An Alabama limited power of attorney lets allows someone to assign someone else, known as the agent or attorney-in-fact, to handle a SPECIFIC responsibility to the benefit of the Principal. Complete and have at least two non-blood related witnesses or a notary public view the signatures to make the form valid.

Full Answer

Does a power of attorney need to be witnessed?

General: Alabama has adopted the Uniform Power of Attorney Act and may be found in Ala. Code 26-1A-101 et. seq. Execution: This power of attorney must be in writing, signed by the principal, dated and notarized. The Principal should sign the power of attorney in the presence of the notary or other person taking the acknowledgment.

Who should sign a power of attorney in Alabama?

Oct 17, 2008 · Notary: Although the Alabama statutes do not explicitly state that a power of attorney must be notarized to be effective, it is highly recommended that any power of attorney created in Alabama be notarized. Witnesses: No requirement that the signature of the principal be witnessed. Signature of Agent: No requirement that the agent sign the POA; however, the …

What is a limited power of attorney form in Alabama?

1 It is important to remember that a power of attorney may not preclude the need for the appointment of a guardian or conservator.2 However, ... In Alabama, an Attorney-in-Fact may only sell real property if that power is included in the instrument. 10 In order to comply with the witness requirements for the conveyance of real

What is a 5 13 power of attorney in Alabama?

An Alabama limited power of attorney lets allows someone to assign someone else, known as the agent or attorney-in-fact, to handle a SPECIFIC responsibility to the benefit of the Principal. Complete and have at least two non-blood related witnesses or a notary public view the signatures to make the form valid.

What is a power of attorney?

The power of attorney is an extremely flexible planning tool that allows an individual (the principal) to authorize another (the agent or Attorney-in-Fact) to deal with his or her property. Although the power of attorney is most often thought of in terms of a planning tool for the elderly or disabled, it should not be limited to this segment of society, but should also be considered by those who are young and in good health in planning for the possibility of incapacity or unavailability. Because of the possibility of incapacity, it is recommended that all powers of a attorney be made durable pursuant to Ala. Code §26-1-2 (1992).

What are the advantages of a power of attorney?

power of attorney has many advantages. It is an inexpensive, flexible planning tool and is easier to implement in comparison to the other options which afford similar powers over the principal’s property —conservatorships and trusts.1 It is important to remember that a power of attorney may not preclude the need for the appointment of a guardian or conservator.2 However, the principal may nominate an individual to serve as guardian or conservator in the power of attorney and the Probate Court must appoint that nominee except for good cause or disqualification.3

Can an attorney in fact make decisions for the principal?

An Attorney-in-Fact may make health care decisions for the principal if, in the opinion of the attending physician the principal cannot give directions to health care providers.18 Unless limited in the durable power of attorney, an Attorney-in-Fact make any health care decision that the principal could have made except decisions regarding (i) psychosurgery, (ii) sterilization, (iii) abortion (unless necessary to preserve the principal's life) or (iv) involuntary commitment.

What is the role of an attorney in fact?

As an agent, the Attorney-in-Fact must act in the principal’s best interest in dealing with the principal’s property . The following pronouncement from the Supreme Court of Alabama in Sevigny v. New South Federal Savings and Loan Association sets forth the agent’s obligations to the principal:

Can an attorney in fact delegate powers?

It may be appropriate to allow the Attorney-in-Fact the right to delegate his or her powers. This would allow the Attorney-in-Fact to have another act on his or her behalf if necessary (i.e., if the Attorney-in-Fact were out of town).

Does a power of attorney need to be reviewed?

It is recommended that the principal periodically review the power of attorney with their attorney to make sure that the power of attorney continues to meet the principal’s objectives and ensure that appropriate Attorneys-in-Fact are named.

Is the principal the client?

The drafting attorney must remember that the principal is the client, and it is the principal’s interest that must be protected. While a third party may approach you to create a power of attorney, this person is not the client.

What is a power of attorney in Alabama?

