Submit your Form 2848 securely at IRS.gov/Submit2848. Fax. Fax your Form 2848 to the IRS fax number in the Where To File Chart. Mail. Mail your Form 2848 directly to the IRS address in the Where To File Chart.

Full Answer

What can you do with a power of attorney?

Dec 17, 2019 · A Power of Attorney (POA) is a legal document authorizing someone to represent you. You, the taxpayer/grantor, must complete, sign, and return this form if you want to grant power of attorney to an accountant, tax return preparer, attorney, family member, or anyone else to act on your behalf with the Idaho State Tax Commission.

What is power of attorney forms?

o Provisions can limit “agents” power; examples could be simply deeming the agent responsible for your real property or healthcare. • How to fill out power of attorney form? o Idaho Legal Aid has an interactive online form (listed below). o Designate your …

What is a standard power of attorney?

IDAHO STATUTORY FORM POWER OF ATTORNEY - 3 55555.0056.2410066.2 4. Grant of Specific Authority (Optional). My agent MAY NOT do any of the following specific acts for me UNLESS I have INITIALED the specific authority listed below:

What is statutory power of attorney?

Mar 04, 2021 · Power of Attorney Revocation Form - Use this template to create a form that will revoke a power of attorney you currently have in place but want to cancel. Demand for Accounting by Agent Letter - Use this template to create a letter asking your agent (the person you gave your power of attorney to) to make an accounting of their actions on your ...

How do I file a power of attorney in Idaho?

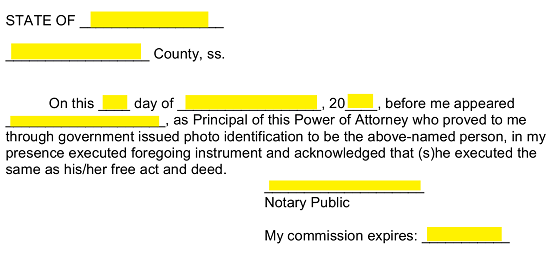

Steps for Making a Financial Power of Attorney in IdahoCreate the POA Using a Statutory Form, Software, or Attorney. ... Sign the POA in the Presence of a Notary Public. ... Store the Original POA in a Safe Place. ... Give a Copy to Your Agent or Attorney-in-Fact. ... File a Copy With the Recorder's Office.More items...

How long is a power of attorney good for in Idaho?

The agent's authority will continue until your death unless you revoke the power of attorney or the agent resigns. Your agent is entitled to reasonable compensation unless you state otherwise in the Special Instructions. This form provides for designation of one (1) agent.

Does power of attorney need to be notarized in Idaho?

In Idaho, a durable power of attorney may not necessarily need to be signed in front of a notary public when executed by the principal. A power of attorney does not need to be recorded unless it is being used in connection with a real estate transaction.Jan 5, 2022

Do I need to register my power of attorney?

In order for a Lasting Power of Attorney to be valid and be used by the Attorney it must be registered. With a Property and Affairs Lasting Power of Attorney, once it has been successfully registered it can be used straight away.

Can you name more than one agent?

This form provides for designation of one (1) agent. If you wish to name more than one (1) agent, you may name a coagent in the Special Instructions. Coagents are not required to act together unless you include that requirement in the Special Instructions.

Can a power of attorney be used to make health decisions?

This power of attorney does not authorize the agent to make health care decisions for you. You should select someone you trust to serve as your agent. The agent’s authority will continue until your death unless you revoke the power of attorney or the agent resigns.

What is the Idaho Consumer Protection Act?

The Idaho Consumer Protection Act prohibits commercial sellers from engaging in unfair competition and unfair and deceptive business practices in trade and commerce. The Attorney General enforces the Act and may file civil actions on behalf of the State of Idaho in situations of statewide significance.

How to contact Consumer Protection?

If you want to report a problem with a business, telephone solicitor or charitable entity instead, please submit a Complaint Form or call our office at 208-334–2424, or toll–free at 800-432–3545.

What is a power of attorney in Washington?

Create Document. A power of attorney form used by an individual (“principal”) to appoint someone else to handle their affairs (“agent” or “attorney-in-fact”). The agent is able to handle financial, medical, guardianship, or tax-related matters during the principal’s lifetime. If the form is durable, ...

What is a Durable Power of Attorney?

View and read the Types of Power of Attorney in order to get a better understanding of which form (s) are best. The most common is the Durable Power of Attorney for financial purposes and allows someone else to handle any monetary or business-related matter to the principal’s benefit.

What is an agent in fact?

An agent, also known as an Attorney-in-Fact, is the individual that will be making the important decisions on your behalf. This individual does not need to be an attorney, although an attorney can be your agent. The two (2) most important qualities you should look for in your agent is accountability and trust.

Who will keep forms after signing?

These forms are not filed with any government agency or office so it will be up to each individual to securely maintain the form until it is needed.

What is banking banking?

Banking – To be able to deposit or withdraw funds in addition to conducting any type of financial transaction that the principal could also do themselves. Upon initials being placed on this line, the agent will have the full capacity to

Popular Posts:

- 1. how much attorney cost to draft deed to intervivos

- 2. who elects the missouri state attorney general

- 3. what does a attorney do for a private practice

- 4. when your attorney manipulates you

- 5. how long should an attorney keep file florida

- 6. is there a way to find out which attorney was used for state planning

- 7. what pi attorney prevails the most in pitkin county

- 8. what are the responsibilities of a medical power of attorney?

- 9. how do you get pay back on a attorney that has screw you over

- 10. who can be a us attorney general