Signature of taxpayer(s)—If a tax or fee matter concerns a joint return, both spouses must sign if joint representation is requested. If you are a corporate officer, partner, guardian, tax or fee matters partner/person, executor, receiver, registered domestic partner, administrator, or trustee on behalf of the taxpayer, by signing this power of attorney, you are certifying that you have the authority to execute this form on behalf of the taxpayer.

How do I give someone power of attorney on a cdtfa?

spouses must sign if joint representation is requested. If you are a corporate officer, partner, guardian, tax or fee matters partner/person, executor, receiver, registered domestic partner, administrator, or trustee on behalf of the taxpayer, by signing this power of attorney, you are certifying that you

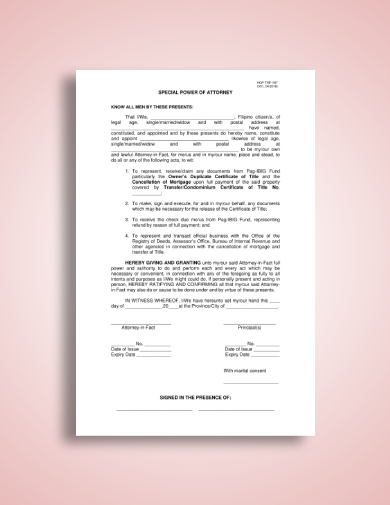

What is a power of attorney/general authorization?

Power of Attorney . A power of attorney is required if a designated representative submits this offer or if you want us to direct questions or requests for information to your representative. Forms CDTFA-392, Power of Attorney, may be used. If your offer is related to sales and use tax, please submit your completed and signed application to your

What powers does the Attorney (s)-in-fact and/or authorized representative (s) have?

spouses must sign if joint representation is requested. If you are a corporate officer, partner, guardian, tax or fee matters partner/person, executor, receiver, registered domestic partner, administrator, or trustee on behalf of the taxpayer or feepayer, by signing this Power of

What is a power of attorney for tax information?

Power of Attorney CDTFA-392 (FRONT) REV. 12 (3-21) STATE OF CALIFORNIA POWER OF ATTORNEY CALIFORNIA DEPARTMENT OF TAX AND FEE ADMINISTRATION EMPLOYMENT DEVELOPMENT DEPARTMENT Check below to indicate the appropriate agency. ... —If a tax or fee matter concerns a joint return, both spouses must sign if joint representation is requested. If …

How do I submit power of attorney to cdtfa?

CDTFA-392, Power of Attorney, is available on our website. You can complete the form online, save it and either email the PDF version to us, or print a hardcopy and mail it to us at the address which follows. CDTFA-5226, Marine Invasive Species Fee – Agent Agreement, is available on our website.May 2, 2020

Can I file Cdtfa 65 online?

You can use our Online Services Portal to close your account(s) if you are registered in our Online Services system. However, if you use a Limited Access Code to file your returns or do not have an online account with us, then you would need to use the enclosed CDTFA-65, Notice of Closeout, to notify us.

What is Cdtfa Schedule B?

SCHEDULE B - DETAILED ALLOCATION BY COUNTY. OF SALES AND USE TAX TRANSACTIONS. DUE ON OR BEFORE.

What is Cdtfa 82?

CDTFA-82, AUTHORIZATION FOR ELECTRONIC TRANSMISSION OF DATA.

Where do I file CDTFA 392?

Please note that a separate form must be completed and provided to each agency checked.CALIFORNIA DEPARTMENT OF.TAX AND FEE ADMINISTRATION.PO BOX 942879.SACRAMENTO, CA 94279-0001.1-800-400-7115 (TTY:711)EMPLOYMENT DEVELOPMENT DEPARTMENT.PO BOX 826880 MIC 28.SACRAMENTO CA 94280-0001.More items...

What is CDTFA limited access code?

The Express Login Code is a unique eight digit alphanumeric code. This code can be located or obtained from the following sources: Correspondence received from the CDTFA. Contacting our customer service representatives at 800-400-7115, Monday through Friday, 8:00 a.m. to 5:00 p.m. Pacific time, excluding state holidays ...

What is Schedule C Cdtfa?

