If your return is signed by a representative for you, you must have a power of attorney attached that specifically authorizes the representative to sign your return. To do this, you can use Form 2848. You would include a copy of the form 2848 if you are filing a paper version.

Full Answer

How to write a power of attorney letter [10+ best examples]?

Mar 09, 2022 · IRS Power of Attorney (Form 2848) – Revised in Dec. 2015, allows an individual or business entity to elect a party, usually an accountant or tax attorney, to file federal taxes on their behalf. Download: Adobe PDF

Why should I have a power of attorney?

Mar 17, 2022 · To understand powers of attorney there are a few legal terms you need to know. Agent. A person who is given authority by a POA. Also called an attorney-in-fact (which has nothing to do with being a lawyer). Durable Power of Attorney. A POA is durable if it continues in effect after you become incapacitated. Limited/Special Power of Attorney.

What are the three types of power of attorney?

Apr 16, 2015 · The most common type of power of attorney is a durable, general power of attorney. This document transfers nearly every legal right a person has to another individual. Durable means the document...

Why do you need power of attorney?

What is the best form of power of attorney?

A general power of attorney allows the agent to make a wide range of decisions. This is your best option if you want to maximize the person's freedom to handle your assets and manage your care. A limited power of attorney restricts the agent's power to particular assets.Mar 19, 2019

What are the different types of power of attorney UK?

Different types of power of attorneyOrdinary power of attorney.Lasting power of attorney (LPA)Enduring power of attorney (EPA)Mar 7, 2022

What are 2 types of lasting power of attorney?

There are two types of LPA, one covering health and welfare and the other covering property and financial affairs. You can make an LPA for one or both areas depending on your needs.

What three decisions Cannot be made by a legal power of attorney?

You cannot give an attorney the power to: act in a way or make a decision that you cannot normally do yourself – for example, anything outside the law. consent to a deprivation of liberty being imposed on you, without a court order.

What Is Power of Attorney?

A Power of Attorney is the act of allowing another individual to take action and make decisions on your behalf. When an individual wants to allow a...

How to Get Power of Attorney?

Obtaining a Power of Attorney (form) is easy, all you need to do is decide which type of form best suits your needs. With our resources, creating a...

Power of Attorney vs Durable Power of Attorney

A Power of Attorney and the powers granted to the Agent ends when the Principal either dies or becomes mentally incapacitated. If you select to use...

How to Sign A Power of Attorney?

The following needs to be executed in order for your power of attorney to be valid: 1. Agent(s) and Principal must sign the document. 2. As witness...

How to Write A Power of Attorney

Before the Principal writes this form they should keep in mind that the Agent (or ‘Attorney-in-Fact’) will need to be present at the time of signat...

How to choose a power of attorney?

Step 1 – Choose an Agent. Select and ask someone that you trust if they would like to be your “Agent” or “Attorney-in-Fact”. Especially for a durable power of attorney, the agent selected should be someone you have trusted most of your life.

What is a power of attorney?

Power of attorney is a legal document that allows an individual (known as the “Principal”) to select someone else (“Agent” or “Attorney-in-Fact”) to handle their business affairs, medical responsibilities, or any decision that requires someone else to take over an activity based on the Principal’s best interest and intentions. ...

How many witnesses do you need for a notary?

In most cases, a Notary Public will need to be used or Two (2) Witnesses. STATE. DURABLE.

Can a principal use a power of attorney?

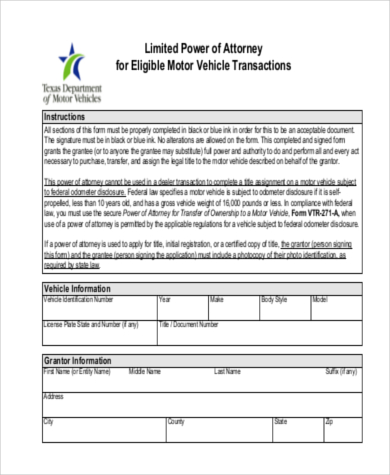

For other nominations, a principal may assign power of attorney under a special circumstance with the limited form. In addition, if the principal is looking to have someone only handle personal and business filings the tax power of attorney should be used.

Do you need to record a power of attorney?

It is important for all parties involved to have copies of their form. A power of attorney does not need to be recorded with any government office and is primarily held by the Principal and Agent (s).

Is a power of attorney valid for a principal?

Although, the general power of attorney is no longer valid if the principal becomes mentally incompetent. IRS Power of Attorney (Form 2848) – To hire or allow someone else to file federal taxes to the Internal Revenue Service on your behalf. Limited Power of Attorney – For any non-medical power.

