What are the duties of an agent under a power of attorney?

Agent The person designated to be the agent assumes certain responsibilities. First and foremost, the agent is obligated to act in the principal’s best interest. The agent must always follow the principal’s directions. Agents are “fiduciaries,” which means that the agent must act with the highest degree of good faith in behalf of their principals.

How does an agent use a power of attorney?

The attorney-in-fact, also known as the agent, is the person you choose to make decisions with a POA. The POA loses its power when you die. At that point, whoever is appointed as your executor or personal representative in your will takes over managing the estate and handling affairs.

What can a power of attorney agent do?

Nov 25, 2003 · Power of attorney (POA) is a legal authorization that gives a designated person, termed the agent or attorney-in-fact, the power to act for another person, known as the principal. The agent may be...

Who is the agent in a power of attorney?

May 02, 2022 · An attorney-in-fact is a person you've assigned to manage your affairs through the power of attorney document. This person is an agent acting on your behalf, also called a fiduciary . An attorney-in-fact does not need to be someone who can practice law.

What type of agent has power of attorney?

What does successor agent mean?

What qualities should you look for when appointing someone as an agent via a power of attorney and or a durable power of attorney?

What is a gratuitous agent?

What is a successor attorney?

What three decisions Cannot be made by a legal power of attorney?

Who makes decisions if no power of attorney?

Who is the best person to be power of attorney?

