Full Answer

Who conducts the title search when buying a house?

The buyer’s attorney or the real estate agent’s attorney typically conducts the title search. A title search generally involves reviewing public property records to ensure that there are no errors in the title to the property.

What is the purpose of a title search?

A title search is an examination of public records to determine and confirm a property's legal ownership, and find out what claims are on the property. ... A title search is usually performed by a title company or an attorney, often on behalf of a prospective buyer who may be interested in making an offer on the property.

What kind of records are examined in a title search?

The records examined include deeds, court records, name indexes, property indexes, as well as many other documents. The function of the title search is to verify that the seller is the actual legal owner of the property and to ensure that the title is not clouded, has no mortgage claims, liens, title claims, judgments,...

Who is responsible for title insurance when buying a house?

In most cases, the attorney’s office will handle the title search and either the attorney or the real estate agent will choose the title insurer. The cost of title insurance varies and is typically paid as a one-time fee as part of the buyer’s closing costs.

What is the lender's attorney's responsibility at the closing?

The closing attorney's primary function is to take care of all arrangements necessary to close the lender's mortgage transaction. The closing attorney coordinates all of the efforts outside of the loan approval process that allows the closing to take place.

How long does a title search Take in Alabama?

Processing times may vary. Titles are normally issued within 10 – 15 days from the date the application and supporting documents are received by the Department and all required documentation is correct.

How long does a title search take in SC?

between 10 and 14 daysThe title search can take as little as a few hours, but in most cases, it'll take between 10 and 14 days.

How much does a title search cost in Virginia?

A title search costs $75 to $200, in most cases.

Who picks the title company in Alabama?

The seller should select the title company unless they work with a buyer who has already selected one. Sellers have control over what is done in the sale and should diligently protect their interests.

How much is a title search in Alabama?

Title search and recording fees Title searches typically cost around $75 to $100; sellers and buyers customarily split this fee in Alabama.

Is a title search required in SC?

It's not required by law that a prospective buyer does a title search before purchasing real estate in South Carolina, but skipping the title search is, frankly, reckless.

How long does it take to transfer title on a house?

four to six weeksIt usually takes four to six weeks to complete the legal processes involved in the transfer of title.

What is a title check on property?

A property title search examines public records on the property to confirm the property's rightful legal owner. The title search should also reveal if there are any claims or liens on the property that could affect your purchase.

Who pays closing costs in VA?

When using a VA loan, the buyer, seller, and lender each pay different parts of the closing costs. The seller cannot pay more than 4% of the total home loan in closing costs. However, their portion of the closing costs includes the commissions for buyer and seller real estate agents.

Who pays for owner's title insurance in Virginia?

the home buyerIn Virginia, the home buyer typically pays for both title insurance policies. It may be possible to include a credit from the seller in your contract. Your realtor or mortgage lender will probably refer you to the title insurance company they usually work with.

Do buyers pay realtor fees in Virginia?

Buyers don't pay realtor fees in Virginia. The buyer's agent commission — which averages 2.66% in Virginia — is typically paid by the seller as part of the sale proceeds. However, as the buyer, you may be eligible for a home buyer rebate. A rebate puts money back in your pocket after you purchase a home.

How long does it take to do property searches?

The environmental search usually takes between 24 and 48 hours. The slowest local authority at the time of writing is Camden in Greater London, taking on average 50 working days. It is not however uncommon for searches (especially personal searches) to take 24 hours to process.

How do you check the status of a title in Alabama?

Please go to: https://alts.mvtrip.alabama.gov/Application/ApplicationStatus/Prequalifier, to track the status of your title application.

How do I do a title search in Alabama?

0:023:47Alabama title search - YouTubeYouTubeStart of suggested clipEnd of suggested clipIn fact no matter what city it is you have to go to the county records to get the documents for thatMoreIn fact no matter what city it is you have to go to the county records to get the documents for that title. In the city that resides in that county.

How long does it take to transfer title on a house?

four to six weeksIt usually takes four to six weeks to complete the legal processes involved in the transfer of title.

What is a Title Search?

