The authorized representative should mail or fax the Power of Attorney to the IRS office handling this matter. Additions/Deletions to Authorized Acts Under POA - Describe any specific additions or deletions to the acts otherwise authorized by this Power of Attorney. Do Not Revoke Prior Power of Attorney Forms on Record

Full Answer

Can a federal power of attorney be used in Georgia?

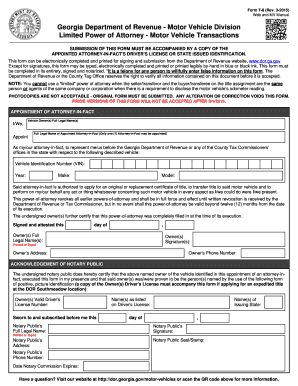

How to Submit a Power of Attorney | Georgia Department of Revenue. The .gov means it’s official. Local, state, and federal government websites often end in .gov. State of Georgia government websites and email systems use “georgia.gov” or “ga.gov” at the end of the address. Before sharing sensitive or personal information, make sure ...

Is there a new form for a power of attorney?

Power of Attorney and Declaration of Representative (Form RD-1061) Form RD-1061 allows a representative to: Represent the taxpayer before the Department. Receive confidential information. Perform certain acts on behalf of the taxpayer. Submit the completed Form RD-1061 through the Georgia Tax Center (GTC) or to the Department employee handling ...

How do I enter a power of attorney on my taxes?

Local, state, and federal government websites often end in .gov. State of Georgia government websites and email systems use “georgia.gov” or “ga.gov” at the end of the address. Before sharing sensitive or personal information, make sure you’re on an official state website. ... RD-1061 Power of Attorney and Declaration of ...

What is a statutory form power of attorney?

A power of attorney is a legal document that allows an individual to make decisions for another person, known as the principal. There are two main types of power of attorney: financial and medical. In Georgia, power of attorney must meet certain basic requirements, including being signed by the principal, witnesses, and a notary public.

Where do I send my power of attorney in Georgia?

Submit the completed Form RD-1061 through the Georgia Tax Center (GTC) or to the Department employee handling your inquiry.

How do I file a power of attorney in Georgia?

How To Get a Georgia Power of AttorneySelect your agents. Your agent for POA and your advance health care directive should be someone you trust. ... Decide how much power to give your agents. ... Fill out and sign your document with the correct number of witnesses. ... Deliver your document to necessary parties.Jun 4, 2021

Does power of attorney need to be notarized in Georgia?

Power of Attorney is created simply by composing and signing a document that grants this authority. In the State of Georgia, two adult witnesses are required to authenticate Power of Attorney. While it is not required, getting the document notarized is also a good idea.Aug 5, 2019

How do I contact Georgia Department of Revenue?

404-417-2100. More information about the Department of Revenue.

How do I notarize a power of attorney in Georgia?

It must be signed by one or more witnesses. It must be signed by a notary public or other person authorized to administer oaths. The notary may not be a witness. The principal, witnesses, anyone signing for the principal, and notary must all be present when they sign.Jul 12, 2018

Who can notarize a power of attorney?

notary publicOne of the most common requirements in such cases is that the power of attorney is certified by a notary public.Jan 20, 2016

Can a family member witness a power of attorney?

The witness must be over 18. The same witness can watch all attorneys and replacements sign. Attorneys and replacements can all witness each other signing. The certificate provider could also be a witness.

Is an old power of attorney still valid?

To summarise, an Enduring Power of Attorney is still likely to be valid but may well be out of date. It will certainly need to be reviewed and consideration should be given to entering into new Lasting Powers of Attorney, both financial and health and welfare.Apr 21, 2020

How long does it take for power of attorney to go through?

How long does it take to get a PoA registered? It usually takes 8 to 10 weeks for The Office of the Public Guardian to register a power of attorney, so long as there are no mistakes on the form. It may take longer if there are issues they want to look into, although this is rare.

