While your Power of Attorney will need to be notarized in Alabama due to Alabama’s different laws governing PoA forms, it will be allowed in other states. Your power of attorney must be submitted to be recorded or filed with your local county upon confirmation that a professional in charge of real estate transaction will be competent.

Full Answer

Where can I get a power of attorney form in Alabama?

Jan 27, 2022 · Ronald. Select the right agent for obtaining an Alabama power of attorney form. Those who own your company need to be over the age of 18, must have the ability to act for you, must be willing to do the right thing, and must be fit for duty. Do your duty to your agent. Your agent is solely responsible for what he or she does.

What is the Alabama Power of attorney form 2848a?

Mar 05, 2021 · Download the Alabama DOR POA at the bottom of this page and enter your business information in the following order: Company Name. Account Number (make sure you have applied for the Alabama Dept. of Labor) Type of Entity. Federal Employment Identification Number (12-3456789) Address. The Owner/operator will need to sign at the bottom of the form.

How do you prepare a power of attorney form?

Dec 21, 2021 · Updated December 21, 2021. An Alabama power of attorney allows an individual to designate someone else, an “agent”, to handle important decisions on their behalf. This form is most commonly used by a person who would like to have an agent represent them if they are not able to for health reasons, not being able to appear at a specified location, or when time …

How do I request a power of attorney or tax information authorization?

Steps for Making a Financial Power of Attorney in Alabama. 1. Create the POA Using a Statutory Form, Software, or Attorney. Alabama offers a statutory form (a form drafted by the state legislature) with blanks that you can fill out to create your POA. For a more user-friendly experience, you can try a software program like WillMaker, which ...

Where do I mail my Alabama 40NR?

Individual IncomeFormMaking a PaymentCurrent Form 40A- Individual Income Tax Return (Short Form)Alabama Department of Revenue P. O. Box 2401 Montgomery, AL 36140 -0001Current Form 40NR – Individual Income Tax Return (Nonresidents)Alabama Department of Revenue P. O. Box 2401 Montgomery, AL 36140 -00016 more rows

Does power of attorney have to be notarized in Alabama?

While Alabama does not technically require you to get your POA notarized, notarization is very strongly recommended. Under Alabama law, when you sign your POA in the presence of a notary public, you signature is presumed to be genuine—meaning your POA is more ironclad.

How do you get power of attorney in Alabama?

How To Get an Alabama Financial Power of Attorney FormChoose an agent. Your agent must be over age 18 and willing and able to act in your best interests. ... Assign duties to your agent. Your agent's duties depend entirely on you. ... Hire a notary public. ... Distribute copies. ... Revoking a Financial Power of Attorney.Jan 24, 2022

Where do I send my Alabama state tax return?

If you are not making a payment, mail your return to: Alabama Department of Revenue P.O. Box 154 Montgomery, AL 36135-0001.Jun 7, 2019

Does power of attorney need to be notarized?

If a person wants to authorise someone to act as a power of attorney on his behalf, it must be signed and notarised by a certified notary advocate, who is able to declare that you are competent at the time of signing the document to issue the said power of attorney.

How long does a power of attorney take?

How long does it take to get a PoA registered? It usually takes 8 to 10 weeks for The Office of the Public Guardian to register a power of attorney, so long as there are no mistakes on the form. It may take longer if there are issues they want to look into, although this is rare.

Can you do a power of attorney yourself?

Some types of power of attorney also give the attorney the legal power to make a decision on behalf of someone else such as where they should live or whether they should see a doctor. In order to make a power of attorney, you must be capable of making decisions for yourself.

What is power of attorney in Alabama?

A power of attorney (“POA”) is a written instrument by which one person (the “principal”) grants to another person or persons (the “agent” or “attorney-in-fact”) authority to act for and in the place of the principal. Alabama POAs executed on or after January 1, 2012 are governed by the Act.Oct 29, 2013

What is a durable power of attorney in Alabama?

A durable power of attorney (POA) allows a person (agent, usually denominated as attorney-in-fact) to conduct your affairs if you are not present or not able. Durable means it is not terminated by the principal's incapacity.Feb 15, 2019

Do I need to send a copy of my federal return with my Alabama state return?

You do not need to send copies of your state returns with your Federal return. Many states require that you send a copy of your Federal return with your state return. TT will usually print out the Federal return with the state return if this is needed. Yes, you can staple your W-2 to your return.Jun 7, 2019

Where should I mail my 2019 tax return?