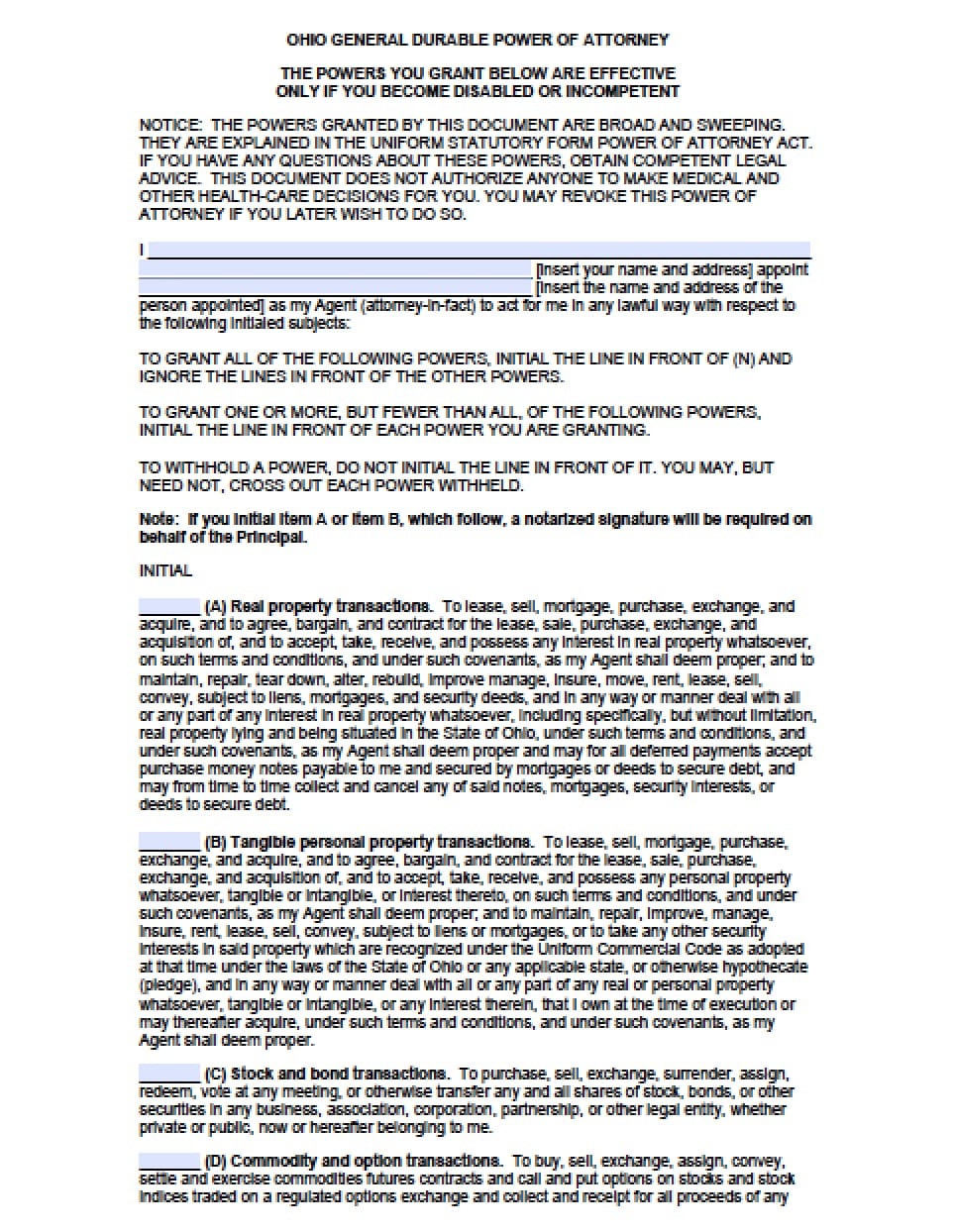

What is a general power of attorney?

A general power of attorney acts on behalf of the principal in any and all matters, as allowed by the state. The agent under a general POA agreement may be authorized to take care of issues such as handling bank accounts, signing checks, selling property and assets like stocks, filing taxes, etc.

When should a power of attorney be considered?

A power of attorney should be considered when planning for long-term care. There are different types of POAs that fall under either a general power of attorney or limited power of attorney . A general power of attorney acts on behalf of the principal in any and all matters, as allowed by the state.

Why does a power of attorney end?

A power of attorney can end for a number of reasons, such as when the principal dies, the principal revokes it, a court invalidates it, the principal divorces their spouse, who happens to be the agent, or the agent can no longer carry out the outlined responsibilities. Conventional POAs lapse when the creator becomes incapacitated.

What is a POA?

Key Takeaways. A power of attorney (POA) is a legal document giving one person, the agent or attorney-in-fact, the power to act for another person, the principal. The agent can have broad legal authority or limited authority to make decisions about the principal's property, finances, or medical care. The power of attorney is often used ...

What is limited POA?

For example, the limited POA may explicitly state that the agent is only allowed to manage the principal's retirement accounts. A limited POA may also be in effect for a specific period of time (e.g., if the principal will be out of the country for, say, two years).

How to start a power of attorney?

A better way to start the process of establishing a power of attorney is by locating an attorney who specializes in family law in your state. If attorney's fees are more than you can afford, legal services offices staffed with credentialed attorneys exist in virtually every part of the United States.

Can you use verbal instruction to get a POA?

While some regions of the country accept oral POA grants, verbal instruction is not a reliable substitute for getting each of the powers of attorney granted to your agent spelled out word-for-word on paper. Written clarity helps to avoid arguments and confusion.

What is a power of attorney?

A power of attorney is a document that lets you name someone to make decisions on your behalf. This appointment can take effect immediately if you become unable to make those decisions on your own.

What is a power of attorney for health care?

A health care power of attorney grants your agent authority to make medical decisions for you if you are unconscious, mentally incompetent, or otherwise unable to make decisions on your own. While not the same thing as a living will, many states allow you to include your preference about being kept on life support.

Is a power of attorney valid if you are mentally competent?

A power of attorney is valid only if you are mentally competent when you sign it and, in some cases, incompetent when it goes into effect. If you think your mental capability may be questioned, have a doctor verify it in writing.

What is a POA?

A power of attorney (POA) is a document that allows you to appoint a person or organization to manage your property, financial, or medical affairs if you become unable to do so.

What powers can an agent exercise?

You can specify exactly what powers an agent may exercise by signing a special power of attorney. This is often used when one cannot handle certain affairs due to other commitments or health reasons. Selling property (personal and real), managing real estate, collecting debts, and handling business transactions are some ...

Why is it important to have an agent?

It is important for an agent to keep accurate records of all transactions done on your behalf and to provide you with periodic updates to keep you informed. If you are unable to review updates yourself, direct your agent to give an account to a third party.

Why do you need multiple agents?

Multiple agents can ensure more sound decisions, acting as checks and balances against one another. The downside is that multiple agents can disagree and one person's schedule can potentially delay important transactions or signings of legal documents. If you appoint only one agent, have a backup.

Learn the ins and outs of creating a POA and choosing an agent

A power of attorney (POA) is a simple document that gives someone you trust the power to act on your behalf. The person you allow to step into your shoes is called an "attorney-in-fact"—or "agent," in some states.

