- Determine your state's requirements. ...

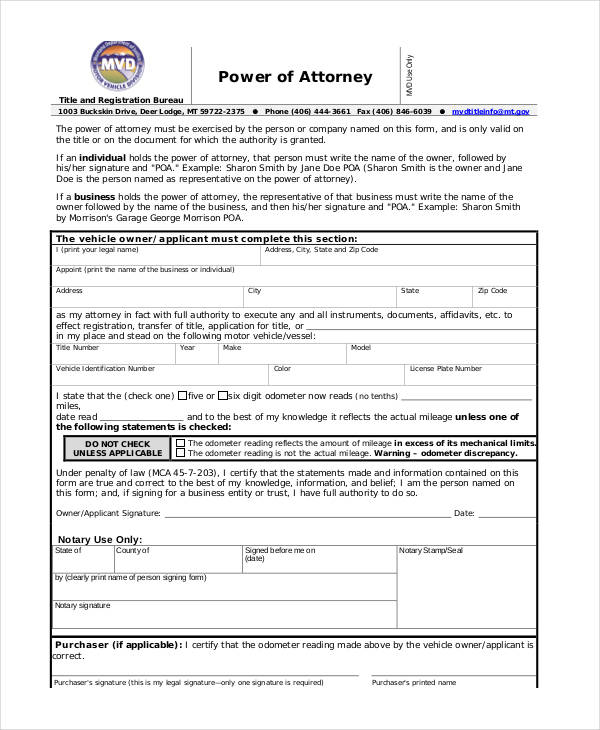

- Obtain a power of attorney form from your state. ...

- Purchase forms locally or from a reputable online legal service.

What is a power of attorney?

A power of attorney is a legal document giving a person (known as the agent or attorney-in-fact) broad powers to manage matters on behalf of anothe...

Are there different types of power of attorney documents?

Yes. A power of attorney can be durable or non-durable. A durable power of attorney remains effective after the principal becomes incapacitated whi...

What are the most common reasons for needing a power of attorney?

Executing a power of attorney document may be helpful in a variety of ways. The power of attorney can permit an agent to act on the principal’s beh...

Is a person being a co-owner the same as that person having power of attorney?

In a joint account ownership situation,. any co-owner has full access to the account, including the ability to make withdrawals and pay bills. If o...

Is a person being a trusted contact the same as that person having power of attorney?

No. A trusted contact is an individual age 18 or older who is identified by you as someone we’re able to contact about your account for any of the...

I’m a trustee on a trust account. Can I use a power of attorney to name an agent to act on the trust...

A delegation of a trustee’s power may be subject to state laws and limitations in the trust agreement. Consult with your legal advisor to determine...

Is an account with an agent appointed in a power of attorney the same thing as an account with one o...

No. Sometimes referred to as a Totten trust or an in trust for (ITF) account, a payable on death (POD) account is an account ownership type in whic...

Does an agent have the same authority as a POD (payable on death) beneficiary?

No. Once a power of attorney document is executed and accepted by the bank and the agent is added to the account, the agent is authorized to act on...

What is a power of attorney?

A power of attorney is a legal document that allows someone (the principal) to give another person (the agent) the legal power to make decisions on the principal's behalf. An agent is sometimes called an attorney-in-fact or a health care proxy when the power of attorney concerns health care. An agent must be an adult.

When does a springing power of attorney become effective?

A springing power of attorney only becomes effective if the principal becomes incapacitated. If you want your agent to have powers over your finances or health care only when you cannot make your own decisions, you could use a springing power of attorney.

What happens if a power of attorney is not durable?

In some states, if your power of attorney does not have language that it is durable, it will be an ordinary power of attorney and your agent's power will cease if you are in a coma or lack the mental ability to make decisions for yourself.

Can you use a power of attorney for health care?

Power of Attorney for Health Care. If you want someone to make decisions about your health care when you are incapacitated, you can use a power of attorney for health care. This is different from a living will and does not allow your agent to make decisions that contradict your living will. A living will tells doctors what treatment you want at ...

Can a power of attorney be revoked?

