An attorney or law firm paying fees for referral or co-counsel above $600, must issue a Form 1099 to the recipient. The same goes for a client paying a law firm or lawyer more than $600 in a year as a part of the client's business, must send out an IRS Form 1099.

Why do attorneys get 1099?

also file a Form 1099-MISC for payments to all attorneys, even if the attorney’s law practice is incorporated. What Types of Payments to Attorneys Must Be Reported? Payments of $600 or more in a calendar year strictly for legal services must be reported by the payor (business entity) on Form 1099-MISC (in Box 7). Payments of $600 or more in a calendar year to an attorney that …

Should Attorneys receive a 1099?

Under this rule, if there are exempt and nonexempt transferors, you must file Form 1099-S only for the nonexempt transferor. An exempt volume transferor is someone who sold or exchanged during the year, who expects to sell or exchange during the year, or who sold or exchanged in either of the 2 previous years at least 25 separate items of reportable real estate to at least 25 …

Do all attorneys get 1099?

Jul 15, 2020 · Therefore, you must report attorneys’ fees (in box 1, Form 1099- NEC) or gross proceeds (in box 10, Form 1099-NEC) as described earlier to corporations that provide legal services. The term “attorney” includes a law firm or other provider of legal services.

Do attorneys need 1099s?

There are some instances where attorney and law firm payments are reported on the IRS Form 1099-MISC, instead of the Form 1099-NEC. If payments above $600 are NOT reported on Box 1 of the Form 1099-NEC are made to an attorney or law firm in the course of your business or trade in connection with legal services that are not directly provided by an attorney, chances are they …

Who is responsible for filing the 1099s?

Businesses are required to issue a 1099 form to a taxpayer (other than a corporation) who has received at least $600 or more in non-employment income during the tax year. For example, a taxpayer might receive a 1099 form if they received dividends, which are cash payments paid to investors for owning a company's stock.

Do attorneys issue 1099s to clients?

It is less clear whether you should issue a Form 1099 in other kinds of cases. The rules are complex and practice varies. However, most lawyers do not issue Forms 1099 to clients, on the theory that they are merely acting as an intermediary.

Where do 1099s get filed?

the IRSAll 1099 forms must be submitted to the IRS and the recipient, but some forms must also be submitted to the Department of Revenue for certain states. With the 1099-NEC being part of the Combined Federal and State Filing program in tax year 2021, we expect changes to some states' filing requirements.

Do attorneys get a 1099-MISC or 1099-NEC?

Payments to attorneys. The term “attorney” includes a law firm or other provider of legal services. Attorneys' fees of $600 or more paid in the course of your trade or business are reportable in box 1 of Form 1099-NEC, under section 6041A(a)(1).Jan 31, 2022

Do accountants receive 1099s?

The IRS requires businesses, self-employed individuals, and not-for-profit organizations to issue Form 1099-MISC for professional service fees of $600 or more paid to accountants who are not corporations.

Are legal settlements 1099 reportable?

If your legal settlement represents tax-free proceeds, like for physical injury, then you won't get a 1099: that money isn't taxable. There is one exception for taxable settlements too. If all or part of your settlement was for back wages from a W-2 job, then you wouldn't get a 1099-MISC for that portion.

What happens if I don't file a 1099 NEC?

If a business fails to issue a form by the 1099-NEC or 1099-MISC deadline, the penalty varies from $50 to $270 per form, depending on how long past the deadline the business issues the form. There is a $556,500 maximum in fines per year.Dec 15, 2021

Where do you file 1099 NEC?

You'll use the amount in Box 1 on your Form(s) 1099-NEC to report your self-employment income. Instead of putting this information directly on Form 1040, you'll report it on Schedule C.

Who should receive a 1099 NEC?

You'll need to file Form 1099-NEC if you paid someone at least $600 during the year who meets these criteria: They are not your employee. You made payment for services in the course of your business — in other words, this wasn't a personal payment. They are an individual, partnership or estate.

Do I send my attorney a 1099-NEC?

When to report attorney payments on a 1099-NEC Rule of thumb: Report payments to an attorney on Form 1099-NEC if you were their client. Of course, the reporting requirements we went through above still apply: The payments need to be $600 or more and rendered for work-related services.

Do lawyers get 1099 if paid by card?

Each credit card processing company and each third-party payment aggregator must now issue your firm a Form 1099-K reporting the total amount processed.Feb 4, 2013

Do I send a 1099-NEC to a 501c3?

