Healthcare proxy

A healthcare proxy is a document (legal instrument) with which a patient (primary individual) appoints an agent to legally make healthcare decisions on behalf of the patient, when he or she is incapable of making and executing the healthcare decisions stipulated in the proxy.

How do I create a medical power of attorney?

Aug 02, 2021 · While a person acting under a power of attorney for medical decisions is required to make those decisions following any healthcare wishes that you've made known to them, you are still placing a great deal of trust in them. Designate someone who won't later decide to disregard your wishes. If You Do Not Have a Medical Power of Attorney

How do you obtain a medical power of attorney?

A medical power of attorney gives the agent authority to make health-related decisions on behalf of the principal. The medical POA springs into action only after the principal’s doctor says they are unable to make critical decisions themselves.

How to establish a medical power of attorney?

Feb 17, 2021 · A durable health care power of attorney (HCPA), also called a durable power of attorney for health care, healthcare proxy, or medical power of attorney, legally designates an agent to make medical decisions on behalf of the principal if he / she is unable to do so himself / herself. The decisions in which the agent can make are quite varied.

How to write a medical power of attorney?

Jul 08, 2021 · A medical power of attorney is a legal document that designates someone to make health care decisions for you if you’re too sick or unable to communicate your preferences. In legal terms, this person is known as your agent. In some states, a medical power of attorney is called: Health care power of attorney Durable power of attorney for healthcare

Who makes medical decisions if you are incapacitated?

For patients who are incapacitated and have no advance directive in place to state their preferences for medical decisions, there are two options — a court-appointed guardian or a surrogate decision-maker.May 19, 2021

Who makes medical decisions if you are not married?

Health Care Directives If you don't take the time to prepare them and you become incapacitated, doctors will turn to a family member designated by state law to make medical decisions for you. Most states list spouses, adult children, and parents as top-priority decision makers, making no mention of unmarried partners.

Who makes medical decisions if there is no power of attorney?

The legal right to make care decisions for you If you have not given someone authority to make decisions under a power of attorney, then decisions about your health, care and living arrangements will be made by your care professional, the doctor or social worker who is in charge of your treatment or care.Mar 30, 2020

Are you legally married after living together for 7 years?

Living together is a right to life and therefore it cannot be held illegal.” If live-in relationships continue for a long period of time and the couple present themselves to the society as husband-wife, they get recognized as being legally married.Mar 19, 2021

When to Use A Medical Poa

We all hope that we will never need to use a Medical Power of Attorney. But the fact remains we all grow old and life can be unpredictable. It’s no...

Medical Poa vs Living Will

A Medical (Health Care) Power of Attorney allows an individual to give someone else the right to make decisions about their end of life treatment o...

How to Write A Medical Poa

To write a medical power of attorney the principal, or person granting power, will have to elect someone to handle their health care decisions (alo...

How to Sign A Medical Poa

All medical power of attorney forms must be signed in the presence of either witness(es) and/or a notary public. The following States require these...

What Is a Power of Attorney?

Hold on, what is a power of attorney? To some, it might sound like something a fairy godmother does to magically transform you into a lawyer. Pumpkins and all. But hold your horses. Even though that might be great to see, a power of attorney is a document that confers specific powers on someone, and we’re not talking about superpowers.

