Trust law

A trust is a relationship whereby property is held by one party for the benefit of another. A trust is created by a settlor, who transfers property to a trustee. The trustee holds that property for the trust's beneficiaries. Trusts exist mainly in common law jurisdictions and similar systems existed since Roman times.

Can a power of attorney be designated for a trust?

Durable POAs stay in effect even if you are to ever become incapacitated. A traditional POA would expire at that point, eliminating any protection it ever provided you. Having a Durable POA means your agent will be authorized to act on your behalf until you pass away, or until you decide to revoke his or her power. Durable POAs are often used as a type of financial Power of Attorney, …

What is the difference between living trust and durable power of attorney?

Generally, a power of attorney (POA) is not designated for a trust. However, there could be instances when you might want to name the same person as your trustee and as your attorney-in-fact. A POA is a legal document that gives someone else the power to act on your behalf. A trust, on the other hand, is managed by a trustee.

What is a durable power of attorney?

Durable Power of Attorney. A Durable Power of Attorney is just a different type of a Financial POA. Both give legal rights to an agent so he or she can step in to deal with any non-medically-related issues or affairs. The big difference is this: the “durable” part establishes that the POA should remain intact if you are incapacitated in any way.

Do I need a durable POA if I have a trust?

Sep 20, 2017 · A durable power of attorney is essentially a specific type of power of attorney that can remain effective even you, the principal, become incapacitated for any reason. A durable power of attorney can also be drafted so that it only becomes effective when at the point you become incapacitated. The choice is yours. Let our living trust lawyers explain the difference

What is the difference between a trustee and a durable power of attorney?

The Trustee only manages the assets that are owned by the trust, not assets outside the trust. ... The Power of Attorney controls assets that are not inside your trust such as retirement accounts, life insurance, sometimes annuities, or even bank accounts that are not in trust title.

Who holds the real power in a trust the trustee or the beneficiary?

A trust is a legal arrangement through which one person, called a "settlor" or "grantor," gives assets to another person (or an institution, such as a bank or law firm), called a "trustee." The trustee holds legal title to the assets for another person, called a "beneficiary." The rights of a trust beneficiary depend ...Jun 22, 2021

Can you have POA on a trust?

Generally, a power of attorney (POA) is not designated for a trust. However, there could be instances when you might want to name the same person as your trustee and as your attorney-in-fact. A POA is a legal document that gives someone else the power to act on your behalf.

Who has power in a trust?

A trust is an arrangement in which one person, called the trustee, controls property for the benefit of another person, called the beneficiary. The person who creates the trust is called the settlor, grantor, or trustor.

How much power does a trustee of a trust have?

The trustee usually has the power to retain trust property, reinvest trust property or, with or without court authorization, sell, convey, exchange, partition, and divide trust property. Typically the trustee will have the power to manage, control, improve, and maintain all real and personal trust property.Apr 10, 2017

Who has more power executor or trustee?

The main difference is that the trustee is the person responsible for making the decisions that maintain the estate whilst it is held on trust before it is given to the beneficiaries, and the executor is the person that carries out (or executes) the actions in the Will eg applying for probate.

Can durable power of attorney change a trust?

Your power of attorney can only make changes to your living trust if you specifically grant them that authority. ... However, if the POA document fails to include the power to change your living trust, your agent doesn't have the right to do so.Sep 29, 2020

What is the difference between power of attorney and a trust?

Generally, a power of attorney covers assets outside the grantor's trust, whereas a trust document governs assets inside the trust. ... Assets held in the trust will be controlled by the successor trustee or co-trustees.May 21, 2019

Is a trustee an agent of the trust?

The trustee is not an agent of the beneficiary. The trustee's duty not to delegate the administration of the trust could well be implicated if the trustee without authority were to behave as if he were the beneficiary's agent.Jul 1, 2015

Who is the best person to manage a trust?

trusteeMost people choose either a friend or family member, a professional trustee such as a lawyer or an accountant, or a trust company or corporate trustee for this key role.May 31, 2019

Who is the trustee of a family trust?

The trustee In a family trust, the trustees are usually Mum and Dad (or a company of which Mum and Dad are the shareholders and directors). Their children and any other dependants are usually listed as beneficiaries.

How does a beneficiary get money from a trust?

There are three main ways for a beneficiary to receive an inheritance from a trust: Outright distributions. Staggered distributions. Discretionary distributions.

What is a POA?

A Power of Attorney (POA) is an incredibly important piece of your Estate Planning efforts. Your POA allows you to appoint another person, known as an “agent,” to act in your place. An agent can step in to make financial, medical or other major life decisions should you become incapacitated and no longer able to do so.

When does a POA end?