However, some states require an agent to sign an acceptance or acknowledgment of the power of attorney before acting on behalf of the principal. Barring incapacity, a principal can always revoke a power of attorney.

Can an agent be paid?

An agent must be an adult. Your agent can be paid, like if you choose a professional like an attorney or accountant, or unpaid, which is usually the case with close family members. You can choose two or more co-agents but be careful because it could create disagreements and the need to go to court.

Can a principal revoke a power of attorney?

Barring incapacity, a principal can always revoke a power of attorney. If you revoke a power of attorney, you should do so in writing and give copies of the revocation to your agent and any businesses or organizations that the agent has dealt with on your behalf. An agent's powers will not survive the principal's death.

How to obtain a power of attorney?

1. Determine your state's requirements. State statutes authorize power of attorney forms. Many states' laws follow the Uniform Power of Attorney Act.

What is a power of attorney?

Power of attorney forms are common estate-planning tools used to authorize someone else to handle some or all of your financial affairs. If you create these tools and later become incapacitated or otherwise unable to make decisions, a durable power of attorney can give a loved one or other trusted individual the authority to handle your affairs ...

Is a power of attorney dangerous?

Power of attorney forms are valuable, but they can be dangerous in the wrong hands. Before you create these forms, evaluate your options for whom to name as your attorney-in-fact (your agent). Choose someone you believe will act with your best interests in mind.

Can an estate planning attorney make a power of attorney?

Finally, an estate planning attorney licensed to practice law in your jurisdiction can also create a valid power of attorney document for you. If your situation is complex or if you have questions about the scope of your power of attorney, working with a lawyer can provide valuable peace of mind. When you work with an attorney, you can generally expect to receive a professional-looking document. In addition, attorneys usually assist with the legal formalities to make the form valid. This eliminates the need to locate witnesses or a notary public on your own.

How to choose a power of attorney?

Step 1 – Choose an Agent. Select and ask someone that you trust if they would like to be your “Agent” or “Attorney-in-Fact”. Especially for a durable power of attorney, the agent selected should be someone you have trusted most of your life.

What is a power of attorney?

Power of attorney is a legal document that allows an individual (known as the “Principal”) to select someone else (“Agent” or “Attorney-in-Fact”) to handle their business affairs, medical responsibilities, or any decision that requires someone else to take over an activity based on the Principal’s best interest and intentions. ...

How many witnesses do you need for a notary?

In most cases, a Notary Public will need to be used or Two (2) Witnesses. STATE. DURABLE.

Can a principal use a power of attorney?

For other nominations, a principal may assign power of attorney under a special circumstance with the limited form. In addition, if the principal is looking to have someone only handle personal and business filings the tax power of attorney should be used.

Do you need to record a power of attorney?

It is important for all parties involved to have copies of their form. A power of attorney does not need to be recorded with any government office and is primarily held by the Principal and Agent (s).

Is a power of attorney valid for a principal?

Although, the general power of attorney is no longer valid if the principal becomes mentally incompetent. IRS Power of Attorney (Form 2848) – To hire or allow someone else to file federal taxes to the Internal Revenue Service on your behalf. Limited Power of Attorney – For any non-medical power.

What is a power of attorney?

A power of attorney is a legal document giving a person (known as the agent) broad powers to manage matters on behalf of another person (known as the principal). Under certain circumstances, Bank of America allows agents to be added to the principal's accounts ...

Can a bank review a power of attorney?

The power of attorney and ID documents will be reviewed by the bank. Due to the complexities of power of attorney documents, multiple reviews may be required. As a result, the review process may require more than one visit to the financial center if further documentation is required.

How many copies of POA form are needed?

Successor Agent (optional) – Elect to have in case the agent is not available. Durable POA Form (3 copies) – It is recommended to bring 3 copies for signing. Notary Public / Witnesses – Depending on the State, it is required the form is signed by a notary public or witness (es) present.

What is a durable power of attorney?

A durable power of attorney form (DPOA) allows an individual (“principal”) to select someone else (“agent” or “attorney-in-fact”) to handle their financial affairs while they are alive. The term “durable” refers to the form remaining valid and in-effect if the principal should become incapacitated (e.g. dementia, Alzheimer’s disease, etc.).