An Alabama real estate power of attorney allows someone else to handle responsibilities related to their property. This is most commonly used when selecting an attorney to handle a real estate closing but may also be used to refinance or manage tenants on a property.

What is durable power of attorney?

The term “durable” refers to the designation that if the principal can no longer make decisions for themselves that their selected agent will be able to act on their behalf.

What is an advance directive in Alabama?

An Alabama advance directive, which includes a medical power of attorney and a living will, which allows a person to handle another’s health care decision making in the chance the Principal cannot do so for themselves.

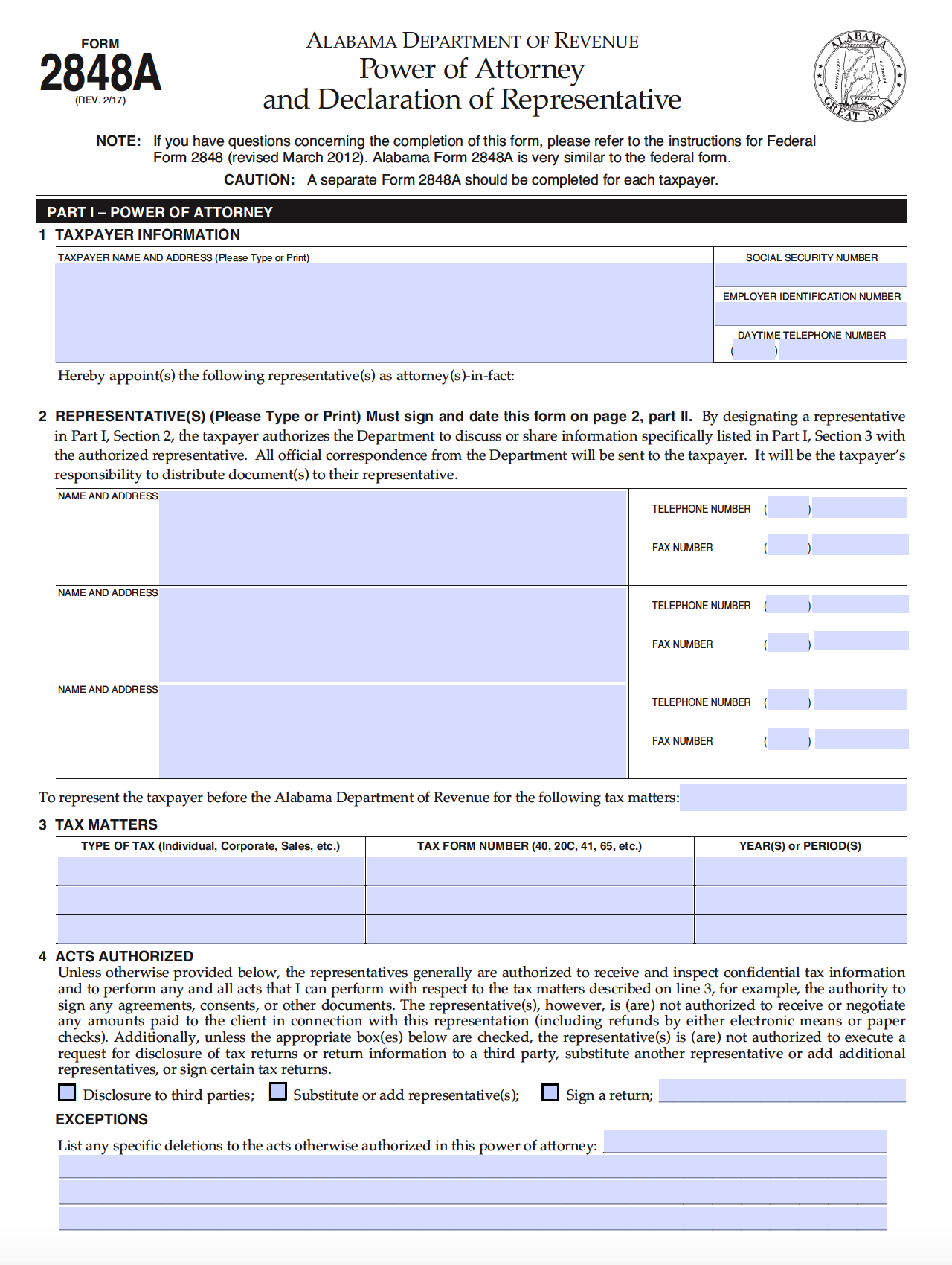

What is a 2848A?