You do not need to send a Form 1099-NEC or 1099-MISC to: A C-corporation (but see pages 2 – 3 of the instructions). An S-corporation. A professional corporation (except for law firms; see above) and payments for medical or health care services (see page 6 of the instructions).Jul 10, 2021

Who must file 1099-S?

Who Must File. Generally, the person responsible for closing the transaction, as explained in (1) below, is required to file Form 1099-S. If no one is responsible for closing the transaction, the person required to file Form 1099-S is explained in (2), later. However, you may designate the person required to file Form 1099-S in a written agreement, ...

How long do you have to keep a 1099-S?

You must keep the certification for 4 years after the year of sale. You may keep the certification on paper, microfilm, microfiche, or in an electronic storage system.

What is a reportable real estate transaction?

Generally, you are required to report a transaction that consists in whole or in part of the sale or exchange for money, indebtedness, property, or services of any present or future ownership interest in any of the following. Improved or unimproved land, including air space.

What is closing disclosure?

A Closing Disclosure includes any amendments, variations, or substitutions that may be prescribed under Dodd-Frank if any such form discloses the transferor and transferee, the application of the proceeds, and the identity of the settlement agent or other person responsible for preparing the form.

Is a sale of a home a reportable sale?

Sale or exchange. A sale or exchange includes any transaction properly treated as a sale or exchange for federal income tax purposes, even if the transaction is not currently taxable. For example, a sale of a main home may be a reportable sale even though the transferor may be entitled to exclude the gain under section 121.

Do you need a 1099-S for a joint tenant?

If the transferors were spouses at the time of closing, who held the property as joint tenants, tenants by the entirety, tenants in common, or as community property, treat them as a single transferor. Only one Form 1099-S showing either of them as the transferor is required.

What is a transfer in full or partial satisfaction of a debt secured by the property?

Any transaction that is not a sale or exchange, including a be quest, a gift (including a transaction treated as a gift under section 1041), and a financing or refinancing that is not related to the acquisition of real estate. A transfer in full or partial satisfaction of a debt secured by the property.

What is attorney fee on 1099?

The term “attorney” includes a law firm or other provider of legal services. You must report all attorneys’ fees of $600 or more paid in the course of your trade or business in box 1 of Form 1099-NEC. Also, report any gross proceeds paid to attorneys. These are amounts that are NOT attorney’s fees.

Who must file a 1099-MISC?

What entities must file a 1099-NEC or 1099-misc. Trades, businesses or business-like entities must report payments that they make to non-employees using Form 1099-MISC or Form 1099-NEC. You do not have to report personal payments.

What is the difference between a 1099 and a 1099?

There are two parts to the 1099: Part 1: the 1099 issued to the person you paid. They use this to record and report their income. Part 2: a 1099 report that you file with the IRS where you tell them about all of the 1099’s you issued to individuals.

What is the penalty for late filing?

The penalty for late filing or furnishing within 30 days of the due date is $50 per return, with a maximum penalty of $565,000.

When is the 1099-NEC due?

Form 1099-NEC is due to the IRS and the payee by January 31 of the following year (so due in January 2021 for payments in 2020).

How to collect 1099?

Be sure to collect information from vendors/contractors throughout the year. Have them fill out a W-9 form before you make the first payment. It is much easier to get people to respond when they have to in order to receive money.

What are business-like entities?

Business-like entities include trusts of qualified pension or profit-sharing plans of employers, certain organizations exempt from tax under section 501 (c) or 501 (d), farmers’ cooperatives that are exempt from tax under section 521, and widely held fixed investment trusts. Federal, state, and local government agencies must also report payments.

Who must issue a 1099-S?

Businesses (like title companies) and any other parties involved in a real estate transaction (where no title company is involved) must issue an IRS Form 1099-S to anyone who receives at least $600 during the year. They are required by law to do this.

What is a 1099 S?

IRS Form 1099-S is a tax document used to ensure that the full amount of capital gains received for a real estate sale are accurately reported to the IRS. Typically, when real estate is sold, the seller is subject to a capital gains tax. In order to calculate how much tax you are required to pay, the IRS must know how much you made on the sale.

How much is a 1099 penalty?

Technically, there are penalties that the IRS can issue for failure to fill out any type of 1099 Form. These start at $250 per failure if they find out about it. However, there’s a fairly small chance that you’ll be the one specifically in charge of the 1099-S form.

What form do you report a 1099S?

