Where do I send my 2848?

| THEN use this address... | Fax number* |

|---|---|

| Internal Revenue Service PO Box 268, Stop 8423 Memphis, TN 38101-0268 | 901-546-4115 |

| Internal Revenue Service 1973 N Rulon White Blvd MS 6737 Ogden, UT 84404 | 801-620-4249 |

How do I submit POA FTB?

- Choose the correct form. ...

- Fill out the form correctly. ...

- Sign the form. ...

- Provide supporting documentation, if necessary, such as: ...

- Submit the form. ...

- After you submit.

Can I fax a POA to the IRS?

You must then mail or fax a copy of the power of attorney with the revocation annotation to the IRS, using the Where To File Chart, or if the power of attorney is for a specific matter, to the IRS office handling the matter.Sep 2, 2021

Where do I mail my 3520?

How long does it take for the IRS to process a power of attorney?

Can I file Form 3520 electronically?

How do I send documents to the IRS?

Where do I fax IRS forms?

Can IRS power of attorney be signed electronically?

What is the difference between Form 3520 and 3520-A?

Form 3520 “Annual Return To Report Transactions With Foreign Trusts and Receipt of Certain Foreign Gifts” and Form 3520-A “Annual Information Return of Foreign Trust With a U.S. Owner.” Both forms involve Foreign Trust Reporting.

Do I have to file Form 3520?

You're only required to file this form if you received: A gift of more than $100,000 from a foreign person or estate. A gift of more than $15,601 from a foreign partnership or corporation.

When should I file Form 3520?

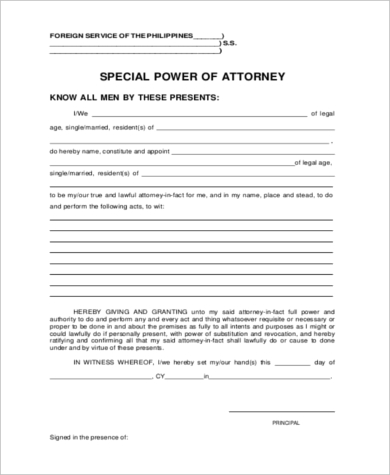

What Is Power of Attorney?

A Power of Attorney is the act of allowing another individual to take action and make decisions on your behalf. When an individual wants to allow a...

How to Get Power of Attorney?

Obtaining a Power of Attorney (form) is easy, all you need to do is decide which type of form best suits your needs. With our resources, creating a...

Power of Attorney vs Durable Power of Attorney

A Power of Attorney and the powers granted to the Agent ends when the Principal either dies or becomes mentally incapacitated. If you select to use...

How to Sign A Power of Attorney?

The following needs to be executed in order for your power of attorney to be valid: 1. Agent(s) and Principal must sign the document. 2. As witness...

How to Write A Power of Attorney

Before the Principal writes this form they should keep in mind that the Agent (or ‘Attorney-in-Fact’) will need to be present at the time of signat...

What is a POA?

General POA. A general POA grants overall control over the principal’s finances to an agent but terminates when the principal becomes incapacitated or unable to make his or her own decisions. At this point, it is usually replaced by guardianship, conservatorship, or a durable POA.

What is POA in real estate?

In a property transaction, a POA will be filed by the realty agent in the appropriate real estate records as proof that the agent had the right to sign the deed in the principal’s name.

3. Sign the form

Only the individual, estate representative, trustee, or officer of the business can sign the form. Be sure that person includes all of the following:

5. Submit the form

Online through MyFTB#N#11#N#. In the services menu, select File a Power of Attorney.

6. After you submit

Generally, it takes us 3 weeks to review and process POA declarations. If we need more information or clarification, it may take longer.

What is a power of attorney?

Power of attorney is the designation of granting power to a person (“agent”) to handle the affairs of someone else (“principal”). The designation may be for a limited period of time or for the remainder of the principal’s life. The principal can appoint an agent to handle any type of act legal under law. The most common types transfer financial ...

What is a power of attorney in Washington?

Create Document. A power of attorney form used by an individual (“principal”) to appoint someone else to handle their affairs (“agent” or “attorney-in-fact”). The agent is able to handle financial, medical, guardianship, or tax-related matters during the principal’s lifetime. If the form is durable, ...

What is an agent in fact?

An agent, also known as an Attorney-in-Fact, is the individual that will be making the important decisions on your behalf. This individual does not need to be an attorney, although an attorney can be your agent. The two (2) most important qualities you should look for in your agent is accountability and trust.

Who will keep forms after signing?

These forms are not filed with any government agency or office so it will be up to each individual to securely maintain the form until it is needed.

What is banking banking?

Banking – To be able to deposit or withdraw funds in addition to conducting any type of financial transaction that the principal could also do themselves. Upon initials being placed on this line, the agent will have the full capacity to

Do you need to record a power of attorney?

It is important for all parties involved to have copies of their form. A power of attorney does not need to be recorded with any government office and is primarily held by the Principal and Agent (s).

What is a power of attorney?

Power of attorney is a legal document that allows an individual (known as the “Principal”) to select someone else (“Agent” or “Attorney-in-Fact”) to handle their business affairs, medical responsibilities, or any decision that requires someone else to take over an activity based on the Principal’s best interest and intentions. ...

How many witnesses do you need to be a notary public?

In most cases, a Notary Public will need to be used or Two (2) Witnesses.

What is an advance directive?

An advance directive, referred to as a “living will” or “medical power of attorney”, lets someone else handle health care decisions on someone else’s behalf and in-line with their wishes. These powers include: Everyday medical decision-making; End-of-life decisions; Donation of organs;

How long does it take to register a power of attorney?

When you’ve made your lasting power of attorney ( LPA ), you need to register it with the Office of the Public Guardian ( OPG ). It takes up to 15 weeks to register an LPA if there are no mistakes in the application. You can apply to register your LPA yourself if you’re able to make your own decisions. Your attorney can also register it for you.

How long does it take to register an LPA?

It takes up to 15 weeks to register an LPA if there are no mistakes in the application. You can apply to register your LPA yourself if you’re able to make your own decisions. Your attorney can also register it for you. You’ll be told if they do and you can object to the registration.

Popular Posts:

- 1. what is a statutory form power of attorney

- 2. when is it too late to get power of attorney in oklahoma

- 3. how concerned should americans be about us attorney bharara's firing?

- 4. for an attorney, what is a reasonable photocopy charge to client for copies per page?

- 5. how much do i jeed to pay attorney to refile chapter 13 as 7

- 6. how to respectfully address a district attorney

- 7. how to verify attorney license

- 8. discovery of who pays attorney florida

- 9. how to give power of attorney to next generation

- 10. why would dems bring in attorney with known anti trump bias to run impeachment