Principal’s best interest and intentions. ...

What is an advance directive?

An advance directive, referred to as a “living will” or “medical power of attorney”, lets someone else handle health care decisions on someone else’s behalf and in-line with their wishes. These powers include: Everyday medical decision-making; End-of-life decisions; Donation of organs;

How many witnesses do you need to be a notary public?

In most cases, a Notary Public will need to be used or Two (2) Witnesses.

Can a principal use a power of attorney?

For other nominations, a principal may assign power of attorney under a special circumstance with the limited form. In addition, if the principal is looking to have someone only handle personal and business filings the tax power of attorney should be used.

Do you need to record a power of attorney?

It is important for all parties involved to have copies of their form. A power of attorney does not need to be recorded with any government office and is primarily held by the Principal and Agent (s).

Popular Posts:

- 1. how to fire a divorce attorney letter

- 2. who was the attorney general for duane buck

- 3. north carolina attorney general who should i vote for

- 4. legal how to deal with a revocation power of attorney

- 5. who is the district attorney of baltimore marylan

- 6. how to press fraud to the attorney general florida

- 7. what is a immigration attorney

- 8. how to prepare for criminal defense attorney visit

- 9. attorney general of texas what does he do

- 10. what right allows attorney client privilege