If filed-it would be in your local state court with the clerk of court. The answer given does not imply that an attorney-client relationship has been established and your best course of action is to have legal representation in this matter. You need to record it with the recorders office.

Full Answer

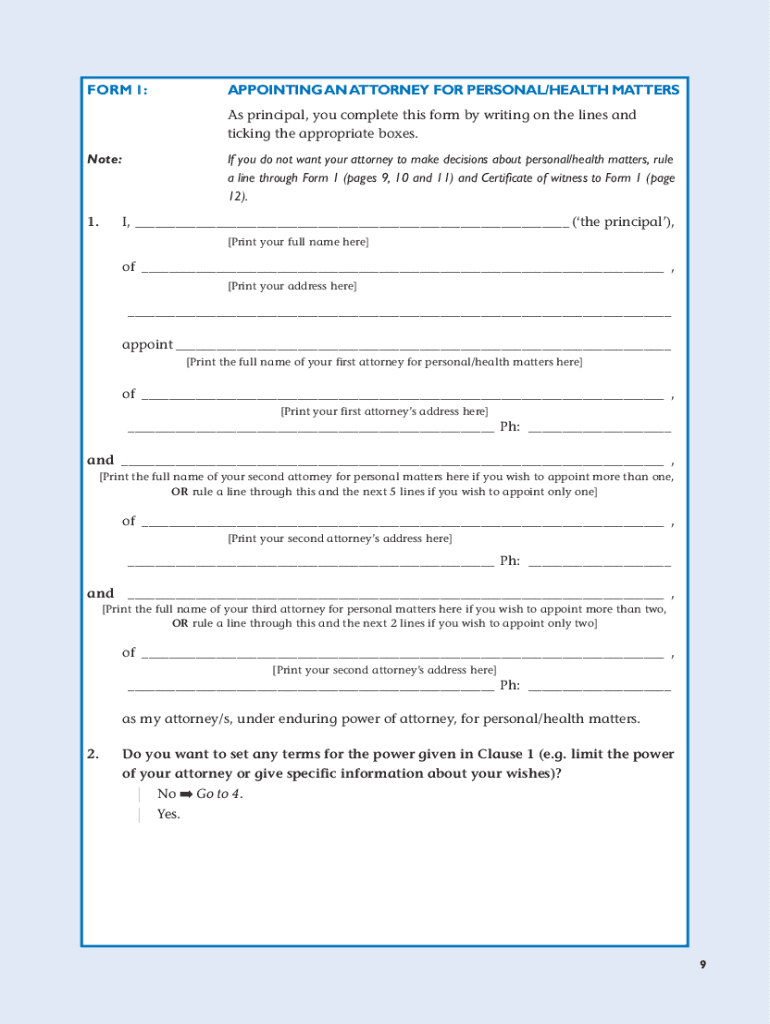

Is a power of attorney a court form?

A Power of Attorney is a legal form but is NOT a court form. A Power of Attorney cannotbe used to give someone the power to bring a lawsuit on your behalf.

How do I file a power of attorney?

5. Submit the form . In the services menu, select File a Power of Attorney. Mail your form. 6. After you submit Generally, it takes us 3 weeks to review and process POA declarations.

Where can I get a power of attorney in California?

A Power of Attorney form in the state of California becomes valid only after it is authorized by a public notary. You can find a public notary at any commercial bank. The last step to complete the process of getting a Power of Attorney is to notify the court.

Where can I get a power of attorney notarized?

Only the Principal needs to be present with the notary for the Power of Attorney to be notarized. You can find a notary at any banking or financial institution. The easiest way is to go to a banking institution that you are associated with, as they will usually do it for free.

How do I file a power of attorney in California?

Steps for Making a Financial Power of Attorney in CaliforniaCreate the POA Using a Statutory Form, Software, or Attorney. ... Sign the POA in the Presence of a Notary Public or Two Witnesses. ... Store the Original POA in a Safe Place. ... Give a Copy to Your Agent. ... File a Copy With the Land Records Office.More items...

Does power of attorney need to be recorded in California?

Powers of attorney concerning real property must be acknowledged (notarized). There is no statutory requirement that the power of attorney be recorded with the County Recorder in the county where the real property is located.

How do I file a power of attorney in Arizona?

How to Get or Obtain Power of Attorney in AZObtain the POA Packet.Take witness, original special power of attorney form and Photo ID to a Notary Public.You and the witness sign the Power of Attorney in front of a Notary.Make copies of the Power of Attorney for documentation.

How do you get power of attorney in MN?

How Do I Create a Power of Attorney?In writing;Signed by you in front of a notary public;Dated appropriately; and.Clear on what powers are being granted.

How do you activate a power of attorney?

Your LPA needs to be registered by the Court of Protection before it can be activated. You have two options, you can either register the Lasting Power of Attorney as soon as it's in place and signed by you and your attorney, or leave it to be registered at a later date.

Do you have to register a power of attorney?

In order for a Lasting Power of Attorney to be valid and be used by the Attorney it must be registered. With a Property and Affairs Lasting Power of Attorney, once it has been successfully registered it can be used straight away.

Where do I send my power of attorney in Arizona?

A taxpayer may now submit the Arizona Form 285 and Form 285B through email or fax, in addition to the mail. These forms authorize the Department to release confidential information to the taxpayer's Appointee. Taxpayers may email these completed forms to [email protected] or fax to (602) 716-6008.

Does power of attorney need to be recorded in Arizona?

The Power of Attorney does not need to be filed with the Court. Each person who is made your Agent should keep the original of his or her Power of Attorney form in a convenient place so that it can be located easily when needed.

Does a power of attorney in Arizona need to be notarized?

