Stock transfers should be completed by the executor of the estate or by someone appointed by the executor and who has power of attorney for the decedent. This person will fill out stock transfer paperwork, send it to appropriate parties and make sure the transfer is completed in a timely manner. Paper Stock Certificates

Full Answer

Do I need an attorney to transfer my stocks?

Nov 26, 2003 · Stock Power: A legal power of attorney form that transfers the ownership of certain shares of a stock to a new owner. A stock power transfer form is normally only required when an owner opts to ...

How do I transfer stock certificates?

A power of attorney that allows a person to transfer ownership of stock. Stock powers are commonly used in secured lending transactions. If certificated securities owned by a borrower are collateral in a loan transaction, a stock power is delivered to the secured party along with a stock certificate. When completed and signed, the stock power enables the secured party to transfer …

How do I transfer my stock account to another brokerage firm?

In order to transfer a stock certificate, you must get the help of the firm holding your shares. If you intend to transfer your stock to another brokerage account, the easiest way is usually to use the Automated Customer Account Transfer Process, or ACATS. Through ACATS, transfers are usually completed in 6 to 10 business days. ...

When do you need a stock power of attorney?

Determine whether or not you need to hire an attorney to help you with the transfer of your stock certificates. You may want to consider consulting an attorney if your stock holdings are significant, or if the stock transfer is being done as part of the settlement of an estate.

How do I change ownership of a stock certificate?

In order to cash in the stock, you need to fill out the transfer form on the back of the certificate and have it notarized. Once complete, send the notarized certificate to the transfer agent, who will register the stock to you as owner.

Can power of attorney transfer stocks?

Stock power is a legal power of attorney form that transfers the ownership of certain shares of a stock to a new owner. A stock power transfer form usually is only required when an owner opts to take physical possession of securities certificates, rather than holding securities with a broker.

How do I transfer ownership of shares?

You may see it referred to as form J30 or a share transfer form, but it means the same thing. The person selling the shares (often called the 'transferor') should complete their details on the stock transfer form, including their name and address as well as identifying the shares to be transferred, and then sign it.Mar 5, 2020

How do I remove a name from a stock certificate?

Submit the signed stock ownership certificate, the stock power form and W-9 form to your brokerage firm or the company you have stock through. If you are changing your own name, due to marriage, divorce or court order, include a certified court document that verifies and authenticates your name change.

What is a stock power of attorney?

This Standard Document is a share power (also known as a share transfer power of attorney). When certificated securities are pledged as collateral for a loan obligation, a share power is delivered to the secured party together with the corresponding share certificate to perfect the secured party's security interest.

What are the 4 types of power of attorney?

AgeLab outlines very well the four types of power of attorney, each with its unique purpose:General Power of Attorney. ... Durable Power of Attorney. ... Special or Limited Power of Attorney. ... Springing Durable Power of Attorney.Jun 2, 2017

Can shares be transferred without a stock transfer form?

Transfer of shares 23. The instrument of transfer of a share may be in any usual form or in any other form which the directors may approve and shall be executed by or on behalf of the transferor and, unless the share is fully paid, by or on behalf of the transferee.

Is a stock transfer a change of ownership?

Change in Ownership means any sale, disposition, transfer or issuance or series of sales, dispositions, transfers and/or issuances of shares of the capital stock by the Corporation or any holders thereof which results in any person or group of persons (as the term “group” is used under the Securities Exchange Act of ...

How do you transfer stock ownership after death?

To facilitate a transfer, the executor will need a copy of the decedent's will or a letter from the probate court confirming that the beneficiary in question is indeed the person entitled to receive the shares. The executor must then send these documents to a transfer agent, who can complete the transfer of ownership.Feb 27, 2016

How do I transfer stock from my custodial account?

A stock power form formally instructs your broker to transfer ownership from the custodian to you. This form requires information, such as your full name, address and Social Security number; the description of the shares and how they are to be reissued; and your signature or that of the former custodian.

Can you transfer ownership of shares to another person?

Shares are like any other form of property, they can be transferred between individuals at any time. This can be done because of several reasons: The shareholder has died. They are trying to recoup investment.

Are stock certificates transferable?

By delivering the stock certificate, ownership is now transferred to the person of your choice, whether they bought your shares of stock or received them from you as a gift.

How do you transfer stock certificates?

Contact your financial representative. In order to transfer a stock certificate, you must get the help of the firm holding your shares. If you intend to transfer your stock to another brokerage account, the easiest way is usually to use the Automated Customer Account Transfer Process, or ACATS.

How do I transfer shares to a family member?

The owner must endorse the stock by signing it in the presence of a guarantor, which can be their bank or broker. There may also be a form on the back of the certificate, which relates to the transferring of ownership. After the certificate is complete, it will be rendered non-negotiable and becomes transferable.

