What are attorney fees and how do they work?

Attorney fees are the amount of money billed to a client by a lawyer for performing legal services on the client's behalf. You may also see attorney fees referred to as attorney's fees or attorneys' fees. Attorney fees can be set in a few different ways, such as by an attorney-client compensation agreement, by statute, or by a court.

Who pays closing costs when buying a home?

In short, buyer and seller closing costs are paid based on the terms of the home purchase contract, which both mortgage parties agree on. As a rule, the buyer’s closing costs are substantial, but the seller is often responsible for some closing fees as well. Much depends on the purchase agreement.

How much do lawyers get paid for winning a case?

Under the typical arrangement, if the attorney wins the case for the client, the attorney will take a percentage of the amount won, but if the attorney is not successful, the client pays nothing. Often, the percentage that the attorney receives depends on what stage the case settled at.

How much does a business sale attorney cost?

If a client is forming a corporation or LLC at the same time, the cost is $6,995. Including internet terms, trademarks and employment the estimate is $11,995. Comment On Your Experience With a Business Sale Attorney

Who pays the fees to draw up a FSBO purchase agreement?

Who can help a buyer with a real estate contract?

What is land contract?

What is FSBO sale?

What is a purchase contract?

What is a seller's agent?

Who is the transactional agent for a contract?

See 4 more

About this website

Do sellers pay closing costs in NJ?

Both sellers and buyers are responsible for paying certain closing costs on a property in New Jersey. Generally, the seller pays their attorney fees, transfer fees, and realtor commissions.

Who pays closing costs in NJ buyer or seller?

In New Jersey, as in most states, it's common for both the buyer and seller to have their own closing costs during a home sale. It's typical for sellers to pay for the real estate agent commissions, transfer fees relating to the sale of the home, and (in some cases) their own attorney fees.

Do sellers pay closing costs in NC?

In North Carolina, closing costs are paid by both the buyer and seller. Your closing costs will vary depending on the home's purchase price, the location and whether you're paying in cash.

Who pays closing costs in SC?

Closing Costs can be paid by three separate parties in the transaction – the buyer, the seller and the Lender, or a combination of the three.

Does the seller pay closing costs?

Typically, buyers and sellers each pay their own closing costs. A home buyer is likely to pay between 2% and 5% of their loan amount in closing costs, while the seller could pay 5% to 6% of the sale price to their real estate agent. But it doesn't always work out that way.

Who pays transfer tax in NJ?

the sellerThe State of New Jersey imposes a Realty Transfer Fee (RTF) on the seller whenever there is a transfer of title by deed. The fee is based on the sales price of the property, and the seller is required to pay the fee at the time of closing.

Does a seller need an attorney at closing in NC?

Unlike some states that allow title companies to facilitate home sales, residential property sales in North Carolina must be processed by a residential real estate attorney. In addition to the buyer, seller, and their attorneys, real estate agents and either an escrow or settlement agent may be involved in the closing.

How much is a closing attorney in NC?

between $600 to $1,000Legal/Attorney Fees If you choose to work with an attorney on your home sale, expect to pay anywhere between $600 to $1,000. Sellers aren't required by the state of North Carolina to employ an attorney for home sales. If you're selling your house without a realtor, it may be a good idea to hire a lawyer.

How much does a real estate attorney cost in NC?

Attorney fees in the Triangle NC area range from about $375 – 600. Be sure to ask if the lower fees include the cost of the Title Search. Many attorneys will price that separately and that could range from $125 – 250.

Do buyers pay realtor fees in South Carolina?

In South Carolina, the home seller typically pays the realtor fees for all agents involved in the sale. This is the standard nationwide. Realtor fees are baked into the price of the home and are paid out of the proceeds when it sells.

Do you need an attorney to buy a house in SC?

Title Issues in South Carolina South Carolina law requires the buyer to hire a lawyer to perform a title search before purchasing a house.

Is South Carolina an attorney closing state?

South Carolina considers the conducting of a real estate closing the practice of law, which only an attorney can do. State v. Buyers Service Co., 357 S.E.2d 15 (S.C. 1986.) In South Carolina, any reputable mortgage lender will require that an attorney be selected to conduct the closing.

Who pays for title in NJ?

Q: Who pays for Title insurance? A: In most cases the buyer pays for the insurance premium on the owner's policy and the lender's policy. The insurance premium is part of the closing costs. In New Jersey the lender's policy cost is only a nominal fee added to the owner's premium.

