Does a power of attorney need to be notarized?

It depends on the state, since each state has its own rules for validating a power of attorney. Some require two witnesses and no notary, some requ...

How much does a power of attorney cost?

The cost for a power of attorney varies, depending on how you obtain the form and your state’s notary requirements. Online forms may be free, and y...

How many people can be listed on a power of attorney?

You can name multiple agents on your power of attorney, but you will need to specify how the agents should carry out their shared or separate duties.

What are the requirements to be a power of attorney agent?

Legally, an agent must be at least 18 years old and of sound mind.4 You should also choose someone you trust to act in your best interests.

When should I create a power of attorney?

You can create a power of attorney at any point after you turn 18. You need to create a power of attorney while you’re of sound mind.

What Is A Durable Power of Attorney?

A Durable Power of Attorney (form) is for anyone wanting another person to handle matters on their behalf when incapacitated. It’s by far the most...

How to Get Durable Power of Attorney

Getting a durable power of attorney will require the principal to find someone that they can trust to handle their assets if they should not be abl...

Durable Poa vs General Poa

Both forms allow for the principal to select someone else to act on their behalf. Although, the durable allows for the relationship to continue in...

Agent’S Acceptance of Appointment

At the end of the form, the Agent must read and acknowledge the power that they have and how important their position is for the principal. This ad...

What does it mean to have a power of attorney?

If you are an attorney, this means you have the power to act on someone else's behalf. You’ll often hear lawyers referred ...

What is a durable POA?

With durable POA, you may also consent to treatment on your principal's behalf, or withdraw prior consent that your principal made before losing consciousness.

Who do you give notice to if your principal is incapacitated?

Give notice to your principal's guardian and successor agent. If your principal is incompetent or incapacitated, give notice to her guardian as well as to anyone she named as a successor agent that you no longer want to carry out your duties as her agent.

Can a principal revoke a POA?

Understand your principal can revoke your authority at any time. If your principal's condition improves, or if she decides she no longer wants a POA, she can revoke it whenever she wants as long as she's mentally competent.

Do you need multiple copies of POA?

You will need multiple copies of each POA to distribute to anyone who requires proof that you are authorized to act on your principal's behalf. For example, you may need to file the medical POA with all of your principal's doctors or specialists.

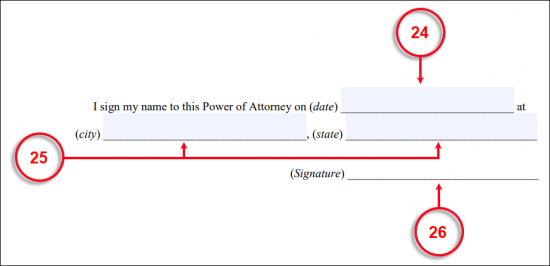

Where to sign POA?

Sign the document in front of a notary. Every state requires you and your principal to sign the durable POA in the presence of a notary. If you’re not sure where to find a notary, you can use the Notary Locator provided by the American Society of Notaries.

Do you need to sign a POA with a principal?

Even if you are acting both as healthcare POA and financial POA, your principal may have you sign separate documents, because you will need to show these documents to others who may not need to know all your personal details. For example, your principal's banker may need to see the POA to give you access to her bank accounts, but he doesn’t need to know her personal medical information.

What is a durable power of attorney?

A durable power of attorney form (DPOA) allows an individual (“principal”) to select someone else (“agent” or “attorney-in-fact”) to handle their financial affairs while they are alive. The term “durable” refers to the form remaining valid and in-effect if the principal should become incapacitated (e.g. dementia, Alzheimer’s disease, etc.).

How many copies of POA form are needed?

Successor Agent (optional) – Elect to have in case the agent is not available. Durable POA Form (3 copies) – It is recommended to bring 3 copies for signing. Notary Public / Witnesses – Depending on the State, it is required the form is signed by a notary public or witness (es) present.

How many states have adopted the Uniform Power of Attorney Act?

The following 28 States have adopted the Uniform Power of Attorney Act:

Can a power of attorney be filed to end a marriage?

If married and the spouse is the agent, and a court action is filed to end the marriage unless specific language exists in the power of attorney allowing such legal action without terminating the document.

What is a reimbursement for attorney fees?

Reimburse the principal or their successors in interest for the attorney’s fees and other costs related to obtaining a judgment against the agent.

