Full Answer

Can a loan document be signed with a power of attorney?

For the nuts and bolts on signing and notarizing of a power of attorney, refer to last week’s article Part 3 – Notarizing a Power of Attorney. You may be curious about whether certain loan documents are more likely to be signed with a POA than others. It would be rare for commercial loan documents to be signed with a POA.

How do you sign a limited power of attorney form?

If the agent is signing a document on behalf of the principal, they must sign and then use the phrase below the signature line “Acting as POA”. The completed and signed limited power of attorney form should always be kept in a safe and easy to access place while not in use.

What is a limited power of attorney for bank accounts?

Understanding Limited Power Of Attorney. The "limited" in LPOA refers to the fact that certain critical account functions are still only available to the account holder, such as cash withdrawals, a change of beneficiary or other significant account actions. Clients need to clearly state which powers they wish to retain.

What is a limited Poa for a car loan?

A limited POA only allows an agent to make decisions on your behalf in defined situations. This POA outlines specific directions for your agent during a set timeframe. To refinance your auto loan, you’ll use a limited POA. It will allow the lender, broker, or agent’s power to transfer your car title.

What is the lien holder address for Capital One?

The Capital One Auto Finance lienholder address is P. O. Box 660068 / Sacramento / CA 95866. Hence, if you need the official lienholder mailing address for Capital One Auto Finance, you need to use the address P. O. Box 660068/Sacramento/CA 95866.

Can I sell a car with power of attorney in California?

The California vehicle power of attorney form, also referred to as the DMV Form REG-260, permits an owner of a vehicle or vessel located in California to choose an agent to handle a transfer of ownership. The document does not need to be witnessed or notarized to be legally enforceable.

Is Capital One a lien holder?

Signing the refinance contract obligates you to ensure Capital One Auto Finance is listed as the first lien holder on your refinance vehicle.

How do I access my Capital One auto loan?

How can I access my auto loan online? As a new or current customer, simply enroll in Online Banking to access your auto loan account online. You'll need your last name, social security number, and date of birth. If you have questions, please contact us.

How do I transfer a car title with power of attorney in California?

If you want to transfer your vehicle or property title using an agent acting under authority of a power of attorney (POA), obtain a POA form. Fill it out, naming your agent and signing the POA as required in your state, and then let your agent do the rest.

Can you sell a car on someone's behalf?

Yes, someone else can sell your car on your behalf whether this is your husband, wife, another family member, or friend. However, you will need to ensure that the correct documentation is in place.

How many car payments can you missed before repo Capital One?

Two or three consecutive missed payments can lead to repossession, which damages your credit score.

Why is my auto loan closed?

"Paid," or "paid in full," is the term applied to installment accounts, like car loans, after the last payment is made and you have completed repayment of the loan as agreed. Since you can't use the account for anything else, once a loan is paid in full, it is essentially closed.

What credit score do you need for Capital One auto loan?

A Capital One auto loan might be for you if you have a nonprime (between 601 and 660) or subprime (between 501 and 600) credit score. In these credit categories, borrowers may be rejected by many lenders or offered high interest rates. Capital One works with borrowers with credit scores as low as 500.

Is it good to refinance your auto loan?

Refinancing and extending your loan term can lower your payments and keep more money in your pocket each month — but you may pay more in interest in the long run. On the other hand, refinancing to a lower interest rate at the same or shorter term as you have now will help you pay less overall.

How Long Will Capital One finance a car?

24 to 72 monthsCapital One Auto Loan DetailsLoan Amount Range$7,500 to $50,000APRDepends on credit profileLoan Term Length24 to 72 monthsPrepayment PenaltyNone1 more row•Mar 25, 2022

Will Capital One lower my auto loan interest rate?

Refinancing your CapitalOne auto loan means quite the opposite: you will be able to lower your payments by decreasing your interest rate and/or stretching the term because you've done a good job and made your payments in time and in full.

What is a limited power of attorney?

What Is Limited Power of Attorney? Limited Power of Attorney (LPOA) is an authorization that permits a portfolio manager to perform specific functions on behalf of the account owner.

What is a POA?

Clients typically complete a power of attorney (POA) form when they open an account with a portfolio manager. Most forms give clients the option to choose between an LPOA or a full power of attorney. A limited power of attorney restricts the authorization to a specific sphere, such as investment management. The client must designate an attorney in ...

What is LPOA in portfolio management?

An LPOA gives the portfolio manager the authority to buy and sell assets, pay fees, and handle various necessary forms. Certain critical account functions still can be made only by the account holder, including cash withdrawals and a change of beneficiary.