How are closing costs calculated in NJ?

On average, closing costs in New Jersey are around 1.5% of the home sales price for sellers, not including the broker commission, which can add another 3% to 6%. NJ home buyers can expect closing costs between 2% and 3%. Closing costs are all the costs associated with buying or selling a house.

How many months are property taxes collected at closing in NJ?

The state collects property taxes every 4 months—February, May, August, and November—and on the first day of those months.

Does NJ have a exit tax?

New Jersey exit tax particulars The New Jersey exit tax requires you to withhold either 8.97 percent of the profit/capital gain you make on the sale of your home or 2 percent of the total sale price: whichever is higher.

Documents To Sell A House For Sale By Owner

Selling a house for sale by owner doesn’t need to be a hassle. Here are the main documents you are going to need, and where you can find them to make a smooth sale.

THIS IS A LEGALLY BINDING CONTRACT BETWEEN PURCHASER AND SELLER IF YOU ...

5. APPRAISAL. This offer is _____ is not_____ subject to the property appraising for at least the purchase price. If the appraisal reveals repairs, which must be made, Purchaser and Seller will negotiate

Purchase Agreement: Who Draws Them Up and How Do They Work?

A purchas e agreement is a contract that outlines the conditions of the sale of a home. Once the buyer and seller have agreed to these conditions and apply their signature, this document becomes legally binding. A purchase agreement covers different topics such as home financing, repairs, closing details, and the final date the buyer can take possession of the property.

What is attorney fee agreement?

Attorney fees typically must be set forth in a written agreement, no matter the type of fee arrangement. These written agreements may be called representation agreements or retainer agreements. Regardless of the name, a written attorney fee agreement can help set the terms of the attorney-client relationship, providing a record of what you agree to pay in case a later dispute arises over legal bills.

What Are Attorney Fees?

Attorney fees are the amount of money billed to a client by a lawyer for performing legal services on the client's behalf. You may also see attorney fees referred to as attorney's fees or attorneys' fees. Attorney fees can be set in a few different ways, such as by an attorney-client compensation agreement, by statute, or by a court.

What is retainer fee?

Retainer fees are essentially a deposit that you pay toward the total cost of legal services, not a separate additional fee. These fees make sure that the lawyer will get something in the end. Lawyers can also use retainer fees in exchange for being on call to handle legal issues whenever they come up.

What is contingency fee?

Common among medical malpractice and personal injury attorneys , contingency fees are based on a percentage of the amount you receive. This overall amount of money can come from a judgment in court, or it can be negotiated in a case's settlement. For example, if you are awarded $1 million in a case, your lawyer may get 40% of that as a contingency fee. The more complex or risky your case is, the higher the contingency fee a lawyer is likely to request.

What is hourly attorney fee?

Hourly attorney fees are the most common type of arrangement. A lawyer will charge a per hour rate, then track the time spent working on the case in fractions of an hour, for example in 10ths of an hour (or 6-minute increments).

Do lawyers charge flat fees?

A lawyer may charge a flat fee for some kinds of legal matters. Attorneys who handle large volumes of a particular kind of case may opt for charging a flat fee as they can use standardized forms and practices for each case they take on. Generally speaking, lawyers use flat fees for relatively uncomplicated cases, including:

Who pays the fees to draw up a FSBO purchase agreement?

The cost of drawing up a purchase contract is typically included in the real estate seller’s commission fee, paid at closing from escrow as part of closing costs.

Who can help a buyer with a real estate contract?

Buyers can have real estate agreements drawn up by a real estate attorney or agent. A title company or Realtor can help the buyer find someone to write a contract if necessary. If the seller doesn’t have an agent lined up to draft the purchase contract, the buyer’s own real estate agent can take care of the transaction paperwork as ...

What is land contract?

A land contract is used when the owner provides financing when going to sell, so that you do not have to get a mortgage elsewhere to purchase the property. The contract stipulates the amount of the loan, the interest rate, and what happens if you fall behind on property taxes or payments. You and the seller can negotiate the terms of the agreement, ...

What is FSBO sale?

A FSBO sale can occur in a seller’s market or when sellers want to maximize their profits on a sale by not having to pay a commission to a real estate agent. So if the buyers want to make a written offer on property, who will be tasked with drawing up the purchase agreement, or the contract outlining the terms and conditions of the sale?

