Online. Submit your Form 2848 securely at IRS.gov/Submit2848. Note. You will need to have a Secure Access account to submit your Form 2848 online. For more information on Secure Access, go to IRS.gov/SecureAccess. Fax. Fax your Form 2848 to the IRS fax number in the Where To File Chart. Mail. Mail your Form 2848 directly to the IRS address in the

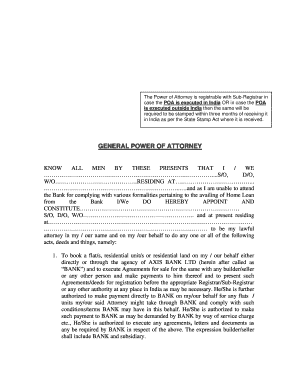

How do I get a power of attorney in Indiana?

Taxpayers who authorize a representative to have Power of Attorney on their behalf for state tax matters must have a properly completed POA-1 form, which must be submitted to DOR in one of the following ways: By mail with a hardcopy of the original. By fax as a copy of the original.

How do I renew a poa-1 in Indiana?

6. The Power of Attorney form can contain the specific type of tax, or the option ALL. By choosing the option ALL, you will be allowed access to ALL tax types appropriate to the taxpayer. The tax years must be specific. 7. The taxpayer’s signature or the signature of an individual authorized to execute the Power of Attorney on the taxpayer ...

What is a power of attorney form?

Indiana Power of Attorney Forms. Indiana Power of Attorney Forms allow individuals to appoint representatives to take care of their finances and health care decisions. Using the durable power of attorney and living will forms (medical power of attorney), agents can be given the authority to act on behalf of the principal in the event of their incapacitation.

Where can I get a copy of my power of attorney?

LIMITED POWER OF ATTORNEY VEHICLE AND WATERCRAFT TRANSACTIONS State Form 1940 (R6 / 6-21) INDIANA BUREAU OF MOTOR VEHICLES INSTRUCTIONS: 1. Complete in blue or black ink. If more than one customer’s signature is required, each customer must complete their own Limited Power of Attorney section below. 2.

How do I file a power of attorney in Indiana?

Indiana POA RequirementsBe in writing.Name an attorney in fact.Give the attorney in fact the power to act on behalf of the principal.Be signed by the principal or at the principal's direction by another individual in the presence of a notary public.

Does a power of attorney need to be recorded in Indiana?

(b) An attorney in fact shall record the power of attorney authorizing the execution of a document that must be recorded before presenting the document for recording.

Where do I mail my Indiana?

Mailing AddressesPaper returns (original and amended) without paymentPaper returns (original and amended) with paymentIndiana Department of Revenue PO Box 40 Indianapolis, IN 46206-0040Indiana Department of Revenue PO Box 7224 Indianapolis, IN 46207-7224

Does a power of attorney have to be notarized in Indiana?

Please note that Indiana law has very specific requirements for a Power of Attorney to be valid. The member's signature must be witnessed and attested to by a Notary Public. The Notary Public must also sign the document along with their printed name and the notarial seal.

Does Indiana have a statutory power of attorney form?

Indiana does not have a statutory form to create a power of attorney.

Do you need a lawyer to get a power of attorney?

Do I need a lawyer to prepare a Power of Attorney? There is no legal requirement that a Power of Attorney be prepared or reviewed by a lawyer. However, if you are going to give important powers to an agent, it is wise to get individual legal advice before signing a complicated form.

Where do I mail my Indiana it 40?

IndianapolisWhere to Mail Completed Tax FormsRegardingAddressCityForm IT-9 (Filing Extension)P.O. Box 6117Indianapolis, INForms IT-40, PNR and RNR (Enclosing payment)P.O. Box 7224Indianapolis, INForms IT-40, PNR and RNR (All others)P.O. Box 40Indianapolis, INForm ES-40 (New Accounts)P.O. Box 6102Indianapolis, IN64 more rows

Where do I mail my Indiana state tax return 2021?

Indiana Department of Revenue. P.O. Box 40. Indianapolis, IN 46206-0040.Jun 4, 2019

How do I contact Indiana Department of Revenue?

(317) 233-5656 All tax forms can be found online and downloaded here.

Can you have two power of attorneys in Indiana?

(a) Except as otherwise stated in the power of attorney, if more than one (1) attorney in fact is named, each attorney in fact may act independently of the other attorney in fact in the exercise of a power or duty.

Is a power of attorney valid after death in Indiana?

A power of attorney is no longer valid after death. The only person permitted to act on behalf of an estate following a death is the personal representative or executor appointed by the court. Assets need to be protected.

What is Indiana durable power of attorney?

The Indiana durable power of attorney form is a document by which an individual (principal) can authorize an agent (attorney-in-fact) to act on their behalf during their lifetime and in the event that they become incapacitated or die.

Popular Posts:

- 1. what are reasonable attorney fees in south carolina

- 2. who is alabama's attorney general after luther strange appointed to senate

- 3. where can i get a power of attorney ohio

- 4. how does power of attorney sign

- 5. what kind of attorney is needed for a business to sue a business in texas

- 6. where is impersonating an attorney a felony

- 7. new york us attorney lynch who appointed

- 8. how to get power of attorney in state of pa

- 9. attorney who does wills 33908

- 10. who pays attorney fee in pa act 534 benefits