First, you need to find the proper form online. Use our form-building software to download the official template or visit the Texas HHSC site. Once you get the form, open it on your laptop or desktop.

Full Answer

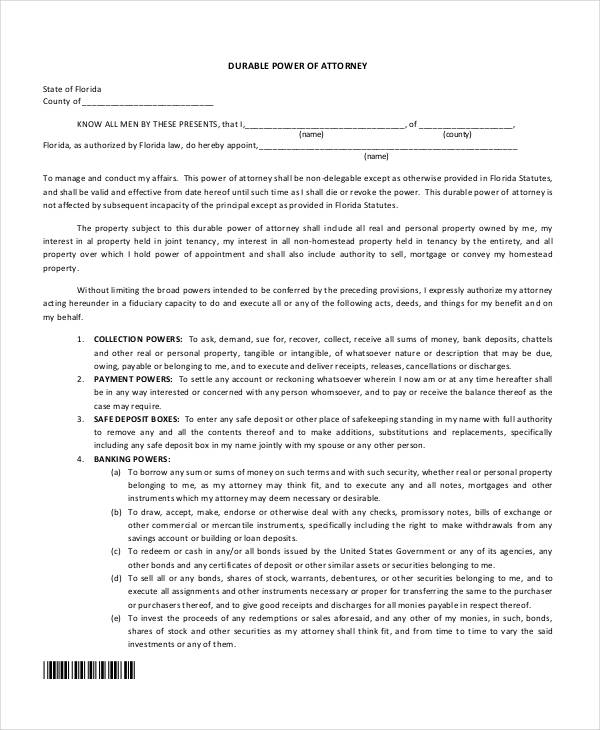

How do you get a durable power of attorney form?

statutory durable power of attorney 09-1-2017. p. a. ge. 1. statutory durable power of attorney. 0. 9-1-201. 7. statutory durable power of attorney. 0. 9-1-201. 7. p. a. ge. 1. p. a. ge. 1. statut. o. ry durable po. w. er of attorney. notice: the powers granted by this document are broad and sweeping. they are explained in the durable power of ...

How do you create a durable power of attorney?

texas statutory durable power of attorney notice: the powers granted by this document are broad and sweeping. they are explained in the durable power of attorney act, subtitle p, title 2, estates code. if you have any questions about these powers, obtain competent legal advice. this document does not authorize anyone to make medical and other

How to get a durable power of attorney?

Instructions Updated: 9/2017 Purpose This form is for designating an agent who is empowered to take certain actions regarding your property. It does not authorize anyone to make medical and other healthcare decisions for you.

Do I need to file power of attorney in Texas?

Texas Durable Power of Attorney Form - Free Download on UpCounsel Texas Durable Power of Attorney SAMPLE TEXAS DURABLE POWER OF ATTORNEY FORM THE POWERS YOU GRANT BELOW ARE EFFECTIVE EVEN IF YOU BECOME DISABLED OR INCOMPETENT. NOTICE: THE POWERS GRANTED BY THIS DOCUMENT ARE BROAD AND SWEEPING.

Where do I get power of attorney forms in Texas?

Texans can access free financial POA forms on the Texas Health and Human Services website, and a free medical POA template in the Texas Health and Safety Code. Another option is to use FreeWill to create your free Texas durable financial power of attorney or living will (which includes a healthcare power of attorney).Oct 5, 2021

How do I fill out a statutory durable power of attorney in Texas?

How to Write1 – Download This Paperwork To Appoint An Agent With Power Of Attorney. ... 2 – Complete The Declaration Statement. ... 3 – Define How The Principal Power Should Be Used. ... 4 – Detail How These Powers Will Start. ... 5 – Execute This Appointment By Signing It. ... 6 – Additional Information Has Been Included For The Agent.Dec 28, 2021

Does a durable power of attorney have to be notarized in Texas?

We often hear the question, “does the power of attorney need to be notarized in Texas?” The answer is yes; the document and any changes to it should be formally notarized. Once these steps are completed, power of attorney is validly granted.May 25, 2021

Can I write my own power of attorney in Texas?

