Where do you send Form 2848?

| Where you live | Mailing address | Fax number |

| Alabama, Arkansas, Connecticut, Delaware ... | Internal Revenue Service 5333 Getwell Ro ... | 855-214-7519 |

| Alaska, Arizona, California, Colorado, H ... | Internal Revenue Service 1973 Rulon Whit ... | 855-214-7522 |

| All APO and FPO addresses, American Samo ... | Internal Revenue Service International C ... | 855-772-3156 304-707-9785 (Outside the U ... |

Full Answer

Where to mail form 2848 IRS?

Jul 18, 2021 · You can request Power of Attorney or Tax Information Authorization online with Tax Pro Account, Submit Forms 2848 and 8821 Online, or forms by fax or mail. You have these options to submit Power of Attorney (POA) and Tax Information Authorization (TIA).

Where to file Form 2848 with IRS?

Jul 18, 2021 · Authorize with Form 2848 - Complete and submit online, by fax or mail Form 2848, Power of Attorney and Declaration of Representative. Your authorization for Power of Attorney is recorded on the Centralized Authorization File (CAF) unless Line 4, Specific Use is checked.

Where and how to fax form 2848 to IRS?

Mar 02, 2022 · Information about Form 2848, Power of Attorney and Declaration of Representative, including recent updates, related forms, and instructions on how to file. Form 2848 is used to authorize an eligible individual to represent another person before the IRS.

What is the tax form for power of attorney?

Topic No. 311 Power of Attorney Information. You have the right to represent yourself before the IRS. You may also authorize someone to represent you before the IRS in connection with a federal tax matter. If you choose to have someone represent you, your representative must be an individual authorized to practice before the IRS.

Where do I send my 2848?

| THEN use this address... | Fax number* |

|---|---|

| Internal Revenue Service PO Box 268, Stop 8423 Memphis, TN 38101-0268 | 901-546-4115 |

| Internal Revenue Service 1973 N Rulon White Blvd MS 6737 Ogden, UT 84404 | 801-620-4249 |

How do I send 2848 to IRS?

Can I fax a POA to the IRS?

You must then mail or fax a copy of the power of attorney with the revocation annotation to the IRS, using the Where To File Chart, or if the power of attorney is for a specific matter, to the IRS office handling the matter.Sep 2, 2021

What address do I send my IRS documents to?

How long does it take IRS to process form 2848?

Can IRS power of attorney be signed electronically?

Where do I fax IRS forms?

What number do I fax to the IRS?

Does the IRS accept durable power of attorney?

How do I send mail to IRS?

Write both the destination and return addresses clearly or print your mailing label and postage. If your tax return is postmarked by the filing date deadline, the IRS considers it on time. Mail your return in a USPS blue collection box or at a Postal location that has a pickup time before the deadline.

What address do I mail 1099 forms to?

What address do I send my 1040 ES payment?

How to authorize a power of attorney?

Authorize with Form 2848 - Complete and submit online, by fax or mail Form 2848, Power of Attorney and Declaration of Representative.

Where is my tax authorization?

Your Tax Information Authorization is recorded on the Centralized Authorization File (CAF) unless Line 4, Specific Use is checked. The record lets IRS assistors verify your permission to speak with your representative about your private tax-related information.

How to authorize a third party to file taxes?

There are different types of third party authorizations: 1 Power of Attorney - Allow someone to represent you in tax matters before the IRS. Your representative must be an individual authorized to practice before the IRS. 2 Tax Information Authorization - Appoint anyone to review and/or receive your confidential tax information for the type of tax and years/periods you determine. 3 Third Party Designee - Designate a person on your tax form to discuss that specific tax return and year with the IRS. 4 Oral Disclosure - Authorize the IRS to disclose your tax information to a person you bring into a phone conversation or meeting with us about a specific tax issue.

What is a tax information authorization?

A Tax Information Authorization lets you: Appoint a designee to review and/or receive your confidential information verbally or in writing for the tax matters and years/periods you specify. Disclose your tax information for a purpose other than resolving a tax matter.

How long does a power of attorney stay in effect?

Power of Attorney stays in effect until you revoke the authorization or your representative withdraws it. When you revoke Power of Attorney, your representative will no longer receive your confidential tax information or represent you before the IRS for the matters and periods listed in the authorization.

Why do we disclose tax returns?

The tax return information we may disclose to allow the third party to assist you.

Do you need a signature for a power of attorney?

