Submit your Form 2848 securely at IRS.gov/Submit2848. Fax. Fax your Form 2848 to the IRS fax number in the Where To File Chart. Mail. Mail your Form 2848 directly to the IRS address in the Where To File Chart.

Full Answer

How do I fill out a form 2848?

Submit your Form 2848 securely at IRS.gov/ Submit2848. Note. You will need to have a Secure Access account to submit your Form 2848 online. For more information on Secure Access, go to IRS.gov/SecureAccess. • Fax. Fax your Form 2848 to the IRS fax number in the Where To File Chart. • Mail. Mail your Form 2848 directly to the IRS address in the

Where to file Form 2848?

If authorized, your representative can send in a new Form 2848 to substitute or add another representative(s). Your representative must sign the new Form 2848 on your behalf, and submit it to the appropriate IRS office with a copy of your written permission or the original Form 2848 that delegated the authority to substitute or add another representative.

Who can sign a 2848?

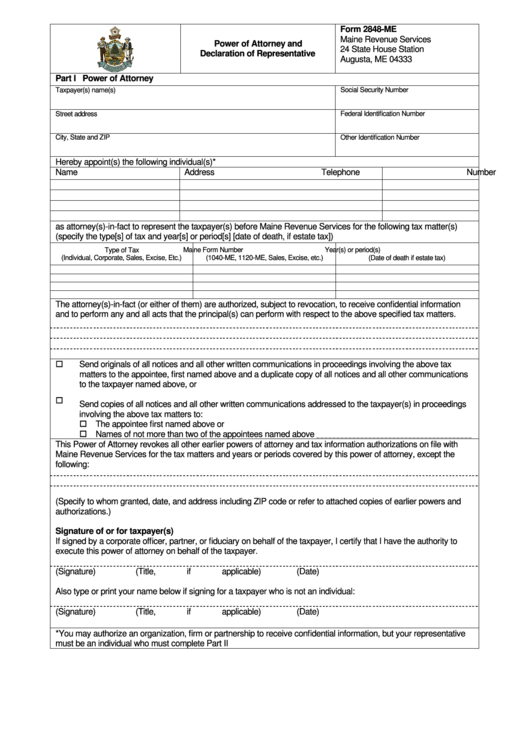

Form 2848 (Rev. January 2021) Department of the Treasury Internal Revenue Service . Power of Attorney and Declaration of Representative . Go to . www.irs.gov/Form2848 . for instructions and the latest information. OMB No. 1545-0150 . For IRS Use Only . Received by: Name . Telephone Function . Date / / Part I Power of Attorney . Caution:

How to suppress Form 2848?

Form 2848, Power of Attorney and Declaration of Representative, can be generated by using screen 2848 Power of Attorney located on the Other Forms tab. Form 2848 is available in all return types in Drake Tax. It cannot be e-filed, but may be completed for an e-filed return and either: attached to the return for e-filing, or

How do I submit a 2848 to the IRS?

The "Submit Forms 2848 and 8821 Online" tool is available from the IRS.gov/taxpros page. It also has "friendly" web addresses that can be bookmarked: IRS.gov/submit2848 and IRS.gov/submit8821. To access the tool, tax professionals must have a Secure Access username and password from an IRS account such as e-Services.

How do I send IRS forms?

Visit the Free File Site. Select "Free File Fillable Forms Now” and then hit “Leave IRS Site” after reading the disclaimer.Start the Process. Select “Start Free File Fillable Forms” and hit “Continue.”Get Registered. ... Select Your 1040. ... Fill Out Your Tax Forms. ... E-File Your Tax Form. ... CREATE AN ACCOUNT. ... Complete Your Account.More items...

Where do I send my 2848?

Forms 2848 with an electronic signature image or digitized image of a handwritten signature may only be submitted to the IRS online at IRS.gov/Submit2848.Sep 2, 2021

Where do I fax SC POA?

You can mail a paper copy of the completed SC2848 to PO Box 125, Columbia, SC 29214-0400. If you have a tax matter pending (such as an audit) you can mail, email, or fax the SC2848 to the SCDOR division that is handling the tax matter.Dec 2, 1975

Where do you file and withdraw forms 2848 and 8821?

Where to File Forms 2848 and 8821. Practitioners must mail or fax their authorization forms to the applicable CAF unit (Ogden, Utah; Memphis, Tenn.; or Philadelphia) unless they check the box on line 4 of Form 2848 or 8821 (specific use not recorded on the CAF).Jun 30, 2015

Can form 2848 be signed electronically?

