Who should you choose to be your power of attorney?

Your first step, if you want to establish a power of attorney, will be to select someone you trust to handle your affairs if and when you can’t. Whoever you select as your agent must be a person you trust with your life, because that is exactly what you will be doing. You can’t be too careful. Choose someone who is qualified for the task.

Who should I nominate as power of attorney?

You should consider the following categories of people when deciding who to appoint:

- Family members.

- Friends.

- Professional advisors such as your solicitor or accountant. This category is generally only appropriate for LPAs for financial decisions.

How do you become a power of attorney?

Hartsfield

- An LPA gives you back control An LPA allows you to appoint an attorney to make important decisions on your behalf if you are no longer able to. ...

- Decisions can be made quickly on your behalf without unnecessary delays or additional costs The unexpected can strike at any moment. ...

- You’ll have peace of mind

Who can serve as my power of attorney?

In a power of attorney, you name someone as your attorney-in-fact (or agent) to make financial decisions for you. The power gives your agent control over any assets held in your name alone. If a bank account is owned in your name alone, your attorney-in-fact will have access to it.

Who is the best person to give power of attorney?

Most people select their spouse, a relative, or a close friend to be their power of attorney. But you can name anyone you want: Remember that selecting a power of attorney is not about choosing the person closest to you, but rather the one who can represent your wishes the best.

Who can be given power of attorney in India?

'Power Of Attorney' is an authority given by an instrument by one person, called as the donor or principal, authorising another person, called donee or agent to act on his behalf. There may be possibility of giving 'Power Of Attorney' by two or more persons jointly to one or more persons.

What is the person called who has power of attorney?

agentThe person named in a power of attorney to act on your behalf is commonly referred to as your "agent" or "attorney-in-fact." With a valid power of attorney, your agent can take any action permitted in the document. Often your agent must present the actual document to invoke the power.

How much does it cost to get a power of attorney in Ontario?

$100 to $300 per documentThe legal fees of a power of attorney in Ontario are usually calculated based on the document you want to authorize to a lawyer. The price can range anywhere from $100 to $300 per document.

Can I give power of attorney to a friend?

Things to remember when you give power of attorney to the person. Power of Attorney (POA) is all about giving the right to act on your behalf to a trusted friend or family member. A Power of Attorney allows the holder of the POA to take clearly defined actions and decisions on behalf of the donor in this case.

Can I do power of attorney myself?

If you're aged 18 or older and have the mental ability to make financial, property and medical decisions for yourself, you can arrange for someone else to make these decisions for you in the future. This legal authority is called "lasting power of attorney".

Can two siblings have power of attorney?

Generally speaking, while it is good to include your spouse or siblings, consider the fact that they may not be around or have the inclination to sort out your wishes when the time comes. If possible, include two attorneys as standard and a third as a back-up should one of the attorneys not be able to act.

Does next of kin override power of attorney?

No. If you have made a Will, your executor(s) will be responsible for arranging your affairs according to your wishes. Your executor may appoint another person to act on their behalf.

What are the 3 power of attorney?

Generally speaking, there are three main types of POA: Ordinary power of attorney. Lasting power of attorney. Enduring power of attorney.

Do I need a lawyer for power of attorney in Canada?

A power of attorney is a legal document that you sign to give one person, or more than one person, the authority to manage your money and property on your behalf. In most of Canada, the person you appoint is called an “attorney.” That person does not need to be a lawyer.

Can I write my own POA in Ontario?

You can make a power of attorney document yourself for free or have a lawyer do it.

What three decisions Cannot be made by a legal power of attorney?

Are there any decisions I could not give an attorney power to decide? You cannot give an attorney the power to: act in a way or make a decision that you cannot normally do yourself – for example, anything outside the law. consent to a deprivation of liberty being imposed on you, without a court order.

What is the power of attorney in fact?

Generally, the law of the state in which you reside at the time you sign a power of attorney will govern the powers and actions of your agent under that document.

Why do you need a power of attorney?

