Otherwise, you can mail your completed form to the following address: POWER OF ATTORNEY FORM 3-252 ILLINOIS DEPARTMENT OF REVENUE PO BOX 19001 SPRINGFIELD IL 62794-9001 For questions, see the instructions for Form IL-2848, call us at 1 800 732-8866 or 1 217 782-3336, or call our TDD-telecommunications device for the deaf at 1 800 544-5304.

What are the Illinois Power of attorney forms?

Otherwise, you can mail your completed form to the following address: POWER OF ATTORNEY FORM 3-252 ILLINOIS DEPARTMENT OF REVENUE PO BOX 19001 SPRINGFIELD IL 62794-9001 For questions, see the instructions for Form IL-2848, call us at 1 800 732-8866 or 1 217 782-3336, or call our TDD-telecommunications device for the deaf at 1 800 544-5304.

Can a power of attorney file an il-2848?

Mail — mail your completed form to the following address: POWER OF ATTORNEY FORM 3-252 ILLINOIS DEPARTMENT OF REVENUE PO BOX 19001 SPRINGFIELD IL 62794-9001. Click here to download the pdf form

What is an advance directive power of attorney Illinois?

• Fax — Send it as a single fax to 217 782-4217. Do not include a cover page or combine multiple Forms IL-2848. You can also mail your completed Form IL-2848, including required schedules and supporting documents to: ILLINOIS DEPARTMENT OF REVENUE POWER OF ATTORNEY FORMS 3-252 PO BOX 19001 SPRINGFIELD IL 62794-9001

How do I send form il-2848 to the IRS?

State of Illinois . Illinois Department of Public Health . Illinois Statutory Short Form . Power of Attorney for Health Care . NOTICE TO THE INDIVIDUAL SIGNING . THE POWER OF ATTORNEY FOR HEALTH CARE . No one can predict when a serious illness or accident might occur. When it does, you may need someone else to speak or make health care ...

Where do I send my 2848?

Where To Mail Form 2848Then send Form 2848 to the following address:Or fax to the following number:Internal Revenue Service 5333 Getwell Road Stop 8423 Memphis, TN 38118855-214-7519Internal Revenue Service 1973 Rulon White Blvd., MS 6737 Ogden, UT 84201855-214-75221 more row

How do I file a power of attorney in Illinois?

Steps for Making a Financial Power of Attorney in IllinoisCreate the POA Using a Statutory Form, Software, or Attorney. ... Sign the POA in the Presence of a Notary Public. ... Store the Original POA in a Safe Place. ... Give a Copy to Your Agent or Attorney-in-Fact. ... File a Copy With the Recorder of Deeds.More items...

Can I fax Form 2848 to the IRS?

Both forms are available at IRS.gov. Authorizing someone to represent you does not relieve you of your tax obligations. If you check the box on line 4, mail or fax Form 2848 to the IRS office handling the specific matter.Sep 2, 2021

Does a power of attorney have to be notarized in Illinois?

Finally, the power of attorney document requires the principal's notarized signature and at least one witness to be effective. Please note, according to Section 3-3.6 of the Illinois Power of Attorney Act, the requirement of at least one witness's signature applies to agencies created after June 9, 2000.Jun 5, 2018

Does power of attorney need to be notarized?

If a person wants to authorise someone to act as a power of attorney on his behalf, it must be signed and notarised by a certified notary advocate, who is able to declare that you are competent at the time of signing the document to issue the said power of attorney.

How long does it take for power of attorney?

How long does it take to get a PoA registered? It usually takes 8 to 10 weeks for The Office of the Public Guardian to register a power of attorney, so long as there are no mistakes on the form. It may take longer if there are issues they want to look into, although this is rare.

How do I send documents to the IRS?

Visit www.taxpayeradvocate.irs.gov or call 877-777-4778. Complete this form, and mail or fax it to us within 30 days from the date of this notice.

Where do I fax IRS forms?

Fax: (855) 215-1627 (within the U.S.)Feb 8, 2022

Can IRS form 2848 be signed electronically?

As long as you can create a Secure Access account and follow authentication procedures, you may submit a Form 2848 or 8821 with an image of an electronic signature.

Does Illinois recognize out of state power of attorney?

Uniform Power of Attorney Act It is best to consult a Power Of Attorney lawyer to make sure that if you are the agent of a POA, or you want to grant POA authority to someone, your Illinois POA will be recognized in another state where you own property or other assets or have business interests.

Can family members witness a power of attorney?

An attorney's signature must also be witnessed by someone aged 18 or older but can't be the donor. Attorney's can witness each other's signature, and your certificate provider can be a witness for the donor and attorneys.Aug 26, 2021

Who can witness the signing of a power of attorney?

Witnessing the attorney's signature on a power of attorney Here are the rules on who can witness a lasting power of attorney this time: The witness must be over 18. The same witness can watch all attorneys and replacements sign. Attorneys and replacements can all witness each other signing.

Durable Power of Attorney Illinois Form – Adobe PDF

The Illinois durable power of attorney form enables the principal (individual creating the form) to assign an agent to oversee their finances and make decisions on their behalf. Because the form is durable, the agent will be able to operate even when the principal is unable to make decisions for herself (as determined by a licensed physician).

General Power of Attorney Illinois Form – Adobe PDF

The Illinois general power of attorney is a document that transfers authority to an agent to act on behalf of the principal (individual creating the document) so long as the principal can make decisions for themselves.

Limited Power of Attorney Illinois Form – Adobe PDF

The Illinois limited power of attorney form provides a resident with the opportunity to transfer limited financial powers to another individual (referred to as an attorney-in-fact or agent). The selected representative will be able to act on behalf of the resident for the completion of a singular, agreed upon act.