Power of Attorney must be authorized with your signature. Here’s how to do it:

What does authorization of a qualifying representative do?

Your authorization of a qualifying representative will also allow that individual to receive and inspect your confidential tax information.

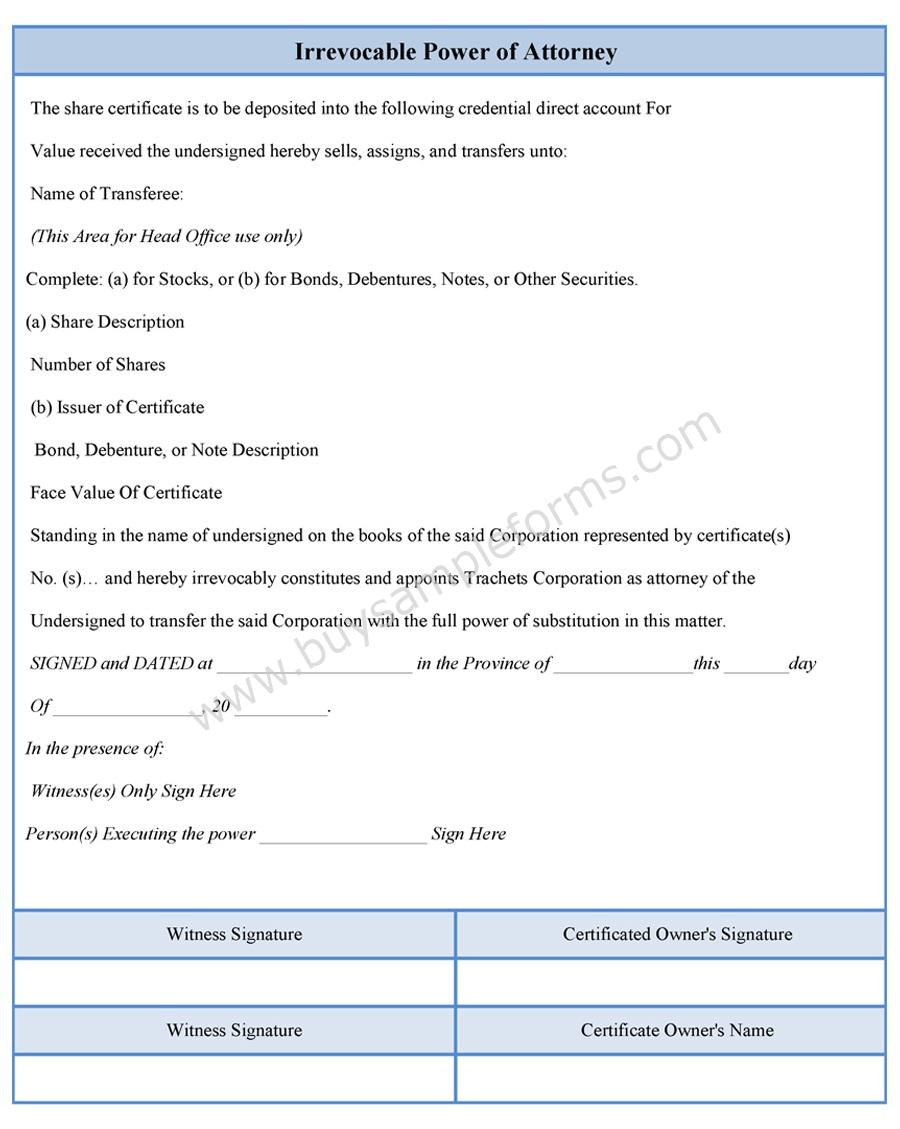

What is a 2848 form?

About Form 2848, Power of Attorney and Declaration of Representative. Use Form 2848 to authorize an individual to represent you before the IRS. The individual you authorize must be a person eligible to practice before the IRS.

How to represent yourself before the IRS?

If you choose to have someone represent you, your representative must be an individual authorized to practice before the IRS. Submit a power of attorney if you want to authorize an individual to represent you before the IRS. You can use Form 2848, Power of Attorney and Declaration of Representative for this purpose. Your signature on the Form 2848 allows the individual or individuals named to represent you before the IRS and to receive your tax information for the matter (s) and tax year (s)/period (s) specified on the Form 2848.

What is a 2848 form?