What is a purchase contract?

As a real estate buyer, a purchase contract is one of the first steps toward closing the sale. “In layman’s terms, a purchase contract is simply the written contract between the buyer and seller outlining the terms of the sale,” Hardy explains.

What is a seller's agent?

The seller’s agent is typically the person who draws up a real estate purchase agreement. But what happens if the home is for sale by owner (or FSBO) and the owner isn’t represented by a real estate agent at all? A FSBO sale can occur in a seller’s market or when sellers want to maximize their profits on a sale by not having to pay a commission ...

Who is the transactional agent for a contract?

If you as the buyer decide to use a transactional agent for the contract, think of them as “one person who neither represents the seller nor the buyer but facilitates the documents necessary for the sale ,” says Joyce Mitchell of Mitchell & Associates, in Bigfork, MT. If you have any doubts about the contract, consult your own attorney.

How much does an attorney charge to draw up a contract?

Having an attorney draw up a business purchase contract or an asset transfer agreement often requires at least 10-15 hours of the lawyer's time at an hourly rate of $100-$300, for a total of $1,000-$4,500. That's a starting point for a straightforward agreement with revisions. More complex agreements or those with a lot ...

How much does it cost to have an attorney review an agreement?

Having an attorney review an agreement proposed by the other party could take an hour or more, starting around $100-$400 and going up depending on how much work is involved and your attorney's hourly rate.

How to sell a small business?

What should be included: 1 The process of selling a business takes a minimum of several months. Among other steps, you will want a potential buyer to sign a nondisclosure/confidentiality agreement before providing details about your business operations. The nonprofit group Score lists 12 crucial steps for selling a small business and FindLaw.com outlines the advantages and disadvantages of an asset transfer compared to a purchase [ 5] . 2 Each aspect of a purchase agreement can have tax or other implications, so many experts recommend having legal advice from the first stages of negotiating a business or asset purchase agreement. The document itself is likely to be both long and complicated; for more elaborate deals, the contract plus attachments can be hundreds of pages long. Usually the buyer's lawyer provides the initial draft of the agreement; then the seller reviews the document with another attorney and suggests possible revisions. Lawyers.com provides an overview of the sale process. 3 A typical agreement should include such items as a list of the assets being sold, the purchase price, a list of inventory and specific financial arrangements (in as many as 90 percent of all sales of small businesses, the seller provides some of the financing for the buyer). The Small Business Administration offers a checklist [ 6] of what should be part of the agreement and a Colorado attorney provides a glossary [ 7] of common terms.

What is business lawyer?

In business law, attorneys who handle legal disputes are litigators while those who handle contracts, securities and other business matters are transactional lawyers. An Illinois attorney provides tips for selecting [ 8] a business lawyer.

What is the most common arrangement for buying a small business?

However, the most common arrangement for buying a small business (and often the most beneficial from a buyer's perspective) is an asset transfer agreement , where the buyer purchases specific assets (or all the assets) of a business, but not the entire entity.

What is a business purchase agreement?

A business purchase agreement (or stock purchase agreement for a corporation) is used when a buyer is acquiring an entire business, its assets and its liabilities, including its debts and obligations such as unpaid taxes or potential lawsuits . However, the most common arrangement for buying a small business ...

What should an attorney provide?

Your attorney should provide you with a written fee agreement; be sure you understand what is or is not included, and all potential costs.

What are seller concessions?

