A power of attorney (POA) is a written, legal document that authorizes one person to act on behalf of another. The person giving the power of attorney is called the principal and the person authorized to act on the principal's behalf is called the attorney-in-fact or agent.

Full Answer

What can a person with power of attorney do?

Power of Attorney. An important part of lifetime planning is the power of attorney. A power of attorney is accepted in all states, but the rules and requirements differ from state to state. A power of attorney gives one or more persons the power to act on your behalf as your agent. The power may be limited to a particular activity, such as closing the sale of your home, or be …

How do I find out who has power of attorney?

Sep 02, 2020 · A power of attorney, also known as a letter of attorney, is a legal document that you sign to authorize another person to act on your behalf. The person who is giving his or her power is known as the principal, the grantor or the donor. The person taking on the power is known as the agent or the attorney-in-fact.

Who can create a power of attorney?

What Does a Power of Attorney Do? The person you appoint as your Power of Attorney is known as a fiduciary – someone who is responsible for managing the affairs of another. Depending on the type of POA that’s in effect, the powers your agent can exercise could have a …

What is power of attorney and how does it work?

A power of attorney is a legal document giving a person (known as the agent or attorney-in-fact) broad powers to manage matters on behalf of another person (known as the principal).

What is a power of attorney?

A power of attorney is a legal document giving a person (known as the agent or attorney-in-fact) broad powers to manage matters on behalf of anothe...

Are there different types of power of attorney documents?

Yes. A power of attorney can be durable or non-durable. A durable power of attorney remains effective after the principal becomes incapacitated whi...

What are the most common reasons for needing a power of attorney?

Executing a power of attorney document may be helpful in a variety of ways. The power of attorney can permit an agent to act on the principal’s beh...

Is a person being a co-owner the same as that person having power of attorney?

In a joint account ownership situation,. any co-owner has full access to the account, including the ability to make withdrawals and pay bills. If o...

Is a person being a trusted contact the same as that person having power of attorney?

No. A trusted contact is an individual age 18 or older who is identified by you as someone we’re able to contact about your account for any of the...

I’m a trustee on a trust account. Can I use a power of attorney to name an agent to act on the trust...

A delegation of a trustee’s power may be subject to state laws and limitations in the trust agreement. Consult with your legal advisor to determine...

Is an account with an agent appointed in a power of attorney the same thing as an account with one o...

No. Sometimes referred to as a Totten trust or an in trust for (ITF) account, a payable on death (POD) account is an account ownership type in whic...

Does an agent have the same authority as a POD (payable on death) beneficiary?

No. Once a power of attorney document is executed and accepted by the bank and the agent is added to the account, the agent is authorized to act on...

What is the power of attorney in fact?

Generally, the law of the state in which you reside at the time you sign a power of attorney will govern the powers and actions of your agent under that document.

Why do you need a power of attorney?

Another important reason to use power of attorney is to prepare for situations when you may not be able to act on your own behalf due to absence or incapacity. Such a disability may be temporary, for example, due to travel, accident, or illness, or it may be permanent.

What to do if you are called upon to take action as someone's agent?

If you are ever called upon to take action as someone’s agent, you should consult with an attorney about actions you can and cannot take and whether there are any precautionary steps you should take to minimize the likelihood of someone challenging your actions.

How long does a power of attorney last?

Today, most states permit a "durable" power of attorney that remains valid once signed until you die or revoke the document.

Why is a power of attorney important?

A power of attorney allows you to choose who will act for you and defines his or her authority and its limits, if any.

What are the qualifications to be an attorney in fact?

There are no special qualifications necessary for someone to act as an attorney-in-fact except that the person must not be a minor or otherwise incapacitated. The best choice is someone you trust. Integrity, not financial acumen, is often the most important trait of a potential agent.

What is a springing power of attorney?

The power may take effect immediately, or only upon the occurrence of a future event, usually a determination that you are unable to act for yourself due to mental or physical disability. The latter is called a "springing" power of attorney.

