A. A power of attorney must always be signed in front of a notary public. If you wish, it can be recorded at the county register of deeds office in North Carolina where it is to be used.

Full Answer

Where do I get a financial power of attorney in Florida?

A lasting power of attorney must be registered with the Office of the Public Guardian. The donor can register it or one of the attorneys. You may have made the lasting power of attorney using a paper form (LP1F or LP1H), or by using the government’s online service. The process is slightly different in each case.

How do I register a power of attorney?

Apr 22, 2011 · A Power of Attorney, like a Trust, does not need to be registered or recorded in the public records in order to be effective. It does have to be in writing, signed, witnessed and notarized. However, once your agent is appointed via a valid Power of Attorney, he or she simply has to present the document at the institution where business is to be transacted on your behalf.

Do I need a financial power of attorney?

May 11, 2021 · Financial Power of Attorney: How It Works. A durable financial power of attorney can avoid financial disaster in the event you become incapacitated. You can also use a POA to allow someone to transact business for you if you are out of town or otherwise unavailable.

Do you have to register a last power of attorney?

A Financial Power of Attorney is a component of your Estate Plan that ensures financial matters in your estate and are handled appropriately and responsibly. Knowing that your financial responsibilities, investments, retirement, bills and everything else in your financial world is in good hands can be a great source of comfort.

How does a financial POA get activated?

When is a power of attorney activated?If it's a health and welfare LPA, you can only activate it if the donor (that's the person who made the LPA) has lost mental capacity and can't make their own decisions.If it's a property and financial LPA, you may be able to activate it as soon as it's registered.

Does power of attorney need to be recorded?

A Power of Attorney, like a Trust, does not need to be registered or recorded in the public records in order to be effective. It does have to be in writing, signed, witnessed and notarized.Apr 22, 2011

How do I activate a power of attorney in Ontario?

You can make a power of attorney document yourself for free or have a lawyer do it. To make a power of attorney yourself, you can either: download and complete this free kit. order a print copy of the free kit online from Publications Ontario or by phone at 1-800-668-9938 or 416-326-5300.

How do I file a power of attorney in NY?

Here are the basic steps to make your New York power of attorney:Decide which type of power of attorney to make. ... Decide who you want to be your agent. ... Decide what authority you want to give your agent. ... Get a power of attorney form. ... Complete the form, sign it, and have it witnessed and notarized.More items...•Oct 22, 2021

Does a power of attorney need to be recorded in NY?

SHOULD MY NEW YORK DURABLE POWER OF ATTORNEY BE RECORDED AT THE COUNTY CLERK'S OFFICE? It is usually unnecessary to record the power of attorney. Only if a deed or other document is being recorded with the agent's signatures. ... Filing a document in the County Clerk's office makes it a public document.

What three decisions Cannot be made by a legal power of attorney?

You cannot give an attorney the power to: act in a way or make a decision that you cannot normally do yourself – for example, anything outside the law. consent to a deprivation of liberty being imposed on you, without a court order.

Is a power of attorney valid if not registered?

Contrary to the Lasting power of attorney (LPA), the enduring power of attorney (EPA) does not need to be registered in order to give your attorney(s) the authority to act on your behalf. Your attorney(s) are duly authorised to act on your behalf as soon as the EPA has been properly signed.

How do I activate a power of attorney in Canada?

Talk to the person you've chosen as attorney to make sure they're willing to be your attorney. If they are, talk to them about their duties. Make sure that they're aware of your wishes. Remind the attorney that they're legally obligated to always act in your best interest, not their own.Nov 20, 2017

How long does it take to activate power of attorney?

How long does it take to get a PoA registered? It usually takes 8 to 10 weeks for The Office of the Public Guardian to register a power of attorney, so long as there are no mistakes on the form. It may take longer if there are issues they want to look into, although this is rare.

Where can I get a power of attorney form in Ontario?

Copies of the Power of Attorney Kit can be obtained from:The Ministry of the Attorney General.any Office of the Public Guardian and Trustee.by calling 1-800-366-0335, (416) 314-2800 in Toronto.your Member of Provincial Parliament (MPP)Oct 29, 2015

How much does a power of attorney cost in NY?

How much does a Power of Attorney cost in NY? The cost of finding and hiring a lawyer to create a Power of Attorney could be between $200 and $500.

Where do I send my NYS POA 1?

Fax to:518-435-8406Mail to:NYS TAX DEPARTMENT POA CENTRAL UNIT W A HARRIMAN CAMPUS ALBANY NY 12227-0864Feb 2, 2022

How do you complete a power of attorney?

