What is a New Jersey tax power of attorney form?

Aug 03, 2021 · Division personnel can only access clients' accounts after a practitioner faxes in a completed New Jersey Division of Taxation Appointment of Taxpayer Representative, Form M …

How do I cancel a power of attorney in New Jersey?

Type of Tax (New Jersey Gross Income, Sales and Use, Corporation, Partnership, Employment, Inheritance, etc.) Years(s) and Period(s) ... I/We do not want the Division to send any notices or …

Where is my power of attorney on my tax return?

A power of attorney is a legal document with which a person—called the principal—gives authority to another person—the agent or attorney-in-fact— to perform certain duties for them. The most …

How do I request a power of attorney or tax information authorization?

Jul 18, 2021 · Fax or Mail Forms 2848 and 8821. If you can’t use an online option, you can fax or mail authorization forms to us. Paper forms by fax or mail. Handwritten signature only. First-in, …

Where do I send my NJ business tax return?

Where do I send my NJ taxes?

What is PO Box 046 Trenton NJ?

| Mailing Address | City | Zip Code |

|---|---|---|

| PO Box 046 | Trenton | 08646-0046 |

| PO Box 187 | Trenton | 08695-0187 |

| PO Box 188 | Trenton | 08646-0188 |

| PO Box 189 | Trenton | 08695-0189 |

Where do I send my 1099 to NJ?

Is NJ accepting 2021 tax returns?

What is schedule NJ DOP?

How do I contact the NJ Division of Taxation?

What is a NJ Dln number?

Are NJ state tax offices open?

Do you have to file 1099-NEC with State of NJ?

Do I need to file 1099 Misc with NJ?

The Division of Taxation requires mandatory electronic filing for W-2s and 1099s. This mandate includes Forms NJ-W-3, W-2, W-2G, 1094/1095, and all 1099s.Feb 7, 2022

How do I file a 1099-NEC?

Where to find check box for Power of Attorney?

Locate the check box in Section 6. If there have been previous Powers of Attorney issued for some or all of the Tax Matters defined here, it will be automatically revoked at the Principal Signing. If the Principal Taxpayer needs any such previous Powers to remain in effect then mark this check box and attach a copy of the Power Document to remain in effect. Otherwise, leave this check box unmarked.

Who is authorized to receive copies of correspondence?

By default, the first Representative Attorney-in-Fact listed above will be authorized to receive copies of correspondence (regarding the Tax Matters defined) addressed to the Principal Tax Payer. If the Principal Taxpayer does not wish this, then mark the first check box in Section 5. If the Principal Taxpayer wishes both Representatives to receive copies of such correspondence, then mark the second check box in Section 5.

What entity type is listed in the principal taxpayer table?

The area directly below the Principal Taxpayer table will present a list of Entity Types, each with a check box: Individual, Corporation, Partnership, Limited Liability Company, Sole Proprietorship, Trust, and Other. Only one of these check boxes should be marked. After the word “Other,” define what the Principal Taxpayer’s Legal Status Type is.

Can a power appointment be terminated?

Generally, previously issued power documents concerning any of the subject matters (or years) where the agent is assigned principal authority will automatically be terminated by this document’s execution. In such cases, it would be considered wise to make sure such an Agent is aware of his or her termination through a written revocation. If the principal chooses to, he or she may also keep previously issued power appointments in place so long as this intent is documented here on this form before its execution.

Is a principal's Social Security number the same as a NJ tax ID number?

Generally, the Principal’s Social Security is identical to his or her NJ Taxpayer ID Number , however if the Principal Taxpayer has a separate NJ Taxpayer ID Number, it should be reported. If the Principal Taxpayer has a Trustee Or Executor, report such a party’s Name in the box labeled “Name And Address Of Trustee Or Executor.”.

What is a power of attorney in New Jersey?

