If you decide to appoint someone to act on your behalf regarding your NYSLRS retirement benefits, it is important that you get your POA to NYSLRS so it can be reviewed and noted in your account. You can submit a POA document whether you are retired or still working, and we will accept a photocopy. You can mail it to: Albany, NY 12244-0001.

...

| Fax to: | 518-435-8406 |

|---|---|

| Mail to: | NYS TAX DEPARTMENT POA CENTRAL UNIT W A HARRIMAN CAMPUS ALBANY NY 12227-0864 |

How to file a power of attorney form in New York?

How to file the Power of Attorney form, IA 900: 1. Mail the original form to the address above, or 2. Fax it to (518) 485-8010 You need to submit a separate form for each representative. General Information: The Power of Attorney (IA 900) form is used only for New York State Unemployment Insurance purposes.

How do I cancel a power of attorney in New York?

You can mail it to: NYSLRS 110 State Street Albany, NY 12244-0001 You can revoke or terminate your POA at any time for any reason by mailing a signed letter to the address above. If you have questions about submitting your POA, or about what your agent will be able to do, please contact us. (Rev. 6/21) (Return to Top)

When does power of attorney go into effect in New York?

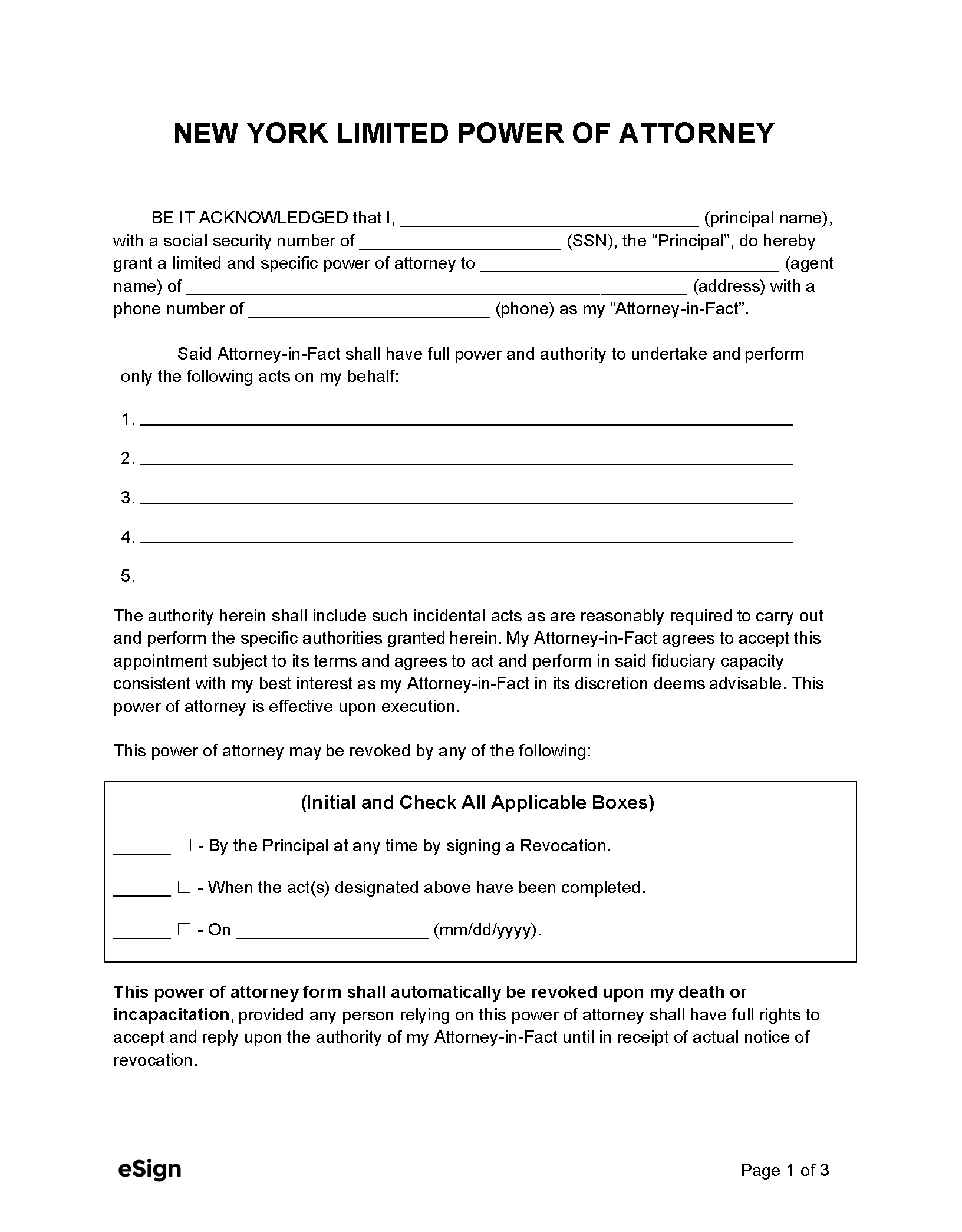

02900106170094 New York State Department of Taxation and Finance New York City Department of Finance Power of Attorney POA-1 (6/17) Read instructions on the back before completing this form. For estate tax matters, use Form ET-14, Estate Tax Power of Attorney. Filing Form POA-1 does not automatically revoke any previously filed powers of attorney …

How to file a power of attorney form in Iowa?

