Make sure everyone who needs a copy has one You (the principal) and the agent should each have a copy of the power of attorney. A POA doesn't need to be filed with a court or government office.

Where can I give copies of my durable power of attorney?

Jan 27, 2022 · You (the principal) and the agent should each have a copy of the power of attorney. A POA doesn't need to be filed with a court or government office.

Do I need a durable power of attorney?

Feb 11, 2022 · Durable POA Form (3 copies) – It is recommended to bring 3 copies for signing. Notary Public / Witnesses – Depending on the State, it is required the form is signed by a notary public or witness (es) present. Step 1 – Download the Form Most States have a statutory form that is required to be completed in order to be accepted.

What states have a durable power of attorney form?

May 11, 2022 · A durable power of attorney is generally used to make plans for the care of your finances, property, and investments in the event that you can no longer handle your financial affairs yourself. The Durable Power of Attorney: Health Care and Finances. This article from legal publisher Nolo explains the advantages of durable powers of attorney.

Does a power of attorney need to be recorded in California?

What can you do as a durable power of attorney in Texas?

How do I activate a power of attorney in Ontario?

How do I prove I have power of attorney UK?

You or your attorney can use a certified copy to register your LPA if you do not have the original form. Your attorney can also use the certified copy to prove they have permission to make decisions on your behalf, for example to manage your bank account.

Does a durable power of attorney need to be recorded in Texas?

Does a power of attorney need to be filed with the court in Texas?

Does power of attorney have to be activated?

Does a power of attorney in Ontario need to be notarized?

Is a power of attorney valid if not registered?

How do you prove lasting power of attorney?

Who can certify a copy of power of attorney UK?

Can I get a copy of an LPA?

Does a power of attorney need to be notarized?

It depends on the state, since each state has its own rules for validating a power of attorney. Some require two witnesses and no notary, some requ...

How much does a power of attorney cost?

The cost for a power of attorney varies, depending on how you obtain the form and your state’s notary requirements. Online forms may be free, and y...

How many people can be listed on a power of attorney?

You can name multiple agents on your power of attorney, but you will need to specify how the agents should carry out their shared or separate duties.

What are the requirements to be a power of attorney agent?

Legally, an agent must be at least 18 years old and of sound mind.4 You should also choose someone you trust to act in your best interests.

When should I create a power of attorney?

You can create a power of attorney at any point after you turn 18. You need to create a power of attorney while you’re of sound mind.

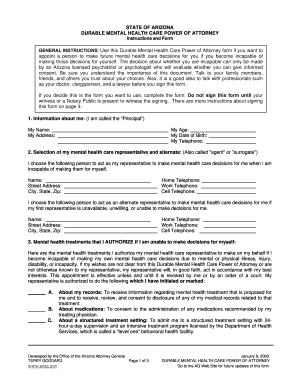

What Is A Durable Power of Attorney?

A Durable Power of Attorney (form) is for anyone wanting another person to handle matters on their behalf when incapacitated. It’s by far the most...

How to Get Durable Power of Attorney

Getting a durable power of attorney will require the principal to find someone that they can trust to handle their assets if they should not be abl...

Durable Poa vs General Poa

Both forms allow for the principal to select someone else to act on their behalf. Although, the durable allows for the relationship to continue in...

Agent’S Acceptance of Appointment

At the end of the form, the Agent must read and acknowledge the power that they have and how important their position is for the principal. This ad...

What does a financial durable power of attorney do?

It is a financial durable power of attorney - this means that it only allows the agent to handle financial matters. It does not permit the agent to make decisions about the principal's health care.

What is incapacitated power of attorney in Texas?

According to Section 751.00201 of the Texas Estates Code, a person is considered to be "incapacitated" for the purposes of a durable power of attorney if a doctor's examination finds that they are not able to manage their own finances.

What is a durable power of attorney?

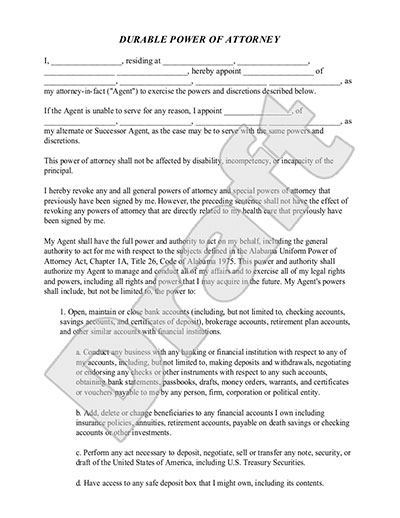

A durable power of attorney allows you to handle another person’s financial decisions on their behalf. All decisions made must be to the benefit of the person being represented. The one thing about the durable form that separates it from the rest is that it remains legal in the event the person being represented can no longer think for themselves.

Do you need a notary public to sign a document?

The document is required to be signed in accordance with State law which usually requires the principal and agent signing in the presence of a notary public. In some States, only witnesses are required and in others witnesses and a notary public.

What powers does an agent have?

The agent that is selected can have very simple and basic powers, such as having the rights to pick up mail, to wide-ranging powers like having complete control over all the facets of the principal’s financial assets. It’s recommended that if an agent is to have such powers that they are the same person that is listed as a beneficiary in the principal’s last will and testament. In that case, if the agent makes a financial move that hurts the principal’s overall value, it will also affect the agent.

What does "acting as attorney in fact" mean?

If the agent is to sign legal documents on behalf of the principal, the agent would sign the principal’s name followed by the word “by” with the Agent’s signature followed by “acting as attorney-in-fact”.

Why do we need a durable powers of attorney?

Durable powers of attorney help you plan for medical emergencies and declines in mental functioning and can ensure that your finances are taken care of. Having these documents in place helps eliminate confusion and uncertainty when family members have to make tough medical decisions.

