Does a POA need to be notarized in Florida?

According to Section 709.2105, in order for the power of attorney to be valid, you must sign the Florida power of attorney in the physical presence of two (2) witnesses and must be acknowledged by a notary. You must all sign in the presence of each other when executing the power of attorney.

Do you need a lawyer for power of attorney in Florida?

A power of attorney must be signed by the principal and two witnesses. For the document to be legally binding under Florida law, a notary must acknowledge the principal's signature. ... A power of attorney may also call upon a third party like a bank, doctor or lawyer.Jul 20, 2020

Can a notary be a witness on a power of attorney in Florida?

Can the Notary serve as a witness? The Notary can serve as one of the witnesses. It's important to note that Floridians are being warned that if the procedures established by the new law are not followed, the powers of attorney that don't comply will be invalid.Oct 19, 2011

Does a power of attorney need to be notarized?

Does my power of attorney need to be notarized? ... It is not a legal requirement for your power of attorney to be notarized, but there are very good reasons to get it notarized anyway. First, notarizing your power of attorney assures others that the signature on the document is genuine and the documents are legitimate.May 16, 2019

How do I fill out a durable power of attorney in Florida?

How to Fill Out a Florida DPOA FormStep 1: Designate an agent. First, choose someone you trust to be your agent. ... Step 2: Grant authority. ... Step 3: Ensure your form is durable. ... Step 4: Sign and date the form. ... Signing on Behalf of the Principal. ... Revoking a Durable Power of Attorney in Florida.Dec 9, 2020

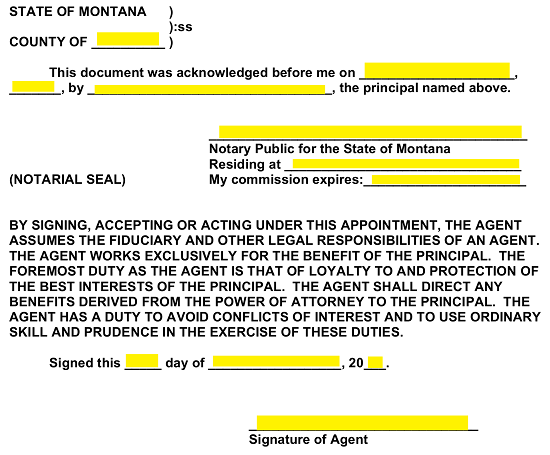

How do I notarize a power of attorney in Florida?

How to Complete a Notarized Power of AttorneyFill out the acknowledgement form, which should be attached to the POA. ... Affirm that the principal appeared before you voluntarily, that the terms of the POA are intended and that the signature on the document belongs to the principal. ... Ask the principal to sign the POA.More items...•May 15, 2019

What are the 4 types of power of attorney?

AgeLab outlines very well the four types of power of attorney, each with its unique purpose:General Power of Attorney. ... Durable Power of Attorney. ... Special or Limited Power of Attorney. ... Springing Durable Power of Attorney.Jun 2, 2017

Who can witness a document in Florida?

If you are doing an in home signing, please contact the customers in advance to let them know they need to have one or two witnesses present to also sign the applicable documents. A witness can be a neighbor, a friend, a relative, etc. as long as they are not a party to the transaction.

Can a family member be a witness on a notarized document in Florida?

A: A notary public may not notarize a signature on a document if the person whose signature is to be notarized is the spouse, son, daughter, mother, or father of the notary public. A notary public may notarize a signature for immediate family members on a marriage certificate.Jun 21, 2018

Who can override a power of attorney?

PrincipalThe Principal can override either type of POA whenever they want. However, other relatives may be concerned that the Agent (in most cases a close family member like a parent, child, sibling, or spouse) is abusing their rights and responsibilities by neglecting or exploiting their loved one.Nov 3, 2019

Does power of attorney need to be recorded?

A Power of Attorney, like a Trust, does not need to be registered or recorded in the public records in order to be effective. It does have to be in writing, signed, witnessed and notarized.Apr 22, 2011

How do you do POA?