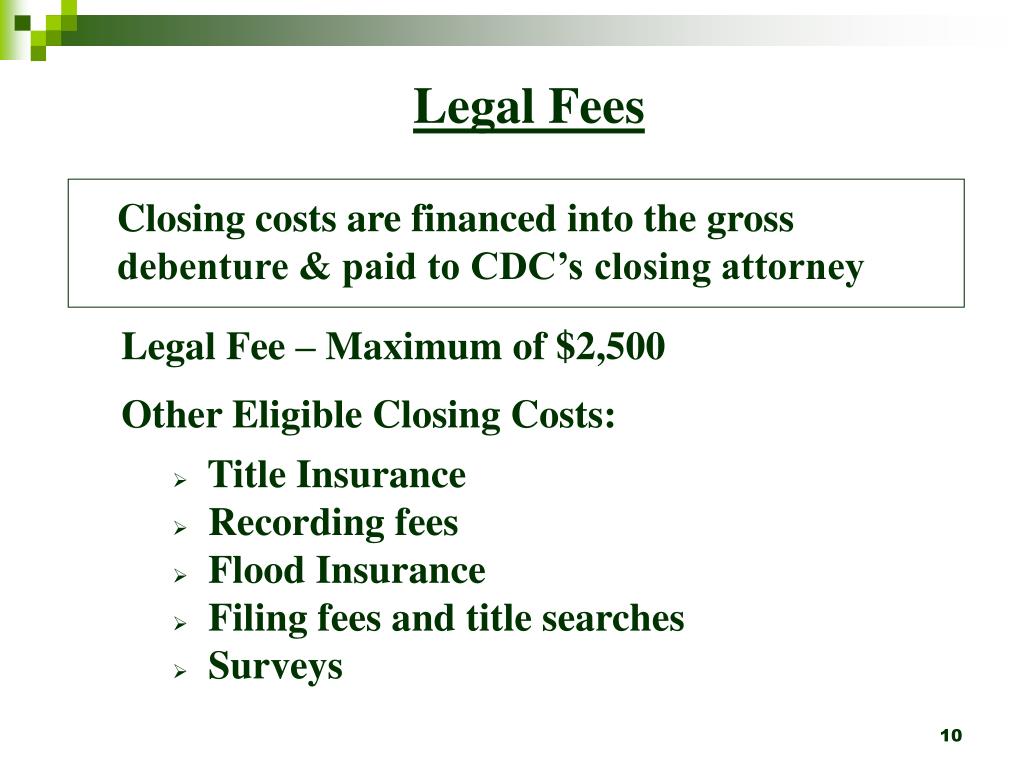

Seller concessions are closing costs that the seller agrees to pay and can substantially reduce the amount of cash you need to bring on closing day. Sellers can agree to help pay for things like property taxes, attorney fees, appraisal inspections and mortgage discount points to lower your interest rate.

What is closing cost?

Closing costs are all of the fees and expenses that must be paid on closing day. The general rule of thumb is that total closing costs on residential properties will amount to 3% – 6% of the home’s total purchase price, although this can vary depending on local property taxes, insurance costs and other factors.

Can you split closing costs?

Although buyers and sellers generally split closing costs, some localities have developed their own customs and practices about how to split closing costs. Be sure to discuss what closing costs look like with your real estate agent early in the home buying process, which may help you negotiate seller concessions.

Do sellers pay closing costs?

Here’s how it works: Sellers don’t agree to pay for closing costs out of the goodness of their hearts. Generally, sellers agree to pay in return for a higher sales price. Buyers might prefer this because it frees them from a demand for cash at a time when there are many financial demands.

Do you pay for appraisals on a home?

Buyers pay for the appraisal – which is required by the lender – and home inspection. Property taxes and homeowner’s association fees are prorated, and buyers pay only for the portion of the year that they will own the home.

Do sellers pay more at closing?

Sellers pay fewer expenses, but they actually pay more at closing. Typically, sellers pay real estate commissions to both the buyers’ and the sellers’ agents. That generally amounts to 6% of total purchase price or 3% to each agent.

Do you have to pay property taxes when closing?

Buyers closing at the end of the year are only responsible for prorated taxes for the remainder of the year. Buyers who are closing at the beginning of the year and live in a high property tax state may have to pay a substantial property tax bill.

Why do attorneys charge different fees?

Some attorneys charge different amounts for different types of work, billing higher rates for more complex work and lower rates for easier tasks .

What expenses do clients have to pay for a lawyer?

Clients may also be responsible for paying some of the attorney or law firm’s expenses including: Travel expenses like transportation, food, and lodging; Mail costs, particularly for packages sent return receipt requested, certified, etc; Administrative costs like the paralegal or secretary work.

Why do lawyers need to put contracts in writing?

A written contract prevents misunderstandings because the client has a chance to review what the attorney believes to be their agreement.

What are the biggest concerns when hiring a lawyer?

Attorney fees and costs are one of the biggest concerns when hiring legal representation. Understanding how attorneys charge and determining what a good rate is can be confusing.

What are the costs of a lawsuit?

Some common legal fees and costs that are virtually inescapable include: 1 Cost of serving a lawsuit on an opposing party; 2 Cost of filing lawsuit with court; 3 Cost of filing required paperwork, like articles forming a business, with the state; 4 State or local licensing fees; 5 Trademark or copyright filing fees; and 6 Court report and space rental costs for depositions.