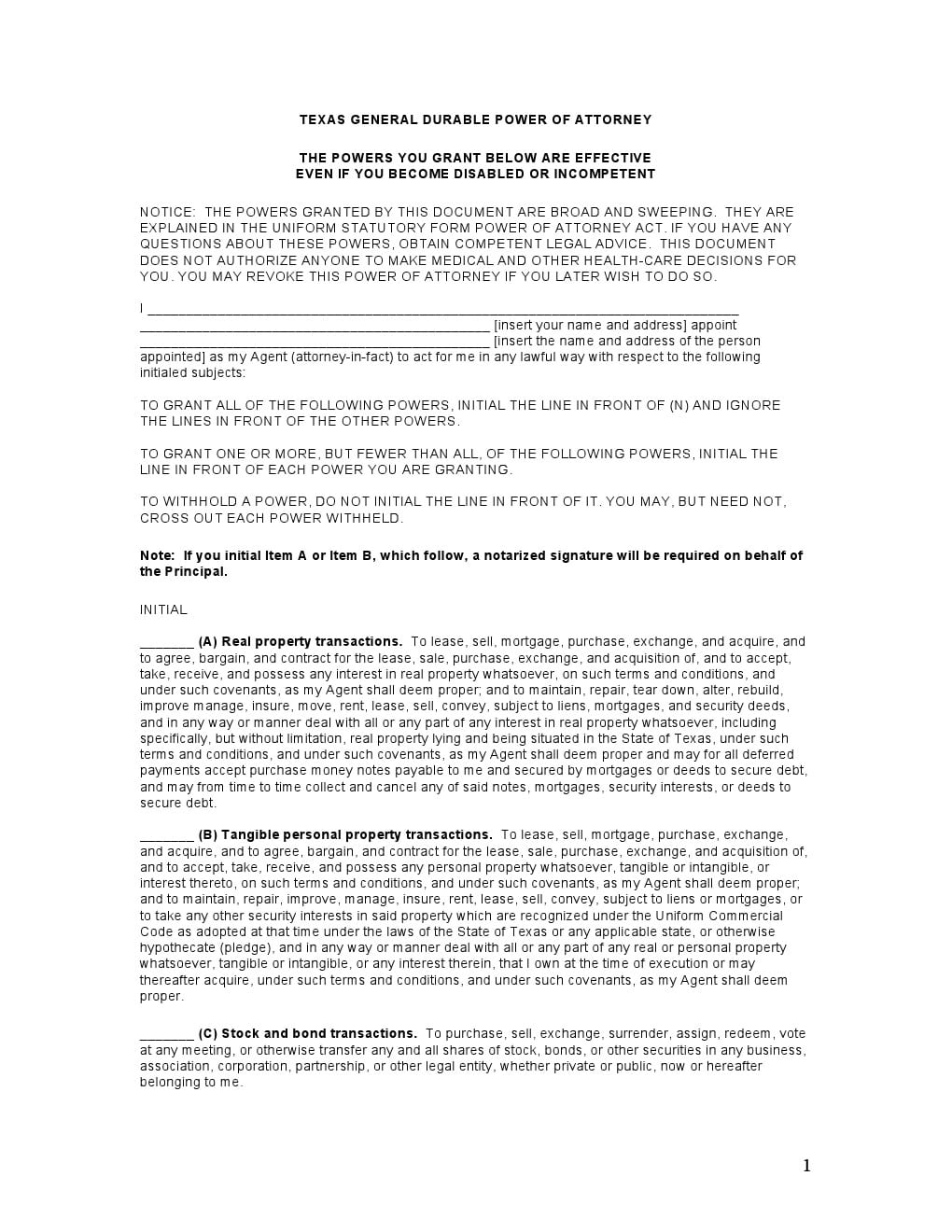

Durable Power of Attorney

A durable POA is one that confers the decision-making power on the agent after the principal gets incapacitated. The POA grants decision-making powers for financial, legal, and property matters. It is called a durable power of attorney because it needs to be explicitly revoked once the principal is available to make decisions once again.

Medical Powers of Attorney

A medical power of attorney gives the agent authority to make health-related decisions on behalf of the principal. The medical POA springs into action only after the principal’s doctor says they are unable to make critical decisions themselves.

How Does A Medical POA Work?

You might be skeptical about ever needing a medical POA. After all, what could ever stop you from talking with your doctors to make your decisions known? Well, a medical POA usually kicks in when the principal:

Should You Get One?

With all the information we’ve put at your disposal, the decision is still yours. However, we think it is better for you to be prepared for any eventualities and to streamline the decision-making process as much as possible when you’re not available to make them yourself.

Also on royallegalsolutions.com

The most exciting aspect for owners of a self-directed IRA with checkbook …

Why is a power of attorney important?

Medicaid Eligibility & Importance of Powers of Attorney. To assist a loved one in becoming eligible for Medicaid, maintaining their eligibility and making Medicaid-related benefit decisions , having a power of attorney is extremely important. 1. Without a POA, an adult child or another individual applying for Medicaid on behalf ...

What is a POA?

A power of attorney, often abbreviated as POA, is a legal document naming an individual to make legal decisions on behalf of another person (often elderly) while they are alive. The “principal” or “grantor” (typically the elderly individual) designates the “attorney-in-fact” or “agent” (usually an adult child) to legally act on their behalf in ...

How much does a POA cost?

POA forms can be found online and downloaded for free, or created via a website for $50 or less. If notarized, notary fees are generally $2 – $20 per signature. For those who choose to hire an attorney, the fee is higher than the “do it yourself” route, but all in all, the fee is generally still fairly minimal.

When does a power of attorney expire?

A general power of attorney, also called a non-durable power of attorney, regular power of attorney, or standard power of attorney, is effective immediately and expires when the principal becomes physically or mentally incapacitated. While a durable power of attorney, also called an enduring power of attorney, is also effective immediately, ...