How do I contact Revenue by phone?

Revenue can deal with simpler RICT queries from companies on the phone. Call (01) 858 9843 between the hours of 9.30am to 1.30pm, Monday to Friday.Dec 16, 2021

Where do I send my Georgia state tax payment?

Mailing Address - Individual/Fiduciary Income TaxIndividual/Fiduciary Income Tax FormMailing Address500 and 500 EZ (refunds and no balance due)Georgia Dept. of Revenue PO Box 740380 Atlanta, GA 30374-0380500 and 500 EZ (payments)Georgia Dept. of Revenue PO Box 740399 Atlanta, GA 30374-03995 more rows

Can the IRS put me in jail?

The IRS cannot send you to jail. However, the court can. When an IRS auditor audits your tax returns and detects possible fraud, they can initiate a criminal investigation. It should be noted that around 3,000 taxpayers are convicted of tax fraud every year.Dec 20, 2020

What is the Georgia Department of Revenue?

The Georgia Department of Revenue has created three separate and distinct authorizations which allow third parties varying degrees of access to taxpayer information and ability to act on that information.

What is RD-1062?

Form RD-1062 allows a third party to receive any confidential tax information specified by the taxpayer. Use this form for a one-time disclosure of tax information to a third party. Form RD-1062 automatically expires once the Department has disclosed the information to the third party.

Can third parties access your account?

All of the forms below may co-exist with one another. Note: Third parties are only granted access through their accounts. They may not access a client’s account through a client’s username and/or password.

What is a Statutory Financial Power of Attorney?

This document contains information about the "Statutory Financial Power of Attorney." It allows you to name one or more persons to help you handle your financial affairs. Depending on your individual circumstances, you can give this person complete or limited power to act on your behalf. This document does not give someone the power to make medical decisions or personal health decisions for you.

How to accept an appointment as an agent under a power of attorney?

person accepts appointment as an agent under a power of attorney by exercising authority or performing duties as an agent or by any other assertion or conduct indicating acceptance; unless otherwise stated in the power of attorney.

Who can nominate a conservator?

A principal may nominate a conservator of the principal's estate for consideration by the court as long as the power of attorney is in place before conservatorship proceedings are begun and except for good cause shown or disqualification, the court shall make its appointment in accordance with the principal's most recent nomination.

Can you cancel a financial document?

Even with this document, you may still legally make decisions about your own financial affairs as long as you choose to or are able to. Talk to your Agent often about what you want and what he or she is doing for you using the document. If your Agent is not following your instructions or doing what you want, you may cancel or revoke the document and end your Agent's power to act for you.

What does "agent" mean in law?

'Agent' means a person granted authority to act in the place of an individual, whether denominated by such term , attorney-in-fact, or otherwise. Such term shall include a co-agent, successor agent, and a person to which authority is delegated.

Can a principal designate two or more coagents?

A principal may designate two or more persons to act as coagents. Unless the power of attorney otherwise provides, coagents shall exercise their authority independently of each other and do not have to be in agreement.

What is a gift for the benefit of a person?

The term a gift 'for the benefit of' a person includes a gift to a trust, an account under the Uniform Transfers to Minors Act, and a tuition savings account or prepaid tuition plan as defined under Internal Revenue Code Section 529, 26 U.S.C. Section 529, in effect on February 1, 2017.

What is a power of attorney for IRS?

Except as specified below or in other IRS guidance, this power of attorney authorizes the listed representative(s) to inspect and/or receive confidential tax information and to perform all acts (that is , sign agreements, consents, waivers, or other documents) that you can perform with respect to matters described in the power of attorney. Representatives are not authorized to endorse or otherwise negotiate any check (including directing or accepting payment by any means, electronic or otherwise, into an account owned or controlled by the representative or any firm or other entity with whom the representative is associated) issued by the government in respect of a federal tax liability. Additionally, unless specifically provided in the power of attorney, this authorization does not includethepower to substitute or add another representative, the power to sign certain returns, the power to execute a request for disclosure of tax returns or return information to a third party, or to access IRS records via an Intermediate Service Provider. Representatives are not authorized to sign Form 907, Agreementto Extend the Time to Bring Suit, unless language to cover the signing is added on line 5a. See Line 5a. Additional Acts Authorized, later, for more information regarding specific authorities.