Another important reason to use power of attorney is to prepare for situations when you may not be able to act on your own behalf due to absence or incapacity. Such a disability may be temporary, for example, due to travel, accident, or illness, or it may be permanent.

Who Should Be Your Agent?

You may wish to choose a family member to act on your behalf. Many people name their spouses or one or more children. In naming more than one person to act as agent at the same time, be alert to the possibility that all may not be available to act when needed, or they may not agree. The designation of co-agents should indicate whether you wish to have the majority act in the absence of full availability and agreement. Regardless of whether you name co-agents, you should always name one or more successor agents to address the possibility that the person you name as agent may be unavailable or unable to act when the time comes.

How The Agent Should Sign?

Catherine, as agent, must sign as follows: Michael Douglas, by Catherine Zeta-Jones under POA or Catherine Zeta-Jones, attorney-in-fact for Michael Douglas. If you are ever called upon to take action as someone’s agent, you should consult with an attorney about actions you can and cannot take and whether there are any precautionary steps you should take to minimize the likelihood of someone challenging your actions. This is especially important if you take actions that directly or indirectly benefit you personally.

What Kinds of Powers Should I Give My Agent?

In addition to managing your day-to-day financial affairs, your attorney-in-fact can take steps to implement your estate plan. Although an agent cannot revise your will on your behalf, some jurisdictions permit an attorney-in-fact to create or amend trusts for you during your lifetime, or to transfer your assets to trusts you created. Even without amending your will or creating trusts, an agent can affect the outcome of how your assets are distributed by changing the ownership (title) to assets. It is prudent to include in the power of attorney a clear statement of whether you wish your agent to have these powers.

What to do if you are called upon to take action as someone's agent?

If you are ever called upon to take action as someone’s agent, you should consult with an attorney about actions you can and cannot take and whether there are any precautionary steps you should take to minimize the likelihood of someone challenging your actions.

How long does a power of attorney last?