Personal use: This is for individuals who received a 1099-S because of the sale of their primary residence. The sale of your home will be reported on Form 8949 and Schedule D. Do not report the sale of your primary residence on your tax return unless your gains exceeded your exclusion amount.

Why do you need to send 1099-S to IRS?

This form is important because it ensures that you are reporting all capital gains as required by federal law. You’ll need to have this done in advance of the deadline, so don’t delay!

What is the purpose of a 1099-S?

The purpose of Form 1099-S is to ensure that sellers are reporting the full amount of their capital gains on each year’s income tax return. Thus, the copy of the 1099-S form you receive from your title company will help you as you file your taxes. Here are the most common uses for the 1099-S.

Who is Erika from New York?

Erika is a former Affordable Housing Director for the City of New York turned full-time Land Investor. She used to help New Yorkers find affordable housing, now she helps people find affordable land around the US.

Why do lawyers send 1099s?

Copies go to state tax authorities, which are useful in collecting state tax revenues. Lawyers receive and send more Forms 1099 than most people, in part due to tax laws that single them out. Lawyers make good audit subjects because they often handle client funds. They also tend to have significant income.

When do you get a 1099 from a law firm?

Forms 1099 are generally issued in January of the year after payment. In general, they must be dispatched to the taxpayer and IRS by the last day of January.

What percentage of 1099 does Larry get?

The bank will issue Larry a Form 1099 for his 40 percent. It will issue Cathy a Form 1099 for 100 percent, including the payment to Larry, even though the bank paid Larry directly. Cathy must find a way to deduct the legal fee.

Is a 1099 required for Joe's fees?

No Form 1099 is required because this was Joe’s money. Big Law also agrees to refund $60,000 of the monies Joe paid for fees over the last three years. Big Law is required to issue a Form 1099 for the $60,000 payment.

Do you need a 1099 for slip and fall?

Given that such payments for compensatory damages are generally tax-free to the injured person, no Form 1099 is required.

Is a 1099 required for a corporation?

Put another way, the rule that payments to lawyers must be the subject of a Form 1099 trumps the rule that payments to corporation need not be.

Is it better to have 1099s or 1099s?

Nevertheless, the IRS is unlikely to criticize anyone for issuing more of the ubiquitous little forms. In fact, in the IRS’s view, the more Forms 1099 the better. Perhaps for that reason, it is becoming common for law firms to issue Forms 1099 to clients even where they are not strictly necessary.

What is a 1099-S?

There are up to 20 different types of 1099 forms. 1099-S one of those types, and it’s used for reporting capital gains on real estate transactions.

When is a 1099-S required?

A 1099-S is NOT required if the seller certifies that the sale price is for $250K or less, and the sale is for their principal residence.

What to do if I didn't get a W-9?

If I didn’t get a W-9 completed by the seller and/or if I failed to include the “designation clause” in my purchase agreement (or even if I did, but wanted to make the process easier for the seller), I could put together a letter of instruction and send it to the seller along with all the forms they’ll need to complete and submit to the IRS. In addition to the forms, I could also provide a pre-addressed envelope for the sellers to send their forms to the IRS.

What happens if I include a designation clause in my purchase agreement?

If I’ve included the above-mentioned “designation clause” in my purchase agreement, I essentially don’t have any further responsibility, because the seller has agreed that they will file these forms on their own behalf (this is something you’ll want to get verified by your own paid tax professional).

What is the purpose of a 1099-S?

The purpose of IRS Form 1099-S is to ensure that sellers are reporting their full amount of capital gains on each year’s tax return (and thus, paying the appropriate amount of taxes to the IRS). For example, if someone buys an investment property for $100,000 and sells it for $150,000 (giving them $50,000 of capital gains income) ...

Do you have to report a 1099S when selling a home?

When selling your home, you may have signed a form certifying you will not have a taxable gain on the sale. If you completed a 1099-S Exemption Certification Form and you met all six criteria for not having to report the sale on your tax return, the title company or closing attorney may not send IRS Form 1099-S, ...

Do you get a 1099 if you sold a house for less than 600?

In the unlikely event that the sale was for less than $600, you probably would not receive a 1099-S. Or, if the transaction was closed without a title company or closing attorney and you agreed to be responsible for reporting of the sale (see the section on Who Issues 1099’s), you would not receive a 1099-S.

What is a 1099 NEC?