Where to Mail A 2019 Tax ReturnFormNo Payment Attached1040Department of the Treasury Internal Revenue Service Kansas City, MO 64999-00021040XDepartment of the Treasury Internal Revenue Service Kansas City, MO 64999-00521040NRDepartment of the Treasury Internal Revenue Service Austin, TX 73301-0215 USA66 more rows

What is Alabama form 40nr?

You must complete your U.S. income tax return first, before you can prepare the Alabama tax return. The UA Tax Office usually hosts several tax seminars with the Alabama Department of Revenue to assist nonresident aliens with filing the Alabama tax return.

Why is this important?

OnPay works with government entities on your behalf, reporting new hires to state labor departments, calculating tax rates, paying taxes and insurance contributions, and filing financial reports. To do this effectively, you will need to grant us Power of Attorney for each state where your company has a tax obligation.

Alabama Department of Revenue

Download the Alabama DOR POA at the bottom of this page and enter your business information in the following order:

Alabama Department of Labor

Download and print the Alabama DOL POA at the bottom of this page and complete the following information:

Returning your completed form

Email your completed Power of Attorney form [email protected]. If you have any questions, call us at (877)-328-6505. We'd love to help!

Download these forms to get started

Nothing in this article and/or information is intended or should be construed, as legal, tax or investment advice, or a legal opinion.

What is power of attorney in Alabama?

Alabama power of attorney is for individuals who would like to designate someone else, the “agent”, to handle decisions on their behalf.

How long can a parent have a power of attorney?

Parental (Minor Children) Power of Attorney – A parent may, for a period of no more than one (1) year, allow another person to care and make decisions for their minor son (s) or daughter (s). Signing Requirements: Notary public.

What Types of Power of Attorneys Are Available in Alabama?

You can make several different types of POAs.

What Are the Legal Requirements of a Financial POA in Alabama?

Alabama requires that the person making a power of attorney be of sound mind. In other words, the person must be " able to understand and comprehend his or her actions." (Troy Health and Rehabilitation Center v. McFarland, 187 So.3d 1112 (Ala.

Steps for Making a Financial Power of Attorney in Alabama

Alabama offers a statutory form (a form drafted by the state legislature) with blanks that you can fill out to create your POA. For a more user-friendly experience, you can try a software program like WillMaker, which guides you through a series of questions to arrive at a POA that meets your specific aims and is valid in your state.

Who Can Be Named an Agent (Attorney-in-Fact) in Alabama?

Legally speaking, you can name almost any competent adult to serve as your agent.

When Does My Durable Financial POA Take Effect?

In Alabama, unless you've explicitly stated otherwise in the document, your durable financial power of attorney takes effect as soon as you've signed it before witnesses and a notary public.

When Does My Power of Attorney End?

Any power of attorney automatically ends at your death. A durable POA also ends if:

What is the power of attorney act in Alabama?

The Alabama Uniform Power of Attorney Act governs the creation of power of attorney documents.

What is a power of attorney?

A power of attorney is an important estate planning document. It authorizes a person to make decisions on your behalf, and can be drafted so that your agent can continue to make decisions about your finances and healthcare if you are no longer able to make those decisions yourself. There are several types of powers of attorney to consider.

How long does a power of attorney last?

For example, you can specify that the document authorizes your agent to handle a specific business transaction, and that the power expires after 3 days. Consider a durable power of attorney. A durable power of attorney lasts after you become unable to make decisions ...

How to revoke a power of attorney?

Make sure you sign and date the revocation. You can also revoke your power of attorney by burning, tearing, defacing, or destroying the original.

What to do if your agent is responsible for making business decisions?

If your agent will be responsible for making business decisions on your behalf, you may need to educate your agent on the workings of the business and your plans for the future of the business.

How old do you have to be to be an agent in Alabama?

The person to whom you give authority to manage your affairs is known as your "agent" or "attorney in fact.". The age of majority in Alabama is 19, so make sure that your designated agent is at least 19 years old.

When does a durable power of attorney end?

A durable power of attorney ends upon your death, or the death of your agent, if there is no successor agent. If your agent is your spouse, the document will be revoked if either of you file for separation, annulment, or divorce, unless the document states otherwise.

What is a power of attorney in Alabama?

An Alabama real estate power of attorney allows someone else to handle responsibilities related to their property. This is most commonly used when selecting an attorney to handle a real estate closing but may also be used to refinance or manage tenants on a property.

What is an advance directive in Alabama?