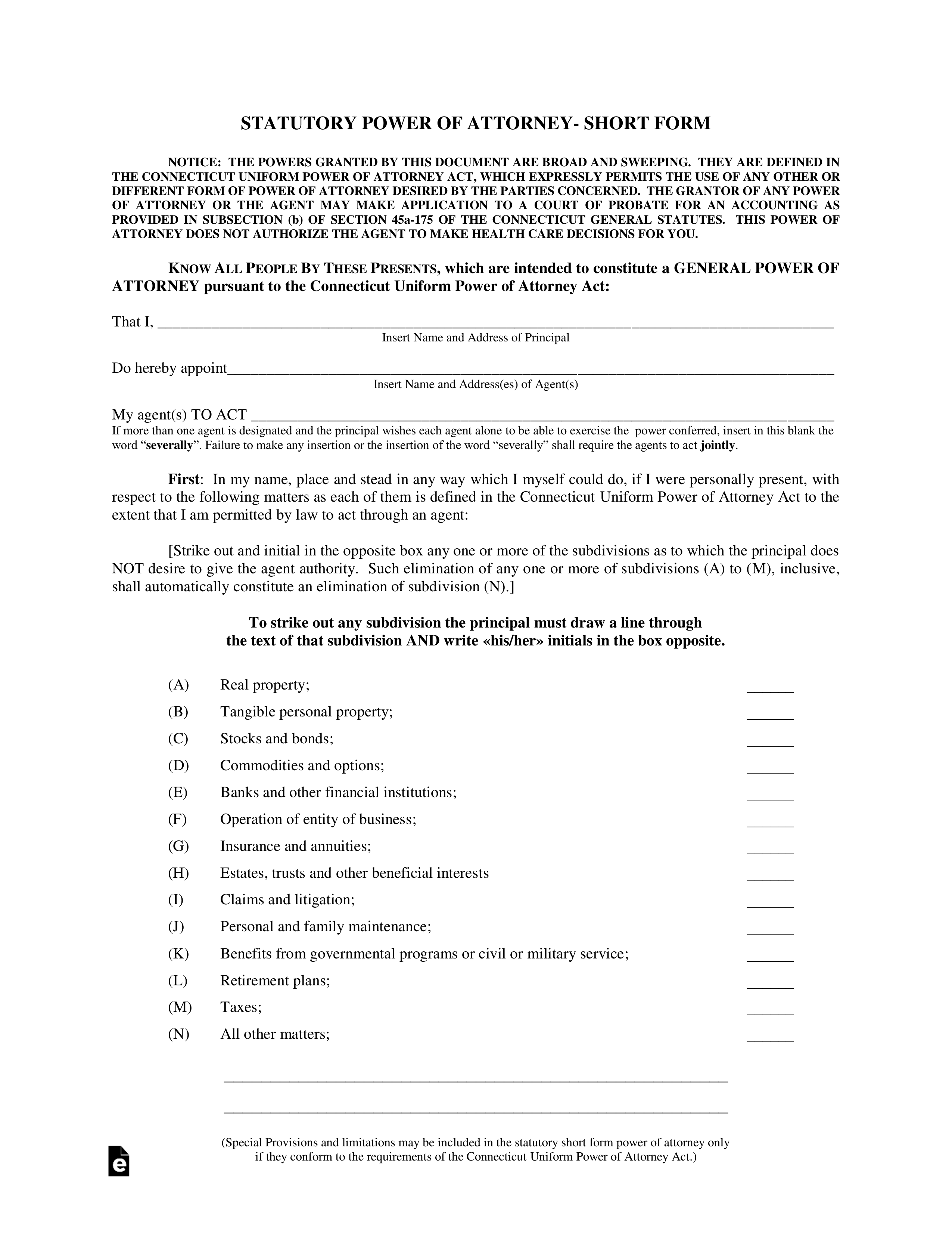

What is a general power of attorney?

General power of attorney can also include insurance decisions and investment decisions, including those regarding your 401(k)or IRA. Special power of attorney: This gives specific authority to the agent.

What are the responsibilities of a POA?

They can handle business transactions, settle claims or operate your business.

How does a POA work?

The key to making a POA work is finding the right agent to make decisions on your behalf. Your choice may depend on which type of POA you are signing. For a POA related to business, for example, you probably want to find someone with business experience. For legal matters, an attorney may make sense.

How to create a POA?

