Full Answer

Where to fax 2848 power of attorney?

Fax: (202) 442-6890 TTY: 711. Ask the Chief Financial Officer. Agency Performance. Fitzroy Lee. Interim Chief Financial Officer-A + A. Listen. D-2848 Power of Attorney and Declaration of Representation Fill-in Version. Reference: mf. D-2848 Power of Attorney and Declaration of Representation Fill-in Version.

Where to fax Poa IRS?

Fax your Form 2848 to the IRS fax number in the Where To File Chart. ... Except as specified below or in other IRS guidance, this power of attorney authorizes the listed representative(s) to inspect and/or receive confidential tax information and to perform all acts (that is, sign agreements, consents, waivers, or other ...

Where to fax 2848 form?

- Select New to enter in the information for the representative.

- Select an existing tax preparer from the list, or select Enter Representative Information. ...

- Enter the representative's full name. ...

- Enter the nine-digit CAF number for the representative. ...

Where to mail form 2848?

Power of Attorney (POA) and Third-Party Authorization

- Disclosure of tax return information. ...

- Power of Attorney, Form M-2848. ...

- Filing a dispute. ...

- Paid tax preparer authorization on tax return. ...

- Verbal representation. ...

- Third-party authorization through MassTaxConnect. ...

Can I fax a POA to the IRS?

Revocation of a power of attorney. You must then mail or fax a copy of the power of attorney with the revocation annotation to the IRS, using the Where To File Chart, or if the power of attorney is for a specific matter, to the IRS office handling the matter.

Where do I send my 2848 fax?

Power of Attorney - Form 2848THEN use this address...Fax number*Internal Revenue Service PO Box 268, Stop 8423 Memphis, TN 38101-0268901-546-4115Internal Revenue Service 1973 N Rulon White Blvd MS 6737 Ogden, UT 84404801-620-42492 more rows•Jun 2, 2022

Can you fax form 2848?

The fax number if sending from within the United States remains the same (855-772-3156). Section references are to the Internal Revenue Code unless otherwise noted. For the latest information about developments related to Form 2848 and its instructions, go to www.irs.gov/form2848.

Where can I fax documents from the IRS?

Fax: (855) 215-1627 (within the U.S.)

How do I send POA to IRS?

Fax or Mail Forms 2848 and 8821 If you can't use an online option, you can fax or mail authorization forms to us. Use for: Individual or business taxpayer. Any tax matter or period.

Does the IRS accept electronic signatures on form 2848?

As long as you can create a Secure Access account and follow authentication procedures, you may submit a Form 2848 or 8821 with an image of an electronic signature.

How long does it take IRS to process form 2848?

The fax and mail options for submitting Forms 2848 and 8821 are still available, however signatures on such forms must be handwritten. Using the online option will not accelerate the time necessary for the IRS to process the authorizations, which is currently estimated to be five weeks.

Does form 2848 need to be notarized?

IRS Form 2848 (Power of Attorney and Declaration of Representative). If an original Form 2848 (which contains original signatures) is submitted to JSND, the form does not need to be notarized. If a copy of the form is submitted, the form must be notarized.

Where do you file and withdraw forms 2848 and 8821?

Where to File Forms 2848 and 8821. Practitioners must mail or fax their authorization forms to the applicable CAF unit (Ogden, Utah; Memphis, Tenn.; or Philadelphia) unless they check the box on line 4 of Form 2848 or 8821 (specific use not recorded on the CAF).

Does IRS accept fax?

You cannot use a fax number for the IRS to file your tax return. While they sometimes accept faxes for some ongoing tax issues, like audits and problems with returns that are already being processed, they don't even publish numbers for people to fax tax returns to, generally speaking.

Does IRS has a fax number?

What Is the IRS Fax Number? The IRS still offers users the option to send sensitive documentation via mail and fax. To fax any document to the IRS, you'll need this number: (855) 215-1627.

Should I fax or mail to the IRS?

Fax or mail, pick one. If mailing documents, use a certified mail service. Send Copies: Never ever send originals. The IRS might lose your documentation, and they certainly won't mail it back.

How to authorize a power of attorney?

Authorize with Form 2848 - Complete and submit online, by fax or mail Form 2848, Power of Attorney and Declaration of Representative.

Where is my tax authorization?

Your Tax Information Authorization is recorded on the Centralized Authorization File (CAF) unless Line 4, Specific Use is checked. The record lets IRS assistors verify your permission to speak with your representative about your private tax-related information.

How to authorize a third party to file taxes?