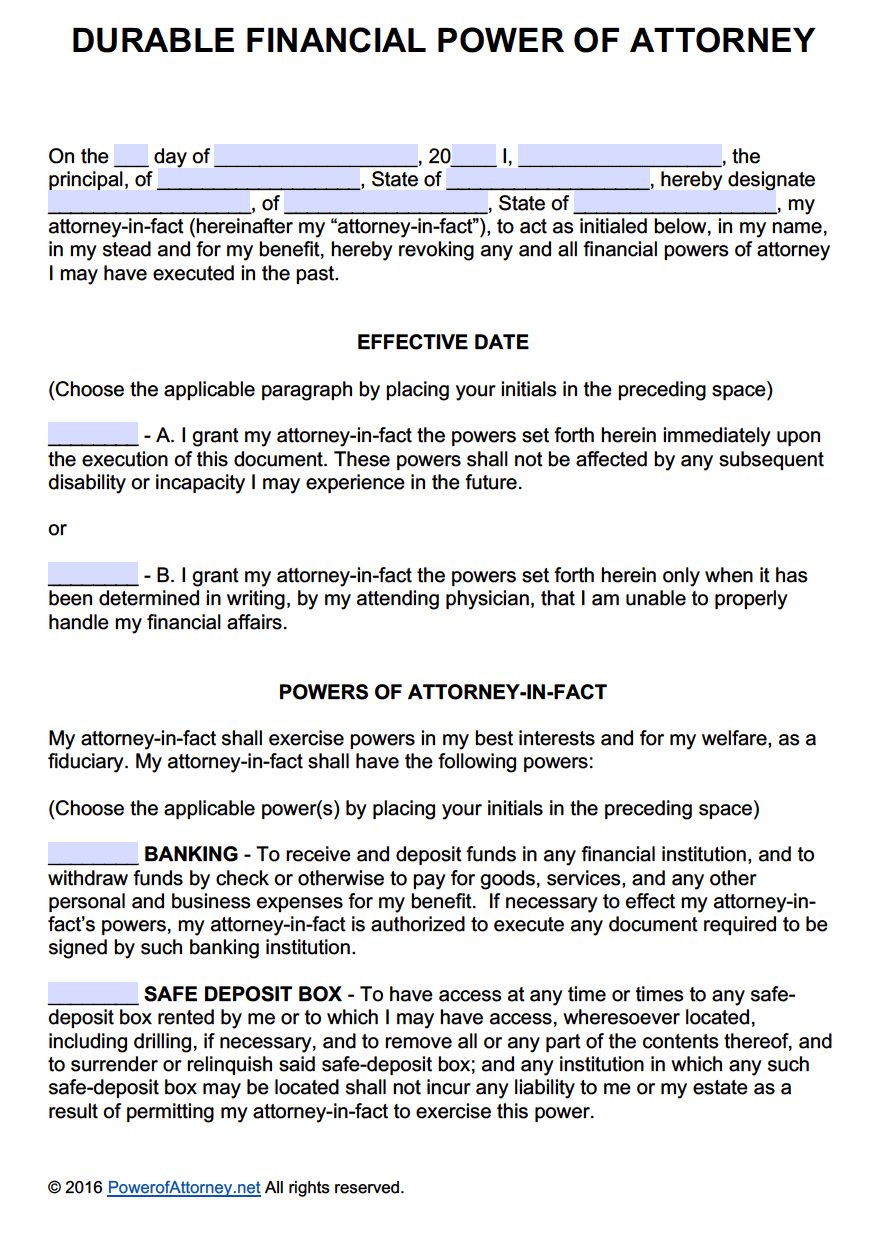

Today, most states permit a "durable" power of attorney that remains valid once signed until you die or revoke the document.

What Does a Power of Attorney Do?

The POA gives the attorney in fact (also known as the agent) the power to make decisions about your affairs. The type of POA you create dictates which affairs you are granting power over.

Why is a power of attorney important?

Power of attorney is essential in the event that you're incapacitated or not physically present to make decisions on your own behalf. Learn more in our in-depth guide.

What is a power of attorney for health care?

A health care power of attorney grants your agent authority to make medical decisions for you if you are unconscious, mentally incompetent, or otherwise unable to make decisions on your own. While not the same thing as a living will, many states allow you to include your preference about being kept on life support.

What to do if your power of attorney is not able to determine mental competency?

If you think your mental capability may be questioned, have a doctor verify it in writing. If your power of attorney doesn't specify requirements for determining mental competency, your agent will still need a written doctor's confirmation of your incompetence in order to do business on your behalf. A court may even be required to decide the ...

When do POAs take effect?

Some POAs take effect immediately after they're signed, and others only kick in after you're incapacitated.

What is the best way to choose a power of attorney?

Trust is a key factor when choosing an agent for your power of attorney. Whether the agent selected is a friend, relative, organization, or attorney, you need someone who will look out for your best interests, respect your wishes, and won't abuse the powers granted to him or her. It is important for an agent to keep accurate records ...

Is a power of attorney binding?

No power of attorney document is legally binding before it's signed and executed according to the laws of your state. This means that no agent can make decisions on your behalf before the POA document goes into effect. You must also be of sound mind when you appoint an agent. You can view more about the creation of a power of attorney in the infographic below.

What is a power of attorney?

A power of attorney is one of the most commonly used legal agreements, particularly in the area of estate planning. Whether you are considering executing a power of attorney and appointing someone as your Agent, or you have been asked to act as an Agent under a power of attorney executed by someone else, you should understand the role of an Agent as well as know who can act as an Agent under a power of attorney.

How to contact a power of attorney in New York?

If you have additional questions or concerns about creating or using a power of attorney in New York, contact the experienced New York estate planning attorneys at The Law Offices of Kobrick & Moccia by calling 800-295-1917 to schedule your appointment.

What is a POA agreement?

What these things have in common is that the law says only you have the legal authority to accomplish them. You can, however, give someone else your legal authority by granting that person your “power of attorney” or POA. A POA agreement is an agreement made by a Principal that gives an Agent the legal authority to act on behalf of the Principal.