A title search, or a property title search, is a process that involves reviewing files from the county records department to see a particular property title’s ownership history. The search is usually conducted by a commercial agent, such as a title company, a real estate attorney, or an escrow officer. The types of records that these agents might examine include:

What is the purpose of title search?

The purpose of a title search is to confirm that the seller is the actual legal owner of the property being sold. It also helps to ensure that the title is not clouded by a defect that could reduce the value of the land or would subject the buyer to some sort of legal liability.

What Other Types of Records Does a Title Search Review?

Each title search company or individual attorney that is hired to perform a title search, may choose to review different kinds of documents. In general, they will typically examine the following:

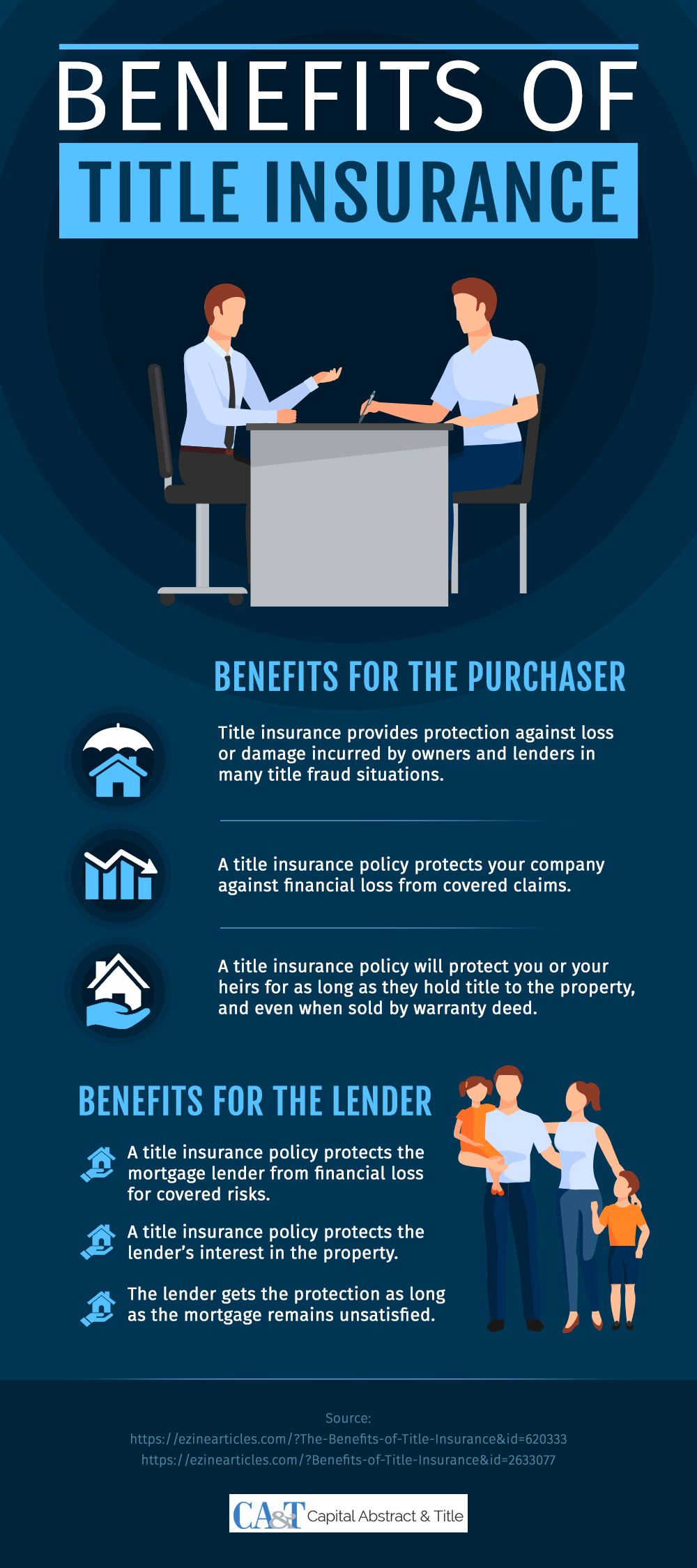

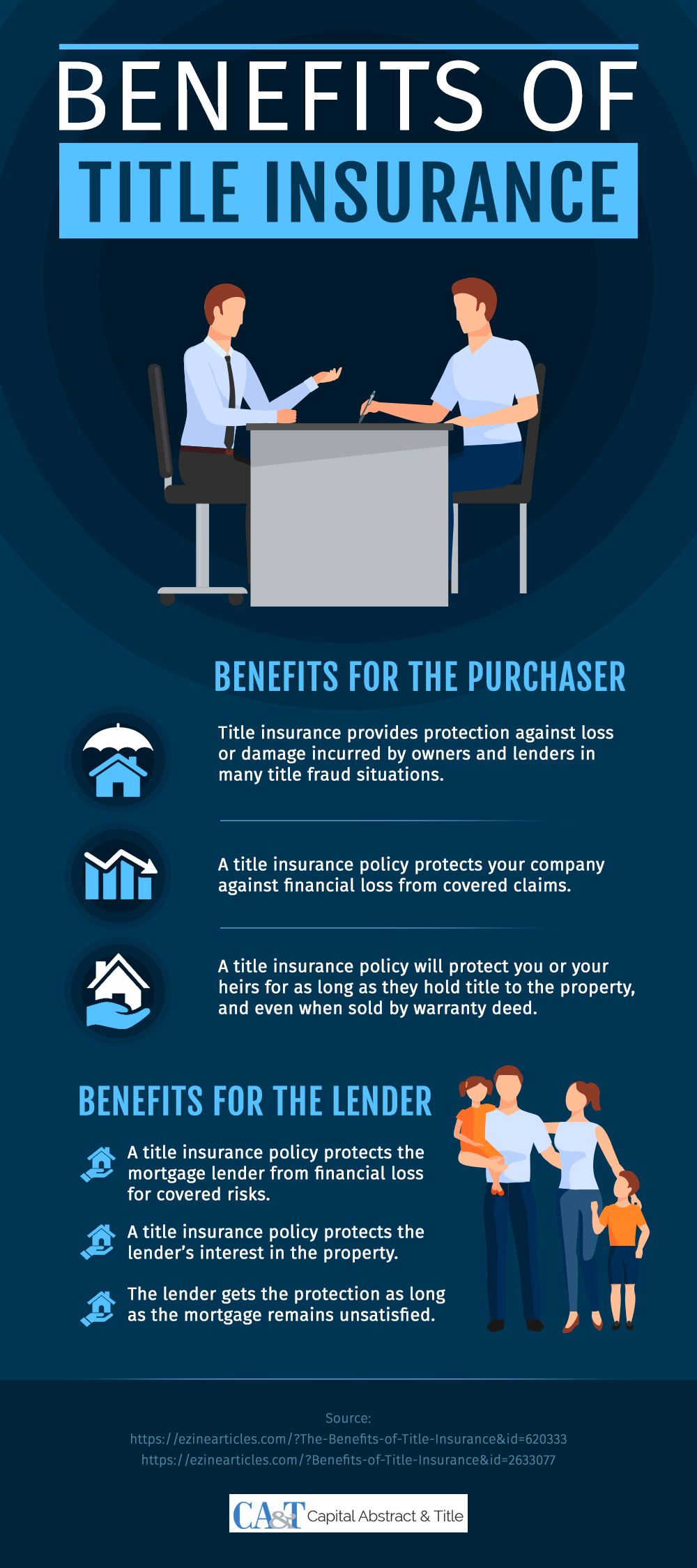

Why do you need title insurance?

In order to limit the risk of such a mistake, title insurance is available to protect a party from any damages incurred due to these errors. For instance, if a buyer purchases property and later on discovers that there is an issue with the property title, then the title insurance company will have to pay out any damages to the title holder or it will try to correct the problem.

What is a deed in real estate?

The “deed” is the actual written legal document that transfers the title rights. In other words, when a party wants to sell or transfer the title to their property, they have to create a deed in order to do so. The deed will be handed over to the buyer at the closing sale.

What to do if you have issues with title?

Also, if you experience any issues with the title after you have already acquired the property, a qualified real estate attorney can help you to defend against any attacks on the title to your property, or alternatively, hold the seller accountable for any damages you may be facing due to a mistake on their part.