What is a power of attorney?

A power of attorney allows someone else to handle your legal, financial, or medical matters. General powers of attorney cover a wide range of transactions, while limited powers of attorney cover only specific situations, such as authorizing a car dealer to register your new vehicle for you.

What does POA stand for in power of attorney?

When power of attorney is made durable, it remains intact if you cannot make decisions for yourself. A power of attorney (POA) authorizes someone else to handle certain matters, such as finances or health care, on your behalf. If a power of attorney is durable, it remains in effect if you become incapacitated, such as due to illness or an accident. ...

What is a power of attorney for healthcare?

A healthcare power of attorney, on the other hand, names someone to make medical decisions any time you are unable to do it yourself, even if you are expected to make a full recovery.

What is the purpose of a durable POA?

The purpose of a durable POA is to plan for medical emergencies, cognitive decline later in life, or other situations where you're no longer capable of making decisions.

Can a POA be effective if you are incapacitated?

The POA can take effect immediately or can become effective only if you are incapacitated. The person you appoint is known as your agent, or attorney-in-fact, although the individual or company doesn't have to be a lawyer. An attorney-in-fact can handle many types of transactions, including: Buying and selling property.

What can an attorney in fact do?

An attorney-in-fact can handle many types of transactions, including: Buying and selling property. Managing bank accounts, bills, and investments. Filing tax returns. Applying for government benefits. If you become incapacitated and don't have a general durable power of attorney, your family may have to go to court and have you declared incompetent ...

What is a durable power of attorney?

A durable power of attorney for finances -- or financial power of attorney -- is a simple, inexpensive, and reliable way to arrange for someone to manage your finances if you become incapacitated (unable to make decisions for yourself).

What happens to a durable power of attorney after death?

Your durable power of attorney automatically ends at your death. That means that you can't give your agent authority to handle things after your death, such as paying your debts, making funeral or burial arrangements, or transferring your property to the people who inherit it.

Is a power of attorney good for your family?

A financial power of attorney is a good document to make for yourself, but it can also be a great blessing for your family. If you become unable to decide for yourself and you haven't prepared a durable power of attorney, a court proceeding is probably inescapable. Your spouse, closest relatives, or companion will have to ask a court ...

When does a financial power of attorney take effect?

When a Financial Power of Attorney Takes Effect. A financial power of attorney can be drafted so that it goes into effect as soon as you sign it. (Many spouses have active financial powers of attorney for each other in case something happens to one of them -- or for when one spouse is out of town.) You should specify that you want your power ...

Can a power of attorney go into effect if you are incapacitated?

Or, you can specify that the power of attorney does not go into effect unless a doctor certifies that you have become incapacitated. This is called a "springing" durable power of attorney. It allows you to keep control over your affairs unless and until you become incapacitated, when it springs into effect. However, springing powers of attorney can ...

Where do you put a copy of a power of attorney?

If your agent will have authority to deal with your real estate, you must put a copy of the document on file at the local land records office. (In two states, North and South Carolina, you must record your power of attorney at the land records office for it to be durable.)

Can you revoke a power of attorney?

As long as you are mentally competent, you can revoke a durable power of attorney at any time. You get a divorce. In a handful of states, if your spouse is your agent and you divorce, your ex-spouse's authority is automatically terminated. In other states, if you want to end your ex-spouse's authority, you have to revoke your existing power ...

Can you give copies of durable power?

If you wish, you can give copies of your durable power to the people your attorney-in-fact will need to deal with —in banks or government offices, for example. If the durable power is in their records, it may eliminate hassles for your attorney-in-fact later because they will be familiar with the document and expecting your attorney-in-fact to take action under it.

Do you need a power of attorney to act on your behalf?

Your attorney-in-fact will need the original power of attorney document, signed and notarized, to act on your behalf. So, if you want your attorney-in-fact to start using the document right away, give the original document to the attorney-in-fact. If you named more than one attorney-in-fact, give the original document to one of them.

What to do if you have more than one attorney in fact?

If you named more than one attorney-in-fact, give the original document to one of them. Between them, they will have to work out the best way to prove their authority. For example, they may decide to visit some financial institutions or government offices together to establish themselves as your attorneys-in-fact.

Can you use a power of attorney if you are incapacitated?

If your power of attorney won't be used unless and until you become incapacitated , however, it may seem premature to contact people and institutions about a document that may never go into effect. It's up to you. Be sure to keep a list of everyone to whom you give a copy.

Can IRS accept a copy of a document?

Some agencies, such as the IRS, will accept a copy of the document, rather than the original: Such flexible policies make things easier on multiple attorneys-in-fact who need to share the original document.

Can you file a durable power of attorney anywhere?

The originals of the Durable Power of Attorney stay in your possession. You do not file them anywhere. You can record them with a county recorder if you intend on affecting a specific piece of property; typically though, if you are selling a piece of real property for another person, for whom you hold the durable power, ...

Do you need to record a power of attorney?

In some cases, it may be necessary to record the power of attorney for instance, if it is used to sell real estate. However, you do not need to record the power of attorney in order to make it generally valid.

Popular Posts:

- 1. depositions where the attorney requests tge computers

- 2. how much will it cost to get an attorney for gross misdemeanor

- 3. who is the best criminal drug defense attorney in alabama

- 4. what is the difference between a public defender and a court appointed attorney

- 5. when do courts apply attorney fees

- 6. what are good questions to ask a divorce attorney

- 7. how to find a real estate attorney breach of contract

- 8. who does the attorney general provide legal advice to

- 9. balance check for what i owe to attorney general ohio

- 10. what happens to the incumbenta florida state attorney if he losses the elwction