What factors determine if a lawyer's fees are reasonable?

Factors considered in determining whether the fees are reasonable include: The attorney’s experience and education; The typical attorney fee in the area for the same services; The complexity of the case; The attorney’s reputation; The type of fee arrangement – whether it is fixed or contingent;

What is the first step in resolving a dispute with a lawyer?

The first step to resolving these disputes is communication . If there is a disagreement, clients and attorneys should first seek to discuss it and try to reach a mutually agreeable solution. Often, small disagreements balloon merely because both the attorney and the client avoided talking to the other out of fear.

Who pays the fees to draw up a FSBO purchase agreement?

The cost of drawing up a purchase contract is typically included in the real estate seller’s commission fee, paid at closing from escrow as part of closing costs.

Who can help a buyer with a real estate contract?

Buyers can have real estate agreements drawn up by a real estate attorney or agent. A title company or Realtor can help the buyer find someone to write a contract if necessary. If the seller doesn’t have an agent lined up to draft the purchase contract, the buyer’s own real estate agent can take care of the transaction paperwork as ...

What is land contract?

A land contract is used when the owner provides financing when going to sell, so that you do not have to get a mortgage elsewhere to purchase the property. The contract stipulates the amount of the loan, the interest rate, and what happens if you fall behind on property taxes or payments. You and the seller can negotiate the terms of the agreement, ...

What is FSBO sale?

A FSBO sale can occur in a seller’s market or when sellers want to maximize their profits on a sale by not having to pay a commission to a real estate agent. So if the buyers want to make a written offer on property, who will be tasked with drawing up the purchase agreement, or the contract outlining the terms and conditions of the sale?

What is a purchase contract?

As a real estate buyer, a purchase contract is one of the first steps toward closing the sale. “In layman’s terms, a purchase contract is simply the written contract between the buyer and seller outlining the terms of the sale,” Hardy explains.

What is a seller's agent?

The seller’s agent is typically the person who draws up a real estate purchase agreement. But what happens if the home is for sale by owner (or FSBO) and the owner isn’t represented by a real estate agent at all? A FSBO sale can occur in a seller’s market or when sellers want to maximize their profits on a sale by not having to pay a commission ...

Who is the transactional agent for a contract?

If you as the buyer decide to use a transactional agent for the contract, think of them as “one person who neither represents the seller nor the buyer but facilitates the documents necessary for the sale ,” says Joyce Mitchell of Mitchell & Associates, in Bigfork, MT. If you have any doubts about the contract, consult your own attorney.

What Are Attorney Fees?

- Attorney fees are the amount of money billed to a client by a lawyer for performing legal services on the client's behalf. You may also see attorney fees referred to as attorney's fees or attorneys' fees. Attorney fees can be set in a few different ways, such as by an attorney-client compensation agreement, by statute, or by a court.

Types of Attorney Fees

- Understanding the different types of attorney fees will help you find the right lawyer for your unique situation. The kind of fee arrangement available to you will depend on the type of legal issue you face. Several types of attorney fees and fee arrangements exist. Common examples include:

Written Attorney Fee Agreements

- Attorney fees typically must be set forth in a written agreement, no matter the type of fee arrangement. These written agreements may be called representation agreements or retainer agreements. Regardless of the name, a written attorney fee agreement can help set the terms of the attorney-client relationship, providing a record of what you agree to pay in case a later disput…

Additional Fees and Costs

- You should always make sure you understand the expectations for litigation costs and other additional costs not typically included in set attorney fees. Find out ahead of time how you will be required to pay for things such as: 1. Copying costs 2. Court fees 3. Expert fees 4. Deposition fees 5. Fees charged by private investigators 6. Messenger fees 7. Postage 8. Travel expenses If you …

Popular Posts:

- 1. guardianship when power of attorney not enough

- 2. how to write a letter to attorney dr.

- 3. _______ is an attorney who waits in reserve in order to assist the accused whenever necessary.

- 4. how do you run search for attorney patients in healthpac

- 5. what is the meaning of attorney general

- 6. the man who shot liberty valance stoddard attorney at law

- 7. how much does a top defense attorney cost

- 8. how can interning for an attorney relate to higher education

- 9. why isn't accuser of democrat running for state attorney believed

- 10. what a probate attorney wants for a person that is incapacitated