How much does a bankruptcy attorney cost?

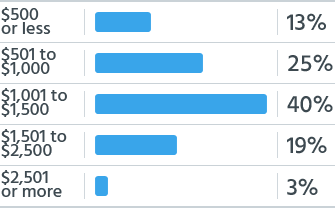

Many filers have a difficult time affording the fees charged by bankruptcy attorneys. Even an affordable bankruptcy attorney can cost between $1,200 to $2,500, depending on the specific situation of the case.

How long does it take to file for bankruptcy in a Chapter 7?

Provided that you pass the Means Test, the app walks you through the various steps of filing a Chapter 7 bankruptcy case including: In a typical no-asset Chapter 7 case, you can complete the bankruptcy case and receive your bankruptcy discharge within four to six months after filing your Chapter 7 bankruptcy petition.

What is a NACBA?

NACBA is a national organization for consumer bankruptcy lawyers handling Chapter 7 and Chapter 13 bankruptcy cases for individual filers and small businesses.

Who is Jonathan Petts?

Jonathan Petts has over 10 years of experience in bankruptcy and is co-founder and Board Chair of Upsolve. Attorney Petts has an LLM in Bankruptcy from St. John's University, clerked for two federal bankruptcy judges, and worked at two top New York City law firms specializing in... read more about Attorney Jonathan Petts

Can you repay debts after bankruptcy?

This offer is wonderful, but make sure that your friend or family members know that you can't repay the money until after your bankruptcy case is closed. You can also stop paying your unsecured debts that will be discharged in a bankruptcy case and use that money to pay an affordable bankruptcy attorney.

Can late payments affect credit score?

In addition, additional late payments will lower your credit score even further. It's typically possible to find a bankruptcy attorney who agrees to accept payments while agreeing to handle creditor calls and provide you with legal advice as needed while you pay the attorney fees.

Can I file for bankruptcy without an attorney?

You also have the choice of filing for Chapter 7 bankruptcy relief without an attorney if you can't find an affordable bankruptcy attorney. The Bankruptcy Code does not prohibit you from filing on your own (" pro se ").

What to do if you can't afford bankruptcy?

If you can't afford a Chapter 7 bankruptcy lawyer, consider whether one of the following might work for you: stop making payments on debts that will get wiped out in bankruptcy and pay your attorney instead. borrow the fees from a friend, family member, or even your employer. retain a bankruptcy lawyer who will handle creditor calls ...

Do you need an attorney to file for bankruptcy?

You aren't required to have an attorney when filing for bankruptcy relief. Whether you should, however, will depend on how complicated your case is and how comfortable you are researching the law and filing on your own. In general, people who have a simple case will be better able to complete a Chapter 7 bankruptcy.

Do you have to file bankruptcy in Chapter 7?

All Chapter 7 cases require you to fill out extensive bankruptcy forms, research exemption laws (to protect property) and follow all local court rules and procedures. If you aren't comfortable doing the work—and assuming the risk—consult with a bankruptcy lawyer.

Can you stop creditors from collecting on your bankruptcy?

The automatic stay order that stops creditors from collecting doesn't go into effect until you file the bankruptcy case. However, once you hire an attorney, you can cut down on annoying calls by instructing creditors to call your lawyer instead of you.

What is Chapter 13 bankruptcy?

Chapter 13 Bankruptcy is a reform of debts intended to help property owners keep their home, valuable assets and vehicles. When filing Chapter 13, it may be possible to stop foreclosure, wage garnishments, repossessions, including debt lawsuits.

How long does a Chapter 13 bankruptcy last?

Chapter 13 bankruptcy allows debtors to repay a portion of their debts and can last anywhere from 3 to 5 years. During this time if you need to take out a new loan you must first file a motion and obtain court permission.

How long does bankruptcy stay on credit report in Florida?

When a person files for Chapter 7 bankruptcy relief in Florida it will remain on your credit report for a period of 10 years from the date of filling. As time goes by the impact of a chapter 7 bankruptcy on your credit report become less significant with every passing year.

Popular Posts:

- 1. why hire an attorney for dui

- 2. how much do you expect to pay attorney for the sale of a small business

- 3. do you pay attorney when i back out during home purchase

- 4. what is the difference of durable power of attorney and power of attorney

- 5. who has to pay court appointed attorney in new jersey

- 6. who is attorney general during wall street bombing of 1920

- 7. how much does a consultation with a small business attorney cost

- 8. which of the following statements are true if a customer signs a non-durable power of attorney?

- 9. how to drop a client attorney

- 10. who is the winner of the illinois primary attorney general democrat