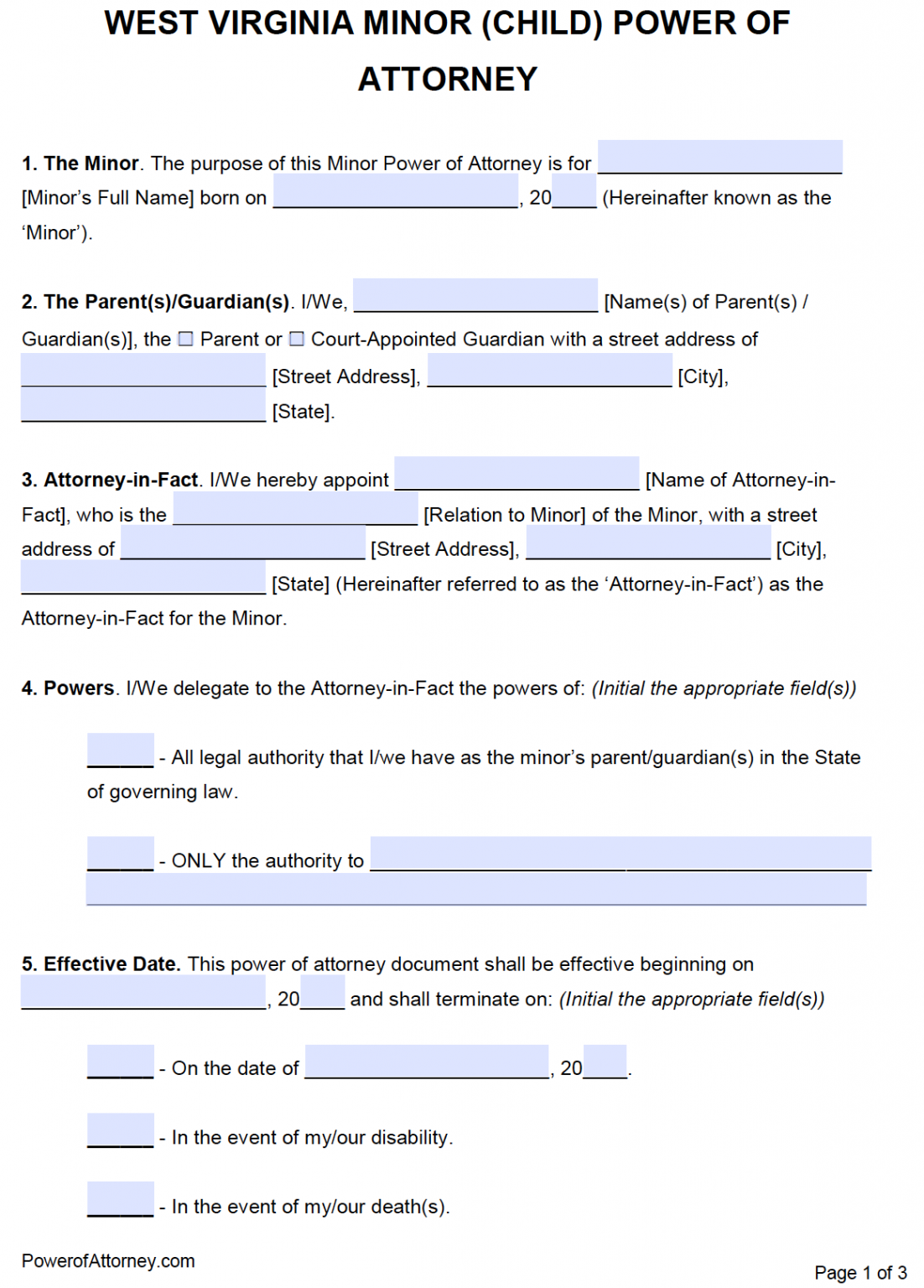

Creating your own POA is not difficult. Here are the steps you’ll need to take: Determine which type you need and choose your agent , which we discuss in more detail below. Buy or download the proper form. The form will depend on the state you are in, so make sure you are getting the correct one.

Who is the person who gives power?

The person who is giving his or her power is known as the principal, the grantor or the donor. The person taking on the power is known as the agent or the attorney-in-fact. The grantor can choose which rights to give the agent.

Can you invoke a POA after death?

It can never be invoked after your death. You can limit the power in scope or to a certain timeframe or event (such as your becoming incapacitated). You can also revoke it. Whether you’re planning your estateor simply planning ahead, here’s what you need to know when giving or assuming POA.

Is a power of attorney a legal document?

The Bottom Line. A power of attorney is a legal document that passes a person’s decision-making power to another person, known as an agent.

What is a financial power of attorney?

A Financial Power of Attorney designates an agent the authority to make financial decisions and act on your behalf should you not be able to. This type of POA can be broad or very specific. It’s another title for General POA, and could typically grant all the same actions listed above.

How to make a power of attorney legally binding?

