1. Emailthe completed form to: [email protected]. 2. Faxthe completed form to: (602) 716-6008. 3. Mail the original or photocopy of the completed form to: Arizona Department of Revenue each license ATTN: Power of Attorney

What is a power of attorney form in Arizona?

A taxpayer may now submit the Arizona Form 285 and Form 285B through email or fax, in addition to the mail. These forms authorize the Department to release confidential information to the taxpayer’s Appointee. Taxpayers may email these completed forms to [email protected] or fax to (602) 716-6008.

How do I send a POA form to Arizona Department of revenue?

Durable Health Care Power of Attorney* AZAG PBGN4F: Durable Mental Health Care Power of Attorney* AZAG PBGN5F: Power of Attorney Delegating Parental Powers: GNPPOA10F *Indicates forms are courtesy of the Office of the Attorney General of Arizona, Mark Brnovich.

How do I revoke a power of attorney in Arizona?

the General Power of Attorney packet at the Maricopa County Superior Court “forms” website or at one of the Law Library Resource Centers located in …

How do I submit my power of attorney and disclosure form?

A “durable” power of attorney is a term that explains when the power of attorney kicks in and how long it lasts, in essence. For example, you might execute a specific power of attorney for a friend or family member to make certain decisions for your children in case of emergency when you go away for an extended vacation.

Does power of attorney need to be recorded in Arizona?

Does a Power of Attorney have to be recorded? It does not have to be recorded immediately after you sign it. If your Agent has to handle a real estate transaction for you, the Power of Attorney will need to be recorded at the time of the transaction.

Does a POA need to be notarized in Arizona?

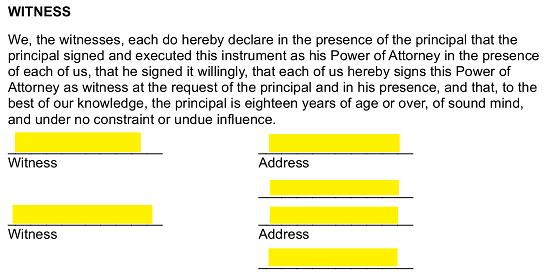

In Arizona, in addition to other legal requirements, a financial power of attorney must be signed, witnessed in writing by a person other than the agent, the agent's spouse, the agent's children or the notary public, who confirms you are at least 18, of sound mind and under no constraint or undue influence and it must ...Aug 20, 2013

Where do I fax Arizona form 285?

Fax the completed form to: (602) 716-6008. Who Can Use Form 285?

What is AZ 285?

A taxpayer may use Arizona Form 285 to authorize the department to release confidential information to the taxpayer's Appointee.

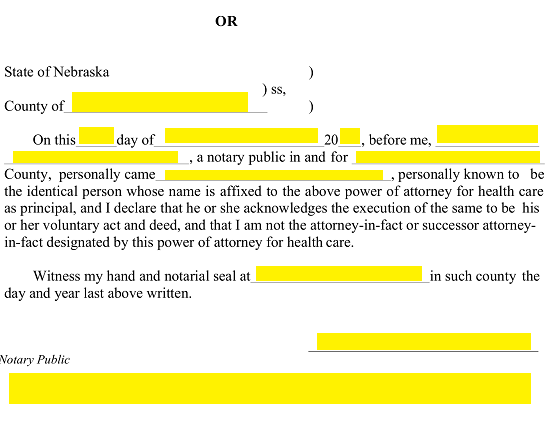

How do I notarize a power of attorney in Arizona?

0:172:49How to Get Power of Attorney in Arizona - Signing RequirementsYouTubeStart of suggested clipEnd of suggested clipAnd business decisions for the principal. Even if they are incapacitated signing requirements inMoreAnd business decisions for the principal. Even if they are incapacitated signing requirements in Arizona signatures of the principal. And one witness and acknowledged before a notary.

Does Arizona recognize out of state power of attorney?

Foreign Powers of Attorney – Powers of Attorney Executed Outside Arizona. A power of attorney executed in another jurisdiction of the United States is valid in Arizona if the power of attorney was validly executed in the jurisdiction in which it was created.

Where can I fax AZ POA?