CDTFA-530, Schedule C, lists the addresses of all your places of business for which seller's permits have been issued. Locations within a single city, or within the unincorporated area of a single county, are grouped.

How do I get a Schedule C?

You will need to file Schedule C annually as an attachment to your Form 1040. The quickest, safest, and most accurate way to file is by using IRS e-file either online or through a tax professional that is an authorized IRS e-file provider.

Do I need to report sales on Schedule B?

However, you don't need to attach a Schedule B every year you earn interest or dividends. It is only required when the total exceeds certain thresholds. In 2021 for example, a Schedule B is only necessary when you receive more than $1,500 of taxable interest or dividends.Mar 8, 2022

What does CDTFA demand?

CDTFA collection officers often demand large, unrealistic payment amounts from businesses (under the threat of levy) in order to get as much money as possible toward the payment of the balance due.

What happens to your credit after a lien is recorded?

For starters, immediately after the lien is recorded, your credit rating will be negatively affected. This will in turn decrease your ability to get a loan, get approval for a new credit card or even sign a lease.

What is sales tax in California?

Sales Tax and Owing the CDTFA. Sales taxes are imposed on individuals and businesses who sell goods or services in California. The amount of the tax is calculated by determining the gross receipts of a business, minus any exempt (non-taxable) sales. The sales and use tax rates are the same and are subject to change.

Is California sales tax the same as use tax?

The sales and use tax rates are the same and are subject to change. In addition to the state sales tax rate, various local jurisdictions add additional municipal sales tax rates. These district rates increase the total sales tax owed by a business and must be remitted to the CDTFA along with the basic California rate.

What is use tax?

Use tax is the other side of sales tax, and it refers to the purchase of items from out-of-state retailers for use in California. This means that if your business is outside California, you are still required to collect use tax on any items you sell in California, and then remit the funds to the CDTFA. There is a wide variety of items which are ...

What is a power of attorney?

Power of Attorney. Power of Attorney is a document giving the written authorization and power to represent or act in someone else’s behalf in their affairs. In California, you may be represented to the taxing authorities by legal counsel, a CPA, or by someone you’ve given power of attorney to.

What is considered confidential information?

For your knowledge, all but the following information is considered confidential taxpayer information: account number, business name, names of general partners, business address, ownership designation, start and close-out dates, and status of permit (i.e., active/ inactive).

How long does a driver's license last?

This authorization will only last for 30 days.

What is Chapter 4 of the book?

In Chapter 4, we talk about how buyers and particularly, sellers, can be “double taxes” in the sales and purchase of a business. We will also talk about corporate liabilities that include stakeholders.

Length of POA

Generally, a POA lasts for 6 years. To extend the POA for an additional 6 years, you must submit a new POA#N#3#N#.

Ending (revoking) your POA

Anyone on the POA declaration can revoke the POA#N#12#N#at any time (such as the individual, business, or representative).

Tax Professionals and MyFTB

If a representative has a tax professional MyFTB#N#13#N#account, they will have online access#N#14#N#to the individual or business account information once the POA is approved. Taxpayers or tax professionals can request full online account access for a tax professional when a POA declaration is submitted.

Find and fill out the correct cdtfa 82

signNow helps you fill in and sign documents in minutes, error-free. Choose the correct version of the editable PDF form from the list and get started filling it out.

How to generate an e-signature for a PDF document online

Are you looking for a one-size-fits-all solution to e-sign cdtfa 82? signNow combines ease of use, affordability and security in one online tool, all without forcing extra software on you. All you need is smooth internet connection and a device to work on.

Popular Posts:

- 1. how to explain attorney client privilege to client

- 2. what is the stsrting salary for lawyer/ attorney after graduation in 2018

- 3. who isdeputy attorney general

- 4. how do i get my retainer fees back from bankruptcy attorney

- 5. under miranda, a suspect has a right to an attorney when undergoing custodial interrogation.

- 6. how to get power of attorney for child living overseas

- 7. who is the attorney general of kentucky

- 8. how do you find a good divorce attorney seattle

- 9. what democrat won attorney general office in newington ct

- 10. where can i get enduring power of attorney forms for free