How To Get a Power of Attorney in NY You can get a NY POA in a few ways. Here are some of them: Downloading a PDF file from an online source Buying the form in a legal supply store Having an attorney create a power of attorney Using DoNotPay to create a durable power of attorney Create a NY POA in a Few Steps Using DoNotPay

How do I file a power of attorney in New York?

How to make a New York power of attorneyDecide which type of power of attorney to make. ... Decide who you want to be your agent. ... Decide what authority you want to give your agent. ... Get a power of attorney form. ... Complete the form, sign it, and have it witnessed and notarized.More items...•Oct 22, 2021

Does a POA need to be recorded in NY?

It is usually unnecessary to record the power of attorney. Only if a deed or other document is being recorded with the agent's signatures.

How much does a power of attorney cost in NY?

between $200 and $500How much does a Power of Attorney cost in NY? The cost of finding and hiring a lawyer to create a Power of Attorney could be between $200 and $500.

Does power of attorney need to be notarized?

If a person wants to authorise someone to act as a power of attorney on his behalf, it must be signed and notarised by a certified notary advocate, who is able to declare that you are competent at the time of signing the document to issue the said power of attorney.

How do I notarize power of attorney in NY?

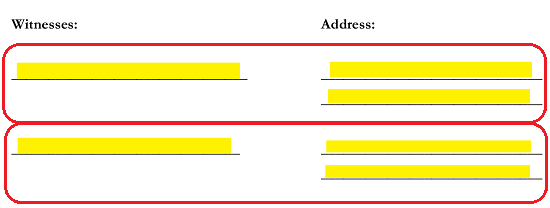

Under the new law, the person designating an agent (known as the “principal”), still needs to have his or her signature notarized, but now must sign the Power of Attorney in the presence of two witnesses (one of whom can be the notary).Sep 13, 2021

Does a power of attorney need to be witnessed?

If you want the power of attorney to be enduring (continue even if you later lack capacity) there are additional requirements. The document must be in writing and be signed and dated by you. The document must also be witnessed. It can be witnessed by a lawyer who has given you legal advice on the document.

How long does it take to get power of attorney?

It usually takes 8 to 10 weeks for The Office of the Public Guardian to register a power of attorney, so long as there are no mistakes on the form. It may take longer if there are issues they want to look into, although this is rare.

What expenses can I claim as power of attorney?

You can only claim expenses for things you must do to carry out your role as an attorney, for example:hiring a professional to do things like fill in the donor's tax return.travel costs.stationery.postage.phone calls.

Can a power of attorney transfer money to themselves?

Attorneys can even make payments to themselves. However, as with all other payments they must be in the best interests of the donor. This can be difficult to determine and may cause a conflict of interests between the interests of an Attorney and the best interests of their donor.

Is POA a public document?

Therefore, it is evident that the certified copy of the power of attorney produced by the petitioner is a public document within the meaning of Section 74(2) of the Indian Evidence Act and the same is admissible in evidence as provided under Section 76 of the Act. 12.Jul 10, 2008

What three decisions Cannot be made by a legal power of attorney?

You cannot give an attorney the power to: act in a way or make a decision that you cannot normally do yourself – for example, anything outside the law. consent to a deprivation of liberty being imposed on you, without a court order.

How do you write power of attorney?

0:051:01How To Say Power Of Attorney - YouTubeYouTubeStart of suggested clipEnd of suggested clipAgua bochini agua bocelli agua agua bocelli agua bochini agua bochini.MoreAgua bochini agua bocelli agua agua bocelli agua bochini agua bochini.

When is POA required in New York?

The law governing the requirements for a POA changed effective June 13, 2021. Any POA executed on or after June 13, 2021, must comply with the new requirements under New York’s General Obligations Law, Article 5, Title 15.

What is a power of attorney?

A Power of Attorney is a powerful document. Once you appoint someone, that person may act on your behalf with or without your consent. We strongly urge you to consult an attorney before you execute this document.

What is gifting authority?

Special authority that you may grant to your agent. You may also intend for your agent to have “ gifting authority ,” which means they will be able to: Direct deposit money into a joint bank account; Elect a pension payment option that provides for a beneficiary; and.

How Does a New York State Power of Attorney Work?

Every state has its rules about powers of attorney. In New York, a POA document enables the principal to delegate powers to an agent. This allows the agent to make financial or medical decisions on behalf of the principal.

What Kind of Authority Can an Agent Have?

A power of attorney in New York state grants the agent the right to do the following on the principal’s behalf:

Create a NY POA in a Few Steps Using DoNotPay

DoNotPay is the world’s first robot lawyer and can help you draft a power of attorney in a few clicks. You can avoid expensive lawyer fees using our platform.