There are different types of third party authorizations: 1 Power of Attorney - Allow someone to represent you in tax matters before the IRS. Your representative must be an individual authorized to practice before the IRS. 2 Tax Information Authorization - Appoint anyone to review and/or receive your confidential tax information for the type of tax and years/periods you determine. 3 Third Party Designee - Designate a person on your tax form to discuss that specific tax return and year with the IRS. 4 Oral Disclosure - Authorize the IRS to disclose your tax information to a person you bring into a phone conversation or meeting with us about a specific tax issue.

What is a tax information authorization?

A Tax Information Authorization lets you: Appoint a designee to review and/or receive your confidential information verbally or in writing for the tax matters and years/periods you specify. Disclose your tax information for a purpose other than resolving a tax matter.

How long does a power of attorney stay in effect?

Power of Attorney stays in effect until you revoke the authorization or your representative withdraws it. When you revoke Power of Attorney, your representative will no longer receive your confidential tax information or represent you before the IRS for the matters and periods listed in the authorization.

Who can authorize oral disclosure?

You can authorize your tax preparer, a friend, a family member, or any other person you choose to receive oral disclosure during a conversation with the IRS.

Do you need a signature for a power of attorney?

Power of Attorney must be authorized with your signature. Here’s how to do it:

What line do you check if you have a power of attorney?

Check the box listed on Line 4 if the IRS power of attorney is for a use that will not be named on the CAF. An IRS power of attorney will not be recorded if it does not relate to a specific period.

What is the power of attorney?

The way you choose depends on the amount of power you are willing to give that person that is going to be helping you. Power of attorney gives them the most power, they can act on your behalf for tax matters. You can limit their power by just authorizing them access to your confidential tax information by filling out and filing ...

How to attach 8453 to a return?

To attach it to the return for e-filing, use the PDF screen to identify the document and then scan and attach it . If you attach the document, do not generate Form 8453 for it, or the IRS will look for a mailed copy.

How long does it take to get a Form 8453?

Print the completed Form 8453 and mail with the completed Form 2848 to the IRS within 3 business days after receiving acknowledgement that the IRS has accepted the electronically filed tax return.

How to mail 8453?

To mail it with Form 8453 (PDI), generate the 8453 by indicating the 2848 as a Form 8453 attachment. Open the MISC screen (on the Miscellaneous tab). On the bottom left, select the option Return signed by Power of Attorney. Enter the name in the Power of Attorney name field.

What is Form 8453?

mailed to the IRS with Form 8453, U.S. Individual Income Tax Transmittal for an IRS e-file Return. This process uses a Paper Document Indicator (PDI), to alert the IRS that you will mail a supporting document after the e-filed return is accepted.

How to give someone access to my tax information?

The way you choose depends on the amount of power you are willing to give that person that is going to be helping you. Power of attorney gives them the most power, they can act on your behalf for tax matters. You can limit their power by just authorizing them access to your confidential tax information by filling out and filing the tax information authorization form.

What is a power of attorney for IRS?

Except as specified below or in other IRS guidance, this power of attorney authorizes the listed representative (s) to inspect and/or receive confidential tax information and to perform all acts (that is, sign agreements, consents, waivers, or other documents) that you can perform with respect to matters described in the power of attorney. Representatives are not authorized to endorse or otherwise negotiate any check (including directing or accepting payment by any means, electronic or otherwise, into an account owned or controlled by the representative or any firm or other entity with whom the representative is associated) issued by the government in respect of a federal tax liability. Additionally, unless specifically provided in the power of attorney, this authorization does not include the power to substitute or add another representative, the power to sign certain returns, the power to execute a request for disclosure of tax returns or return information to a third party, or to access IRS records via an Intermediate Service Provider. Representatives are not authorized to sign Form 907, Agreement to Extend the Time to Bring Suit, unless language to cover the signing is added on line 5a. See Line 5a. Additional Acts Authorized, later, for more information regarding specific authorities.

Where to enter BBA in a power of attorney?

For powers of attorney related to the centralized partnership audit regime, enter “Centralized Partnership Audit Regime (BBA)” in the "Description of Matter" column on line 3, then enter the form number (for example, 1065) and tax year in the appropriate column (s).

How to change last known address?

To change your last known address, use Form 8822, Change of Address, for your home address and Form 8822-B, Change of Address or Responsible Party—Business, to change your business address. Both forms are available at IRS.gov. . Authorizing someone to represent you does not relieve you of your tax obligations. .

What is the APO number for Guam?

855-214-7522. All APO and FPO addresses, American Samoa, the Commonwealth of the Northern Mariana Islands, Guam, the U.S. Virgin Islands, Puerto Rico, a foreign country, or otherwise outside the United States. Internal Revenue Service. International CAF Team.