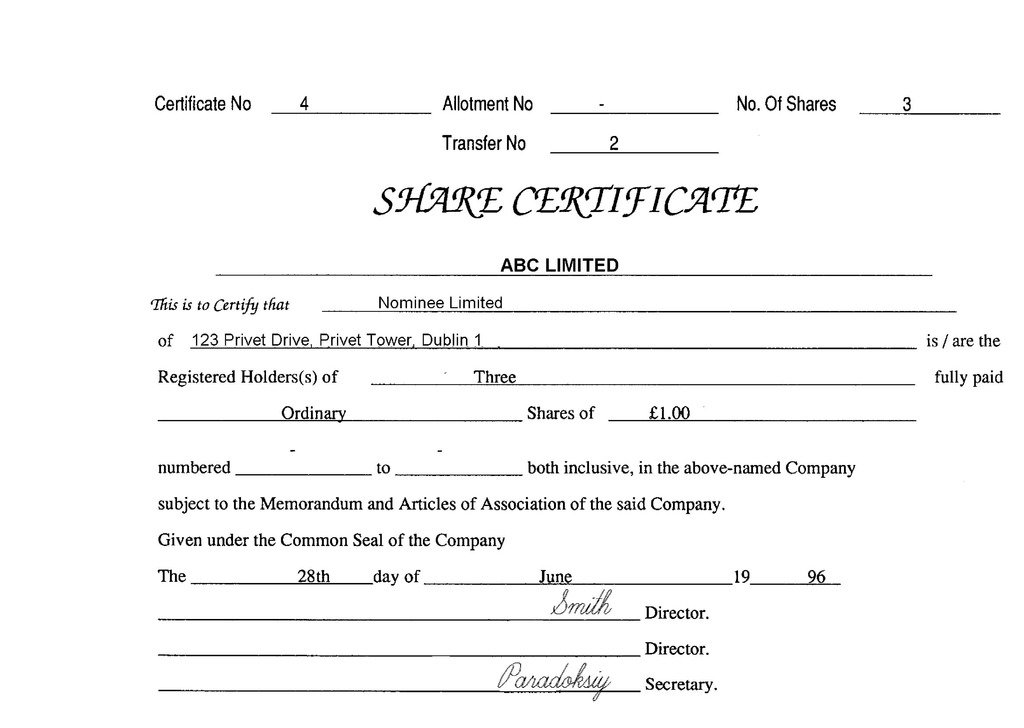

Is a share certificate proof of ownership?

A share certificate is a written document signed on behalf of a corporation that serves as legal proof of ownership of the number of shares indicated. A share certificate is also referred to as a stock certificate.

What is the process of transferring shares?

Step 1: Obtain share transfer deed in the prescribed format. Step 2: Execute the share transfer deed duly signed by the Transferor and Transferee. ... Step 5: Attach the share certificate or allotment letter with the transfer deed and deliver the same to the Company.

How do you transfer shares in a company?

Transferring Ownership of Stock within an S CorporationFollow the corporation's explicit stock transfer processes. ... Draft an agreement for the stock transfer. ... Execute the agreement then attain consideration. ... Record the transfer in the stock ledger of the corporation. ... Prepare to consent to an S corporation election.Mar 4, 2014

Step By Step Help For Cashing In On Old Stock Certificates

The U.S. government amasses millions of dollars of unclaimed assets every year. Some of those assets are old, uncashed dividends and stocks.

Getting Started With Cashing In Old Stock Certificates

First, you must find out if the issuing company is still active. You can do this by investigating the instrument from home or at your local library.

Researching Old Companies

Ideally, you want to find out as soon as possible if your stocks hold any value. Resultantly, it makes good sense to start doing a little research on your own.

Learning More About Your Certificate Through the State

You can also find out information about your old stock certificate through the state. Contact the Secretary of State Office of the issuing state on the certificate.

Approaching the Finish Line

Now you’ve identified the company and your CUSIP number. You have the information you need to investigate the worth of your old stock certificates.

Sealing the Deal

If you’ve gotten this far, the transfer agent will ask you to complete the transfer form. The transfer form is located on the back of the stock certificate.

Yet Another Way to Cash in on Old Stock Certificates

Sometimes, a stock certificate may look valid, but it holds no worth, or it’s been canceled – as mentioned above. If, in the end, you find out that your stock has no value – don’t give up.

What is stock power?

Key Takeaways. Stock power is a power of attorney form that transfers share ownership to a new owner. Stock power is sometimes referred to as a security power form and generally requires a signature guarantee to protect against fraudulent transfers. This form is usually only needed when physical possession of security certificates is taken.

Who is Will Wills?

He developed Investopedia's Anxiety Index and its performance marketing initiative. He is an expert on the economy and investing laws and regulations. Will holds a Bachelor of Arts in literature and political science from Ohio University. He received his Master of Arts in economics at The New School for Social Research.

Do you need a stock power to transfer a security?