As long as you can create a Secure Access account and follow authentication procedures, you may submit a Form 2848 or 8821 with an image of an electronic signature.Nov 15, 2021

How long does it take for IRS to process form 2848?

The fax and mail options for submitting Forms 2848 and 8821 are still available, however signatures on such forms must be handwritten. Using the online option will not accelerate the time necessary for the IRS to process the authorizations, which is currently estimated to be five weeks.Jan 26, 2021

Can I email form 2848 to the IRS?

Electronic signatures are not allowed. Most Forms 2848 and 8821 are recorded on the IRS's Centralized Authorization File (CAF). Authorization forms uploaded through this tool will be worked on a first-in, first-out basis along with mailed or faxed forms.Jan 25, 2021

What forms can be faxed to the IRS?

You can also find more general information on where you can file your taxes by fax (Form 1040, Form 2553, Form 4868, Form 8962, Applying for EIN, …) on IRS's “Where to File Paper Tax Returns With or Without a Payment” page.

Does form 2848 require wet signature?

“Wet” ink signatures are needed in order to fax or mail the Form 2848 to the IRS.Mar 9, 2021

Can I file my 2021 taxes?

IRS Free File, available only through IRS.gov, is now accepting 2021 tax returns. IRS Free File is available to any person or family with adjusted gross income of $73,000 or less in 2021. The fastest way to get a refund is by filing and accurate return electronically and selecting direct deposit.Jan 31, 2022

Where can I get SC tax forms?

If you qualify for a paper copy of a tax form based on these criteria, you can email your paper form request to [email protected] or call 1-844-898-8542 to speak to a representative. You will need to provide your name, address, and the form you are requesting.

How do you get power of attorney in South Carolina?

The specific requirements and restrictions for PoA forms will vary in each state; however, in South Carolina, your Power of Attorney will require notarization and the signatures of two witnesses. If your agent will manage real estate transactions, the Power of Attorney must be notarized and recorded with your county.

How do I submit form 8821?

Submit your Form 8821 securely at IRS.gov/Submit8821. Fax. Fax your Form 8821 to the IRS fax number in the Where To File Chart. Mail. Mail your Form 8821 directly to the IRS address in the Where To File Chart.Sep 3, 2021

Can I upload documents to IRS?

Depending on the situation, the acceptable types of documentation may include copies of pay statements or check stubs. You take a picture of your documentation and the Documentation Upload Tool enables you to upload the image. And just like that, the IRS can access the data and continue working the case.Aug 26, 2021

How do I fill out form 8821?

0:023:59Quick Tips | Filling Out IRS Form 8821: Tax Information AuthorizationYouTubeStart of suggested clipEnd of suggested clipYou need to access their personal tax information form 88 21 authorizes any individual organizationMoreYou need to access their personal tax information form 88 21 authorizes any individual organization or tax professional to receive confidential tax documents for their client.

What is the purpose of Form 2848?

Purpose of Form. Use Form 2848 to authorize an individual to represent you before the IRS. See Substitute Form 2848, later, for information about using a power of attorney other than a Form 2848 to authorize an individual to represent you before the IRS. The individual you authorize must be eligible to practice before the IRS.

What is a power of attorney for IRS?

Except as specified below or in other IRS guidance, this power of attorney authorizes the listed representative (s) to inspect and/or receive confidential tax information and to perform all acts (that is, sign agreements, consents, waivers, or other documents) that you can perform with respect to matters described in the power of attorney. Representatives are not authorized to endorse or otherwise negotiate any check (including directing or accepting payment by any means, electronic or otherwise, into an account owned or controlled by the representative or any firm or other entity with whom the representative is associated) issued by the government in respect of a federal tax liability. Additionally, unless specifically provided in the power of attorney, this authorization does not include the power to substitute or add another representative, the power to sign certain returns, the power to execute a request for disclosure of tax returns or return information to a third party, or to access IRS records via an Intermediate Service Provider. Representatives are not authorized to sign Form 907, Agreement to Extend the Time to Bring Suit, unless language to cover the signing is added on line 5a. See Line 5a. Additional Acts Authorized, later, for more information regarding specific authorities.

Who is Diana's representative on W-2?

Diana authorizes John to represent her in connection with her Forms 941 and W-2 for 2018. John is authorized to represent her in connection with the penalty for failure to file Forms W-2 that the revenue agent is proposing for 2018.