Can a POA be cancelled?

POAs can be cancelled at any time, or the name of the attorney-in- fact can be changed, given the principal is competent to do so. Regardless of the type of POA, all POAs become ineffective upon the death of the principal.

What is POA in legal?

With a POA, the authority of the legal representative may be limited. This could mean the matters in which the attorney-in-fact has legal control are very specific or the agent only has authorization for a one-time action. A POA may also give the attorney-in-fact a very broad range of authority.

Does the VA have a fiduciary program?

For management of VA financial benefits, a state’s durable power of attorney for finances is not sufficient. Rather, the VA has a fiduciary program, where a representative, generally chosen by the veteran, is named by the VA to manage a veterans VA benefits in the event that he / she becomes incapacitated.

What is a successor agent?

Successor (2nd) Agent – Individual selected only if the primary agent is not able to fulfill their duties. Co-agent authority is not usually allowed, must be the decision of 1 person. Compensation – You have the option to set up compensation for the agent selected for lodging, food, and travel costs.

How to make a health care decision?

Step 1 – Select Your Agent. The Agent that you select will have the responsibility of making your decisions based on your health care situation. Therefore you will want someone that you trust and is aware of your basic medical history (such as heart conditions, medication, allergies, etc.)

When does a power of attorney go into effect?

The power of attorney goes into effect after a licensed physician has deemed the principal incapable of making decisions for themselves. It’s recommended for a person that makes a medical power of attorney to also create a living will to write their treatment preferences for an agent to follow.

Can a notary be a witness?

NO WITNESS can be a person that is related to the principal, agent, or be a beneficiary in the principal’s last will and testament. If a notary is required, the notary may not act as a witness.

What is a living will?

A living will is a highly recommended option to be attached to any medical power of attorney. In addition to having someone speak on their behalf, a living will outlines a person’s end of life treatment selections.

Can an agent make decisions about your health?

The decisions you give your agent related to your health care is up to you. You can allow your agent to make any type of decision that presents itself or you could limit your agent to only certain types of decision making. The more detailed you are as to what your agent can and cannot do will enhance the medical staff on your health intentions.

What is a POA in 2021?

A power of attorney (POA) is a legal document in which the principal (you) designates another person (called the agent or attorney-in-fact) to act on your behalf. The document authorizes the agent to make either a limited or broader set of decisions. The term "power of attorney" can also refer to the individual designated ...

How to get a POA?

How to Get a Power of Attorney (POA) The first thing to do if you want a power of attorney is to select someone you trust to handle your affairs if and when you cannot. Then you must decide what the agent can do on your behalf, and in what circumstances. For example, you could establish a POA that only happens when you are no longer capable ...

When does a POA come into play?

This POA comes into play only when a specific event occurs—your incapacitation, for instance. A springing power of attorney must be very carefully crafted to avoid any problems in identifying precisely when the triggering event has happened.

Who is Khadija Khartit?

Khadija Khartit is a strategy, investment, and funding expert, and an educator of fintech and strategic finance in top universities. She has been an investor, an entrepreneur and an adviser for 25 + years in the US and MENA. Article Reviewed on April 30, 2021. Learn about our Financial Review Board.

Do I need a power of attorney for my spouse?

If you have property that is only in your name, your spouse would need a power of attorney to take legal or financial actions related to that property (like selling it ).

What is a POA?

A power of attorney (POA) is a legal document that gives an individual, called the agent or attorney-in-fact, the authority to take action on behalf of someone else, called the principal. The agent can have either extensive or limited authority to make legal decisions about the principal's property, finances, or healthcare, ...

Does Pennsylvania have a power of attorney?

States have different requirements for establishing a power of attorney—Pennsylvania’s statut e, for instance, makes the legal assumption that a power of attorney is durable. 1. Using an attorney to draw up the POA will help ensure that it conforms with state requirements.

What are the duties of an agent?

Here’s a list of common matters for which an agent may be responsible to maintain on behalf of the principal: 1 Banking – Deposits and withdrawals 2 Government Benefits – Including but not limited to health care, social security payments, etc. 3 Retirement Plans – Such as 401 (k)’s. 4 Taxes – State and federal 5 Legal Advice and Proceedings – Filing forms with the court or handling legal proceedings. 6 Real Estate – The Buying, selling, or leasing of property. 7 Personal Property – The handling of all personal assets. 8 Insurance – Obtaining insurance and/or proceeds.

What is durable power of attorney?