Medical Power of Attorney Illinois Form – Adobe PDF

The Illinois medical power of attorney form enables an individual to designate someone as their health care agent. This agent will be able to make health care related decisions on behalf of the individual when they have lost the ability to communicate their wishes.

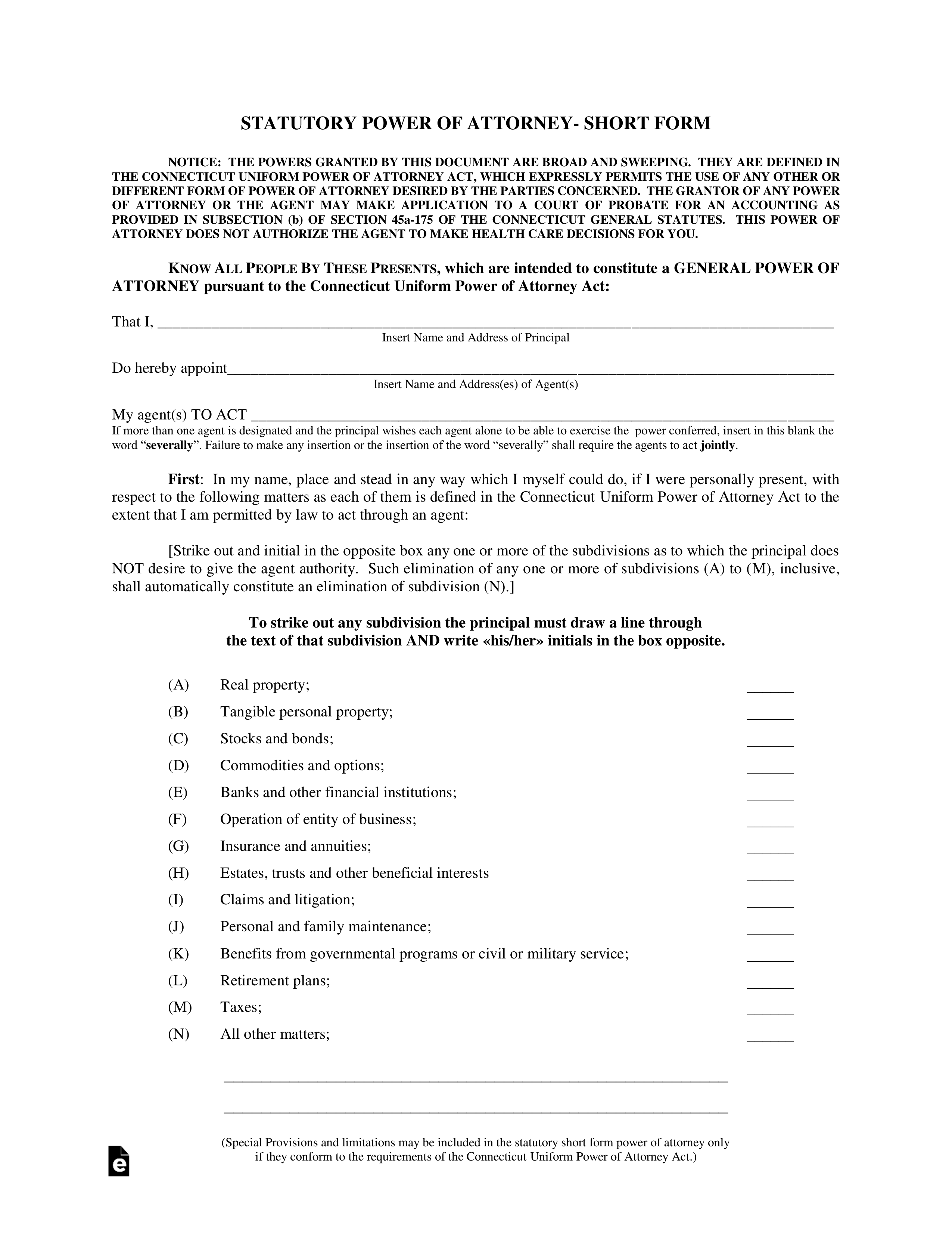

What is a short form power of attorney in Illinois?

Illinois Statutory Short Form Power of Attorney for Health Care. The State of Illinois recognizes the right of adults to control all aspects of his or her personal care and medical treatment, including the right to decline medical treatment or to direct that it be withdrawn, even if death ensues.

What is a report form for a ward?

A report form detailing the ward’s condition, living arrangement, and services provided should be filed annually with the court. The form may be attached to the most recent care plan.

What is an advance directive?

Advance Directives. Declaration For Mental Health Treatment. An adult of sound mind may put into writing his or her preferences regarding future mental health treatment. The preferences may include consent or refusal of mental health treatment and may be stated on the forms provided.

What is successor guardianship?

Successor Guardianship. A petition and order are provided to assist in naming a successor guardian upon the death, resignation or removal of a guardian. Death of a Ward. Guardianship terminates upon death of the ward. A petition to notify the court of the ward’s death and close the guardianship case is attached.

Can you refer to a statute without consulting?

Any statutes, references to case law, or other references to the law should not be relied upon without first consulting with a skilled attorney who is knowledgeable in the particular area of law.

Popular Posts:

- 1. who isdistrict attorney in natchitoches la

- 2. what is the confirmation process for attorney general

- 3. how to change power of attorney for someone that is deceased in virginia

- 4. how to to tell if denton county district attorney

- 5. how do i find the best criminal attorney in houston

- 6. who was the first females african american american attorney gnereal

- 7. how cani find out if an attorney is licensed in virginia

- 8. do i still have power of attorney for my ex spouse who is now in emergency hospital

- 9. what is a plantiff or defense attorney

- 10. how do i get money for a educational attorney ct