What is a power of attorney in Arkansas?

Nov 20, 2018 · Powers of Attorney under Arkansas Law . Warning: A Power of Attorney is a very important document. In accordance with Army Regulation27-3, any person requesting a General Power of Attorney for use by someone who is not a trusted spouse or relative should be cautioned as to the serious legal problems that may arise from its misuse.

Does a power of attorney have to do what you tell them?

Apr 26, 2018 · Under Arkansas law, a power of attorney created under this chapter is durable unless it expressly provides that it is terminated by the incapacity of the principal. See Ark. Code Ann. § 28-68-104. Who can override a power of attorney? You, as long as you have capacity. The power of attorney is your agent.

Who can accept a notarized power of attorney (POA)?

Witnessing the attorney's signature on a power of attorney. Here are the rules on who can witness a lasting power of attorney this time: The witness must be over 18. The same witness can watch all attorneys and replacements sign. Attorneys and replacements can all witness each other signing. ⇗.

Can a power of attorney make decisions without my consent?

What is a power of attorney?

The power of attorney has to act for your benefit and in your best interests. They have to act within the authority granted in the POA, so the language and powers granted to your agent in the document are very important.

What is POA in Arkansas?

A governmental agency overseeing the principal; The principal’s caregiver or someone else that demonstrates a sufficient interest in the principal’s welfare; A person that is asked to accept a POA (who you are trying to use the POA on – a bank, insurance company, etc.) See Ark. Code Ann. § 28-65-116.

When does a POA end?

A POA can end for several reasons. The first is that you put an end date on the power of attorney. Such as “This power of attorney is valid until January 1, 2045.”. On January 2, 2045, that power of attorney is no longer valid. If a power of attorney is not durable it will end when you lose capacity. If the power of attorney was for ...

What happens when a family member fights over POA?

When family members are fighting over POA, one of them might eventually file for guardianship. If a court appoints a guardian, this will typically override the POA and the guardian will take control of the person’s assets.

Can you revoke a POA?

You are the principal of the POA and can revoke most powers of attorneys whenever you want – as long as you still have capacity. You can also revoke a POA by signing a new one. This only works if the new one states “all previously executed power of attorneys are hereby revoked.”.

What happens if you have a durable power of attorney?

So, if you have a durable power of attorney and become incapacitated, it stays in effect. If it is not durable and you become incapacitated, it ends.

What happens if a bank accepts a POA?

That means if a one is fake, but the bank doesn’t know, they can’t get in trouble for allowing the fake power of attorney to use the principal’s funds.

Is a power of attorney durable in Arkansas?

A durable power of attorney in Arkansas will remain in effect even if the person with the power of attorney becomes incapable of normal functioning. If the principal becomes incapacitated, other types of power of attorney will not be in effect. A power of attorney is durable unless stated otherwise on the initial power of attorney form in Arkansas.

What is a minor power of attorney?

If you have children under 18, a minor power of attorney allows you to select someone you trust to care for and make decisions for your children. You can determine how long the power of attorney will last, which can help if people are unable to reach you for some time.

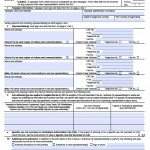

Durable Power of Attorney Arkansas Form – Fillable PDF

The Arkansas durable statutory power of attorney form allows for a person to let someone else take care of all financial related responsibilities. The “durable” functionality allows a person to still be able to make monetary transactions even if the principal should fall into a state of mental incapacity.

General Power of Attorney Arkansas Form – PDF Template

The Arkansas general power of attorney form can be used to grant the full rights to an attorney-in-fact (also known as the agent) to handle the finances of the principal. By executing the document, the signatory will enable the chosen representative to carry out the responsibilities defined therein.

Guardianship Over a Minor Child Power of Attorney – Arkansas – PDF Template

The Arkansas guardianship over a minor child power of attorney can be used by the parents of minor children to select a family member or close friend to act as the guardian. Arkansas law does not specify a limit on the term of validity for this type of arrangement.

Limited Power of Attorney Arkansas Form – Adobe PDF

The Arkansas limited power of attorney permits someone to choose another to take care of a specific financial act or obligation on his or her behalf. The action can be anything from cashing a check to purchasing real estate. Most limited power of attorney documents becomes void after completion of the act or after a fixed time period.

Medical Power of Attorney Arkansas Form – Adobe PDF

The Arkansas medical power of attorney allows a principal’s wishes to be carried out by another person (the “agent”) with regard to their end of life health care.

Real Estate Power of Attorney Arkansas Form – PDF – Word

The Arkansas real estate power of attorney is a legal document used to grant specific powers to an authorized representative. This type of power of attorney limits the attorney-in-fact in that they can only manage tasks relating to the principal’s real estate, such as buying and selling, leasing, investing, deeds, and general managerial duties.

Tax Power of Attorney Arkansas Form – Fillable PDF

The Arkansas tax power of attorney form is a state-issued document that can be used to provide a tax attorney with the legal authority to represent a taxpayer in the filing of their income tax return. The agent will have access to confidential tax information and the authority to perform any act relayed in the power of attorney document.

Popular Posts:

- 1. uninsured motorist coverage when in accident attorney

- 2. respondent attorney quashing the subpoena what to do califonria

- 3. what power does congress have over the attorney general

- 4. what ethical rules are you breaking if the attorney speaks to the opposing team

- 5. minnesota attorney client privilege which state's law aplies

- 6. how much is attorney closing fees

- 7. what attorney representing daycare if child was injured

- 8. how to get the special power of attorney to claim the inheritance?

- 9. what other positions can a licensed attorney get

- 10. how to stop a durable power of attorney