Why should I have a power of attorney?

Jan 27, 2022 · Durable Power of Attorney. A durable power of attorney gives your agent the right to make decisions and take the actions specified for the long term. Even if you are mentally incapacitated or deemed unfit to make decisions for yourself, your agent can …

What makes a PoA durable?

Jan 06, 2022 · This is different from a general power of attorney, which would terminate at this point. According to Section 751.00201 of the Texas Estates Code, a person is considered to be "incapacitated" for the purposes of a durable power of attorney if a doctor's examination finds that they are not able to manage their own finances. The doctor must provide a written statement …

Can you use power of attorney after death?

Nov 03, 2021 · A “durable” POA is simply a power of attorney that survives the incapacity of the Principal. While a Durable General Power of Attorney grants your Agent a considerable amount of legal authority to act on your behalf, it does not grant your Agent the authority to make medical or health care decisions on your behalf. For that, you need to execute a special type of document …

What does a dpoa do?

Apr 30, 2021 · If you have property that is only in your name, your spouse would need a power of attorney to take legal or financial actions related to that …

Does a power of attorney need to be notarized?

It depends on the state, since each state has its own rules for validating a power of attorney. Some require two witnesses and no notary, some requ...

How much does a power of attorney cost?

The cost for a power of attorney varies, depending on how you obtain the form and your state’s notary requirements. Online forms may be free, and y...

How many people can be listed on a power of attorney?

You can name multiple agents on your power of attorney, but you will need to specify how the agents should carry out their shared or separate duties.

What are the requirements to be a power of attorney agent?

Legally, an agent must be at least 18 years old and of sound mind.4 You should also choose someone you trust to act in your best interests.

When should I create a power of attorney?

You can create a power of attorney at any point after you turn 18. You need to create a power of attorney while you’re of sound mind.

What does a financial durable power of attorney do?

It is a financial durable power of attorney - this means that it only allows the agent to handle financial matters. It does not permit the agent to make decisions about the principal's health care.

What is the Texas estate code for a power of attorney?

The agent's authority has been terminated under Texas Estates Code 751.132 and the power of attorney does not provide for a replacement; or. A guardian is appointed for the principal.

What is incapacitated power of attorney in Texas?

According to Section 751.00201 of the Texas Estates Code, a person is considered to be "incapacitated" for the purposes of a durable power of attorney if a doctor's examination finds that they are not able to manage their own finances.

What Is a Power of Attorney?

A power of attorney, or POA, is a legal document that allows you (referred to as the “Principal”) to grant another person (the “Agent”) the legal authority to act on your behalf. The type and extent of the legal authority you grant to an Agent depends on the type of POA you execute.

General vs. Limited Power of Attorney

A general POA grants your Agent almost unlimited power to act on your behalf. This means that your Agent may be able to do things such as withdraw funds from your financial accounts, sell property and assets owned by you, and even enter into contracts in your name while the POA is in effect.

What Does It Mean to Make a Power of Attorney Durable?

Historically, a power of attorney automatically terminated upon the death or incapacity of the Principal. The problem with that was that for many people, the entire point of executing a POA was that they wanted a loved one to have the authority to act for them in the event of their incapacity.

Contact Indianapolis Estate Planning Attorneys

For more information, please join us for an upcoming FREE seminar. If you have additional questions or concerns regarding a durable Power of Attorney, contact the experienced Indianapolis estate planning attorneys at Frank & Kraft by calling (317) 684-1100 to schedule an appointment.

What is a limited power of attorney?

It could be something very specific, like giving your attorney the power to sign a deed of sale for your house while you're on a trip around the world. This is called a "limited power of attorney" and it can be quite common in everyday life.

How long does a durable POA last?

A durable POA begins when it is signed but stays in effect for a lifetime unless you initiate the cancellation. Words in the document should specify that your agent's power should stay in effect even if you become incapacitated. Durable POAs are popular because the agent can manage affairs easily and inexpensively.

What is a POA in healthcare?

A medical POA, or durable power of attorney for healthcare decisions, or health care proxy, is both a durable and a springing POA . The springing aspect means that the POA takes effect only if specific conditions take place.

How does a POA work?

How a Power of Attorney (POA) Works. Certain circumstances may trigger the desire for a power of attorney (POA) for someone over the age of 18. For example, someone in the military might create a POA before deploying overseas so that another person can act on their behalf should they become incapacitated.

What is a POA in 2021?

A power of attorney (POA) is a legal document in which the principal (you) designates another person (called the agent or attorney-in-fact) to act on your behalf. The document authorizes the agent to make either a limited or broader set of decisions. The term "power of attorney" can also refer to the individual designated ...

How to get a POA?

How to Get a Power of Attorney (POA) The first thing to do if you want a power of attorney is to select someone you trust to handle your affairs if and when you cannot. Then you must decide what the agent can do on your behalf, and in what circumstances. For example, you could establish a POA that only happens when you are no longer capable ...

What happens if you have a POA?

If you have a POA and become unable to act on your own behalf due to mental or physical incapacity, your agent or attorney-in-fact may be called upon to make financial decisions to ensure your well-being and care.

What is durable POA?

A durable POA is a type of power of attorney that comes into effect in the event of the incapacitation of the principal. It is called a durable power of attorney because it can last for the entire principal’s lifetime unless it is revoked. The power isn’t activated until the principal is incapacitated, though.

What is a medical power of attorney?