You can use Form 2848, Power of Attorney and Declaration of Representative for this purpose. Your signature on the Form 2848 allows the individual or individuals named to represent you before the IRS and to receive your tax information for the matter (s) and tax year (s)/period (s) specified on the Form 2848.

How to verify a taxpayer's address?

Verify the taxpayer’s name, address and SSN or ITIN through secondary documentation, such as a federal or state tax return, IRS notice or letter, Social Security card or credit card or utility statement. For example, suppose a taxpayer changed their address in 2020. In that case, a 2019 tax return can be used to verify the taxpayer’s name and SSN or ITIN, and a recent utility statement can be used to verify the taxpayer’s new address.

What to do if a form has not been processed?

If the form has not yet been processed and you need to immediately discuss your client’s case with the IRS, for security reasons, you must fax a copy of the form with a “wet” ink signature to the Practitioner Priority Service (PPS) or the IRS employee handling your client’s matter in order to speak with a representative immediately.

How to authenticate a taxpayer's identity?

To authenticate the taxpayer’s identity for remote transactions, take these steps: Inspect a valid government-issued photo identification (ID) of the taxpayer and compare the photo to the taxpayer via a self-taken picture of the taxpayer or video conferencing to compare.

How to submit multiple forms?

To submit multiple forms, select “submit another form" and answer the questions about the authorization. If you are unable to establish a Secure Access account or submit the forms online, you can submit forms by fax or mail.

What is a tax pro account?

The Tax Pro Account will be an all-digital option. Tax professionals can initiate a request for authorization from their account and it will send to the client’s online account for an electronic signature. The client will access their account, electronically sign the authorization, and the system will send it to the CAF database.

When do you have to authenticate a taxpayer?

You must authenticate a taxpayer’s identity when they electronically sign the form in a remote transaction (meaning not in person) and you do not have a personal or business relationship with them. This means that you must ensure a person is who they say they are.

Do you need to authenticate the identity of a taxpayer?

Whether the taxpayer signs in a remote transaction or in an in-person transaction, you should routinely authenticate the taxpayer’s identity as a best practice . For business entity taxpayers, you also should confirm that the individual signing the form on behalf of the business entity taxpayer has this authority.

What is a power of attorney for IRS?

Except as specified below or in other IRS guidance, this power of attorney authorizes the listed representative (s) to inspect and/or receive confidential tax information and to perform all acts (that is, sign agreements, consents, waivers, or other documents) that you can perform with respect to matters described in the power of attorney. Representatives are not authorized to endorse or otherwise negotiate any check (including directing or accepting payment by any means, electronic or otherwise, into an account owned or controlled by the representative or any firm or other entity with whom the representative is associated) issued by the government in respect of a federal tax liability. Additionally, unless specifically provided in the power of attorney, this authorization does not include the power to substitute or add another representative, the power to sign certain returns, the power to execute a request for disclosure of tax returns or return information to a third party, or to access IRS records via an Intermediate Service Provider. Representatives are not authorized to sign Form 907, Agreement to Extend the Time to Bring Suit, unless language to cover the signing is added on line 5a. See Line 5a. Additional Acts Authorized, later, for more information regarding specific authorities.

Where to enter BBA in a power of attorney?

For powers of attorney related to the centralized partnership audit regime, enter “Centralized Partnership Audit Regime (BBA)” in the "Description of Matter" column on line 3, then enter the form number (for example, 1065) and tax year in the appropriate column (s).

What is Form 2848?

The individual you authorize must be eligible to practice before the IRS. Form 2848, Part II, Declaration of Representative, lists eligible designations in items (a)– (r). Your authorization of an eligible representative will also allow that individual to inspect and/or receive your confidential tax information.

What is the APO number for Guam?

855-214-7522. All APO and FPO addresses, American Samoa, the Commonwealth of the Northern Mariana Islands, Guam, the U.S. Virgin Islands, Puerto Rico, a foreign country, or otherwise outside the United States. Internal Revenue Service. International CAF Team.

Can a law student represent a taxpayer?

You must receive permission to represent taxpayers before the IRS by virtue of your status as a law, business, or accounting student working in an LITC or STCP under section 10.7 (d) of Circular 230. Law graduates in an LITC or STCP may also represent taxpayers under the "Qualifying Student" designation in Part II of Form 2848. Be sure to attach a copy of the letter from the Taxpayer Advocate Service authorizing practice before the IRS.

Can I represent a business before the IRS?