Taxpayers may email these completed forms to [email protected] or fax to (602) 716-6008.Sep 1, 2021

How do I submit a power of attorney?

power of attorney. submit a power of attorney....To establish a power of attorney relationship, you must fill out and submit the correct FTB form.Choose the correct form. ... Fill out the form correctly. ... Sign the form. ... Provide supporting documentation, if necessary, such as: ... Submit the form. ... After you submit.Sep 23, 2021

How do I fill out Arizona form 285?

1:059:18Learn How to Complete the Arizona Form 285, General Disclosure ...YouTubeStart of suggested clipEnd of suggested clipAvailable in the department. Website at WWE CDO arrgh of section 1 of the form 285 is for theMoreAvailable in the department. Website at WWE CDO arrgh of section 1 of the form 285 is for the taxpayer. Information. There is space to enter the taxpayers. Name address and a time telephone.

What is a power of attorney in Arizona?

Arizona Power of Attorney allows an individual (“principal”) to appoint a legal representative (“agent” or “attorney in fact”) to operate on their behalf. The decisions that the agent will have authority to make will vary depending on the type of POA form signed and the scope of power assigned within the legal document. There are a multitude of reasons why an individual would draft a power of attorney; they may anticipate losing decisional capacity and require a loved one to care for their needs once they become incapacitated, they may need a financial representative to gain access to their bank accounts and manage their estate, or they may need to assign a trusted guardian to care for their children. Whatever the reason, both parties (the principal and attorney-in-fact) will need to sign the document verifying their consent.

What is a power of attorney revocation form?

The Arizona power of attorney revocation form can be used to cancel or void any type of existing power of attorney document. In order to be considered legally valid, the form must be completed in its entirety, signed by the principal, and notarized by a certified notarial officer. The alternative process through which an individual can terminate ...

What is a 285 power of attorney?

The Arizona tax power of attorney form 285 can be used to elect a person (usually an accountant) to handle another person’s tax filing within the State of Arizona. This document is the only POA form that does not need to have its signatures acknowledged before a notary public or witnessed.

What is a general power of attorney?

General Power of Attorney – A General Power of Attorney is a person that is given complete authority to act upon another adult’s finances, property, business transactions, etc. The General Power of Attorney typically does not have the rights to make decisions on the person’s health care treatment.

What happens to a power of attorney when you pass away?

However, if you pass away a Power of Attorney loses all power making decisions for you specific to your assets, etc.

How long does a power of attorney last?

A Parental Power of Attorney typically begins on a date and ends no more than six months later from the initial date. This is a temporary power of attorney that gives authority over your children in a specific situation and obviously with that, the person that you’ve chosen is willing to accept this responsibility.

How to create a power of attorney?

Also, powers of attorney can be very broad or very limited in scope, so people can give their agent as little or as much authority as they wish. In order to be valid, however, people must adhere to the following guidelines when creating a power of attorney: 1 The principal must understand the nature and effect of signing a power of attorney. 2 The principal must sign the power of attorney willingly. 3 The principal must initial any paragraph in the power of attorney that benefits the agent. 4 A notary and witness other than the agent, the agent’s spouse, or the agent’s children must sign the power of attorney. 5 A power of attorney can be revoked or changed for as long as the principal remains competent. 6 The financial power of attorney form itself must meet certain criteria.

Who must sign a power of attorney?

The principal must sign the power of attorney willingly. The principal must initial any paragraph in the power of attorney that benefits the agent. A notary and witness other than the agent, the agent’s spouse, or the agent’s children must sign the power of attorney.

What is a health care power of attorney?

With a health care power of attorney, people designate an agent to make their medical decisions in the event of an emergency. Health care powers of attorney assure principals that their important health care decisions rest with somebody whom they trust should they become incapacitated.

Can a power of attorney be used to handle a person's finances?

With a durable financial power of attorney, most anybody can designate another person to handle his finances. Powers of attorney can take immediate effect, or spring into effect upon the occurrence of a specified event such as illness or injury.

Popular Posts:

- 1. what kind of cases will the u.s. attorney investigate

- 2. who do i talk to about my attorney that failed to gather evidence

- 3. what can be done when an attorney is not doing his job

- 4. what can a tax attorney reduce $72,000.00 to

- 5. what kind of attorney do you need for landlord issues

- 6. where to get forms for power of attorney

- 7. what type of attorney warren ross attorney florida

- 8. power of attorney agent who comes to your home

- 9. who is the defense attorney in 7 seconds netflix

- 10. how to sign a deed in california by a power of attorney