4. Make Your Power Of Attorney Legally Binding. In order to be legally binding, your POA must be signed and notarized. You should certify multiple copies so your POA can readily act if the time comes. Almost any decision or transaction a POA will make on your behalf will require a certified copy of the legal POA.

What is the difference between a health POA and a financial POA?

The difference between a Health and a Financial POA is exactly what you think. Health POAs allow you to appoint an agent to act on your behalf regarding health-related matters. A Financial POA does this for all other financial-related issues in your life.

What is a POA?

A Power of Attorney (POA) is an incredibly important piece of your Estate Planning efforts. Your POA allows you to appoint another person, known as an “agent,” to act in your place. An agent can step in to make financial, medical or other major life decisions should you become incapacitated and no longer able to do so.

When does a POA end?

A General POA: General POAs end as soon as you are incapacitated. While this tool is great for many things in life, it is not a solid option for end-of-life decisions. A Durable POA: A durable POA stays in effect until you pass away or revoke its power.

What is a fiduciary POA?

The person you appoint as your Power of Attorney is known as a fiduciary – someone who is responsible for managing the affairs of another. Depending on the type of POA that’s in effect, the powers your agent can exercise could have a wide range of authority. At the most basic level, your POA will act on your behalf if you become unable to do so ...

When was the Uniform Power of Attorney Act created?

The Uniform Power of Attorney Act (UPOAA) was created by the Uniform Law Commission in 2006 to establish universal rules for POAs across the states. The law states what powers are included by default, versus which need to be stated outright.

What happens to a power of attorney when you die?

They cease at death. A power of attorney loses all authority at the moment of death.

Why is it important to appoint someone?

It is important that you have no doubt in the ability of that person to perform honorably in any areas for which you give them authority.

What to do if you do not believe a will is in keeping with your wishes?

If you do not believe that the document is in keeping with your wishes, then you should certainly consult with an attorney about how to get the document changed to reflect those wishes. They do not “trump” a will.

Why do parents want to appoint their children?

They do this because they want to be fair to all of them and don’t want anyone to feel slighted. While these are valid reasons, it can create issues down the road.

Can a power of attorney be amended?

A power of attorney is always able to be revoked or amended. As long as you have the capacity to make appropriate legal decisions on your own behalf, then you have the right to make changes to your power of attorney document. If you do not believe that the document is in keeping with your wishes, then you should certainly consult ...

Can you put toothpaste back in the tube?

You can’t put the toothpaste back in the tube. If it is discovered that your power of attorney abused that position and has taken money from you, it can be difficult to recover all of the property. It is like putting toothpaste back into the tube at times.

Does a power of attorney remove the power to act?

A power of attorney does not remove your power to act, it just authorizes someone else to also act under the limitations that you have placed. It is not the same as a conservatorship, where a court removes your power to act and places that power in the hands of another. They are fully revocable.

What is a power of attorney?

A power of attorney is a legal document giving a person (known as the agent) broad powers to manage matters on behalf of another person (known as the principal). Under certain circumstances, Bank of America allows agents to be added to the principal's accounts ...

What happens if one of your co-owners passes away?

If one co-owner passes away, the other co-owner owns all funds in the account. With a power of attorney, the ways in which the individual can conduct transactions can be specific and limited. See what's needed to add a co-owner to your account. See what's needed to add a co-owner to your account.

What does it mean to confirm your health status?

To confirm your health status. To confirm the identity of any legal guardian, executor, trustee or holder of a power of attorney. It's important to know that designating someone as a trusted contact does not give that person the authority to gather information or conduct account transactions on your behalf.

Can a trustee be delegated?

A delegation of a trustee's power may be subject to state laws and limitations in the trust agreement. Consult with your legal advisor to determine any legal requirements (in the law or in the trust agreement) and the appropriate language for including a delegation of a trustee's power in a power of attorney.

Can a bank review a power of attorney?

The power of attorney and ID documents will be reviewed by the bank. Due to the complexities of power of attorney documents, multiple reviews may be required. As a result, the review process may require more than one visit to the financial center if further documentation is required.

Popular Posts:

- 1. what is the job of the missouri state attorney general

- 2. how many illinois attorney general are there

- 3. how to network with cpa as an attorney

- 4. what is the most recent version of amicus attorney software

- 5. attorney monge and associates tv commercial about why we are accepting of bad aervice

- 6. how to renew federal attorney reg no

- 7. when is the kansas attorney general up for election?

- 8. how to question a power of attorney

- 9. why need an attorney for a will

- 10. how to enforce an attorney fee award