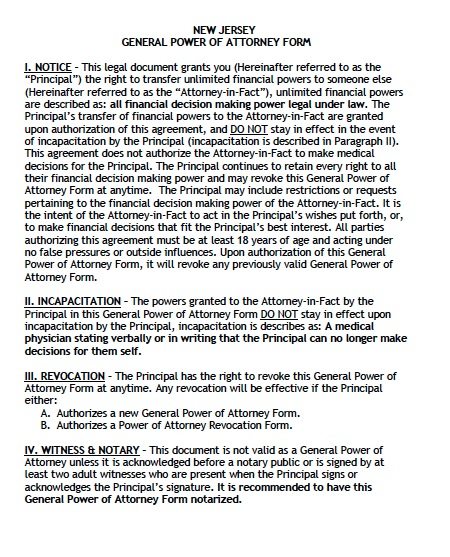

New Jersey Power of Attorney allows a person (known as the “Principal”) to select someone else (known as the “Agent” or “Attorney-in-Fact”) to maintain authority over their financial matters, health care decisions, and other personal and/or business affairs. There may be a point in a person’s life where they feel they want to hand over certain powers concerning their personal or business life to a trusted individual. Having a power of attorney in place means that the agent can perform certain tasks for the principal and, in some cases, this power will continue even if something happens to the principal (mental or physical disability or other type of incapacitation). The principal should be rational when making their selection; an attorney-in-fact must be trustworthy, competent, and responsible.

What does it mean to have a power of attorney?

Having a power of attorney in place means that the agent can perform certain tasks for the principal and, in some cases, this power will continue even if something happens to the principal (mental or physical disability or other type of incapacitation).

What is a minor guardianship power of attorney?

A New Jersey minor guardianship power of attorney form, when executed properly, designates an eligible individual as a temporary guardian over a person’s child or children. The appointed guardian will handle all responsibilities and tasks associated with parenting such as educational matters, health care decisions, disciplinary actions, ...

What is a power of attorney in New Jersey?

A general power of attorney lets the principal authorize the agent to act on their behalf in all matters, as allowed by the state of New Jersey. It comes into effect upon signing and ends when the principal becomes incapacitated or mentally incapable of making decisions for themselves.

What is durable POA in NJ?

A durable POA in NJ authorizes an agent to have power over the principal’s:

What is a do not pay lawyer?

DoNotPay is the world’s first robot lawyer that’s here to deliver no matter the type of assistance you need. Are you frustrated by greedy companies? So are we—that’s why we created a plethora of products that will help you fight money-hungry corporations:

Can an attorney in fact change a will?

An attorney-in-fact isn’t authorized to change, alter, or revoke a will.

Can you create a durable POA in New Jersey?

If you want to create a durable POA in New Jersey, you will have to meet specific requirements within the document. Check out the table below for more details:

How to authorize a power of attorney?

Authorize with Form 2848 - Complete and submit online, by fax or mail Form 2848, Power of Attorney and Declaration of Representative.

Where is my tax authorization?

Your Tax Information Authorization is recorded on the Centralized Authorization File (CAF) unless Line 4, Specific Use is checked. The record lets IRS assistors verify your permission to speak with your representative about your private tax-related information.

How long does a tax authorization stay in effect?

Tax Information Authorization stays in effect until you revoke the authorization or your designee withdraws it.

How to authorize a third party to file taxes?

There are different types of third party authorizations: 1 Power of Attorney - Allow someone to represent you in tax matters before the IRS. Your representative must be an individual authorized to practice before the IRS. 2 Tax Information Authorization - Appoint anyone to review and/or receive your confidential tax information for the type of tax and years/periods you determine. 3 Third Party Designee - Designate a person on your tax form to discuss that specific tax return and year with the IRS. 4 Oral Disclosure - Authorize the IRS to disclose your tax information to a person you bring into a phone conversation or meeting with us about a specific tax issue.

What is a tax information authorization?

A Tax Information Authorization lets you: Appoint a designee to review and/or receive your confidential information verbally or in writing for the tax matters and years/periods you specify. Disclose your tax information for a purpose other than resolving a tax matter.

How long does a power of attorney stay in effect?

Power of Attorney stays in effect until you revoke the authorization or your representative withdraws it. When you revoke Power of Attorney, your representative will no longer receive your confidential tax information or represent you before the IRS for the matters and periods listed in the authorization.

Do you need a signature for a power of attorney?

Power of Attorney must be authorized with your signature. Here’s how to do it:

Popular Posts:

- 1. what are requirements for california attorney fee agreement

- 2. who is the us attorney general now?

- 3. how to make desmume run smoother ace attorney investigations 2

- 4. how long will it take to receive lump sum payment through texas attorney general

- 5. how to sign as power of attorney with notarizaion needed

- 6. why did my attorney gave me his number?

- 7. what can youreport to teh attorney general

- 8. who is a good eeoc attorney

- 9. what is the address of attorney general jeff sessions

- 10. how to activate lasting power of attorney