Just print and sign the form and send it directly to the Tax Department by fax (preferred) or mail. Continue to paper Form POA-1, Power of Attorney. See Form POA-1: additional information for detailed instructions. Fill out the form legibly.

Full Answer

Where can I get the forms for power of attorney?

Jul 18, 2021 · You can request Power of Attorney or Tax Information Authorization online with Tax Pro Account, Submit Forms 2848 and 8821 Online, or forms by fax or mail. You have these options to submit Power of Attorney (POA) and Tax Information Authorization (TIA).

Where can I get durable power of attorney forms?

If you check the box on line 4, mail or fax Form 2848 to the IRS office handling the specific matter. If you did not check the box on line 4, you can choose how to submit your Form 2848 from the options below. If you use an electronic signature (see Electronic Signatures below), you must submit your Form 2848 online. • Online. Submit your Form 2848 securely at IRS.gov/

Where can I get a free power of attorney form?

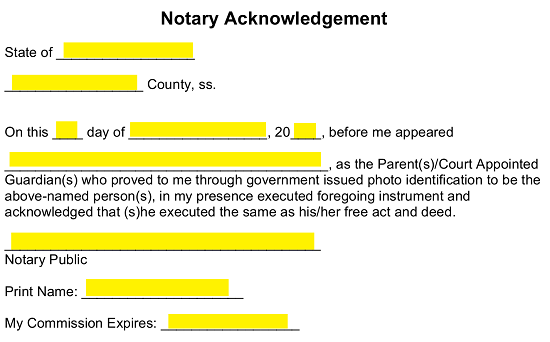

Mar 09, 2022 · Many states require that your power of attorney be notarized to ensure that the signatures are true, which is to help detour fraud. Only the principal needs to be present with the notary for the Power of Attorney to be notarized. You …

Where can I get a power attorney form?

Nov 04, 2008 · If the taxpayer has received a letter or notice from DOR, you should mail or fax your completed Power of Attorney form to the auditor or agent listed on the letter or notice sent to the taxpayer. If you are filing an amended return where the original return was completed by another practitioner, you may submit Form A-222 with the amended return although that is not a …

Where do I send my 2848?

Power of Attorney - Form 2848THEN use this address...Fax number*Internal Revenue Service PO Box 268, Stop 8423 Memphis, TN 38101-0268901-546-4115Internal Revenue Service 1973 N Rulon White Blvd MS 6737 Ogden, UT 84404801-620-42492 more rows

How do I submit a POA to the IRS?

Use Form 2848 to authorize an individual to represent you before the IRS. See Substitute Form 2848, later, for information about using a power of attorney other than a Form 2848 to authorize an individual to represent you before the IRS. The individual you authorize must be eligible to practice before the IRS.Sep 2, 2021

How do I submit a 2848 to the IRS?

The "Submit Forms 2848 and 8821 Online" tool is available from the IRS.gov/taxpros page. It also has "friendly" web addresses that can be bookmarked: IRS.gov/submit2848 and IRS.gov/submit8821. To access the tool, tax professionals must have a Secure Access username and password from an IRS account such as e-Services.

Where do I send my NYS POA 1?

Fax to:518-435-8406Mail to:NYS TAX DEPARTMENT POA CENTRAL UNIT W A HARRIMAN CAMPUS ALBANY NY 12227-0864Feb 2, 2022

How long does it take for the IRS to process a power of attorney?

Generally, it takes us 3 weeks to review and process POA declarations. If we need more information or clarification, it may take longer. We'll send a letter to the taxpayer when we approve or deny the POA.Sep 23, 2021

Can IRS power of attorney be signed electronically?

The process to mail or fax authorization forms to the IRS is still available. Signatures on mailed or faxed forms must be handwritten. Electronic signatures are not allowed.Jan 25, 2021

Can I file form 2848 electronically?

As long as you can create a Secure Access account and follow authentication procedures, you may submit a Form 2848 or 8821 with an image of an electronic signature.Nov 15, 2021

Can I upload documents to IRS?

