Where can I fax a power of attorney in PA?

How do I file a power of attorney in PA?

Does a power of attorney need to be recorded in Pennsylvania?

What is the address of Pennsylvania Department of Revenue?

Does a POA need to be notarized?

What three decisions Cannot be made by a legal power of attorney?

Does a power of attorney expire in Pennsylvania?

Does a living will need to be notarized in Pennsylvania?

Are old power of attorneys still valid?

Can you email PA Department of Revenue?

How do I contact the PA Dept of Revenue?

How do I contact the PA Department of Revenue?

What is a secure power of attorney in Pennsylvania?

Secure Power of Attorney is used by a registered Pennsylvania motor vehicle dealer or by a PennDOT-approved insurance company when a seller’s original proof of ownership is being held by a lienholder and is not available at the time the vehicle is transferred. It may also be used when the seller lost the certificate of title and the dealer or insurance company is applying for a duplicate certificate of title. NOTE: Approved insurance companies may use an e-POA in lieu of Form MV-POA, the Secure Power of Attorney form, with the transfer of salvaged vehicles.

What powers of attorney are needed for title in Pennsylvania?

Various powers of attorney may be used for title applications in Pennsylvania. 1. A Secure Power of Attorney (MV-POA) enables motor vehicle dealers or approved insurance companies to disclose the odometer reading on behalf of the seller and buyer (if applicable) when there is a lien or when the seller lost the proof of ownership and the dealer is applying for a duplicate title. Please note that both Sections A and B of Form MV-POA, contain space for the seller (in Section A) and the buyer (in Section B) to appoint the person from the motor vehicle dealership or insurance company named in the appropriate section of the form as the true and lawful attorney-in-fact to execute any and all applications for or assignment of the title for the vehicle described on the form. The Form MV-POA contains three separate sections:

What is proof of ownership in Pennsylvania?

“Proof of Ownership” – Pennsylvania Certificate of Title (11-89 or newer edition), Manufacturers Certificate of Origin and out-of-state certificate of title. NOTE: A bill of sale is not acceptable as proof of ownership.

Durable Power of Attorney Pennsylvania Form – PDF & Word

A Pennsylvania durable power of attorney is a long-term arrangement between two individuals; the principal (individual implementing the form) and an attorney-in-fact (appointed representative). This type of power of attorney form is used to transfer financial authority from the principal to the attorney-in-fact.