An Alabama tax power of attorney form 2848A is mainly for accountants and attorneys to file taxes on someone else’s behalf and to their benefit. The document is only valid for that tax year. It does not need to be notarized like the other forms and needs the signature of the person filing and the principal to be complete.

How many witnesses are needed for a power of attorney?

Many states require two people to witness your signature. If your state has adopted the Uniform Power of Attorney Act, you must abide by this rule. As of 2018, approximately 25 states have adopted it. Witnesses are generally at least 18 years of age and cannot be the agent, the notary, any relative by blood, adoption, or marriage, ...

How old do you have to be to be a witness?

Witnesses are generally at least 18 years of age and cannot be the agent, the notary, any relative by blood, adoption, or marriage, or a third party who intends to interact with the agent (e.g., medical doctor, banking professional, etc.)

What is a POA?

A power of attorney (POA) is a document that lets you, the principal, appoint someone to act as your agent (also referred to as an attorney-in-fact) in the event you are unavailable or lack the requisite mental capacity to make decisions. They act on your behalf regarding financial matters, health care matters, or both, depending on what powers you give them.

Do you have to sign a POA?

If you are the principal, you must always sign the document, no matter what state you live in. Signing indicates that you're appointing a certain person as your agent or attorney-in-fact.

Do you need a notary to sign a document?

Some states require notarized signatures. Even if your state does not require one, it's good practice to have it. Keep in mind that if you choose to have someone notarize the document, that person can only act as a notary and cannot also act as a witness.

What is power of attorney in Alabama?

Alabama power of attorney is for individuals who would like to designate someone else, the “agent”, to handle decisions on their behalf.

How long can a parent have a power of attorney?

Parental (Minor Children) Power of Attorney – A parent may, for a period of no more than one (1) year, allow another person to care and make decisions for their minor son (s) or daughter (s). Signing Requirements: Notary public.

What is a power of attorney in Alabama?

The free Alabama power of attorney documents are available to download to elect someone else to be able to assist and make decisions on your behalf. This power allows a person that you select, to be able to conduct any type of financial, health care, tax filing, or department of motor vehicle related activity on your behalf.#N#If you will be selecting to have someone be able to make monetary decisions, make sure that he or she is trustworthy as they will have the right to sell real estate or even make loans on your behalf. Once the agreement is signed and notarized it is legal for use and does not become void unless a new document is signed, a revocation is authorized, or upon the death of the Principal.#N#All documents are current with the laws of Alabama and the Uniform Power of Attorney Act.

What is the Alabama monetary form?

Allows a resident of Alabama to handle another person’s monetary affairs only while the person that is being represented is conscious, in a decent state of mind, and not suffering from any type of mental instability such as having signs of dementia. The form allows the agent selected to handle any type of transaction that is related to the Principal as if he or she…

What is a 2848A?

The Alabama power of attorney form 2848A is mainly for accountants and attorneys to file taxes on someone else’s behalf and to their benefit. The document is only valid for that tax year. It does not need to be notarized like the other forms and needs the signature of the person filing and the principal to be complete. It is advised that the Principal review…

Popular Posts:

- 1. when can attorney reveal privileged communication client wavied first

- 2. how to recind a power of attorney

- 3. what does the juror suggest about the defense attorney 12 angry men

- 4. how to write an attorney opinion letter for claiming tax credits

- 5. what does an attorney need to do to become a realtor

- 6. how do you file a criminal charge against an attorney for theft

- 7. what are some legal barriers to “private attorney general” claims relating to data breaches

- 8. who is alan cooper 202-241-2115 state attorney general

- 9. where do mail oath of attorney florida

- 10. what is the role of us attorney