Can a law student represent a taxpayer?

You must receive permission to represent taxpayers before the IRS by virtue of your status as a law, business, or accounting student working in an LITC or STCP under section 10.7 (d) of Circular 230. Law graduates in an LITC or STCP may also represent taxpayers under the "Qualifying Student" designation in Part II of Form 2848. Be sure to attach a copy of the letter from the Taxpayer Advocate Service authorizing practice before the IRS.

Who is an unenrolled return preparer?

An unenrolled return preparer is an individual other than an attorney, CPA, enrolled agent, enrolled retirement plan agent, or enrolled actuary who prepares and signs a taxpayer's return as the paid preparer, or who prepares a return but is not required (by the instructions to the return or regulations) to sign the return.

Can I use a power of attorney other than 2848?

The IRS will accept a power of attorney other than Form 2848 provided the document satisfies the requirements for a power of attorney. See Pub. 216, Conference and Practice Requirements, and section 601.503 (a). These alternative powers of attorney cannot, however, be recorded on the CAF unless you attach a completed Form 2848. See Line 4. Specific Use Not Recorded on the CAF, later, for more information. You are not required to sign Form 2848 when you attach it to an alternative power of attorney that you have signed, but your representative must sign the form in Part II, Declaration of Representative. See Pub. 216 and section 601.503 (b) (2).

What is a fiduciary notice?

Use Form 56, Notice Concerning Fiduciary Relationship, to notify the IRS of the existence of a fiduciary relationship. A fiduciary (trustee, executor, administrator, receiver, or guardian) stands in the position of a taxpayer and acts as the taxpayer, not as a representative.

What is a 2848 form?

Usually, the two aspects of the title are combined into the same person and the form is referred to simply as a “ Power of Attorney Form . IRS Form 2848 is used to designate an individual to represent the taxpayer before the IRS and to allow the representative to perform all tax acts that the taxpayer would normally take care of.

What is the power of attorney?

The way you choose depends on the amount of power you are willing to give that person that is going to be helping you. Power of attorney gives them the most power, they can act on your behalf for tax matters. You can limit their power by just authorizing them access to your confidential tax information by filling out and filing ...

Do I need to include my name on my return?

Individuals need to include their name, social security number, or employer identification number, as well as their address. For a join return, your spouse must also include his/her name, social security number, and address if different from yours.

What is IRS Form 8821?

IRS form 8821 is used to authorize any individual, corporation, firm, organization, or partnership to inspect and/or receive your private tax information. They can receive information from any IRS office for the tax information and years that are listed when the form is completed. When this form is completed it gives the appointee limited power ...

What line do you check if you have a power of attorney?

Check the box listed on Line 4 if the IRS power of attorney is for a use that will not be named on the CAF. An IRS power of attorney will not be recorded if it does not relate to a specific period.

What is the second part of a power of attorney?

The second part of the IRS power of attorney is where your representative signs and dates, while also entering his designation – such as an irs tax attorney , certified public accountant, enrolled agent, officer, family member, etc.

Can I file Form 2848 electronically?

You must file form 2848 if you would like your attorney, family member or accountant to be able to act on your behalf for tax matters. You may file it electronically or by mail. The appropriate mailing addresses are contained in the form’s instructions.

What is a 2848 form?

Form 2848 is processed by an IRS computer , which treats spaces, dashes, and similar notations as characters. The date of the taxpayer's signature must be no later than the date of the representative's signature. This is a sensitive issue with the IRS, and it will not process a POA if a practitioner's signature is dated prior to the taxpayer's.

What is a POA?

The power of attorney (POA) is the written authorization for an individual to receive confidential information from the IRS and to perform certain actions on behalf of a taxpayer. If the authorization is not limited, the individual can generally perform all acts that a taxpayer can perform except negotiating a check.

Popular Posts:

- 1. how much does an attorney cost for traffic violation

- 2. hit and run attorney how much

- 3. which should i choose for va disability claims appeal attorney or claims agent

- 4. how to file power of attorney in connecticut

- 5. what is the process for an attorney requesting my oh criminal record

- 6. what kind of attorney to use for recouping money owed

- 7. how to write a plead letter to district attorney office

- 8. who can issue power of attorney

- 9. what if my ex does not contact my attorney until trail date.

- 10. will my executor who is my power of attorney be made to pay a debt out of my checking account