An Alabama advance directive, which includes a medical power of attorney and a living will, which allows a person to handle another’s health care decision making in the chance the Principal cannot do so for themselves.

What is durable power of attorney?

The term “durable” refers to the designation that if the principal can no longer make decisions for themselves that their selected agent will be able to act on their behalf.

What is the meaning of power of attorney in Alabama?

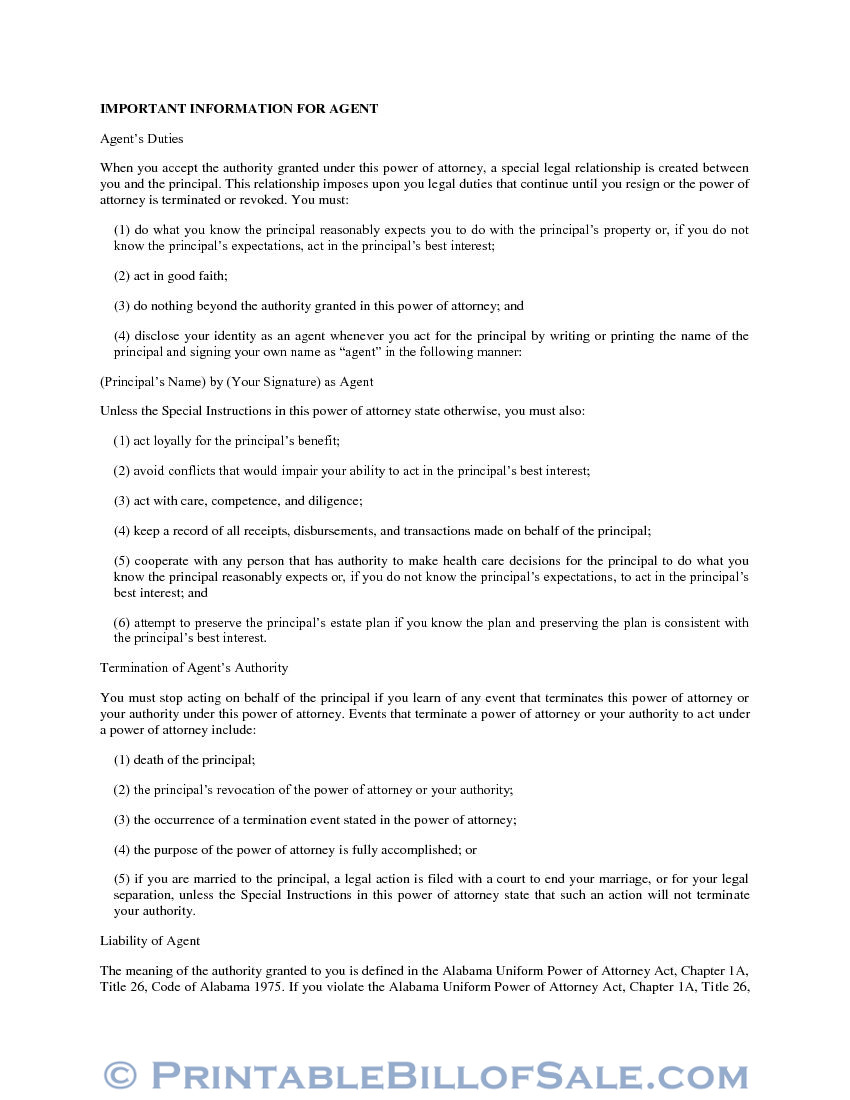

The meaning of the authority granted to you is defined in the Alabama Uniform Power of Attorney Act, Chapter 1A, Title 26, Code of Alabama 1975 . If you violate the Alabama Uniform Power of Attorney Act, Chapter 1A, Title 26, Code of Alabama 1975, or act outside the authority granted, you may be liable for any damages caused by your violation.

What happens when you accept a power of attorney?

When you accept the authority granted under this power of attorney, a special legal relationship is created between you and the principal. This relationship imposes upon you legal duties that continue until you resign or the power of attorney is terminated or revoked. You must:

Popular Posts:

- 1. how to request attorney fee refund?

- 2. in what state should i use the power of attorney form

- 3. ns when a court revokes a power of attorney

- 4. when a client threatens not to pay you attorney

- 5. how to find right attorney for paternity and inheritance

- 6. how to address a attorney

- 7. how many weeks notice to give attorney

- 8. who is alexander county nc county attorney

- 9. how to find if an attorney has been disciplined in oklahoma

- 10. what do a state attorney makes