You must receive permission to represent taxpayers before the IRS by virtue of your status as a law, business , or accounting student working in an LITC or STCP under section 10.7 (d) of Circular 230. Law graduates in an LITC or STCP may also represent taxpayers under the "k" designation in Part II of Form 2848. Be sure to attach a copy of the letter from the Taxpayer Advocate Service authorizing practice before the IRS.

Can an unenrolled return preparer represent taxpayers?

Unenrolled return preparers cannot represent taxpayers, regardless of the circumstances requiring representation, before appeals officers, revenue officers, attorneys from the Office of Chief Counsel, or similar officers or employees of the Internal Revenue Service or the Department of the Treasury.

What is a power of attorney for IRS?

Except as specified below or in other IRS guidance, this power of attorney authorizes the listed representative(s) to inspect and/or receive confidential tax information and to perform all acts (that is , sign agreements, consents, waivers, or other documents) that you can perform with respect to matters described in the power of attorney. Representatives are not authorized to endorse or otherwise negotiate any check (including directing or accepting payment by any means, electronic or otherwise, into an account owned or controlled by the representative or any firm or other entity with whom the representative is associated) issued by the government in respect of a federal tax liability. Additionally, unless specifically provided in the power of attorney, this authorization does not includethepower to substitute or add another representative, the power to sign certain returns, the power to execute a request for disclosure of tax returns or return information to a third party, or to access IRS records via an Intermediate Service Provider. Representatives are not authorized to sign Form 907, Agreementto Extend the Time to Bring Suit, unless language to cover the signing is added on line 5a. See Line 5a. Additional Acts Authorized, later, for more information regarding specific authorities.

What is a CAF power of attorney?

Generally, the IRS records powers of attorney on the CAF system. The CAF system is a computer file system containing information regarding the authority of individuals appointed under powers of attorney. The system gives IRS personnel quicker access to authorization information without requesting the original document from the taxpayer or representative. However, a specific-use power of attorney is a one-time or specific-issue grant of authority to a representative or is a power of attorney that does not relate to a specific tax period (except for civil penalties) that the IRS does not record on the CAF. Examples of specific uses not recorded include but are not limited to:

What is Form 2848?

We ask for the information on this form to carry out the Internal Revenue laws. Form 2848 is provided by the IRS for your convenience and its use is voluntary. If you choose to designate a representative to act on your behalf, you must provide the requested information. Section 6109 requires you to provide your identifying number; section 7803 authorizes us to collect the other information. We use this information to properly identify you and your designated representative and determine the extent of the representative's authority. Failure to provide the information requested may delay or prevent honoring your power of attorney designation; providing false or fraudulent information may subject you to penalties.

How to use Form 2848?

Use Form 2848 to authorizean individual to represent you before the IRS. See Substitute Form 2848, later, for information about using a power of attorney other than a Form 2848 to authorize an individual to represent you before the IRS. The individual you authorize must be eligible to practice before the IRS. Form 2848, Part II, Declaration of Representative, lists eligible designations in items (a)–(r). Your authorization of an eligible representative will also allow that individual to inspect and/or receive your confidential tax information.

Does the IRS require a new 2848?

If the representative's address has changed, the IRS does not require a new Form 2848. The representative can send a written notification that includes the new information and the representative's signature to the location where you filed the Form 2848.

How to establish a power of attorney relationship?

To establish a power of attorney relationship, you must fill out and submit the correct FTB form. 1. Choose the correct form. 2. Fill out the form correctly. Representatives: Provide all available identification numbers: CA CPA, CA State Bar Number, CTEC, Enrolled Agent Number, PTIN.

How long does it take to get a POA?

Generally, it takes us 3 weeks to review and process POA declarations. If we need more information or clarification, it may take longer.

Who can sign a business form?

Only the individual, estate representative, trustee, or officer of the business can sign the form. Be sure that person includes all of the following: Printed name. Title (not required for individuals) Signature.

Do we accept electronic signatures?

We do NOT accept electronic or stamped signatures.

Popular Posts:

- 1. what type of attorney for will

- 2. what is name of attorney for dr ford

- 3. how to be a tax attorney at irs

- 4. who is weisselberg attorney

- 5. why you need an attorney for your ssa claim

- 6. what is involved in power of attorney

- 7. how to fight judgement for attorney fees in arizona

- 8. how to pick a attorney

- 9. what kind of attorney settles family trust issues

- 10. how to fill out a power of attorney for a company