Here are the basic steps to help a parent or loved one make their power of attorney, and name you as their agent:Help the grantor decide which type of POA to create. ... Decide on a durable or non-durable POA. ... Discuss what authority the grantor wants to give the agent. ... Get the correct power of attorney form.More items...•Jun 14, 2021

Who can notarize a document?

notary publicA notarized letter or document is certified by a notary public, a licensed public officer who serves as an impartial witness to the signing of documents and establishes the authenticity of the signatures. A notary's signature and seal are required to authenticate the signature on your letter or legal document.

Does Florida have a statutory power of attorney form?

The financial power of attorney requirements in Florida are found in the Florida Power of Attorney Act, which begins with Section 709.2101 of the Florida Statutes. Unlike many other states, Florida does not allow a springing power of attorney and does not provide an authorized form for a financial power of attorney.

What is a durable power of attorney in Florida?

In Florida, a power of attorney must be signed before two witnesses and a notary public to be considered a legal, binding document. ... Again, a durable power of attorney lets someone act on your behalf if you cannot due to mental incapacity.May 23, 2017

How long is a power of attorney good for in Florida?

One question we often get is, “When does a power of attorney expire?” The answers largely depends on how the power of attorney is drafted. But as a general rule, a durable power of attorney does not have a fixed expiration date.Dec 6, 2019

What is a power of attorney in Florida?

A power of attorney is a legal document that gives a person, called an "agent," the authority to act on behalf of another individual, called the "principal.". Some other helpful terms are:

How old do you have to be to be a trust agent in Florida?

Under Florida law, your agent must be either a person who is at least 18 years of age or a financial institution that has "trust powers," a place of business in Florida, and is authorized to conduct trust business in Florida.

How many witnesses are needed to sign a power of attorney in Florida?

In order to be effective, a Florida power of attorney must be signed by the principal and by two witnesses, and be notarized. In the event the principal is physically unable to sign, the notary public may sign the principal's name on the document.

What is a POA?

A POA that gives the agent a broad range of powers to conduct all types of financial transactions. Limited or special power of attorney. A POA that limits the authority of the agent to a single transaction, certain types of transactions, or to a certain period of time. Durable power of attorney. A power of attorney that is not terminated by ...

Is a last will and testament the same?

State Requirements for a Last Will. A last will and testament basically has the same function no matter where you live, but there may be state variations. That's why it's important to abide by state regulations when filling out your will or you may have an invalid will.

What is Durable Power of Attorney?

Durable power of attorney. A power of attorney that is not terminated by the principal's incapacity. Springing power of attorney. A power of attorney that does not become effective unless and until the principal becomes incapacitated. Incapacity or incapacitated.

How old do you have to be to be a trust agent in Florida?

As provided by the state’s lay, an agent must be either a person that is over 18 years of age or a financial institution with specific requirements, including “trust powers,” a place of business in Florida and is authorized to conduct trust business in the state. In any case, the agent should be a trustworthy person that will act in ...

Who is Romy Jurado?

Business & Immigration Lawyer to Entrepreneurs, Start-ups, Small Business and Foreign Investors. Romy Jurado grew up with the entrepreneurial dream of becoming an attorney and starting her own business. And today, she is living proof that dreams really do come true. As a founder of Jurado & Farshchian, P.L., a reputable business, real estate, and immigration law firm, Romy’s practice is centered primarily around domestic and international business transactions – with a strong emphasis on corporate formation, stock and asset sales, contract drafting, and business immigration. In 2011, Romy earned her Juris Doctor degree from the Florida International University College of Law. She is fluent in two languages (English and Spanish) and is the proud author of Starting a Business in the US as a Foreigner, an online entrepreneurial guide. Call for a Consultation 305-921-0440.

Does Florida have a power of attorney?

Florida law does not permit a springing power of attorney. It also does not provide an authorized form for financial power of attorney.

What is a power of attorney?

A power of attorney is a legal document giving one person (the agent or attorney-in-fact) the power to act on behalf of a third-party (the principal). Hence, the agent in question can have a broad or limited legal authority to make legal decisions about the principal’s property, finances, or medical care. Commonly, powers of attorney are used in ...

Is a durable power of attorney effective?

In terms of time limitation and effectiveness, there is the durable power of attorney and the springing power of attorney. In the first case, the power of attorney is not terminated by the principal’s incapacity. Meanwhile, a springing power of attorney does not become effective unless/until the principal becomes incapacitated mentally ...

