Who is entitled to a court appointed lawyer?

Assume Michael Douglas appoints his wife, Catherine Zeta-Jones, as his agent in a written power of attorney. Catherine, as agent, must sign as follows: Michael Douglas, by Catherine Zeta-Jones under POA or Catherine Zeta-Jones, attorney-in-fact for Michael Douglas.

Why should I appoint a power of attorney?

Nov 25, 2003 · Power of attorney (POA) is a legal authorization that gives a designated person, termed the agent or attorney-in-fact, the power to act for another person, known as the principal. The agent may be...

What is power of attorney and how does it work?

Sep 22, 2021 · As people get older, it is generally recommended that they appoint a power of attorney (POA). Without fully understanding the extent of the duties and responsibilities, people often accept the role, intending to be as helpful as possible during difficult times …

Who can create a power of attorney?

Jul 16, 2021 · A power of attorney (POA) can be an important element of planning for your elderly parent’s future. It allows another person to take action on your parent’s behalf, ensuring bills get paid and medical decisions can be made in the unfortunate circumstance that your elderly parent is unable to do those things on their own or merely needs help with such tasks.

How do I get power of attorney in Australia?

There are a few ways you can make a power of attorney or enduring power of attorney.Public Trustee. The Public Trustee can prepare this documentation for eligible customers.Solicitor. Engage a solicitor - find a lawyer near you on the Law Society of SA website.Do-it-yourself kit. ... Other websites.Nov 16, 2021

Who is the best person to give power of attorney?

Most people select their spouse, a relative, or a close friend to be their power of attorney. But you can name anyone you want: Remember that selecting a power of attorney is not about choosing the person closest to you, but rather the one who can represent your wishes the best.Mar 14, 2020

What three decisions Cannot be made by a legal power of attorney?

You cannot give an attorney the power to: act in a way or make a decision that you cannot normally do yourself – for example, anything outside the law. consent to a deprivation of liberty being imposed on you, without a court order.

Who makes decisions if no power of attorney?

If you have not given someone authority to make decisions under a power of attorney, then decisions about your health, care and living arrangements will be made by your care professional, the doctor or social worker who is in charge of your treatment or care.Mar 30, 2020

How do I get power of attorney over my elderly parent?

The first step to getting power of attorney over an elderly parent is to research powers of attorney, understand how these documents work in your s...

What are the four types of power of attorney?

The four types of power of attorney are limited, general, durable and springing durable. Limited and general POAs end when the principal becomes in...

Can I get a power of attorney if my parent has dementia?

No, if your parent already has cognitive impairment, they can’t legally sign the documents required to set up a power of attorney. This is one reas...

What are the disadvantages of a power of attorney?

The biggest drawback to a power of attorney is that an agent may act in a way that the principal would disapprove of. This may be unintentional if...

Is power of attorney responsible for nursing home bills?

As your parent’s power of attorney, you’re responsible for ensuring their nursing home bills are paid for through their assets and income. However,...

What is the power of attorney in fact?

Generally, the law of the state in which you reside at the time you sign a power of attorney will govern the powers and actions of your agent under that document.

Why do you need a power of attorney?

Another important reason to use power of attorney is to prepare for situations when you may not be able to act on your own behalf due to absence or incapacity. Such a disability may be temporary, for example, due to travel, accident, or illness, or it may be permanent.

What is a springing power of attorney?

The power may take effect immediately, or only upon the occurrence of a future event, usually a determination that you are unable to act for yourself due to mental or physical disability. The latter is called a "springing" power of attorney.

How long does a power of attorney last?

Today, most states permit a "durable" power of attorney that remains valid once signed until you die or revoke the document.

Who is Michael Douglas' wife?

Assume Michael Douglas appoints his wife, Catherine Zeta-Jones, as his agent in a written power of attorney. Catherine, as agent, must sign as follows: Michael Douglas, by Catherine Zeta-Jones under POA or Catherine Zeta-Jones, attorney-in-fact for Michael Douglas. If you are ever called upon to take action as someone’s agent, ...

Can an attorney in fact make gifts?

Gifts are an important tool for many estate plans, and your attorney-in-fact can make gifts on your behalf, subject to guidelines that you set forth in your power of attorney. For example, you may wish to permit your attorney-in-fact to make "annual exclusion" gifts (up to $14,000 in value per recipient per year in 2013) on your behalf ...

Can a power of attorney be revoked?

A power of attorney may be revoked, but most states require written notice of revocation to the person named to act for you. The person named in a power of attorney to act on your behalf is commonly referred to as your "agent" or "attorney-in-fact.". With a valid power of attorney, your agent can take any action permitted in the document.

Why does a power of attorney end?

A power of attorney can end for a number of reasons, such as when the principal dies, the principal revokes it, a court invalidates it, the principal divorces their spouse, who happens to be the agent, or the agent can no longer carry out the outlined responsibilities. Conventional POAs lapse when the creator becomes incapacitated.

What is Durable POA?