What Type of POA Should I Make?

Power of attorneys can address a variety of situations. You can create a POA for a single transaction (for example, authorizing your brother to sell your car for you while you're out of town) or a long-term, "durable" one that will allow someone to handle your financial or health matters if you ever become incapacitated.

How Do I Choose an Agent or Attorney-in-Fact?

For a financial power of attorney, usually any competent adult can serve as your agent. This person need not be a financial expert, but certainly you'll want to choose someone who has a good dose of common sense, and whom you trust completely. In addition, consider these factors:

How Do I Create a POA?

You can make your own power of attorney, but your document needs to be valid in your particular state because each state has its own set of requirements. The good news is that state-specific power of attorney forms are readily available, either from your state government or through guided software programs such as Nolo's Willmaker.

When Does a Power of Attorney Begin and End?

If you made a durable financial power of attorney (the most common POAs made as part of an estate plan), the document usually goes into effect immediately after you've signed it and had it witnessed or notarized. In practice, of course, you can instruct your agent not to use the POA until you are incapacitated.

Can You Help a Loved One Make a POA?

You can nudge or help your loved ones to create their own POA; people often find themselves helping their elderly parents with these documents. Be aware that the person you're helping must have the mental capacity to understand generally what the POA is and what it does. See Helping an Elder Make a Power of Attorney for a more in-depth discussion.

What is a lender?

Lender (or employee of lender) None. Property seller, or any person related to the property seller, including a relative or affiliate. Any real estate agent with a financial interest in the transaction (or any person affiliated with such real estate agent)

What is an affiliate title insurance company?

Affiliate of the title insurance company or its employee (including, but not limited to, the title agency closing the loan) Lender (or employee of lender) None. Property seller, or any person related to the property seller, including a relative or affiliate.

What is a loan originator?

Loan originator. Affiliate of the loan originator. Employee of the title insurance company. Affiliate of the title insurance company or its employee (including, but not limited to, the title agency closing the loan)

What is a power of attorney?

A power of attorney is a document authorizing someone to perform duties on behalf of another individual. A person granted power of attorney to sign documents for someone else is typically referred to as an attorney in fact or agent, and the individual represented is referred to as a principal. An attorney in fact has authority to sign ...

Do you need a thumbprint for a power of attorney in California?

Your article states, "If a California Notary is asked to notarize a signature for a document granting power of attorney that relates to real estate, the Notary must obtain the signer's thumbprint for their journal entry.". However, I believe a thumbprint is required if the document to be notarized deals with real estate (with a few exceptions) ...

What is an attorney in fact?

As stated above, an attorney in fact is a person granted power of attorney to sign documents for someone else (the principal). An attorney in fact has authority to sign the principal's name and have that signature notarized without the principal being present.

Do you need a POA to sign a deed in NJ?

In NJ, if you sign as attorney in fact on a Deed, the POA must be recorded with the Deed. Only a Mortgage doesn't need the POA to be recorded with the Mortgage, but the POA must state this is given for the property in question. A General POA, once recorded, can be used for all transactions, even disability issues.

Do notaries need to notarize power of attorney in Tennessee?

Hello. Tennessee does not require Notaries to request proof of a signer's power of attorney status. However, it is a recommended practice to note if someone is signing as attorney in fact for another party in your Notary journal entry. For general examples of notarizing the signature of an attorney in fact, please see the section "How do I notarize the signature of someone who has power of attorney?" in the article above. If the attorney in fact is requesting an acknowledgment, please note that Tennessee has specific Notary certificate wording for an acknowledgment by an attorney in fact under (TCA 66-22-107 [c]).

Can a notary notarize a signature without the client being present?

If the company is asking the Notary to notarize the client's signature without the client being present, the answer is no. Failing to require personal appearance by the signer could result in serious legal and financial consequences for the Notary.

Popular Posts:

- 1. what does a tax attorney make

- 2. how to revoke a power of attorney in new york state

- 3. how to write a summary for medical malpractice attorney

- 4. what is attorney responsibility for answering interrogatories

- 5. what if attorney is sick and has court

- 6. how to get attorney license in new mexicop

- 7. what can you do if your attorney does not respond to you

- 8. how to appeal a foia denial to the attorney general in arkansas

- 9. how to file an online complaint with louisiana attorney generals office

- 10. what is penalty for attorney general lying to congress