Why do you need a power of attorney?

Choosing someone to hold your power of attorney and specifying that it will operate even if you lose capacity ensures that you have a plan in place for administering your financial and personal affairs if you are ever unable to do so.

Why do you need an attorney to draw up a POA?

Using an attorney to draw up the POA will help ensure that it conforms with state requirements. Since a POA may be questioned if an agent needs to invoke it with a bank or financial services company, you should ask an attorney about prior experience in drafting such powers. You want to select someone not only familiar with state requirements, but also with the issues that can arise when a power is invoked. This way, the attorney can use language that will make clear the full extent of the responsibilities that you wish to convey.

Who Should Be Your Attorney-in-Fact?

The person you choose as your agent must be someone you trust without hesitation. Depending on how you've worded your POA, the person you select will have access to and be able to make decisions about your health, home, business affairs, personal property, and financial accounts.

How long does a durable POA last?

A durable POA begins when it is signed but stays in effect for a lifetime unless you initiate the cancellation. Words in the document should specify that your agent's power should stay in effect even if you become incapacitated. Durable POAs are popular because the agent can manage affairs easily and inexpensively.

How does a POA work?

How a Power of Attorney (POA) Works. Certain circumstances may trigger the desire for a power of attorney (POA) for someone over the age of 18. For example, someone in the military might create a POA before deploying overseas so that another person can act on their behalf should they become incapacitated.

What is a POA in 2021?

A power of attorney (POA) is a legal document in which the principal (you) designates another person (called the agent or attorney-in-fact) to act on your behalf. The document authorizes the agent to make either a limited or broader set of decisions. The term "power of attorney" can also refer to the individual designated ...

How to get a POA?

How to Get a Power of Attorney (POA) The first thing to do if you want a power of attorney is to select someone you trust to handle your affairs if and when you cannot. Then you must decide what the agent can do on your behalf, and in what circumstances. For example, you could establish a POA that only happens when you are no longer capable ...

What is an enduring power of attorney?

The enduring power of attorney agreement gives the appointed attorney the abilities of a power of attorney in the case that the person becomes incapable of doing so. If the person never becomes mentally incapable, the power of attorney agreement essentially does nothing.

What is a POA?

As people get older, it is generally recommended that they appoint a power of attorney (POA). Without fully understanding the extent of the duties and responsibilities, people often accept the role, intending to be as helpful as possible during difficult times in their loved one’s life. Generally speaking, the power of attorney is responsible for making financial and legal decisions on the person’s behalf, in the case where they become incapable of doing so themselves. Usually, the attorney can make any financial or legal decision the person could have made themselves. Before accepting the role of the Power of Attorney, it is important to understand the role (what you might be expected to do) and the rights you have available to you as the person’s attorney.

Can a power of attorney make a will?

The power of attorney is sometimes in a position where they must do a lot of the estate planning for the incapable person and often times this means gift giving before their death. It’s important to understand that a power of attorney does not have any authority to make a will or change an existing will on the incapable person’s behalf, though the attorney can handle some estate related financial tasks.

Can an adult invest in power of attorney?

Unless the enduring power of attorney states otherwise, invest the adult’s property only in accordance with the Trustee Act;

Is it hard to have a power of attorney?

In the end, the role of a power of attorney can be a difficult task at times. It can be stressful managing one’s own financial and legal affairs, let alone a second person’s. If you are unclear of the role/responsibilities of a power of attorney, contact an experienced estate lawyer today. We can help ensure that you are properly prepared to take on the position as a person’s power of attorney.