A durable power of attorney is the most common document of its kind, and the coverage afforded by the form is sweeping. It allows the agent to make financial, business and legal decisions on behalf of a principal, and the durability aspect extends the agent’s powers to during an event of incapacitation.

What is the difference between an agent and a principal?

Principal – the person handing over decision-making powers. Agent – the chosen individual to manage affairs, usually someone the principal deeply trusts , such as a close family member (also called an “attorney in fact”) Incapacitation – when the principal is no longer able to make decisions for themselves .

What are the benefits of government?

Government Benefits – Including but not limited to health care, social security payments, etc. Retirement Plans – Such as 401 (k)’s. Taxes – State and federal. Legal Advice and Proceedings – Filing forms with the court or handling legal proceedings. Real Estate – The Buying, selling, or leasing of property.

Special Needs Power of Attorney & Medical Authorizations

Just weeks before entering her freshman year of college our daughter was diagnosed with Systemic Lupus and a few months later Epstein Barr Replication. Both caused severe complications in the years to come.

What Do You Know about Special Needs Power of Attorney & Medical Authorizations?

Whoa, do you need some time to absorb everything Kathy had to say? Do you have questions you want to ask? Similar experiences to share? In any case, leave a comment to join this important discussion.

Why do you need a power of attorney?

Common Reasons to Seek Power of Attorney for Elderly Parents 1 Financial Difficulties: A POA allows you to pay the bills and manage the finances for parents who are having difficulty staying on top of their financial obligations. 2 Chronic Illness: Parents with a chronic illness can arrange a POA that allows you to manage their affairs while they focus on their health. A POA can be used for terminal or non-terminal illnesses. For example, a POA can be active when a person is undergoing chemotherapy and revoked when the cancer is in remission. 3 Memory Impairment: Children can manage the affairs of parents who are diagnosed with Alzheimer’s disease or a similar type of dementia, as long as the paperwork is signed while they still have their faculties. 4 Upcoming Surgery: With a medical POA, you can make medical decisions for the principal while they’re under anesthesia or recovering from surgery. A POA can also be used to ensure financial affairs are managed while they’re in recovery. 5 Regular Travel: Older adults who travel regularly or spend winters in warmer climates can use a POA to ensure financial obligations in their home state are managed in their absence.

What is a POA in 2021?

Last Updated: July 16, 2021. A power of attorney (POA) can be an important element of planning for your elderly parent’s future. It allows another person to take action on your parent’s behalf, ensuring bills get paid and medical decisions can be made in the unfortunate circumstance that your elderly parent is unable to do those things on their own ...