What documents are reviewed in a title search?

In general, they will typically examine the following: All public and court records associated with the property; The chain of title;

What Is a Title Search?

A title search is an examination of public records to determine and confirm a property's legal ownership, and find out what claims or liens are on the property. A clean title is required for any real estate transaction to be completed.

What happens when you get a preliminary title report?

Once the search is finished, you will receive a preliminary title report. If there are any issues or problems with the title, you can point them out to the seller. Depending on the exact nature of the issue, you can then decide whether you want to go through with the purchase of the property.

What is a basic owner's title insurance policy?

A basic owner's basic title insurance policy typically covers the following hazards: Ownership by another party. Incorrect signatures on documents, as well as forgery and fraud concerning title documents. Defective recordation (flawed records or record-keeping)

Why do you need title insurance?

Title insurance can be purchased to protect against a financial loss that may occur if a title is found to have issues.

What is dirty title?

While a "clean" title proves sole ownership of a piece of property or land, a "dirty" title indicates that there is a cloud of uncertainty or discredit hanging over the property or land.

Who is James Chen?

James Chen, CMT is an expert trader, investment adviser, and global market strategist. He has authored books on technical analysis and foreign exchange trading published by John Wiley and Sons and served as a guest expert on CNBC, BloombergTV, Forbes, and Reuters among other financial media.

Can you miss a title search?

Even a company or professional experienced in conducting title searches can occasionally miss something, or there can be a paperwork error that leads to a document being overlooked. Mistakes can happen, and these mistakes can be costly if you later discover there’s an issue with the property once you have already completed the purchase. For this reason, buyers will often purchase title insurance which can protect you and your mortgage lender from financial loss if a problem with the title arises during or after the sale.

What is a house title search?

Firstly, a house title is the term used in real estate to describe an owner’s rights to a property. Before you buy a home, you’ll need to check that the owner is the only one who is claiming this title and they have the correct rights to sell it to you. Here’s where title searches come in.

How long does a title search take?

While a super simple deal, such as a house that isn’t very old, may take just a few hours, usually a title search will take between 10 and 14 days. The older the home, the more owners it has invariably had and the more transactions that have been done. Which means that the older the home, the longer the title search will take as the company or attorney will need to wade through more information.

What is a property title search and how is it done?

The property title search is generally done after an offer to purchase real estate has been accepted, says David Zawadzki, senior account executive at Proper Title. Multiple sources are searched, including deeds, county land records, tax liens on the federal or state level, divorce cases, bankruptcy court records, and other financial judgments against an owner that could potentially attach to a property.

When is a title search done?

A property title search is typically ordered during escrow when a lender financing a home purchase requests a preliminary report from a title company. However, a search can be done anytime, by anyone, such as a buyer (who might not need a lender’s money) or a homeowner who’s looking to refinance their home.

What happens if liens aren't discovered?

If liens or judgments aren’t discovered prior to closing, the buy er can face messy and expensive issues down the road.

What is a clean title search?

A clean property title search means the buyer—and lender—agree there are no claims on the property that could become an issue after ownership is transferred.

What is a title when buying a house?

When you buy or sell a home, a property title is essentially a fancy way of saying who has the right to own the property—and thus, to sell it . While it may seem straightforward that a home seller owns his house, there could be hidden claims or liens on the property the homeowners themselves may be unaware of, making a title search essential ...

What happens if a seller has a judgment against them?

For example, if the seller has a $10,000 judgment against them and the property was purchased without the judgment being paid off, it becomes the obligation of the new owner , says Jeffrey A. Hensel, broker associate at North Coast Financial in San Diego.

What is a defect on a title?

Defects could be someone else claiming title to the property, a claim that the seller never owned it or a wild deed (where someone buys the property but doesn’t officially record the title). Many properties have defects on a title. For buyers: Property title searches are a vital step in the home-buying process.

Who conducts a title search?

The buyer’s attorney or the real estate agent’s attorney typically conducts the title search. A title search generally involves reviewing public property records to ensure that there are no errors in the title to the property.