Who must sign a portfolio manager form?

Once completed, both the client and the attorney or attorneys in fact must sign the form.

Can an account holder specify other exceptions to the limited power of attorney?

An account holder may specify other exceptions to the limited power of attorney.

Can a portfolio manager withdraw money from a bank account?

The portfolio manager is never permitted to withdraw money from the account or change the beneficiaries. An account holder may specify other exceptions to the limited power of attorney. A limited power of attorney, as opposed to a general power of attorney, restricts the authority of the designated individual to a specific sphere.

Document Package Types Signed with Poas

Terms

- We discussed terms in Part 3, but I think it might be helpful to list them here, as well. 1. Agent – The individual authorized to act on behalf of the principal. 2. AIF – Acronym for Attorney-in-fact 3. Attorney-in-fact – This means the same as “agent,” (the one authorized to act on behalf of the principal). 4. Grantee – Another way to say “agent” ...

Procedures and Tips

- The only downside to an assignment using a POA is time. It will take longer to sign several words rather than merely a first and last name. Otherwise, below are a few suggestions for new notaries who haven’t handled this type of assignment yet. Ask if you are required to pick up and return the original POA. In my experience, the original POA is usually in the hands of the title company befo…

Notarial Certificates

- Certificates may have more blank spaces to complete than you are accustomed to. For instance you could run into this. Acknowledged before me, ___________, _____________, on _________ by __________________as ________________ on behalf of _________________. And, it would be much easier to complete the certificate if you knew that your state’s certificate would be completed this way …

Common Signature Lines

- As stated above, always know how the borrower / signer must execute the documents. Every case is different. However, below are a few examples of how documents are signed. The “ink” part of the signature block is in blue. Harry Stone as Attorney-In-Fact For Edgar A. Poe Pursuant to POA Dated Xx Xx, Xxxx _________________________________________________ EDGAR A. POE Edgar A. Po…

Neatness Counts!

- Here are a few tips your hiring parties will appreciate. 1. Stay out of the margins. Leave 1” clear around the document. 2. Ensure the signer keeps the handwriting above the line so that the printed information under the line is not obscured by handwriting. 3. If a mistake is made, use the signer’s copy and start over with a clean document. It’s not necessarily against the rules to strik…

Safeguards in Place by Lender and Title Company

- New notaries may feel obligated to look at the POA to make sure that the person signing has the proper authority to sign document. It’s not necessary unless required by law.

Next Steps

- Look up your state’s attorney-in-fact certificates and familiarize yourself with the language. If they aren’t easily found, contact your state’s commissioning authority. If you haven’t already, sign up for a notary training course– boost your confidence level by learning notary basics.

in Case You Missed The Previous Articles in This Series —

- Part 1 – Introduction to Wills and Estate Documents for Notaries (PLUS MARKETING TIPS for the fall!)

- Part 2 – Notarizing Wills

- Part 3 – Notarizing a Power of Attorney

Step 1 – Decide The Powers

Step 2 – Select The Agent

Step 3 – Write The Poa

Step 4 – Signing The Form

- Sign this form falls under “financial” related use, it must be authorized in accordance with State ‘Durable’ Laws. Which usually means the form must be signed with the principal in front of a notary public, witness(es), or both.

Step 5 – Acting as An Agent

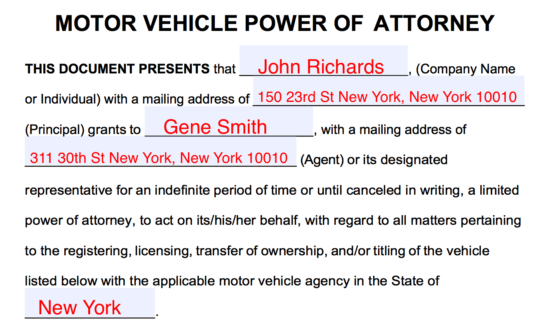

Step 1 – Basic Information of Principal and Agent

Step 2 – Powers

Step 3 – Revocation

Step 4 – State Law

Step 5 – Acceptance of Appointment

Popular Posts:

- 1. must my attorney in fact be present before the notary when the document is signed

- 2. what is required to get power of attorney

- 3. situations where medical power of attorney makes decisions

- 4. where is the proscute attorney office elkins wv

- 5. how to write an effective complaint letter about your attorney

- 6. what do you call it in law when the attorney is reprenting someone else's client?

- 7. ohio criminal defense attorney who cant afford policies

- 8. what does esquire vs attorney mean

- 9. how many united states attorney

- 10. how to contact kirk nurmi attorney