A General POA: General POAs end as soon as you are incapacitated. While this tool is great for many things in life, it is not a solid option for end-of-life decisions. A Durable POA: A durable POA stays in effect until you pass away or revoke its power.

Is a Power of Attorney the same as a Living Will?

Keep in mind that a Healthcare Power of Attorney is not necessarily the same thing as a Living Will. Some states allow certain preferences to be included in a Living Will, such as whether or not you’d want to be on life support.

What is a fiduciary POA?

The person you appoint as your Power of Attorney is known as a fiduciary – someone who is responsible for managing the affairs of another. Depending on the type of POA that’s in effect, the powers your agent can exercise could have a wide range of authority. At the most basic level, your POA will act on your behalf if you become unable to do so ...

Can you have more than one power of attorney?

Yes, you can appoint more than one Power of Attorney. If you designate more than one person, be sure to clearly note how you want them to act. You can specify if they must act jointly or if they can act independently. If you only choose one POA, you should consider having a backup designation.

What is a financial power of attorney?

A Financial Power of Attorney designates an agent the authority to make financial decisions and act on your behalf should you not be able to. This type of POA can be broad or very specific. It’s another title for General POA, and could typically grant all the same actions listed above.

What is a health POA?

Health POAs allow you to appoint an agent to act on your behalf regarding health-related matters. A Financial POA does this for all other financial-related issues in your life. Decisions could be in relation to business or personal financial issues, or a combination of the two.

Why do you need a living trust?

Another important benefit of creating a living trust is that your family may be able to avoid the expensive and time-consuming probate process . With a last will and testament, your estate is required to go through probate so that your assets can be distributed according to the terms of your will. On the other hand, having a living trust means your estate does not go through probate, at least as to the assets that are title in the trust name. That also means your heirs can receive their inheritance much sooner.

What are some examples of estate planning?

There are many different estate planning options, all of which can help you achieve your goals in preparing for the future. A living trust and a durable power of attorney are two common examples. Clients are often confused as to the difference between the two estate planning tools.

What is a power of attorney?

A power of attorney is a customizable estate planning tool that allows you to choose someone to manage all or part of your personal affairs, including making health care and financial decisions while you are alive. As the person who signs and executes the power of attorney, you are referred to as the “principal.”.

What is the purpose of a living trust?

An important component of an estate plan that includes a living trust is that you will be required to transfer your assets to the trust. This must be done in order for your trust to be effective . The trustee has the authority to manage only the trust assets and no other property in your estate.

Can you name yourself as trustee of a trust?

With living trusts, most people name themselves as trustee. That allows you to maintain control over your property while you are still alive. Then upon your death, your chosen successor trustee will take over management of the trust on behalf of your beneficiaries.