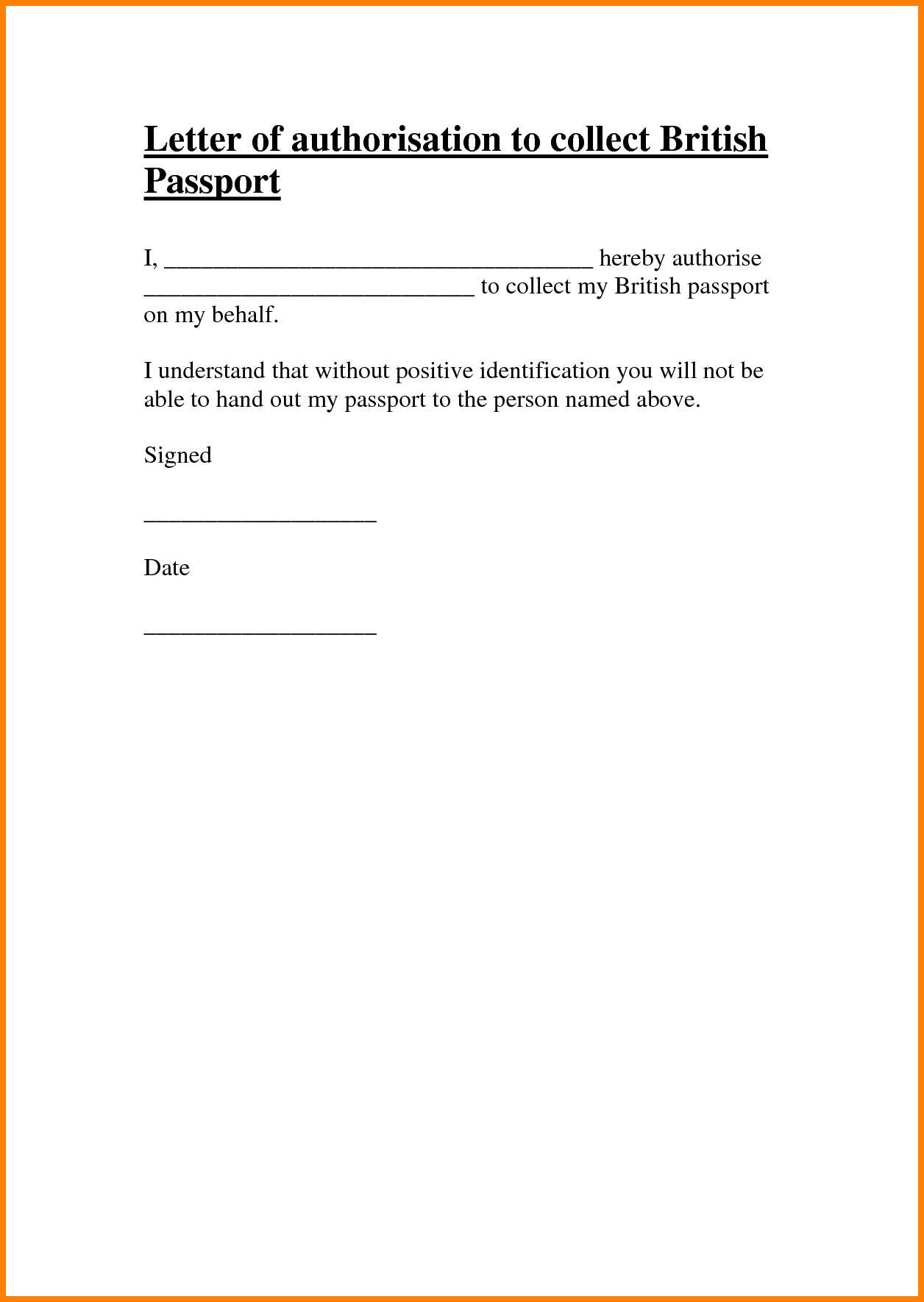

Can an attorney resign as a power of attorney?

In some cases, the attorney no longer wishes to continue in this position as the person’s attorney. At any time, the attorney is able to resign as the power of attorney and relieve themselves of all the duties of the power of attorney. To do so, a letter of resignation must be given to the person and any other people acting as a power of attorney.

What happens to a power of attorney when you die?

They cease at death. A power of attorney loses all authority at the moment of death.

Why is it important to appoint someone?

It is important that you have no doubt in the ability of that person to perform honorably in any areas for which you give them authority.