It Gets Even Better!

With your DoNotPay subscription, not only do you get a powerful weapon to fight boring and annoying daily tasks, but you also get a great resource for earning more money.

What is a POA in New York?

The New York legislature has established standardized forms specifying power of attorney (POA) requirements in New York relating to financial matters and to medical issues.Thanks to their efforts, the process of obtaining a POA in New York is relatively easy.

What is a durable power of attorney?

A durable financial power of attorney can avoid financial disaster in the event you become incapacitated. You can also use a POA to allow someone to transact business for you if you are out of town or otherwise unavailable.

What is a POA?

Power of Attorney 101. A power of attorney (or POA) is a legal document that gives one person (known as the "agent") the authority to act for another person (known as the "principal"). Typically you use a POA if you can't be present to take care of a financial matter, or you want someone to be able to take care of your finances in ...

When does a POA become effective?

Also, traditionally, a POA became effective immediately upon being property signed by the principal. A POA that does not become effective unless and until the principal becomes incapacitated is known as a "springing" power of attorney (which by its nature is also durable).

What is a living trust in New York?

A living trust in New York allows you to place your asset into a trust but still use them during your lifetime. Your beneficiaries inherit them after your death. A revocable living trust (sometimes known as an inter vivos trust) provides many advantages that may make it a desirable part of your estate planning process.

Everything you need to know about a power of attorney in New York in 2021

As we said in the beginning, planning for the future is not just about wills and trusts. Proper estate planning can solve many problems in the future. And, for this, it is ideal to have a power of attorney and an agent who can, eventually, execute it. But don’t worry, as we will explain in detail what to do and how.

What is an agent when we talk about power of attorney?

As we said a few lines before, the agent is the person who will appoint the principal. The agent will make medical or other decisions, as well as carry out specific procedures or actions that will be stipulated in the power of attorney.

Is a power of attorney the same as a guardianship?

A power of attorney is a signed document in which a person, the principal, grants power of attorney to a designated agent for the purpose of performing an action or making certain decisions. You should know that a power of attorney is not the same as a guardianship.

Why hire our New York power of attorney experts?

As the saying goes, it is better to be safe than sorry. A properly drafted and executed power of attorney can be the solution to many current and future problems. First of all, it can give you peace of mind as to what will happen to your property and assets if something happens to you or you become incapacitated.

What is a power of attorney?

The power of Attorney gives legal authority to another person (called an Agent or Attorney-in-Fact) to make property, financial and other legal decisions for the Principal. A Principal can give an Agent broad legal authority, or very limited authority. The Power of Attorney is frequently used to help in the event of a Principal's illness ...

What is a springing power of attorney?

A "Springing" Power of Attorney becomes effective at a future time. That is, it "springs up" upon the happenings of a specific event chosen by the Power of Attorney. Often that event is the illness or disability of the Principal. The "Springing" Power of Attorney will frequently provide that the Principal's physician will determine whether ...

Is a power of attorney good?

Powers of Attorney are only as good as the Agents who are appointed. Appointing a trustworthy person as an Agent is critical. Without a trustworthy Agent, a Power of Attorney becomes a dangerous legal instrument, and a threat to the Principal's best interests.

What is the POA form?

Elimination of the Statutory Gift Rider: In general, the POA form is an intricate document made up of two distinct parts, the POA Statutory Short Form and the SGR. Currently, the SGR Form is a separate optional form used if the principal desires to authorize the agent to make gifts of the principal’s assets.

Is a POA valid?

The new legislation creates a presumption that a POA form is valid and permits courts to award damages. Allowing damages will apply only to unreasonable denial to accept an agent’s authority under a statutory short form POA that substantially complies with the statute.

What is a power of attorney in New York?

A New York general power of attorney form enables a principal to name a representative (“agent” or “attorney-in-fact”) for the management of their financial affairs.

What is a NYS POA-1?

The New York tax power of attorney form, also known as Form POA-1, allows the principal to appoint someone to handle their tax matters with the New York Department of Taxation and Finance. Most likely, the appointed individual will be a certified accountant, attorney, or some other type of tax professional.

What is a minor power of attorney?

The New York minor power of attorney form is a document that parents can use to authorize a third party to temporarily have parental rights over their child. This type of arrangement is usually used during a period of a parent’s absence due to work, military deployment, illness, or education. The designated attorney-in-fact will be able to make decisions regarding the child’s education, health care,…

Popular Posts:

- 1. what does pc stand for in attorney

- 2. what type of attorney handles agricultural contract disputes oregon

- 3. how much to hire attorney for my speeding ticket

- 4. what happens when an attorney grievence is transferred to trenton from the investigator

- 5. what did chicago pd attorney general previously play on

- 6. what is attorney gamesmanship

- 7. why would i need a durable power of attorney

- 8. how to file an attorney withdrawal

- 9. how to commit someone with a power of attorney

- 10. how to give power of attorney over my children