What is UPOAA law?

The Uniform Power of Attorney Act (UPOAA) are laws created by the National Conference of Commissioners on Uniform State Laws (ULC) and have been adopted by 28 States since 2007. The incorporation of the laws is to bring uniformity to all 50 States and set common guidelines. Uniform Power of Attorney Act (UPOAA) Statutes (Revised 2006)

What do you need to do after a form is completed?

After the form has been completed the principal will need to figure out the signing requirements in their State to finalize the document. In addition, the principal will need to gather the agent (s) as they will be required to sign the form in front of either the two (2) witnesses or notary public.

What is an attorney in fact statement?

(25) Attorney-in-Fact Declaration. The Agent who will be granted the principal powers you approved according to the conditions you set will have an acceptance statement to tend to. The printed name of the Attorney-in-Fact must be included in this statement.

What is the step 3 of a disability form?

Step 3 – Effective Immediately or Upon Disability . The principal will have to decide if the form will be effective immediately or if it will be effective upon the disability of the principal. Disability or incapacitation is usually determined by a licensed physician and usually defined under State law.

Who determines if a disability form is effective?

The principal will have to decide if the form will be effective immediately or if it will be effective upon the disability of the principal. Disability or incapacitation is usually determined by a licensed physician and usually defined under State law.

What is a power of attorney for a minor in Washington?

The Washington guardianship of minor child power of attorney form allows for a minor child to have a guardian in the event of a medical emergency or other circumstance where the parent (s) are not available to make decisions. The chosen guardian will have permission to arrange for transportation to medical facilities, ...

What is a limited power of attorney in Washington?

The Washington limited power of attorney form is used to select a representative to execute a specific financial act on behalf of the principal (individual creating the power of attorney).

What is durable power in Washington?

Under Washington law 11.125.040, the Principal may choose to have the form made durable, which means that the agent may continue to act even if the principal should become incapacitated.

What is the Power of Attorney (POA)?

This legal procedure grants another person legal decision-making over many of your affairs or a limited number of them. Usually, you appoint someone you can trust, and the office is temporary, or you can make it permanent in case you get too sick to make your own decisions.

How to Get a Power of Attorney (POA)?

The good news here is that you do not have to hire a lawyer and pay his or her fees to draft a POA. You can download a form once you decide what your needs are, and having a person act on your behalf is the right move to make. Here are those steps to getting one:

What is a Power of Attorney (POA) Form?

This is a legal document telling the authorities, financial, medical, and other institutions that your agent will handle your affairs. It is a form that designates power to another person to act on your behalf and that form is valid temporarily or for life.

Where to Get a Power of Attorney (POA)?

This is probably the easiest part of the process as there are many sources you can turn to. The first and best source would be a lawyer. They will have all the documents with the right legal words on them to make sure nothing is left out, and there is no confusion as to the term, duties, and amount of power the agent has.

How to Write a Power of Attorney (POA)?

Once you have the form that you need, it is time to fill it out. There are several steps to writing one, and it is a good thing they are pre-printed, so you only have to fill in the vital information and check the right boxes.

How to Sign a Power of Attorney (POA)

You will sign the document in the same way you sign most legal paperwork. You will need to voluntarily sign your own name, have 2 non-family members present to witness yours and your agent’s signature as well as a notary public to set his or her seal on the document.

Can You do a power of attorney Yourself without a lawyer?

As long as you follow all the procedures discussed in this article, then the answer is yes, you can. Doing it yourself is one way to save on lawyer’s fees and still get the legal acceptance you need.

Popular Posts:

- 1. where to buy a joint power of attorney form

- 2. car accident where state farm attorney blames everyone but their car driver

- 3. what should a attorney do

- 4. how to protect attorney client privilege with family members injured

- 5. what to wear to a deposition attorney

- 6. hiring a very good powergule attorney who wins court cases against landlords

- 7. what is filing for trial history by attorney mean?

- 8. what is power of attorney for when buying a car

- 9. how to find if an attorney has been disciplined in oklahoma

- 10. how do i go about complaining on an attorney