A “durable” POA remains in force to enable the agent to manage the creator’s affairs, and a “springing” POA comes into effect only if and when the creator of the POA becomes incapacitated. A medical or healthcare POA enables an agent to make medical decisions on behalf of an incapacitated person.

How to start a power of attorney?

A better way to start the process of establishing a power of attorney is by locating an attorney who specializes in family law in your state. If attorney's fees are more than you can afford, legal services offices staffed with credentialed attorneys exist in virtually every part of the United States.

When should a power of attorney be considered?

A power of attorney should be considered when planning for long-term care. There are different types of POAs that fall under either a general power of attorney or limited power of attorney . A general power of attorney acts on behalf of the principal in any and all matters, as allowed by the state.

Who is Julia Kagan?

Julia Kagan has written about personal finance for more than 25 years and for Investopedia since 2014. The former editor of Consumer Reports, she is an expert in credit and debt, retirement planning, home ownership, employment issues, and insurance.

Can you use verbal instruction to get a POA?

While some regions of the country accept oral POA grants, verbal instruction is not a reliable substitute for getting each of the powers of attorney granted to your agent spelled out word-for-word on paper. Written clarity helps to avoid arguments and confusion.

Why do parents need POAs?

Ask parents to create POAs for the sake of everyone in the family—including the children and grandchildren— who may be harmed by the complications and costs that result if a parent is incapacitated without a durable POA in place to manage the parent’s affairs.

Why do you need a power of attorney?

Common Reasons to Seek Power of Attorney for Elderly Parents 1 Financial Difficulties: A POA allows you to pay the bills and manage the finances for parents who are having difficulty staying on top of their financial obligations. 2 Chronic Illness: Parents with a chronic illness can arrange a POA that allows you to manage their affairs while they focus on their health. A POA can be used for terminal or non-terminal illnesses. For example, a POA can be active when a person is undergoing chemotherapy and revoked when the cancer is in remission. 3 Memory Impairment: Children can manage the affairs of parents who are diagnosed with Alzheimer’s disease or a similar type of dementia, as long as the paperwork is signed while they still have their faculties. 4 Upcoming Surgery: With a medical POA, you can make medical decisions for the principal while they’re under anesthesia or recovering from surgery. A POA can also be used to ensure financial affairs are managed while they’re in recovery. 5 Regular Travel: Older adults who travel regularly or spend winters in warmer climates can use a POA to ensure financial obligations in their home state are managed in their absence.

Who is responsible for making decisions in a POA?

One adult will be named in the POA as the agent responsible for making decisions. Figuring out who is the best choice for this responsibility can be challenging for individuals and families, and your family may need help making this decision. Your attorney, faith leader or a family counselor can all help facilitate this process. It’s a good idea to select an agent who is able to carry out the responsibilities but also willing to consider other people’s viewpoints as needed.

What is a POA in 2021?

Last Updated: July 16, 2021. A power of attorney (POA) can be an important element of planning for your elderly parent’s future. It allows another person to take action on your parent’s behalf, ensuring bills get paid and medical decisions can be made in the unfortunate circumstance that your elderly parent is unable to do those things on their own ...

How many witnesses do you need to sign a letter of attorney?

A notary public or attorney must witness your loved one signing the letter of attorney, and in some states, you’ll need two witnesses. The chosen agent must be over 18 and fully competent, meaning they understand the implications of their decision. When filling out the form, the parent must specify exactly which powers are transferring to the agent.

What is a POA?

As mentioned above, a power of attorney (POA), or letter of attorney, is a document authorizing a primary agent or attorney-in-fact (usually a legally competent relative or close friend over 18 years old) — to handle financial, legal and health care decisions on another adult’s behalf. (A separate document may be needed for financial, legal, and health decisions, however).

Is a power of attorney necessary for a trust?

Under a few circumstances, a power of attorney isn’t necessary. For example, if all of a person’s assets and income are also in his spouse’s name — as in the case of a joint bank account, a deed, or a joint brokerage account — a power of attorney might not be necessary. Many people might also have a living trust that appoints a trusted person (such as an adult child, other relative, or family friend) to act as trustee, and in which they have placed all their assets and income. (Unlike a power of attorney, a revocable living trust avoids probate if the person dies.) But even if spouses have joint accounts and property titles, or a living trust, a durable power of attorney is still a good idea. That’s because there may be assets or income that were left out of the joint accounts or trust, or that came to one of the spouses later. A power of attorney can provide for the agent — who can be the same person as the living trust’s trustee — to handle these matters whenever they arise.

What is a POA for aging?

The first is a financial POA, which provides for decisions regarding finances and for the ability to pay bills, manage accounts, and take care of investments. The second is an Advance Healthcare Directive, which is also known as a “living will” or a “power of attorney for healthcare.” This document outlines who will be an agent for healthcare decisions, as well as providing some general guidelines for healthcare decision-making.

What are the different types of power of attorney?

In Irish law there are two types of power of attorney: 1 Power of attorney, which may be general or specific, which ceases once the donor becomes mentally incapacitated. This type is virtually identical to an ordinary 1971 Act power of attorney in England and Wales. 2 Enduring power of attorney, which takes effect once the donor is incapacitated

What is a POA?