Why do parents want to appoint their children?

They do this because they want to be fair to all of them and don’t want anyone to feel slighted. While these are valid reasons, it can create issues down the road.

Can a power of attorney be amended?

A power of attorney is always able to be revoked or amended. As long as you have the capacity to make appropriate legal decisions on your own behalf, then you have the right to make changes to your power of attorney document. If you do not believe that the document is in keeping with your wishes, then you should certainly consult ...

Does a power of attorney remove the power to act?

A power of attorney does not remove your power to act, it just authorizes someone else to also act under the limitations that you have placed. It is not the same as a conservatorship, where a court removes your power to act and places that power in the hands of another. They are fully revocable.

Can you get yourself in trouble with a power of attorney?

At times, it is very easy to unintentionally get yourself in trouble through the use of a power of attorney. The guiding north star for any agent should always be to act solely in the best interests of the person who granted the power of attorney. You cannot use the power of attorney to provide any benefit to yourself.

Is a power of attorney valid if you are incapacitated?

There are powers of attorney that are limited in time. There are also powers of attorney that are no longer valid if you become incapacitated.

Who will forward a copy of a power of attorney?

Upon request of a party in interest, a Center Director or port director having on file an original power of attorney document (which is not limited to transactions in a specific Customs location) will forward a certified copy of the document to another Center director or port director.

How long can a power of attorney last?

Powers of attorney issued by a partnership shall be limited to a period not to exceed 2 years from the date of execution. All other powers of attorney may be granted for an unlimited period.

Can a power of attorney be accepted by a nonresident principal?

A power of attorney executed by a nonresident principal shall not be accepted unless the agent designated thereby is a resident and is authorized to accept service of process against such nonresident.

Who can execute a power of attorney for the transaction of Customs business incident to the trusteeship?

A trustee may execute a power of attorney for the transaction of Customs business incident to the trusteeship.

Can a power of attorney be revoked at any time?

Any power of attorney shall be subject to revocation at any time by written notice given to and received by CBP, either at the port of entry or electronically.

Do customhouse brokers need a power of attorney?

Before transacting Customs business in the name of his principal, a customhouse broker is required to obtain a valid power of attorney to do so. He is not required to file the power of attorney with CBP. Customhouse brokers shall retain powers of attorney with their books and papers, and make them available to representatives of the Department of the Treasury as provided in subpart C of part 111 of this chapter.

What is the purpose of a power of attorney?

Purpose. A power of attorney is designed to grant either specific or general rights to an agent, so she can act on behalf of the principal. The power of attorney duplicates some or all of the principle's rights.

How does a power of attorney terminate?

Termination. A power of attorney may be terminated in many ways. The most common method is the principal terminating the agent's powers, an option open to a principal at any time. A power of attorney may also terminate automatically if the principal either dies or is mentally incapacitated.

Can a principal be an agent?

No general limitations exist on who can serve as an agent for a principal. There is no requirement or qualifications other than being chosen by the principal, and the agreement of the agent to act for that purpose. For instance, criminal records and legal training are irrelevant as to whether someone is qualified to act as an agent.

Is a power of attorney available online?

Power of attorney documents are very common and easily accessible. Forms are available online, and are available free or for a fee if you require extra assistance.

Can a power of attorney be separate from a power of attorney?

A medical or financial power of attorney should always be done separately from any other power of attorney documents. This allows for clear instructions as to management of the principal's finances, health and other assets free from of entanglement and confusion.

Popular Posts:

- 1. what is the best immigration attorney in canada for inadmissibility

- 2. at what age can you be represented by an attorney tx

- 3. how to sue someone without an attorney

- 4. how to sell real estate for an elderly person with dementia and no power of attorney

- 5. when do you get court appointed attorney

- 6. attorney in philadelphia pa who attended columbia university school of law

- 7. why does a defendant have rights to an attorney

- 8. how to revoke a previous power of attorney

- 9. what is power of attorney over a car

- 10. how to undo power of attorney fraud