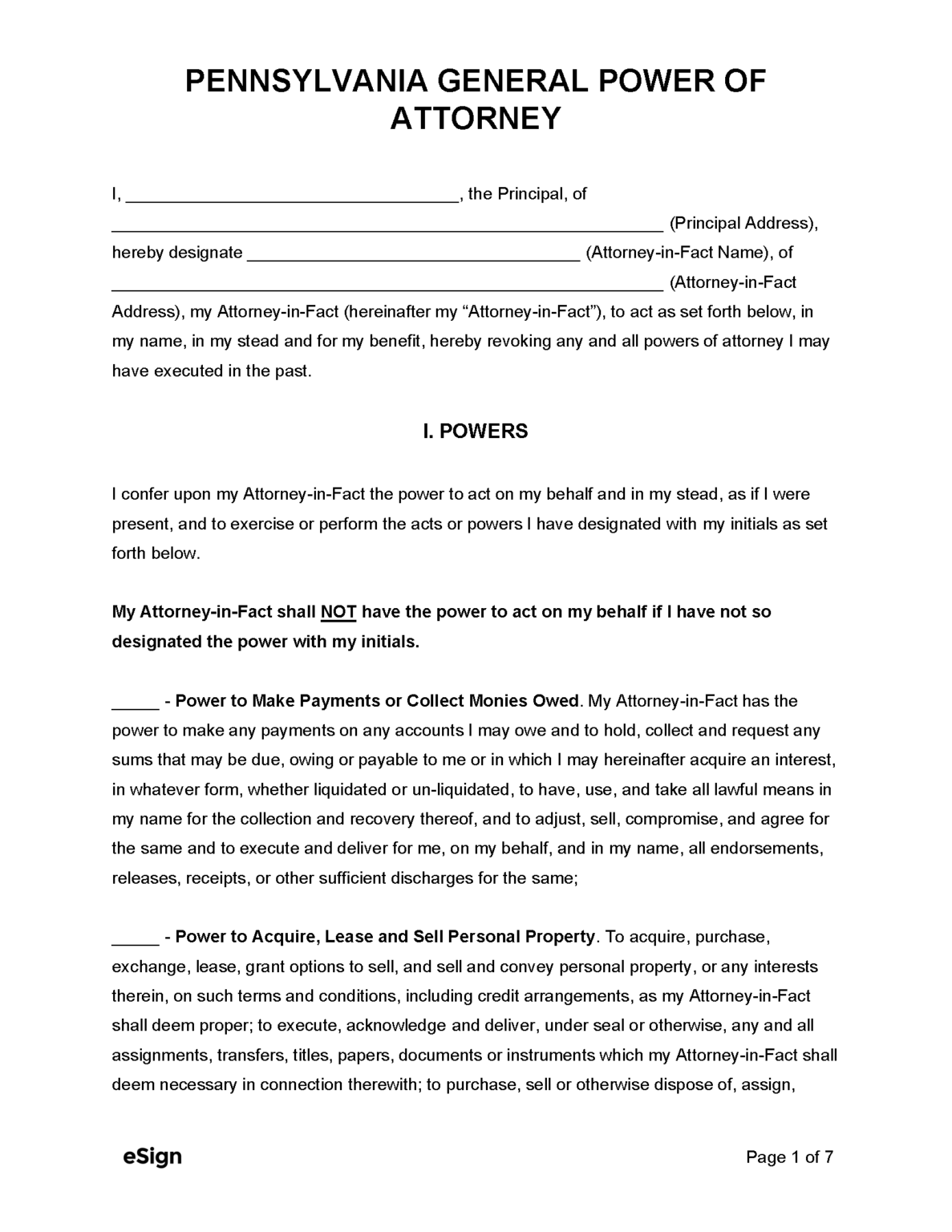

General Power of Attorney Pennsylvania Form – Adobe PDF

The Pennsylvania general power of attorney form allows a principal to designate certain financial powers to a representative (attorney-in-fact). This type of form does not remain in effect if the principal becomes incapacitated; for a more long-term arrangement, one can complete the durable power of attorney form.

Limited Power of Attorney Pennsylvania Form – Adobe PDF

A Pennsylvania limited power of attorney form allows a person to select someone else to carry out one or more specific business-related tasks for them. The principal can choose to have the document terminate upon completion of the task or upon a termination date set forth in the form.

Medical Power of Attorney Pennsylvania Form – Adobe PDF

The Pennsylvania medical power of attorney enables an individual to establish instructions regarding end-of-life treatments and medications and to appoint an attorney-in-fact to make medical decisions on their behalf.

Minor (Child) Power of Attorney Pennsylvania – Adobe PDF

The Pennsylvania minor power of attorney form is a contract by which a parent may delegate parental authority over their children to another individual for a limited duration. As per state law, an attorney-in-fact can be appointed by the principal to take care of their children and any other individuals legally entitled to be supported by them.

Real Estate Power of Attorney Pennsylvania Form – Adobe PDF

The Pennsylvania real estate power of attorney is a legal contract that allows individuals to appoint a representative who will make property-related decisions in their place.

Tax Power of Attorney Pennsylvania Form – Adobe PDF

The Pennsylvania tax power of attorney form appoints an accountant (attorney-in-fact) to represent a person regarding certain tax matters. This power of attorney, also known as Form REV-677, is provided by the Pennsylvania Department of Revenue.

Pennsylvania Tax Power of Attorney (Form REV-677)

Pennsylvania Tax Power of Attorney (Form REV-677) can be used when you intend to appoint a tax professional to make filings, obtain information and otherwise act on your behalf in front of the Pennsylvania Department of Revenue.

How to Write

The form on this page is the method a Pennsylvania Taxpayer should use to formally appoint a Representative with Principal Powers. You can download this Tax document using the buttons below the picture on this page.

What is a power of attorney in Pennsylvania?

A power of attorney (or POA) is a legal document that gives one person (the "agent") the authority to act for another person (the "principal"). A POA is useful if you can't be present to take care of a financial matter or want someone to take care of your finances or medical treatment in the event you become incapacitated—what Pennsylvania law ...

What is a POA in Pennsylvania?

A POA is useful if you can't be present to take care of a financial matter or want someone to take care of your finances or medical treatment in the event you become incapacitated—what Pennsylvania law refers to as disabled or incapacitated. Traditionally, a POA ended if the principal became incapacitated. A POA that continues after incapacity is ...

Is a POA durable in Pennsylvania?

A POA that only becomes effective if the principal becomes incapacitated is called a "springing" POA (which by its nature is also durable). Under Pennsylvania law, a POA is durable unless it specifically states otherwise.

How old do you have to be to get a POA?

You may make a healthcare POA if you are at least 18 years of age or, if under 18, you have graduated from high school, are married, or are legally emancipated. A healthcare POA must be dated, signed by the principal (in the same manner as for a financial POA), and witnessed by two persons who are at least 18 years old.

Popular Posts:

- 1. how to claim power of attorney

- 2. how much to pay a patent attorney

- 3. new york attorney who prepares cema for rushmore loan management services

- 4. how to write to an attorney requesting action

- 5. what is attorney review nj

- 6. he was the attorney general of california who felt that the japanese were a threat.

- 7. who plays the attorney on sons of anarchy

- 8. black attorney who supplied guns to blacks during east saint louis riots

- 9. what are sanctions against an attorney

- 10. what is the correct plural form of attorney