In Arizona, in addition to other legal requirements, a health care power of attorney must be signed and either notarized or witnessed in writing by a person who affirms they were present at the signing and that the person signing the document appeared to be of sound mind and free from duress.

Does a power of attorney need to be notarized in MN?

While Minnesota technically requires you to get your POA notarized only if someone else is signing the document on your behalf (Minn. Stat. § 523.01), notarization is very strongly recommended. Many financial institutions will require a POA to be notarized (even if state law doesn't require it) before they accept it.

Does power of attorney need to be notarized?

Registration of power of attorney is optional In India, where the 'Registration Act, 1908', is in force, the Power of Attorney should be authenticated by a Sub-Registrar only, otherwise it must be properly notarized by the notary especially where in case power to sell land is granted to the agent.

What is the best power of attorney to have?

You can write a POA in two forms: general or limited. A general power of attorney allows the agent to make a wide range of decisions. This is your best option if you want to maximize the person's freedom to handle your assets and manage your care.

What is a power of attorney?

Power of attorney is the designation of granting power to a person (“agent”) to handle the affairs of someone else (“principal”). The designation may be for a limited period of time or for the remainder of the principal’s life. The principal can appoint an agent to handle any type of act legal under law. The most common types transfer financial ...

Who will keep forms after signing?

These forms are not filed with any government agency or office so it will be up to each individual to securely maintain the form until it is needed.

Does power of attorney matter in which state?

A: The power of attorney must be tailored for the state in which your parent resides. It does not matter which state you live in, as long as the power of attorney is applicable to the principal’s state of residence, which in this case is your parent, is what matters.

What is a power of attorney?

A "Power of Attorney" is a written document often used when someone wants another adult to handle their financial or property matters. A Power of Attorney is a legal form but is NOT a court form. A Power of Attorney cannot be used to give someone the power to bring a lawsuit on your behalf. Only licensed attorneys can bring lawsuits on behalf ...

Who is the principal of a power of attorney?

The "principal" is the person who creates a Power of Attorney document, and they give authority to another adult who is called an "attorney-in-fact.". The attorney-in-fact does NOT have to be a lawyer and CANNOT act as an attorney for the principal. The attorney-in-fact must be a competent adult (18 years or older).

Can a court order a conservatorship?

The courts generally are not involved with Powers of Attorney, however, if someone becomes incapacitated or is unable to make their own decisions ( e.g., in a coma, mentally incompetent, etc.) and needs another adult to make decisions for them, the court may get involved to order a legal Guardianship or Conservatorship for the incapacitated person. ...

How to establish a power of attorney relationship?

To establish a power of attorney relationship, you must fill out and submit the correct FTB form. 1. Choose the correct form. 2. Fill out the form correctly. Representatives: Provide all available identification numbers: CA CPA, CA State Bar Number, CTEC, Enrolled Agent Number, PTIN.

Who can sign a business form?

Only the individual, estate representative, trustee, or officer of the business can sign the form. Be sure that person includes all of the following: Printed name. Title (not required for individuals) Signature.

Michael Leo Potter

There is no requirement legally that either the Health Care POA or the General POA be publicly recorded with the County Recorder or filed with the Court. It is valid if properly executed under Nevada law.

Bradley B Anderson

Neither the financial/property power of attorney, nor the health care power of attorney require a court filing. They are independent contracts allowing another person to act on your behalf for the specific purposes set out in the documents.

Ivette M Santaella

Attached is a link that explains the requirements for a valid POA in Nevada.

What is a power of attorney?

Power of attorney is a legal document that allows an individual (known as the “Principal”) to select someone else (“Agent” or “Attorney-in-Fact”) to handle their business affairs, medical responsibilities, or any decision that requires someone else to take over an activity based on the Principal’s best interest and intentions. ...

How to choose a power of attorney?

Step 1 – Choose an Agent. Select and ask someone that you trust if they would like to be your “Agent” or “Attorney-in-Fact”. Especially for a durable power of attorney, the agent selected should be someone you have trusted most of your life.

How many witnesses do you need for a notary?

In most cases, a Notary Public will need to be used or Two (2) Witnesses. STATE. DURABLE.

Can a principal use a power of attorney?

For other nominations, a principal may assign power of attorney under a special circumstance with the limited form. In addition, if the principal is looking to have someone only handle personal and business filings the tax power of attorney should be used.

Do you need to record a power of attorney?

It is important for all parties involved to have copies of their form. A power of attorney does not need to be recorded with any government office and is primarily held by the Principal and Agent (s).

Is a power of attorney valid for a principal?

Although, the general power of attorney is no longer valid if the principal becomes mentally incompetent. IRS Power of Attorney (Form 2848) – To hire or allow someone else to file federal taxes to the Internal Revenue Service on your behalf. Limited Power of Attorney – For any non-medical power.

Douglas Ron Coenson

Assuming this is truly a Power of Attorney and not a Guardianship, you should not have to file the document with the court unless there is some controversy at hand. If the Power of Attorney is for medical care (Designation of Health Care Surrogate), you should provide a copy to all medical facilities and physicians that are treating your father.

Joseph Franklin Pippen Jr

You may or may not need to file the DPOA. I would usually suggest not filing the DPOA unless you are forced to file for some reason. If filed-it would be in your local state court with the clerk of court.

Popular Posts:

- 1. how to get a power of attorney ohio

- 2. what kind of attorney for llc

- 3. how to assign power of attorney in california

- 4. how to odtain a durable power of attorney in brooklyn ny

- 5. what position did whitaker hold previous to attorney general

- 6. what kind a corporation should a sole practioner attorney form in alabama

- 7. how to be an assistant us attorney

- 8. what can you do about a bad defense attorney

- 9. who is attorney who filed fraud charges agaisnt trump

- 10. what happens if you fire your attorney who was working on contingency