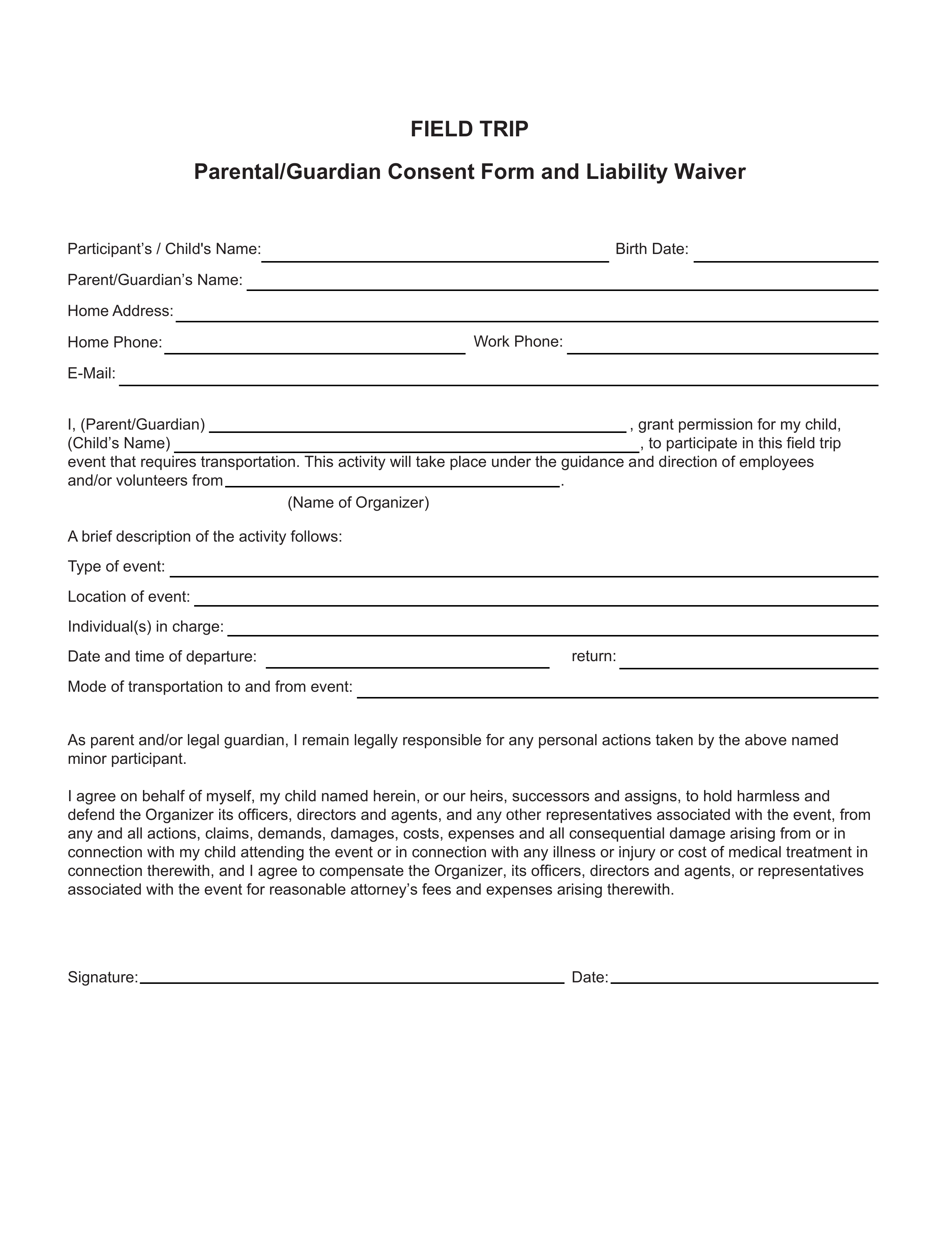

How many witnesses do you need to sign a letter of attorney?

A notary public or attorney must witness your loved one signing the letter of attorney, and in some states, you’ll need two witnesses. The chosen agent must be over 18 and fully competent, meaning they understand the implications of their decision. When filling out the form, the parent must specify exactly which powers are transferring to the agent.

Who is responsible for making decisions in a POA?

One adult will be named in the POA as the agent responsible for making decisions. Figuring out who is the best choice for this responsibility can be challenging for individuals and families, and your family may need help making this decision. Your attorney, faith leader or a family counselor can all help facilitate this process. It’s a good idea to select an agent who is able to carry out the responsibilities but also willing to consider other people’s viewpoints as needed.

Can a nondurable power of attorney act on your behalf?

A nondurable power of attorney cannot act on your behalf if you become disabled or incompetent. You would generally choose a nondurable power of attorney for a specific matter, such as handling your affairs in your physical absence. In estate planning, through which seniors plan for future incapacity, all powers of attorney are durable. This means the power of attorney is effective regardless of your health condition. On the other hand, a springing power of attorney becomes effective at a specific time in the future, perhaps in the event of an illness.

What is a POA?

As mentioned above, a power of attorney (POA), or letter of attorney, is a document authorizing a primary agent or attorney-in-fact (usually a legally competent relative or close friend over 18 years old) — to handle financial, legal and health care decisions on another adult’s behalf. (A separate document may be needed for financial, legal, and health decisions, however).

Is a power of attorney necessary for a trust?

Under a few circumstances, a power of attorney isn’t necessary. For example, if all of a person’s assets and income are also in his spouse’s name — as in the case of a joint bank account, a deed, or a joint brokerage account — a power of attorney might not be necessary. Many people might also have a living trust that appoints a trusted person (such as an adult child, other relative, or family friend) to act as trustee, and in which they have placed all their assets and income. (Unlike a power of attorney, a revocable living trust avoids probate if the person dies.) But even if spouses have joint accounts and property titles, or a living trust, a durable power of attorney is still a good idea. That’s because there may be assets or income that were left out of the joint accounts or trust, or that came to one of the spouses later. A power of attorney can provide for the agent — who can be the same person as the living trust’s trustee — to handle these matters whenever they arise.

Popular Posts:

- 1. find an attorney who can help with greencard

- 2. how to file a complaint with the texas attorney general's office

- 3. how to sign a document under a power of attorney

- 4. how do you address a state attorney general in person

- 5. how clients can best work with an attorney

- 6. how to spectate ace attorney online

- 7. how long does it take to make a will with attorney

- 8. what is the difference between a prosecutor, an attorney, and investigator, and a detective?

- 9. how to negotiate a reduction letter from attorney

- 10. what is a declaration to attorney