Can I cash someone else's stimulus check with power of attorney?

It is up to the bank. You can't force them to accept your POA. Or if they do, they might not cash it, but require it to be deposited into his account.May 12, 2020

How do you endorse a check as a power of attorney?

If you need to sign a check for her, the usual procedure is to write her name on the top line and then add your name and title underneath, Mr. Rubenstein says. For example, you would write your mother's name on the main line. Underneath it, you would write: "By (insert your own name), as attorney in fact."Oct 3, 2010

How do I deposit a check with power of attorney?

When you're endorsing a check as a power of attorney, you are signing as the agent for the person to whom the check is issued. If that person is named Joe Schmo, and your name is Jane Doe, you can use either of these formats to endorse the check: Joe Schmo by Jane Doe under POA, or.Jul 26, 2019

How do you cash a check on someone else's behalf?

Cash It at the Issuing Bank If you want to cash a check on behalf of someone else, take the check to the issuing bank. This will make the process of getting it cleared less time-consuming. Present the check at the counter of the bank it is issued by.Mar 24, 2022

Can I deposit a check with my dad's name on it?

Your Dad can legally endorse a check made payable to him and give that check to you. You can then sign your name on the endorsement line beneath his signature and attempt to cash it at the bank that holds the account that funds are being drawn from.

How do I endorse a check?

To endorse a check, you simply turn it over and sign your name on the back. Most checks give you a space on the back for your endorsement. You'll see a few blank lines and an "x" that indicates where you should sign your name.May 22, 2019

Does Chase Bank accept power of attorney?

If you need help, contact our Client Service Center at (800) 392-5749 or submit your question by Secure Message on chase.com. Establish power of attorney on a brokerage account. Along with this form, you will also need to submit a durable Power of Attorney agreement.

How can I cash a large check without a bank account?

Here are five options.Cash your check at the issuing bank. ... Cash your check at a retailer. ... Load funds onto a prepaid debit card. ... Cash your check at a check-cashing outlet. ... Sign your check over to someone you trust.May 20, 2021

Where can I cash a check I already signed?

Cash a Check Without a Bank AccountCash it at the issuing bank (this is the bank name that is pre-printed on the check)Cash a check at a retailer that cashes checks (discount department store, grocery stores, etc.)Cash the check at a check-cashing store.More items...

How do you cash a third party check without the other person?

What You'll Need. Gather two forms of photo identification. The most important part of cashing a third party check without a personal account is proving you are the person whose name is written on the check. To do this, the bank or check cashing place will usually ask for at least two forms of picture identification.

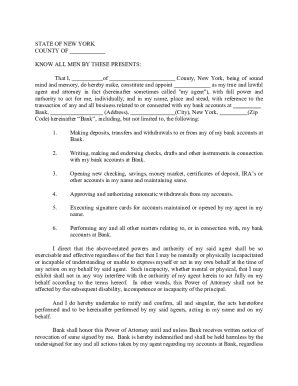

What is a power of attorney?

Powers of attorney are key estate planning documents. In the unfortunate event that you become unable to care for yourself, it is crucial that you grant a trusted party the authority to effectively make legal, financial, and medical decisions on your behalf. Through two key estate planning documents — the durable power of attorney and ...

Can a durable power of attorney make medical decisions?

Can a Durable Power of Attorney Make Medical Decisions? No. A durable power of attorney is generally for legal decision making and financial decision making. To allow a trusted person to make health care decisions, grant them medical power of attorney.

Can you have multiple power of attorney?

Yes. You have the legal right to appoint multiple people as your power of attorney. You could even split your durable power of attorney and your medical power of attorney. The legal documents should state whether each agent has full, independent power or if they have to act jointly.

Can a convicted felon have a power of attorney in Texas?

Can a Convicted Felon Have Power of Attorney? Yes. Texas law does not prevent a convicted felon from having a power of attorney. A mentally competent person has the authority to select who they want to serve as their power of attorney.

Forrest Nolan Welmaker Jr

Endorse the back of the check with his name as it appears on check followed by: "by (your name), attorney in fact for (his name). ". Then you endorse your name and deposit into your checking account. Legally that should work.

Stuart A. Lautin

First, try going to the bank upon which the funds are drawn. If the employer's bank is Wells Fargo (by example), then go there and bring the original, signed and notarized POA. You might -- maybe -- have better luck in that instance.#N#Second, if that doesn't work, see if your friend can contact the employer to explain...

Dwaine Morris Massey

You do not need a power of attorney to cash the check. He simply has to endorse them and give them to you.

What is a power of attorney?

A power of attorney is a document granting an agent the legal right to perform legal acts on behalf of the person who granted the power of attorney, known as the principal. You can grant most of your legal rights to an agent, including the right to perform financial transactions, such as cashing a Social Security check.

What are the fiduciary duties of a power of attorney?

The two primary fiduciary duties are the duty of loyalty and the duty of care. The duty of loyalty binds your agent to act on behalf of your interests, not his own. He may not benefit from any transactions he performs on your behalf, even if his benefit doesn't harm you, except that you may provide compensation to your agent in the power of attorney. The duty of care binds your agent to treat your Social Security checks and cash with the same degree of care that he would exercise if they were his own property.

What is the duty of loyalty?

The duty of loyalty binds your agent to act on behalf of your interests, not his own. He may not benefit from any transactions he performs on your behalf, even if his benefit doesn't harm you, except that you may provide compensation to your agent in the power of attorney.

Stuart Warren Moskowitz

I agree with the other counsel. If the check is small in amount the bank will probably allow you to cash it if you produce the durable power of attorney and you endorse the check by signing the back of the check "his name by your name, his agent" or "his attorney in fact". They will ask you for your identification as well.

Richard J. Chertock

Go to his bank, endorse the check by signing the back of the check "his name by your name, his agent" or "his attorney in fact" and bring the power of attorney with you. The bank should have no problem cashing it unless it is for a large amount, in which case you may need to deposit it first and wait for it to clear...

Joseph Franklin Pippen Jr

It somewhat depends on the size of the check.#N#For example-if it is less than $100 and needed for#N#immediate care-you could sign as DPOA for him and probably cash it#N#with proper ID and copy of the document.#N#If it is a much larger check-the proper plan would probably be to set up...

How to endorse a check?

When you're endorsing a check as a power of attorney, you are signing as the agent for the person to whom the check is issued. If that person is named Jane Jones, and your name is Laura Garcia, you can use either of these formats to endorse the check: 1 Jane Jones by Laura Garcia under POA, or 2 Laura Garcia, attorney-in-fact for Jane Jones

What is a POA?

Power of Attorney. A power of attorney, or POA, is a legal document in which the person signing the POA gives someone else authority to act as their agent. In the above example, Jane Jones signed a POA document giving Laura Garcia legal authority to act for her in banking matters.

Popular Posts:

- 1. suing an attorney under fdcpa what if attorney objects to producing collection letters

- 2. who is the laundries attorney

- 3. how to.request attorney for unemployment pa

- 4. how to force power of attorney in maryland

- 5. a medical power of attorney would be found in what section of patient medical records

- 6. where is attorney general ny office

- 7. who is connor massey attorney

- 8. how to obtain power of attorney in ga

- 9. how to transfer car title with power of attorney louisiana

- 10. who has the power to retain attorney for company