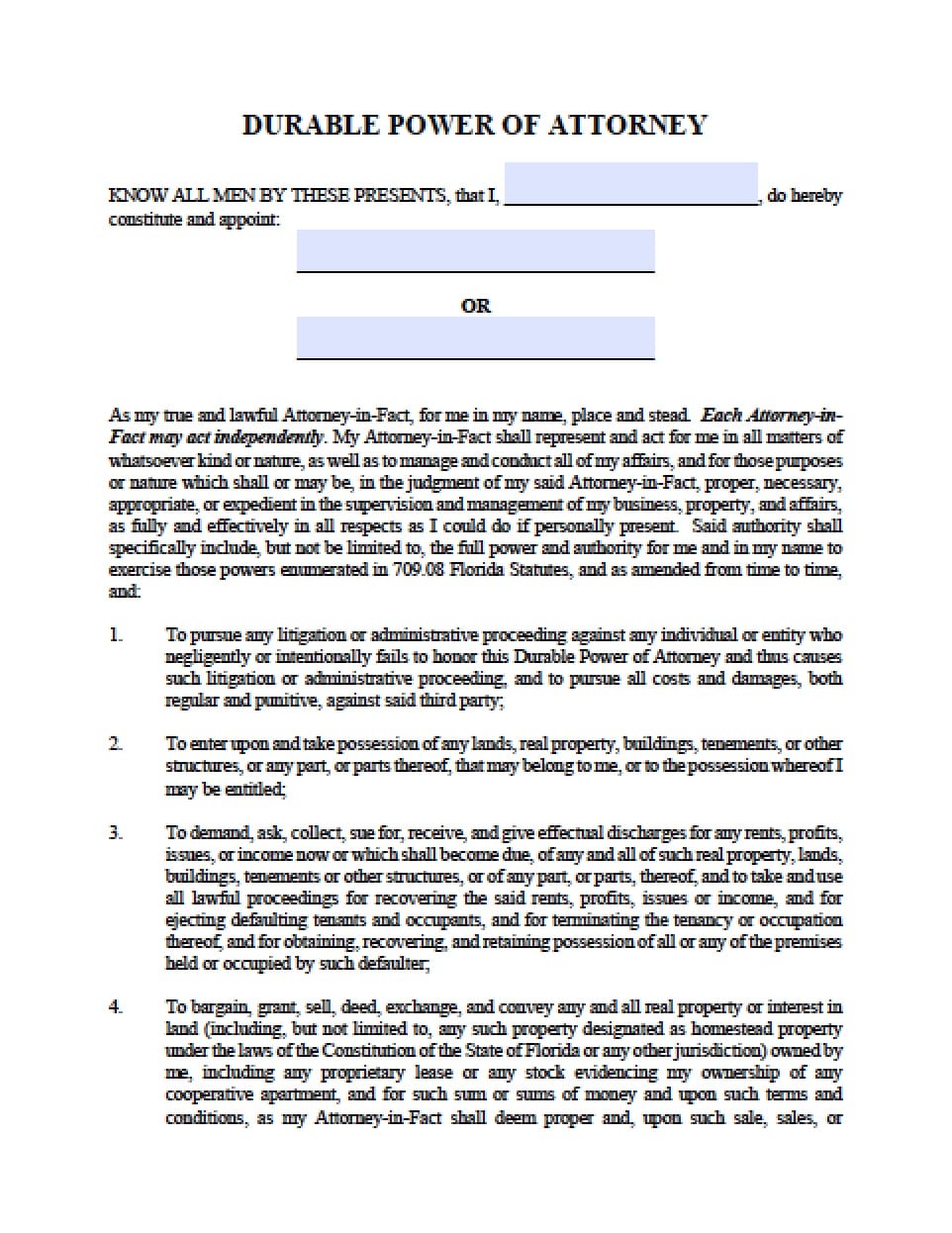

What is a Durable Power of Attorney?

A Durable Power of Attorney for Property (DPA) is a document that allows you (the principa l) to give authority to another person (your agent or attorney-in-fact) to make financial/legal decisions and financial transactions on your behalf.

What powers do you have as an attorney in fact?

The powers you give your attorney-in-fact can be as limited or as broad as you like, and can include the power to buy property, to invest, to contract, to engage in tax planning, to make gifts, and, very importantly, to plan for government benefits, such as Supplemental Security Income and Medicaid (Medi-Cal in California).

How effective is a DPA?

Ordinarily, a DPA is effective as of the day it is signed and executed. This means that even if you are competent to make your own decisions, your attorney-in-fact will also have the legal authority to act on your behalf and engage in financial transactions.

Who can be a trustee?

A trustee can be an individual, such as a family member or friend, or it can be a bank or other financial institution . If you choose an individual to serve as your trustee, you want to make sure that he or she is both trustworthy and able to manage your assets. Some people prefer a neutral third party, such as a bank or trust company. These institutions do charge fees, usually based on a percentage of the trust estate, and you may want to interview several trust companies before you choose one.

Can a spouse be an attorney in fact?

It need not be an attorney: any trusted adult, such as a spouse, partner, relative or friend, can serve as attorney-in-fact. Also, there are several nonprofit agencies that can fill this role.

What is a DPA?

A DPA is a relatively easy, inexpensive mechanism for allowing another person to handle your legal and financial affairs. Unlike a joint tenancy bank account, which people often use as a management device in the event of incapacity, a DPA does not give your attorney-in-fact legal access for his or her own use.

How old do you have to be to sign a DPAHC?

You must be at least 18 years of age and mentally competent to execute a valid DPAHC. You must sign your DPAHC form. Most states will also require qualified adult witnesses and/or a notary public to sign the DPAHC, acknowledging that you are competent and acting under your own volition. No attorney is required.

Why do you need a durable power of attorney?

As demonstrated in the story above, one of the most compelling reasons to create a Durable Power of Attorney is the possibility of incapacity. If you have a revocable living trust, it’s true that your Successor Trustee can step in to take control over the assets of your trust if you become incapacitated.

What is a POA?

A Power of Attorney (or POA) is a legal document that authorizes someone else to handle certain matters on your behalf. A Durable Power of Attorney remains in effect even if the creator becomes mentally incompetent. This is different from a traditional Power of Attorney which becomes defunct when the creator loses mental capacity.

How old do you have to be to sign a power of attorney?

The principal must have the same legal capacity to enter into a contract; namely, they must be at least 18 years old and “of sound mind”. The Durable Power of Attorney” must be signed by the principal in front of a notary public or two qualified witnesses.

Can you put life insurance in a trust?

But some assets, like life insurance and retirement accounts, cannot be titled into a trust. If you become incapacitated and want someone to access these assets, your agent will need a Power of Attorney document.

What is a power of attorney?