Does the IRS require a new 2848?

If the representative's address has changed, the IRS does not require a new Form 2848. The representative can send a written notification that includes the new information and the representative's signature to the location where you filed the Form 2848.

What is an unenrolled return preparer?

An unenrolled return preparer is an individual other than an attorney, CPA, enrolled agent, enrolled retirement plan agent, or enrolled actuary who prepares and signs a taxpayer's return as the paid preparer, or who prepares a return but is not required (by the instructions to the return or regulations) to sign the return.Limited representation rights. Unenrolled return preparers may only represent taxpayers before revenue agents, customer service representatives, or similar officers and employees of the Internal Revenue Service (including the Taxpayer Advocate Service) during an examination of the tax period covered by the tax return they prepared and signed (or prepared if there is no signature space on the form). Unenrolled return preparers cannot represent taxpayers, regardless of the circumstances requiring representation, before appeals officers, revenue officers, attorneys from the Office of Chief Counsel, or similar officers or employees of the Internal Revenue Service or the Department of the Treasury. Unenrolled return preparers cannot execute closing agreements, extend the statutory period for tax assessments or collection of tax, execute waivers, execute claims for refund, or sign any document on behalf of a taxpayer.Representation requirements. Unenrolled return preparers must possess a valid and active Preparer Tax Identification Number (PTIN) to represent a taxpayer before the IRS, and must have been eligible to sign the return or claim for refund under examination.

What is a CAF power of attorney?

Generally, the IRS records powers of attorney on the CAF system. The CAF system is a computer file system containing information regarding the authority of individuals appointed under powers of attorney. The system gives IRS personnel quicker access to authorization information without requesting the original document from the taxpayer or representative. However, a specific-use power of attorney is a one-time or specific-issue grant of authority to a representative or is a power of attorney that does not relate to a specific tax period (except for civil penalties) that the IRS does not record on the CAF. Examples of specific uses not recorded include but are not limited to:

What is Form 2848?

We ask for the information on this form to carry out the Internal Revenue laws. Form 2848 is provided by the IRS for your convenience and its use is voluntary. If you choose to designate a representative to act on your behalf, you must provide the requested information. Section 6109 requires you to provide your identifying number; section 7803 authorizes us to collect the other information. We use this information to properly identify you and your designated representative and determine the extent of the representative's authority. Failure to provide the information requested may delay or prevent honoring your power of attorney designation; providing false or fraudulent information may subject you to penalties.

What is a power of attorney?

This power of attorney authorizes another person (your agent) to make decisions concerning your property for you (the principal ). Your agent will be able to make decisions and act with respect to your property (including your money) whether or not you are able to act for yourself. The meaning of authority over subjects listed on this form is explained in O.C.G.A. Chapter 6B of Title 10.

What happens when you accept a power of attorney?

When you accept the authority granted under this power of attorney, a special legal relationship is created between you and the principal. This relationship imposes upon you legal duties that continue until you resign or the power of attorney is terminated or revoked. You must:

Popular Posts:

- 1. in the united states of america who is the best medical attorney

- 2. how soon after a bad accident do you find an attorney indiana

- 3. how to file bankruptcy in ky without an attorney

- 4. story of attorney who quits and goes on vacation

- 5. shay ryan alexander boise id who is his defense attorney

- 6. how to notify ct court of attorney temp retirement

- 7. what is civil rights attorney in michigan

- 8. attorney in southern calif who is ineffective assistance of counsel expert

- 9. how to transfer power of attorney from one state to another

- 10. which attorney proved his case better with 9th court of appeals