Can a law student represent a taxpayer?

You must receive permission to represent taxpayers before the IRS by virtue of your status as a law, business, or accounting student working in an LITC or STCP under section 10.7 (d) of Circular 230. Law graduates in an LITC or STCP may also represent taxpayers under the "Qualifying Student" designation in Part II of Form 2848. Be sure to attach a copy of the letter from the Taxpayer Advocate Service authorizing practice before the IRS.

Can I represent a business before the IRS?

You must receive permission to represent taxpayers before the IRS by virtue of your status as a law, business , or accounting student working in an LITC or STCP under section 10.7 (d) of Circular 230. Law graduates in an LITC or STCP may also represent taxpayers under the "k" designation in Part II of Form 2848. Be sure to attach a copy of the letter from the Taxpayer Advocate Service authorizing practice before the IRS.

Does John represent Diana on 1040?

Diana only authorizes John to represent her in connection with her Form 1040 for 2018. John is not authorized to represent Diana when the revenue agent proposes a trust fund recovery penalty against her in connection with the employment taxes owed by her closely held corporation.

How to establish a power of attorney relationship?

To establish a power of attorney relationship, you must fill out and submit the correct FTB form. 1. Choose the correct form. 2. Fill out the form correctly. Representatives: Provide all available identification numbers: CA CPA, CA State Bar Number, CTEC, Enrolled Agent Number, PTIN.

How long does it take to get a POA?

Generally, it takes us 3 weeks to review and process POA declarations. If we need more information or clarification, it may take longer.

Who can sign a business form?

Only the individual, estate representative, trustee, or officer of the business can sign the form. Be sure that person includes all of the following: Printed name. Title (not required for individuals) Signature.

Do we accept electronic signatures?

We do NOT accept electronic or stamped signatures.

What is an addition to a POA?

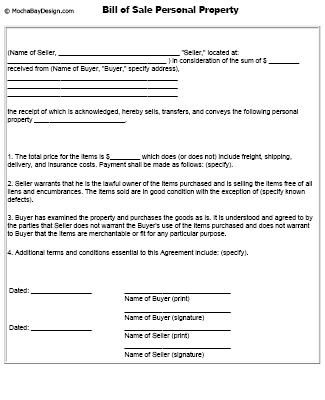

Additions/Deletions to Authorized Acts Under POA - Describe any specific additions or deletions to the acts otherwise authorized by this Power of Attorney.

How to access Form 2848?

To access Form 2848, from the Main Menu of the Tax Return (Form 1040) select: Plan Number - The program will pull the taxpayer name (s), address, SSN (s) and daytime phone number. If an Employer Identification Number and/or Plan Number applies, enter these items in this menu. Select New to enter in the information for the representative.

What to do if CAF number has not been assigned?

Check the appropriate box to indicate if either the address, telephone number or fax number is new since a CAF number has been assigned. Select the designation for the representative.

Can a power of attorney be recorded on a CAF?

Is the Power of Attorney recorded on a CAF file - If the Power of Attorney is for a use that will not be listed on the CAF, change the answer to YES. The authorized representative should mail or fax the Power of Attorney to the IRS office handling this matter.

Who is responsible for filing 1041?

The business or activity is reporting income on Form 1041, Trust or Estate Tax Return. The trustee, executor or other fiduciary responsible for filing the Form 1041 return; Generally the fiduciary must submit Form 56.

Who signs POA 2848?

Form 2848 is signed by the manager under state law or the TMP. Generally, only a TMP signed POA can extend the period for assessing partners and only a manager signed POA can sign documents for the LLC itself. If the TMP is not a natural person, the attribution for who acts on behalf of that partner/entity signs the POA (for example: the person authorized under state law to sign on behalf of a partnership, officer of a corporation, trustee of a trust, etc.).

Is an LLC a TEFRA?

The LLC is a TEFRA partnership and has designated a TMP but involves issues binding non-notice partners or requests for partnership level administrative adjustments. The partners. Not allowed. Only the TMP can file a partnership-level AAR or sign a settlement agreement binding non-notice partners.

Popular Posts:

- 1. who was aarizonas u s attorney appointed by

- 2. who was jkk's attorney general

- 3. what happens when you fire an attorney

- 4. which department is the attorney general in

- 5. how many state attorney generals are democrats

- 6. attorney filled a certificate of service in behalf of defendant ohio what does thois mean

- 7. who is the attorney general in nys

- 8. sessions attorney general who replaces senate seat

- 9. how does a person obtain power of attorney

- 10. testimony when you answer questions from the attorney who hired you