In other words, Form 1099-NEC reports a payment for services. For 2019 and prior years, putting income in box 7 of a Form 1099-MISC usually tipped the IRS off that this person should not only be paying income tax but also paying self-employment tax.

What is box 14 on 1099?

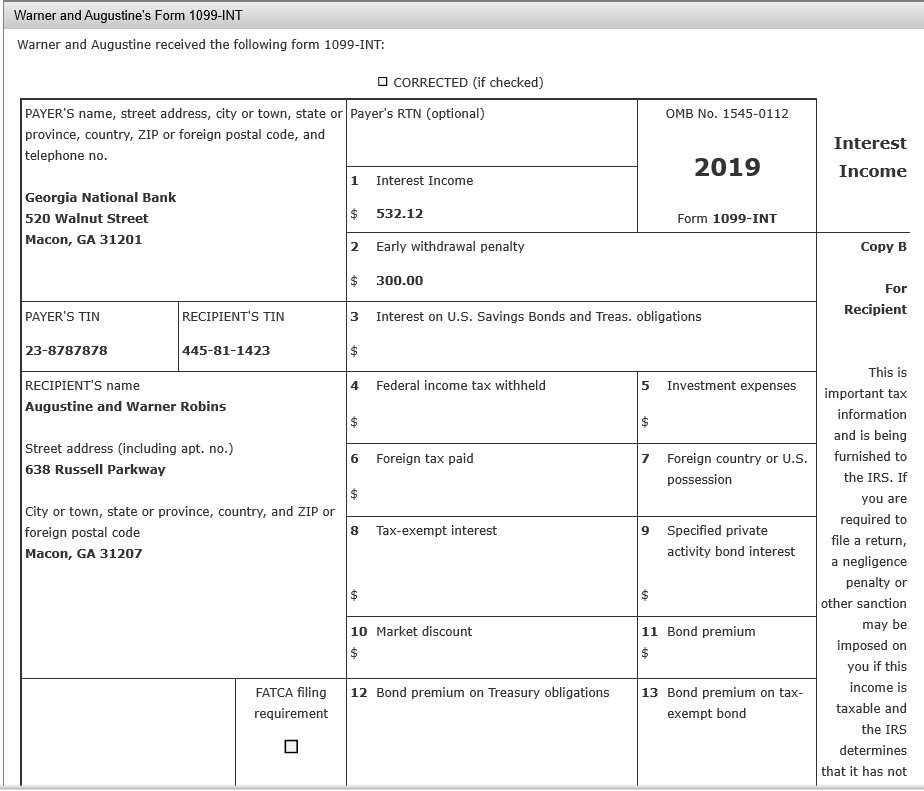

Up through 2019 payments, IRS Form 1099-MISC box 14 was for gross proceeds paid to an attorney. That means the payments you received in 2019 that were reported in early 2020 were on these 2019 forms. For payments in 2020, they will be reported in January of 2021 on a new version of Form 2020-MISC.

What box is gross proceeds paid to an attorney?

Gross proceeds paid to an attorney for 2019 and prior years was box 14. But now, it is reported in box 10 of the new 2020 Form 1099-MISC. This box is only for reporting payments to lawyers. It turns out that there are numerous special Form 1099 rules for lawyers.

Do defendants have to issue 1099?

Thus, the defendant generally has the obligation to issue any Form 1099 necessary. If lawyers perform management functions and oversight of client monies, they become payers required to issue Forms 1099, but just being a plaintiff’s lawyer and handling settlement money is not enough.

Can you report 1099 to IRS?

Failing to report a Form 1099 on your tax return (or at least explain it) will get you an IRS notice. Thus, if you receive a Form 1099, report it, even if you are claiming that the money should be tax free. Report it even if some of it really went to your lawyer and you are entitled to a tax deduction for legal fees.

Do attorneys get 1099s?

That way the attorney receives a Form 1099 for only the attorney fees, and not also for the client’s money .

How much is self employment tax?

Self-employment tax can add a whopping 15.3% on top of income taxes.

Popular Posts:

- 1. who is the city attorney for glasgow, ky?

- 2. who assists the attorney general

- 3. how did attorney general a. mitchell palmer justify arresting suspected communists?

- 4. what attorney fees are deductible on 1041

- 5. when an individual represents herself as her own attorney this is called

- 6. what happend to the state attorney on freddie ray gray case

- 7. what is the pleural for power of attorney?

- 8. how to complete the durable power of attorney form lf205

- 9. how much should i pay a financial power of attorney

- 10. what is a united states district court attorney?