A Durable Power of Attorney (DPOA) is a legal document that lets individuals appoint a person they trust to take control of their finances in the event they are unable to manage their assets themselves. This can apply in the following situations: You become disabled or incapacitated You become legally incompetent

Full Answer

What is the durable general power of attorney?

Jan 27, 2022 · Durable Power of Attorney. A durable power of attorney gives your agent the right to make decisions and take the actions specified for the long term. Even if you are mentally incapacitated or deemed unfit to make decisions for yourself, your agent can …

What is a durable financial power of attorney?

Apr 12, 2022 · Who Should You Choose as Your Durable Power of Attorney? Oftentimes, people designate a close family member such as a spouse or child to be their agent. You also can designate co-agents if you wish, although it would be wise to have one agent act as a majority in the event that your co-agents have differing opinions.

What is a durable family power of attorney?

Jan 06, 2022 · A durable power of attorney is one that either takes effect upon or lasts after the principal's incapacitation. This is different from a general power of attorney, which would terminate at this point.

How do you get a durable power of attorney form?

A durable power of attorney is a legal document that addresses this exact situation. But what does it do, exactly, and how do you get one? Answers to these questions and more ahead. This important document empowers an appointed agent (also known as an attorney-in-fact) to make financial and legal decisions on your behalf.

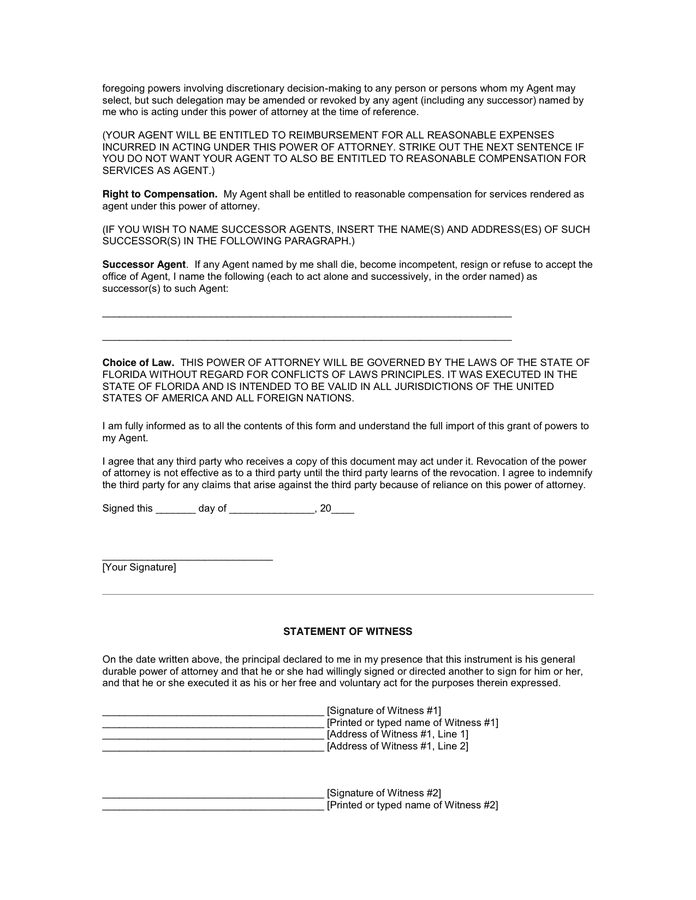

Does a power of attorney need to be notarized?

It depends on the state, since each state has its own rules for validating a power of attorney. Some require two witnesses and no notary, some requ...

How much does a power of attorney cost?

The cost for a power of attorney varies, depending on how you obtain the form and your state’s notary requirements. Online forms may be free, and y...

How many people can be listed on a power of attorney?

You can name multiple agents on your power of attorney, but you will need to specify how the agents should carry out their shared or separate duties.

What are the requirements to be a power of attorney agent?

Legally, an agent must be at least 18 years old and of sound mind.4 You should also choose someone you trust to act in your best interests.

When should I create a power of attorney?

You can create a power of attorney at any point after you turn 18. You need to create a power of attorney while you’re of sound mind.

What is a durable power of attorney?