Power of attorney. A power of attorney ( POA) or letter of attorney is a written authorization to represent or act on another's behalf in private affairs, business, or some other legal matter. The person authorizing the other to act is the principal, grantor, or donor (of the power). The one authorized to act is the agent, attorney, ...

Do powers of attorney need to be notarized?

Formerly, the term "power" referred to an instrument signed under seal while a "letter" was an instrument under hand, meaning that it was simply signed by the parties, but today a power of attorney does not need to be signed under seal. Some jurisdictions require that powers of attorney be notarized or witnessed, ...

What is an attorney in fact?

Attorney-in-fact. The term attorney-in-fact is used in many jurisdictions instead of the term agent. That term should be distinguished from the term attorney-at-law. In the United States, an attorney-at-law is a solicitor who is also licensed to be an advocate in a particular jurisdiction.

Is a power of attorney written or oral?

Oral and written. Depending on the jurisdiction, a power of attorney may be oral and, whether witnessed, will hold up in court, the same as if it were in writing. For some purposes, the law requires a power of attorney to be in writing.

What happens if you don't have a power of attorney?

If a person does not have the capacity to execute a power of attorney (and does not already have a durable power in place), often the only way for another party to act on their behalf is to have a court impose a conservatorship or a guardianship .

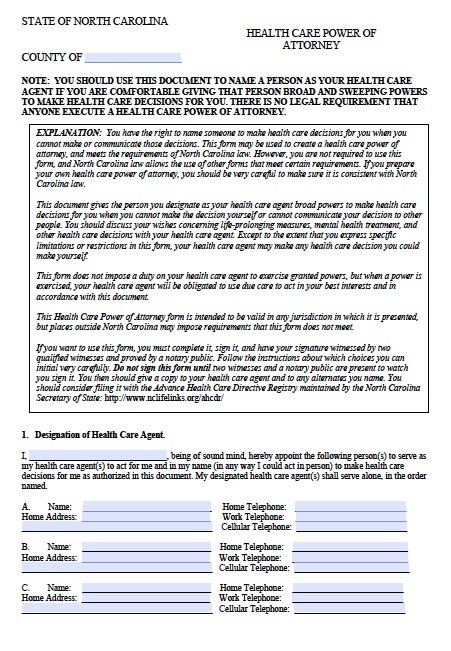

Can a POA be standardized?

Standardized forms are available for various kinds of powers of attorney, and many organizations provide them for their clients, customers, patients, employees, or members. However, the grantor should exercise caution when using a standardized POA form obtained from a source other than a lawyer because there is considerable variation in approved formats among the states. In some jurisdictions statutory power of attorney forms are available.

What are the duties of a power of attorney?

What Are the Duties of Power of Attorney? What Are the Duties of Power of Attorney? A power of attorney is a legally enforceable document that grants one person, the agent, the ability to act on behalf of another person, the principal, in specific matters ranging from health care to the management of personal property and finances.

What powers does a principal have?

A principal may execute a limited power of attorney for a specific purpose, such as for the purchase or sale of property or handling a certain bank account. A principal can also grant an agent powers to make health care decisions on the principal's behalf.

What are the duties of an agent?

Through one or more powers of attorney, the principal can authorize an agent to manage numerous tasks, including entering into contracts, dealing with real and personal property, handling the principal's financial and tax affairs, and arranging for the principal's housing and health care. The agent's primary duty is ...

What to do with a power of attorney?

It is important to understand what you are trying to accomplish with a power of attorney and then make certain that you have such a document crafted for that purpose. Appoint someone you trust. This can’t be overstated. You are appointing someone to make all of your business, financial, and medical decisions for you.

What happens to a power of attorney when you die?

They cease at death. A power of attorney loses all authority at the moment of death.

Why is it important to trust your child?

It is important that you have no doubt in the ability of that person to perform honorably in any areas for which you give them authority. If you have a child that has made poor financial or personal decisions, don’t give them the opportunity to make similar poor decisions on your behalf. You must trust them.

Can a power of attorney be amended?

A power of attorney is always able to be revoked or amended. As long as you have the capacity to make appropriate legal decisions on your own behalf, then you have the right to make changes to your power of attorney document. If you do not believe that the document is in keeping with your wishes, then you should certainly consult ...

Can you put toothpaste back in the tube?

You can’t put the toothpaste back in the tube. If it is discovered that your power of attorney abused that position and has taken money from you, it can be difficult to recover all of the property. It is like putting toothpaste back into the tube at times.

Popular Posts:

- 1. who played the attorney on ncis

- 2. how do you spell the name of attorney orly tiatiz?

- 3. what does a power of attorney cover

- 4. who pays attorney fees if both the landlord and tenant have violations in chicago

- 5. what to do when a contract for monetary reimbursement from an attorney is not fulfilled

- 6. what type of attorney works with schools

- 7. what percentage of attorney referral fees taxed

- 8. how to tell if an attorney can represent someone

- 9. who was attorney general in 1995

- 10. how much can an attorney charge to withdraw from a case