What is a Title Search?

A title search is conducted through public records. These public records are searched in order to find all documents that relate to the title.

What is the Title Insurance Process?

Prior to the buyer obtaining title insurance, the first step to purchasing a home is to ensure that the home or property is legally available to be sold and purchased. Title searches are currently conducted as part of a standard real estate transaction in order to help prevent any issues with the purchase.

What is a Defective Title?

Having a valid title to a property means that the owner has the exclusive legal right to own and use the piece of property. In order for a title to be valid, the title must be free of defects.

How do I Secure and Pay for a Title Insurance Policy?

A buyer typically does not conduct a title search or find title insurance. The attorney or real estate agent the individual hires should initiate the process.

Why Do I Need Title Insurance?

Title insurance protects the purchaser from potential property disputes. In general, a title search that is done thoroughly determines the current and past status of the real estate the buyer is attempting to purchase.

What is a superior claim to property?

A superior claim to ownership of the property by another individual or entity occur s in cases where a creditor, to whom an owner owes a money judgment, may have a superior claim to someone who is seeking to purchase the property. The creditor protects their interest in the property by filing a lien in the county land recording office. The potential seller must pay off, or satisfy, this lien, prior to a buyer being able to purchase the property.

What is the service of a buyer's attorney?

In addition to reviewing/negotiating the P&S, another important service a buyer’s attorney performs is to review the closing documents prepared by the closing attorney. Naturally, neither the lender nor the closing attorney’s office would purposefully prepare closing documents that are not accurate, but there is human error, and one can make an argument that a third party trained to represent the buyer’s interest is going to be more likely to catch an error in the closing documents when they are not the person who prepared those documents.

Who pays closing attorney?

The homebuyer pays the closing attorney as part of their closing costs. A buyer also is required to purchase lender’s title insurance, and owner’s title insurance is optional, but recommended. The closing attorney will typically receive a portion of the title insurance premium (for both the lender’s and owner’s policies) as their fee ...

How much does a closing attorney save?

If the closing attorney agrees to represent the homebuyer free of charge for reviewing the purchase and sale agreement and other items associated with buyer representation, the buyer can potentially save between $400 and $800.

What is a settlement agent in Massachusetts?

Most homebuyers that purchase a home in Massachusetts obtain a mortgage loan from a lender. The person/company that handles the closing (transfer of title) for the lender is known as the settlement agent. In Massachusetts, the practice of closing transactions for buyers and sellers when there is a home loan is considered the practice of law; therefore, the settlement agent for any real estate closing involving a lender must be conducted by a licensed attorney. That settlement agent is often called the “closing attorney.” If you're moving to Massachusetts, this part of the closing process may be different than the state you're moving from.

What is a closing attorney in Massachusetts?

That settlement agent is often called the “closing attorney.”. If you're moving to Massachusetts, this part of the closing process may be different than the state you're moving from. The legal fees for the closing attorney is one of several closing costs a homebuyer is responsible for paying at closing. That closing attorney represents the lender, ...

What is a note in a mortgage?

The note is a contract for the homebuyer/borrower to repay the loan based on the legal terms of the note. And the mortgage is a security instrument that a borrower gives to the lender allowing it to foreclose on the property, if the covenants and agreements in the note and mortgage are not met. The reason why a buyer has to pay for ...

What are the disadvantages of having a lender's attorney?

Disadvantages of having your lender’s attorney provide dual representation: 1. Different services. Closing attorneys provide a myriad of services before, during and after a closing. Among other duties, they review and certify title, review/prepare/record the deed, obtain and payoff existing mortgages, order and payoff municipal bills ...

Popular Posts:

- 1. how to re send a power of attorney

- 2. how to get your sister to be your power of attorney

- 3. how much does a rural assiatant district attorney make fresh out of law school

- 4. what is the difference between a prosecutor and a defense attorney

- 5. how to file for divorce witout an attorney

- 6. what is the max fee an ssdi attorney can charge

- 7. what is going on with attorney general and his testimony

- 8. who is the current defense attorney on the vanderbilt rape case

- 9. what kind of attorney do i need to transfer property to an llc

- 10. how to change address using power of attorney