A general power of attorney legally authorizes your “agent” (aka attorney-in-fact) to act on your behalf in a wide range of business matters. A few examples include filing tax returns; buying and selling real estate; paying bills; and managing bank accounts.

What is a springing power of attorney?

Springing Power of Attorney: This type of Durable Power of Attorney does not “spring into effect” until the principal (creator) becomes incapacitated, allowing you to avoid giving your agent immediate authority. In California, a Springing Power of Attorney usually includes this phrase: “This power of attorney shall become effective upon ...

What can an attorney in fact do?

The attorney-in-fact can manage assets that fall outside a trust, such as real estate, tangible property, investments, bank accounts, business interests, and IRA assets . The attorney-in-fact can file taxes, make legal claims, gift property on behalf of the incapacitated individual, and even create additional trusts for estate planning purposes.

Who can act as successor trustee?

The grantor of the trust can designate an individual, bank, or trust company to act as successor trustee or co-trustee. Upon the grantor's incapacity or death, property titled in the trust's name will be controlled by the successor trustee or co-trustees in accordance with any direction you have provided in your trust.

Is a will a good start?

Having a will is a good start, but sound advance planning should go further. Granting a power of attorney and creating a trust are two additional planning vehicles to consider. There are pros and cons to each, and often, using a combination of the two brings added benefits.

Can an attorney in fact make gifts?

The attorney-in-fact can exercise only those powers specifically granted in the document, such as the power to make gifts. Unless a particular power is clearly stipulated, the attorney-in-fact won't be able to carry it out.

What is POA letter?

A POA letter for a trust is necessary when you require certain day-to-day financial matters to be taken care of once you are unable to do so. These can include: Filing tax returns for the trust. Managing assets that aren’t in the trust. Changing the trust if you become incapacitated.

What is a living trust?

A trust or living trust is a legal document that regulates the transfer of your property after you pass away. It is similar to a will but avoids the lengthy and potentially expensive process of probate, meaning that your property can be transferred to your beneficiaries without having to go through a court.

What is a trustee power of attorney?

Short-term financial needs and those of your family are taken care of. A trustee can appoint an agent under a power of attorney, with the trustee in the role of principal. The agent can then be empowered under the POA to sign for the trustee in whatever circumstances ...

What is POA in financial terms?

A POA hands legal control of certain aspects of your life to a third party or agent for them to manage on your behalf. In the case of a financial POA, its commencement date, termination, and scope are defined by the type of POA you choose, such as:

Do you need a notary to sign a POA?

Once you—and your agent—are happy with your POA document, you should sign it in the presence of a notary. Having your document notarized adds legal weight to your POA, as the notary: Verifies you are who you claim to be. Checks and attests that you are of sound mind when you sign the POA.

What is the scope of a POA?

In the case of a financial POA, its commencement date, termination, and scope are defined by the type of POA you choose, such as: Whatever type you grant, you need to be sure that the power of attorney allows your agent to perform all the tasks necessary to safeguard your—and your family’s—well-being.

Can you use DoNotPay to find missing money?

The best part of using DoNotPay is that you can both save and earn money. As soon as you sign up, make sure you check out how you can find missing money, get free raffle tickets, get compensation for victims of crime, report a late or missing delivery and get a refund for it, and request gift card cash back.

Charles A. LeFebvre

I emphatically agree that no one can give you a meaningful answer to this question without reviewing the documents that you are referencing.

Matthew Joseph Gardner

I agree with the answers provided by the other attorneys, the Financial/Durable POA and Healthcare POA are stand alone documents outside of the Trust. In response to your question "who has control over the properties?", you and your parents will need to meet with an attorney to get a clear and accurate answer to this question...

Bruce Kiselstein

I agree with the previous answer. By your reference to "within the trust are POA and Healthcare POA", I can only assume that you mean that the package of documents with the Trust, also included Powers of Attorney for Property and Powers of Attorney for Health Care. A Power of Attorney would not be part of the actual Trust document...

Paul A. Smolinski

Normally attorneys do not place powers of attorney inside of a trust so your question starts out rather confusing. Then you reference your dad but not your mom - is this a second marriage?#N#Powers of attorney are important; however, they can be dangerous if you are not...

Popular Posts:

- 1. how much does it cost to create a power of attorney

- 2. what type of attorney is warren ross

- 3. what happens if you request respondent to pay attorney fees fl 100

- 4. what does it mean to be the power of attorney

- 5. if i have texas power of attorney of a child what rights do i have

- 6. how much is the attorney charges if the buyer cancels the property deal in new jersey

- 7. how much are the attorney fee for inmigration

- 8. how much will an attorney cost for controlled dubstance charges

- 9. what studies need to become an attorney

- 10. where can i get a power of attorney form in ill