A durable power of attorney is generally used to make plans for the care of your finances, property, and investments in the event that you can no longer handle your financial affairs yourself. The Durable Power of Attorney: Health Care and Finances.

What is a guardian in Texas?

A guardian is appointed for the principal. If a spouse was appointed as the agent and the couple divorces or the marriage is annulled or declared void, Section 751.132 of the Texas Estates Code states that their authority as agent terminates.

What is a springing power of attorney?

With a springing power of attorney, the authority to act on your behalf only kicks in after a doctor certifies that you’re incapacitated. (One drawback to keep in mind: That extra step can sometimes create delays.)

What happens if you are unable to manage your own affairs?

So if you are unable to manage your own affairs for any reason—for example, you’re unconscious in the hospital, or you develop severe dementia—your agent can step in and pay your bills or file your taxes, deposit checks in your bank account, manage your investments, handle insurance issues, and make many other important decisions. ...

What is a Durable Power of Attorney?

A Durable Power of Attorney (DPOA) is a legal document that lets individuals appoint a person they trust to take control of their finances in the event they are unable to manage their assets themselves. This can apply in the following situations: 1 You become disabled or incapacitated 2 You become legally incompetent 3 You wish for an agent to take control of your financial affairs now AND if/when you become incapacitated or legally incompetent

What is Durable POA?

A Durable POA for Healthcare has some similarities to an Advance Directive or Living Will, as it gives details regarding your desires for medical treatment if you are unconscious or incapacitated. The key difference with a DPOA for Healthcare, however, is that it empowers the Agent to make medical decisions for you.

How to complete a Power of Attorney?

The first step to completing a Power of Attorney Document is to find a suitable person to be your Agent or Attorney-in-Fact. This should be an individual that you trust implicitly and can confidently rely upon to make sensible financial decisions on your behalf.

Who is the principal in a power of attorney?

The Principal: The individual who is seeking to appoint a power of attorney. The Agent: An Agent, also known as the Attorney in Fact, takes control of the Principal’s financial affairs. Additional Co-Agents can also be appointed by the Principal in a DPOA.

Can you appoint a POA?

In a simple case, you can just appoint your Agent to manage assets like any real estate you own, personal property or your bank accounts and taxes. However, if your situation is more complex your POA can include powers to manage stocks and shares, government benefits or making business or litigation decisions for you.

What is advance directive?

It allows the Agent (s) or Attorney-in-Fact to act for you if you are incapacitated due to injury, disability, declining health, advanced age, or mental health reasons. An Advance Directive is strictly limited in scope to:

How long does a power of attorney last?

Unless you have specified otherwise, a Durable Power of Attorney can last until your death . Whilst, your appointed Agent may manage your funeral plans and financial affairs before you have died, they cannot take on these responsibilities after your death.

What is a power of attorney?

Regardless of the name, a power of attorney is someone you choose to make health and medical decisions for you if you're unable to make them for yourself. 1. For most people, having this person in place to make medical decisions when they are no longer able to do so can bring peace of mind. Some people choose to designate a power ...

How to choose a power of attorney?

When choosing your power of attorney, talk to the person you are considering. Be sure that they feel they could serve in this capacity. Encourage the person to be honest.

Who is Sherri Gordon?

Sherri Gordon is a published author and a bullying prevention expert. Cristian Zanartu, MD, is a licensed board-certified internist who has worked for over five years in pain and palliative medicine. One of the most important healthcare decisions you will make is choosing your power of attorney.

Can you designate a power of attorney?

But really, you can designate your power of attorney anytime you want. You simply need to have an attorney draw up the paperwork. You also can specify when the duties of the power of attorney begin to take effect.

Popular Posts:

- 1. what does the general attorney in the cabinet do?

- 2. how long can an attorney hold on to a retenter fee after case has close

- 3. what should i do if i am contacted by someone other than my own attorney in a civil case?

- 4. what are hourly fees for a labor attorney in salt lake city

- 5. how can you remove an attorney general

- 6. how much is it to hore bankruptcy attorney leesburg va

- 7. where can i find a grand jury report from the attorney general in pennsylvania

- 8. when do i need work comp attorney

- 9. when an employee gets an attorney

- 10. who is the city attorney of emporia, ks?