Stock powers are needed for each account and each security being transferred. All owners must sign the form and generally have their signatures guaranteed with a medallion signature guarantee. In some cases, if a stock power is too old, it might be rejected.

Step 1

Contact your financial representative. In order to transfer a stock certificate, you must get the help of the firm holding your shares. If you intend to transfer your stock to another brokerage account, the easiest way is usually to use the Automated Customer Account Transfer Process, or ACATS.

Step 2

Sign the certificates and transfer them yourself. If you hold your own stock certificates, or for any reason do not want to go through the ACATS process, you can make the transfer yourself. Follow the instructions on the back of your stock certificate to make the transfer legal.

Step 3

Monitor the transfer. Make sure that the proper amount of the correct security ends up in the right account. Although the stock transfer process is pretty straightforward, even with explicit instructions, mistakes do occur.

Step 1

Determine how your name appears on your account at the receiving firm. In order for the transfer to be processed you will have to complete your stock certificates with the exact name as it appears on your account at the brokerage firm that will be receiving your account.

Step 2

Enter the number of shares in the appropriate blank on your stock certificate. Enter the name of the receiving firm in the assignee section.

Step 3

Enter the date and sign using your name exactly as it appears on your account with the receiving firm.

Step 4

Check the current price of the stock you own so you can estimate how much your investment is worth. There are a number of places where you can check the value of your stock, including websites like Yahoo! Finance and Money.CNN.com.

Step 5

Determine whether or not you need to hire an attorney to help you with the transfer of your stock certificates. You may want to consider consulting an attorney if your stock holdings are significant, or if the stock transfer is being done as part of the settlement of an estate.

Peter Collins Freeman

Typically, a third party (usually the company's attorney) assists in transferring stock from one shareholder to another. You questions, as noted by Mr. Doland, understandably pertain to the endorsement language pre-printed on stock certificates.

Michael Charles Doland

What you are looking at is how to transfer your stock certificate.#N#"In the presence of" mean where the witnesses sign (but not required here in CA)#N#You dont need to fill in the blank since the company almost certainly has no transfer agent...

John P Corrigan

I do not recommend you do this and your confusion on the stock certificate lingo is not surprising. You should have a short Stock Purchase Agreement to memorialize the agreement between the parties as to any financial and other terms between you.

How to transfer shares of stock?

A person's percentage of ownership in a company is determined by the shares they hold. The respective shares can be sold or given by their owners however they see fit, as long as it complies with the shareholder agreements they signed prior to the transfer.

What is stock transfer?

Stock Transfers. Shares can be transferred through different types of business entities, such as corporations, partnerships or limited liability companies. Each entity has a different share structure, share transfer guidelines, and maximum number of shareholders. Most companies have share transfer guidelines and written agreements between owners, ...

Why is the ledger important?

The ledger is useful for any action regarding the shares, such as sale, transfer, or loss. Due to its obvious importance for a corporation, the ledger is kept by the corporation's secretary, along with other crucial documents like the corporate seal.

What is an S corporation?

An S corporation is a business that complies with a specific set of regulations to benefit from a special tax regime offered by the IRS. One of the most important regulations includes a restriction on who can own stock in the company. Not complying can mean losing tax privileges. Any well run S corporation should be careful to restrict stock ...

What is a sales agreement?

A sales agreement must be drafted, clearly specifying the parties involved, the price of the stock, and how much of it will be purchased. Another important clause in the sale agreement is the buying entity agreeing to fully respect the S corporation's internal laws and shareholder agreements already in place.

How to contact HMRC about stamp duty?

If you're not sure whether your transaction is exempt from Stamp Duty, or if you think you may be entitled to relief from Stamp Duty, you can contact the HMRC Stamp Taxes Helpline on 0845 603 0135 or, if calling from overseas, +44 1726 209 042. Alternatively visit

Can a shareholder sign a power of attorney?

If a shareholder is unable to deal with their shares and a Power of Attorney is in place, and this is already registered with us, the person with Power of Attorney can sign on their behalf.

What is stock certificate?

Stock certificates, along with house deeds and certificates of deposit, are proof of asset ownership. Always keep your financial papers in a safe deposit box or other secure place.

What is a medallion stamp?

The Medallion stamp verifies the identity of the person signing the stock certificate. If your financial institution provides this service, make an appointment to bring in the stock certificates and ask what personal identification you need to provide. Take your stock certificates to your financial institution.

Popular Posts:

- 1. what type of attorney would be able to advise on student loan issues?

- 2. can we give power of attorney when buying a house

- 3. who was attorney general foroperation fast and furious

- 4. what is the qualification for a districr attorney

- 5. what is an aod attorney general

- 6. how long to become an attorney in mexico

- 7. how will my attorney or the judge decide a monthly amount for disability

- 8. who sings my attorney berne

- 9. what did shelia jackson give ford's attorney

- 10. who would be a recommended criminal defense attorney near hillsboro il