How to Fill Out a Power of AttorneyChoose an agent. Before you begin to fill out the form, you have some decisions to make. ... Decide on the type of authority. You can choose whether you want your POA to be broad or narrow. ... Identify the length of time the POA will be in effect. ... Fill out the form. ... Execute the document.

What documents do you need for power of attorney?

Donor – Person Making The Power Of AttorneyAddress.Date of birth.Contact telephone number.Email address.Whether you want to make a Property and Affairs Lasting Power of Attorney or Health and Welfare Lasting Power of Attorney.

Can a power of attorney transfer money to themselves?

Attorneys can even make payments to themselves. However, as with all other payments they must be in the best interests of the donor. ... Gifts can be on occasions such as births, marriages, birthdays, or anniversaries etc., and only to those people who are closely connected with the donor.

Who can notarize a power of attorney?

In order to do that, the person signing the power (the grantor) must normally meet in person with a notary public who will certify the identity and signature of the grantor, and make sure that the document is executed properly.Jan 20, 2016

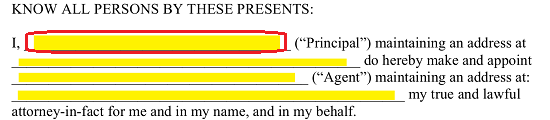

What is a POA?

What Is Power of Attorney? A power of attorney (or POA) is a legal document that authorizes someone to act on your behalf. The person who gives the authority is called the "principal," and the person who has the authority to act for the principal is called the "agent," or the "attorney-in-fact.".

How does a POA work?

Financial Power of Attorney: How It Works. A durable financial power of attorney can avoid financial disaster in the event you become incapacitated. You can also use a POA to allow someone to transact business for you if you are out of town or otherwise unavailable. If you need to give another person the ability to conduct your financial matters ...

When does a POA become effective?

When Does a Power of Attorney Become Effective? Depending upon how it is worded, a POA can either become effective immediately, or upon the occurrence of a future event. If the POA is effective immediately, your agent may act on your behalf even if you are available and not incapacitated. This is done when someone can’t be present ...

Do banks have power of attorney?

Many states have an official durable power of attorney form, which is usually a durable financial power of attorney form. Some banks and brokerage firms have their own power of attorney forms. Also, for buying or selling real property, a title insurance company, lender or closing agent may require the use of their form.

What is financial power of attorney?

What Is a Financial Power of Attorney? A financial power of attorney is a particular type of POA that authorizes someone to act on your behalf in financial matters. Many states have an official financial power of attorney form.

When does a POA end?

The authority conferred by a POA always ends upon the death of the principal. The authority also ends if the principal becomes incapacitated, unless the power of attorney states that the authority continues. If the authority continues after incapacity, it is called a durable power of attorney (or DPOA). In cases of incapacity, a DPOA will avoid ...

Can a third party accept a POA?

The big question about any POA is will a third party accept it? Generally, a third party is not required to accept a power of attorney. However, some state laws provide for penalties for a third party who refuses to accept a power of attorney using the state’s official form. One thing you can do to help assure its acceptance is contact anyone you think your agent may need to deal with and be sure they find your POA acceptable.

What is a Financial Power of Attorney?

A Financial Power of Attorney is the part of your Estate Plan that allows you to grant authority to someone you trust to handle your financial matters. Your Financial POA (also known as an Attorney-in-Fact) can step in when and if you’re ever unable to make financial decisions on your own due to incapacitation, death or absence.

What is a Durable Financial Power of Attorney?

A Durable Financial Power of Attorney is just the term used that denotes someone can act even after you become incapacitated and can’t express your will or make decisions. It’s not uncommon to wonder what powers does a Durable Power of Attorney have - and we’ll cover that in a bit.

How to Choose a Financial Power of Attorney

Choosing your Financial POA can be a bit daunting, but you want to take the time to make sure you’re confident with your decision and that you trust the person you name. In the long run, it will be well worth the time you’ll spend deciding.

Why do I Need a Financial Power of Attorney?

A Financial Power of Attorney is a component of your Estate Plan that ensures financial matters in your estate and are handled appropriately and responsibly. Knowing that your financial responsibilities, investments, retirement, bills and everything else in your financial world is in good hands can be a great source of comfort.

Notify people

Before you register, send a form to notify people (LP3) to all the ‘people to notify’ (also called ‘people to be told’) you listed in the LPA.

How much it costs

It costs £82 to register each LPA unless you get a reduction or exemption.

If you make a mistake on your form

Depending on the type of mistake, OPG may let you correct it and apply again within 3 months for £41.