Depending on the situation, the acceptable types of documentation may include copies of pay statements or check stubs. You take a picture of your documentation and the Documentation Upload Tool enables you to upload the image. And just like that, the IRS can access the data and continue working the case.Aug 26, 2021

How long does it take for IRS to process form 2848?

The fax and mail options for submitting Forms 2848 and 8821 are still available, however signatures on such forms must be handwritten. Using the online option will not accelerate the time necessary for the IRS to process the authorizations, which is currently estimated to be five weeks.Jan 26, 2021

Does a power of attorney need to be recorded in New York?

It is usually unnecessary to record the power of attorney. Only if a deed or other document is being recorded with the agent's signatures.

How long does it take to complete a power of attorney?

It usually takes 8 to 10 weeks for The Office of the Public Guardian to register a power of attorney, so long as there are no mistakes on the form. It may take longer if there are issues they want to look into, although this is rare.

How do I get power of attorney for elderly parent in NY?

How to Get a POA for Elderly Parents in Good HealthTalk it through with your parent(s) At this point, you should have a better idea of what type of power of attorney would suit your situation. ... Consult with a lawyer. The laws governing powers of attorney vary from state to state. ... Document your rights. ... Execute the document.

What Is Power of Attorney?

A Power of Attorney is the act of allowing another individual to take action and make decisions on your behalf. When an individual wants to allow a...

How to Get Power of Attorney?

Obtaining a Power of Attorney (form) is easy, all you need to do is decide which type of form best suits your needs. With our resources, creating a...

Power of Attorney vs Durable Power of Attorney

A Power of Attorney and the powers granted to the Agent ends when the Principal either dies or becomes mentally incapacitated. If you select to use...

How to Sign A Power of Attorney?

The following needs to be executed in order for your power of attorney to be valid: 1. Agent(s) and Principal must sign the document. 2. As witness...

How to Write A Power of Attorney

Before the Principal writes this form they should keep in mind that the Agent (or ‘Attorney-in-Fact’) will need to be present at the time of signat...

What is a power of attorney?

A power of attorney is a legal document giving a person (known as the agent or attorney-in-fact) broad powers to manage matters on behalf of anothe...

Are there different types of power of attorney documents?

Yes. A power of attorney can be durable or non-durable. A durable power of attorney remains effective after the principal becomes incapacitated whi...

What are the most common reasons for needing a power of attorney?

Executing a power of attorney document may be helpful in a variety of ways. The power of attorney can permit an agent to act on the principal’s beh...

Is a person being a co-owner the same as that person having power of attorney?

In a joint account ownership situation,. any co-owner has full access to the account, including the ability to make withdrawals and pay bills. If o...

Is a person being a trusted contact the same as that person having power of attorney?

No. A trusted contact is an individual age 18 or older who is identified by you as someone we’re able to contact about your account for any of the...

I’m a trustee on a trust account. Can I use a power of attorney to name an agent to act on the trust...

A delegation of a trustee’s power may be subject to state laws and limitations in the trust agreement. Consult with your legal advisor to determine...

Is an account with an agent appointed in a power of attorney the same thing as an account with one o...

No. Sometimes referred to as a Totten trust or an in trust for (ITF) account, a payable on death (POD) account is an account ownership type in whic...

Does an agent have the same authority as a POD (payable on death) beneficiary?

No. Once a power of attorney document is executed and accepted by the bank and the agent is added to the account, the agent is authorized to act on...

Popular Posts:

- 1. who is attorney general/

- 2. what to do about attorney-client breach of verbal contract

- 3. who nominated kimba wood for attorney general

- 4. who higher than the attorney general in new york

- 5. who is the district attorney for lamar county alabama

- 6. what the difference between guardian and power of attorney

- 7. how to apply for power of attorney maricopa county az

- 8. who pays attorney fees in child custody cases site:www.avvo.com

- 9. how much does a personal injury attorney in california cost on average

- 10. what is a deputy assistant attorney general versus a district attorney