What is a surrogate in health care?

A Health Care Surrogate is a person (agent) authorized via a Designation of Health Care Surrogate form to make medical decisions on behalf of a third-party (principal), in case of physical or mental incapacity to make sound decisions.

What is a durable power of attorney in Florida?

A Florida durable power of attorney form is a document that grants someone (the “agent”) the legal authority to act and make decisions for another person (the “principal”) in the state of Florida. Unlike a regular non-durable power of attorney (POA), a durable power of attorney (DPOA) stays in effect even if the principal becomes incapacitated ...

What does the principal need to mark on the form?

The principal needs to mark on the form which areas of their life they want to give the agent legal power over. This can be general authority (e.g., operation of a business) or specific authority (e.g., make a loan). They can also write specific instructions about which actions the agent can perform on their behalf.

Durable (Financial) Power of Attorney Florida Form – PDF Template

A Florida durable power of attorney form is used by a principal seeking to choose an agent to handle financial transactions on their behalf. This is common for senior citizens that elect family members to handle their banking, taxes, and real estate.

General Power of Attorney Florida Form – PDF – Word

The Florida general power of attorney form allows for the same rights for an agent as the durable, which is to act in the principal’s best interest for any financial matter legal within the State.

Limited Power of Attorney Florida Form – PDF – Word

The Florida limited power of attorney form provides an agent with the authority to handle a specific financial decision or transaction on behalf of the principal. The task can range from representing the person at a real estate closing to withdrawing money from his or her bank account.

Medical Power of Attorney Florida Form – PDF Template

The Florida medical power of attorney form, referred to as the Designation of Health Care Surrogate, is a document that enables an individual to select their health care representative to prepare for a circumstance in which they are unable to effectively communicate their wishes.

Minor (Child) Power of Attorney Florida Form – PDF – Word

The Florida minor (child) power of attorney form enables a parent to choose a representative and provide them with specific, temporary parental authority. The individual chosen for this position will serve as the child’s caregiver and act on the parent’s behalf.

POWERS AND DUTIES OF AGENT

An agent may perform only those acts specified in the Power of Attorney and any acts reasonably necessary to give effect to the specified acts. If an agent is unsure whether he or she is authorized to do a particular act, the agent should consult the lawyer who prepared the document or other legal counsel.

HEALTH CARE AND THE POWER OF ATTORNEY

A Declaration of Living Will specifies a person’s wishes as to the provision or termination of medical procedures when the person is diagnosed with a terminal condition, has an end-stage condition, or is in a persistent vegetative state.

What is a power of attorney?

A power of attorney is a document that creates a legally binding agreement between two parties — a principal and an attorney-in-fact. A power of attorney form grants an attorney-in-fact the right to: access the principal’s financial accounts. sign legal documents on the principal’s behalf. manage the principal’s legal and business affairs.

How to act as an attorney in fact?

access the principal’s financial accounts. sign legal documents on the principal’s behalf. manage the principal’s legal and business affairs. As an attorney-in-fact, you must act in the principal’s best interest, and adhere to their wishes when signing documents for them. This means doing what the principal would want you to do, no matter what.

Who is Mollie Moric?

Mollie Moric is a staff writer at Legal Templates. She translates complex legal concepts into easy to understand articles that empower readers in their legal pursuits. Her legal advice and analysis...

How to sign a POA?

Step 1: Bring Your Power of Attorney Agreement and ID. When signing as a POA, you need to bring the original power of attorney form to the meeting — even if you’ve already registered a copy of the document with the institution (such as a bank, financial agency, or a government institution). You also need to bring government-issued photo ...

Popular Posts:

- 1. how to designate temporary document review attorney in your resume

- 2. how does a kansas attorney apply for texasf law license

- 3. attorney who protect right studenns in san diego---- list and addresses

- 4. what happens if attorney general barr is held in contempt of congress?

- 5. direct hire va

- 6. who is john william king's attorney

- 7. what migh happen if an attorney is not used to draft an llp

- 8. how do i find out if an attorney is licenses in the new york bar

- 9. what is power of attorney of personal property

- 10. when your foster kid's attorney is useless