What is a power of attorney?

A general power of attorney gives your agent broad power to act on your behalf — making any financial, business, real estate, and legal decisions that would otherwise be your responsibility. For example: 1 managing banking transactions 2 buying and selling property 3 paying bills 4 entering contracts

How many types of power of attorney should I include in my estate plan?

Therefore, you may want to include two or three types of power of attorney in your estate plan.

What is POA in estate planning?

A power of attorney, or POA, is an estate planning document used to appoint an agent to manage your affairs. There are several different types of power of attorney. Each serves a different purpose and grants varying levels of authority to your agent. Related Resource: What is Power of Attorney?

When does a power of attorney expire?

For example, during an extended period of travel outside of the country. A general power of attorney expires upon your incapacitation (unless it’s durable) or death. The powers granted under a general power of attorney may be restricted by state statutes.

When does a medical power of attorney become effective?

A medical power of attorney becomes effective immediately after you’ve signed it, but can only be used if you’ve been declared mentally incompetent by physician (s). Once you’ve selected an agent, make sure they know how to sign as power of attorney on your behalf. 3. General Power of Attorney.

Can a limited power of attorney cash checks?

For example, a limited power of attorney can allow someone to cash checks for you. However, this person won’t be able to access or manage your finances fully. This type of power of attorney expires once the specific task has been completed or at the time stated in the form.

Can you rescind a durable power of attorney?

A durable power of attorney ends automatically when you die. You can rescind a durable POA using a revocation of power of attorney form as long as you’re competent .

Why do we need a power of attorney?

Some are a good idea to have in place now, because you never know when an emergency may arise and a power of attorney will be needed. Other types of powers of attorney may only be needed if a particular situation arises.

What does a power of attorney cover?

Such a power of attorney may cover things such as enrolling the child in school, consenting to field trips, and even making emergency medical treatment decisions in the event a parent cannot be reached quickly.

What is a springing power of attorney?

Springing Power of Attorney. A POA is considered springing if it is not effective immediately, but becomes effective in the future due to the occurrence of specified events, for example, if it becomes effective upon your incapacity.

What is a POA?

A POA that confers less than full authority upon the agent. Many power of attorney forms give the agent authority that is as comprehensive and broad as possible. A limited power of attorney grants less authority, sometimes referred to as a special power of attorney, grants less authority. It might only give a few specified powers, ...

What is a POA agent?

Agent. A person who is given authority by a POA. Also called an attorney-in-fact (which has nothing to do with being a lawyer). Durable Power of Attorney. A POA is durable if it continues in effect after you become incapacitated. Limited/Special Power of Attorney.

What is a child care power of attorney?

Child Care Power of Attorney. Some states permit a child care power of attorney, which authorizes your agent to make decisions regarding the care of your child. This is typically done when a child will be temporarily living with relatives or others in a location some distance from the parents.

Is it a good idea to have a durable power of attorney?

It is a good idea to have a springing durable financial power of attorney as part of your estate plan. This will enable someone you trust to handle your financial matters in the event you become incapacitated.

What is a general power of attorney?

After nearly a decade and a half of war, service members and their spouses are likely familiar with general powers of attorney. The most common type of power of attorney is a durable, general power of attorney. This document transfers nearly every legal right a person has to another individual.

When does a power of attorney spring into effect?

Rather, the document springs into effect if and when the designator becomes incapacitated and unable to act on his or her own behalf.

When does an attorney in fact sign an affidavit?

When an event occurs that incapacitates the designator, an attorney-in-fact will sign (and have notarized) an affidavit attached to the springing power of attorney. Once the affidavit is signed, the springing power of attorney is in effect.

Can a power of attorney be assigned to someone else?

Still, not all powers of attorney assign every legal right of a person to someone else. There are special powers of attorney that can assign a limited right. Common special powers of attorney include: • Guardianship (handy when leaving children in the care of someone else.

Is a springing power of attorney a good choice?

If able to make their own decisions now and there is no need in the immediate future for others to act on behalf of those designating a power of attorney, a springing power of attorney may be the best choice. A springing power of attorney is a general power of attorney, but it is not in effect at the time it is signed.

Popular Posts:

- 1. who was the defense attorney for peter zenger

- 2. how to get health care power of attorney for my wife with dementia

- 3. what does a finance attorney do

- 4. when an attorney lied

- 5. where do i get power of attorney papers?

- 6. pittsburgh attorney anthony who passed away

- 7. my attorney has not filed my divorce mediation paperwork. it's been 30 days. what now?

- 8. what does a completed power of attorney look like hawaii

- 9. how does a ny attorney get admitted to the supreme court of the us

- 10. how to track activity as an attorney