A medical power of attorney gives the attorney-in-fact the power to make decisions regarding the principal’s health. You might also hear it called a health power of attorney, an advance directive, or an advance healthcare directive.

What is durable power of attorney?

Drafting a durable power of attorney is an act of love: By detailing how you want matters regarding your health and finances handled in the event of an emergency, you are sparing your family and friends the unpleasant task of making such decisions in a stressful time.

What is a power of attorney for healthcare?

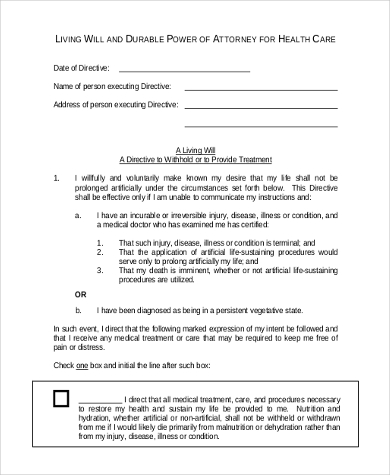

Power of Attorney for Healthcare. The power of attorney for healthcare designates the person who will make medical decisions for you in an emergency. Even though you may have set out your wishes in your living will, such documents cannot cover every circumstance.

How old do you have to be to get a power of attorney?

In order to create a power of attorney for healthcare, most states only require that you be an adult (typically 18) and be competent when you create the document. This document takes effect when your doctor declares that you lack the "capacity" to make your own health care decisions.

Do you need a power of attorney to act in your best interest?

The person is required to act in your best interests. Most states offer simple forms to help you create a power of attorney for finances. Generally, the document must be signed, witnessed and notarized by an adult.

What is a durable power of attorney?

A durable power of attorney form (DPOA) allows an individual (“principal”) to select someone else (“agent” or “attorney-in-fact”) to handle their financial affairs while they are alive. The term “durable” refers to the form remaining valid and in-effect if the principal should become incapacitated (e.g. dementia, Alzheimer’s disease, etc.).

How many copies of POA form are needed?

Successor Agent (optional) – Elect to have in case the agent is not available. Durable POA Form (3 copies) – It is recommended to bring 3 copies for signing. Notary Public / Witnesses – Depending on the State, it is required the form is signed by a notary public or witness (es) present.

What is UPOAA law?

The Uniform Power of Attorney Act (UPOAA) are laws created by the National Conference of Commissioners on Uniform State Laws (ULC) and have been adopted by 28 States since 2007. The incorporation of the laws is to bring uniformity to all 50 States and set common guidelines. Uniform Power of Attorney Act (UPOAA) Statutes (Revised 2006)

What powers does the principal have in real estate?

Financial Powers. The principal may grant the following standard financial powers to the agent in accordance with Section 301 (page 68): Real property – The buying, selling, and leasing of real estate; Tangible Personal Property – The selling or leasing of personal items;

What do you need to do after a form is completed?

After the form has been completed the principal will need to figure out the signing requirements in their State to finalize the document. In addition, the principal will need to gather the agent (s) as they will be required to sign the form in front of either the two (2) witnesses or notary public.

What is an attorney in fact statement?

(25) Attorney-in-Fact Declaration. The Agent who will be granted the principal powers you approved according to the conditions you set will have an acceptance statement to tend to. The printed name of the Attorney-in-Fact must be included in this statement.

How can an agent's duties be terminated?

The agent’s duties can be terminated in any of the following ways ( Section 301 (page 71 ): Death of the principal; A revocation form authorized by the principal; The occurrence of a termination event; The purpose of the power of to be accomplished or completed;

What Is A Power of Attorney?

- A power of attorney (POA) is a legal document that gives someone (called an attorney-in-fact or an agent) the authority to act on behalf of another person (called a principal). A power of attorney is usually used when the principal becomes ill, is disabled, or cannot be physically present to sign legal or financial documents. A POA is especially important to real estate investors because it …

Types of Powers of Attorney

- Building on our earlier statement, we will broadly cover two types of power of attorney; durable and medical power of attorney.

How Do You Prepare A Durable Power of Attorney?

- Thanks to LegalZoom and a ton of other online sites, you can download or buy a power of attorney template online. However, because of how the requirements vary by state, we recommend you contact a asset protection attorney to guide you through the process. While a POA is extremely useful, it doesn’t allow the delegations of a few rights, such as the right to vote…

Choosing An Agent and The Risks Involved

- Creating a durable power of attorney can have tremendous advantages: it means you can still be in charge (in a sense) if you are incapacitated. However, in essence, you are signing over your entire financial and legal life to someone else to control. Even though there are means to help make creating a power of attorney safer, such as choosing multiple agents and having them che…

Do You Need A POA?

- A durable power of attorney document will help safeguard your investments when you’re not able to do so personally. You should take care to select an appropriate agent when creating one, to ensure optimal protection. Interested in learning more? Check out our articles Using a Power of Attorney With a Land Trust and Do I Need a Medical Power of Attorney?

Popular Posts:

- 1. what does a civil litigation attorney job descroption

- 2. john adams attorney of who

- 3. who has to prepare a power of attorney

- 4. why would law firms want to hire a paralegal instead of any attorney

- 5. who plays jake the city attorney in parks and rec

- 6. where to obtain a power of attorney

- 7. how to compensate attorney for contingent fee cases

- 8. who is the attorney general for wisconsin

- 9. what is an mdl fee assessment by an attorney

- 10. how do you get a power of attorney in florida?