What is personal and family maintenance?

Personal and Family Maintenance – Deciding and budgeting the amount of money to pay for the principal and any family members being supported;

What powers does the principal have in real estate?

Financial Powers. The principal may grant the following standard financial powers to the agent in accordance with Section 301 (page 68): Real property – The buying, selling, and leasing of real estate; Tangible Personal Property – The selling or leasing of personal items;

Why do we need durable POA?

The point of a durable POA is to do it while you’re well and when you don’t actually need it. Because it stays in effect after you’re unable to take care of yourself, you’ll allow a seamless transfer of responsibility without leaving your loved ones to figure out who will pay your bills, make your health decisions, or protect your assets.

Who should be the initial agent for a POA?

Instead, experts suggest naming the child who leaves nearest to you and may be most hands-on with your care as the initial agent, and then having another child or family member listed as a backup. It’s always smart to have a backup agent, in case something happens to the initial agent, and he or she isn’t able to carry out the duties of the POA.

What happens if you are unable to manage your own affairs?

So if you are unable to manage your own affairs for any reason—for example, you’re unconscious in the hospital, or you develop severe dementia—your agent can step in and pay your bills or file your taxes, deposit checks in your bank account, manage your investments, handle insurance issues, and make many other important decisions. ...

What is a springing power of attorney?

With a springing power of attorney, the authority to act on your behalf only kicks in after a doctor certifies that you’re incapacitated. (One drawback to keep in mind: That extra step can sometimes create delays.)

Can you have a power of attorney for health care?

You’ll also want to have a separate durable power of attorney for health care, or health care proxy, which appoints someone to make medical decisions on your behalf if you can’t speak for yourself. You can have the same person fill both of these roles, or choose different people if you think that the best person to make decisions about your medical care is not the best person to manage your finances. (But if you do pick two different people, make sure they can work well together.)

Why is an attorney in fact important?

This important document empowers an appointed agent (also known as an attorney-in-fact) to make financial and legal decisions on your behalf. It’s durable because it remains in effect even if you become incapacitated for any reason.

Can you override a power of attorney?

You still have the right to control your life, your money, your property, and your assets. And you can always override your agent, if you’re of sound mind.

What is durable power of attorney?

Drafting a durable power of attorney is an act of love: By detailing how you want matters regarding your health and finances handled in the event of an emergency, you are sparing your family and friends the unpleasant task of making such decisions in a stressful time.

What is a power of attorney for healthcare?

Power of Attorney for Healthcare. The power of attorney for healthcare designates the person who will make medical decisions for you in an emergency. Even though you may have set out your wishes in your living will, such documents cannot cover every circumstance.

When does a power of attorney end?

The power of attorney for finances is typically extinguished upon death, revocation, or divorce.

Do you need a power of attorney to act in your best interest?

The person is required to act in your best interests. Most states offer simple forms to help you create a power of attorney for finances. Generally, the document must be signed, witnessed and notarized by an adult.

Can a healthcare directive contradict a power of attorney?

You should still make your healthcare directive as detailed as possible: The person you charge with making your healthcare decisions can never contradict the terms of your healthcare declaration . In order to create a power of attorney for healthcare, most states only require that you be an adult ...

What does a financial durable power of attorney do?

It is a financial durable power of attorney - this means that it only allows the agent to handle financial matters. It does not permit the agent to make decisions about the principal's health care.

What is the Texas estate code for a power of attorney?

The agent's authority has been terminated under Texas Estates Code 751.132 and the power of attorney does not provide for a replacement; or. A guardian is appointed for the principal.

What is incapacitated power of attorney in Texas?

According to Section 751.00201 of the Texas Estates Code, a person is considered to be "incapacitated" for the purposes of a durable power of attorney if a doctor's examination finds that they are not able to manage their own finances.

Popular Posts:

- 1. ace attorney dual destinies what year apollo was attacked

- 2. who is attorney general's boss

- 3. what is the starting salary of a constitutional attorney

- 4. how long does it take a solo attorney to become successful

- 5. what does it take to become a criminal defense attorney

- 6. how to get the move button to work on ace attorney online

- 7. how many u.s. attorneys report and are serviced by u.s. attorney general

- 8. what percentage do workers compensation attorney takes

- 9. on the sitcome seinfeld what was the nickname of the attorney george hired to get babu's visa?

- 10. who is alabama's district attorney