Durable (Financial) Power of Attorney Florida Form – PDF Template

A Florida durable power of attorney form is used by a principal seeking to choose an agent to handle financial transactions on their behalf. This is common for senior citizens that elect family members to handle their banking, taxes, and real estate.

General Power of Attorney Florida Form – PDF – Word

The Florida general power of attorney form allows for the same rights for an agent as the durable, which is to act in the principal’s best interest for any financial matter legal within the State.

Limited Power of Attorney Florida Form – PDF – Word

The Florida limited power of attorney form provides an agent with the authority to handle a specific financial decision or transaction on behalf of the principal. The task can range from representing the person at a real estate closing to withdrawing money from his or her bank account.

Medical Power of Attorney Florida Form – PDF Template

The Florida medical power of attorney form, referred to as the Designation of Health Care Surrogate, is a document that enables an individual to select their health care representative to prepare for a circumstance in which they are unable to effectively communicate their wishes.

Minor (Child) Power of Attorney Florida Form – PDF – Word

The Florida minor (child) power of attorney form enables a parent to choose a representative and provide them with specific, temporary parental authority. The individual chosen for this position will serve as the child’s caregiver and act on the parent’s behalf.

What is a power of attorney in Florida?

What is a power of attorney? According to the Florida Bar, a power of attorney is a legal document delegating authority from one person to another. In the document, the maker of the Power of Attorney (the “principal”) grants the right to act on the maker’s behalf as their agent. What authority is granted depends on the specific language ...

Who is Persante Law Group?

The Persante Law Group brings actions against brokers and broker-dealers. If you believe that you may need legal assistance regarding a Florida securities litigation matter, please contact us at (727) 796-7666.

What powers does an agent have?

Under the following super powers, an agent can: With respect to a trust created by or on behalf of the principal, amend, modify, revoke, or terminate the trust, but only if the trust instrument explicitly provides for amendment, modification, revocation, or termination by the settlor's agent;

How to act in good faith?

Act in good faith. Act loyally for the sole benefit of the principal. Act so not to create a conflict of interest that impairs the agent’s ability to act impartially to the principal’ s best interest. Act with care, competence, and diligence originally exercised by agents in similar circumstances.

Can an agent exercise power of attorney?

There are many different types of authority that can be delated to the agent, but it is important to know that the agent can only exercise authority that is specifically granted to the agent in the power of attorney and any authority reasonably necessary to give effect to that express grant of specific authority.

What is the job of a principal?

Perform duties under a contract that requires the exercise of personal services of the principal; Make any affidavit as to the personal knowledge of the principal; Vote in any public election on behalf of the principal; Execute or revoke any will or codicil for the principal; or.

What is a guardian in a trust?

A guardian, conservator, trustee, or other fiduciary acting for the principal or the principal's estate. A person authorized to make health care decisions for the principal if the health care of the principal is affected by the actions of the agent.

What is a power of attorney in Florida?

A power of attorney is a legal document that gives a person, called an "agent," the authority to act on behalf of another individual, called the "principal.". Some other helpful terms are:

How old do you have to be to be a trust agent in Florida?

Under Florida law, your agent must be either a person who is at least 18 years of age or a financial institution that has "trust powers," a place of business in Florida, and is authorized to conduct trust business in Florida.

How many witnesses are needed to sign a power of attorney in Florida?

In order to be effective, a Florida power of attorney must be signed by the principal and by two witnesses, and be notarized. In the event the principal is physically unable to sign, the notary public may sign the principal's name on the document.

What is a POA?

A POA that gives the agent a broad range of powers to conduct all types of financial transactions. Limited or special power of attorney. A POA that limits the authority of the agent to a single transaction, certain types of transactions, or to a certain period of time. Durable power of attorney. A power of attorney that is not terminated by ...

Is a last will and testament the same?

State Requirements for a Last Will. A last will and testament basically has the same function no matter where you live, but there may be state variations. That's why it's important to abide by state regulations when filling out your will or you may have an invalid will.

What is Durable Power of Attorney?

Durable power of attorney. A power of attorney that is not terminated by the principal's incapacity. Springing power of attorney. A power of attorney that does not become effective unless and until the principal becomes incapacitated. Incapacity or incapacitated.

Popular Posts:

- 1. who is the san francisco district attorney-- phone number

- 2. how long does a statutory durable power of attorney last

- 3. how to change attorney of record

- 4. what does it involve to be power of attorney for someone?

- 5. what documents do you need for power of attorney

- 6. how many attorney generals

- 7. why does seller have to sign power of attorney on car sale

- 8. attorney in seattle who sued avvo for his rating and was outed by

- 9. who is deputy peter peraza attorney

- 10. what do they call an attorney that represents the suspect