Any adult may create a power of attorney in Texas. The document must include one of the following statements: "This power of attorney is not affected by subsequent disability or incapacity of the principal." This makes it a durable power of attorney and gives the agent immediate authority.

What three decisions Cannot be made by a legal power of attorney?

Are there any decisions I could not give an attorney power to decide? You cannot give an attorney the power to: act in a way or make a decision that you cannot normally do yourself – for example, anything outside the law. consent to a deprivation of liberty being imposed on you, without a court order.

What is statutory durable power of attorney Texas?

Texas's statutory form of durable power of attorney is found in Section 752.051 of the Texas Estates Code. It is a financial durable power of attorney - this means that it only allows the agent to handle financial matters. It does not permit the agent to make decisions about the principal's health care.Jan 6, 2022

Does a durable power of attorney survive death in Texas?

Durable Power of Attorney Expires When Principal Dies However, the agent's power ends when the principal dies. At that point, the personal representative of the estate takes over to wind up the deceased person's estate.Jun 27, 2011

Can a power of attorney transfer money to themselves?

Attorneys can even make payments to themselves. However, as with all other payments they must be in the best interests of the donor. This can be difficult to determine and may cause a conflict of interests between the interests of an Attorney and the best interests of their donor.

Can two siblings have power of attorney?

Your parents' next of kin (a spouse, you, other siblings etc) cannot just take control of their finances or make health-related decisions. The only person who can do this legally is the nominated power of attorney.Jul 16, 2020

Does a durable power of attorney need witnesses in Texas?

The durable power of attorney does not need to be signed by any witnesses. It is not necessary to file the durable power of attorney unless the agent uses it with respect to a real property transaction.Aug 29, 2012

What is the difference between power of attorney and lasting power of attorney?

An ordinary power of attorney is only valid while you have the mental capacity to make your own decisions. If you want someone to be able to act on your behalf if there comes a time when you don't have the mental capacity to make your own decisions you should consider setting up a lasting power of attorney.Mar 7, 2022

Does a power of attorney have to be recorded in Texas?

WHY ARE POWERS OF ATTORNEY FILED IN THE LOCAL RECORDS? Section 489 of the TEXAS PROBATE CODE actually requires recording of the Power of Attorney when it is durable and the durability feature is being relied on in the transaction.

What is the power of attorney in Texas?

The authority granted to you under this power of attorney is specified in the Durable Power of Attorney Act (Subtitle P, Title 2, Estates Code). If you violate the Durable Power of Attorney Act or act beyond the authority granted, you may be liable for any damages caused by the violation or subject to prosecution for misapplication of property by a fiduciary under Chapter 32 of the Texas Penal Code.

What is fiduciary relationship?

When you accept the authority granted under this power of attorney, you establish a "fiduciary" relationship with the principal . This is a special legal relationship that imposes on you legal duties that continue until you resign or the power of attorney is terminated, suspended, or revoked by the principal or by operation of law. A fiduciary duty generally includes the duty to:

Instructions

This form is for designating an agent who is empowered to take certain actions regarding your property. It does not authorize anyone to make medical and other healthcare decisions for you.

Purpose

This form is for designating an agent who is empowered to take certain actions regarding your property. It does not authorize anyone to make medical and other healthcare decisions for you.

Signing Requirements

The principal is required to have their signature acknowledged before a notary public ( § 751.0021 ).

Statutory Form

Texas’ statutory durable power of attorney form can be found within TX Est Code § 752.051.

What is a durable power of attorney in Texas?

A Texas durable power of attorney form is a document that grants someone (the “agent”) the legal authority to act and make decisions for another person (the “principal”) in the state of Texas. Unlike a regular non-durable power of attorney (POA), a durable power of attorney (DPOA) stays in effect even if the principal becomes incapacitated ...

Where to store durable power of attorney?

After completing your durable power of attorney form, you should store it in a safe deposit box or secure place in your home. To use the durable power of attorney, you need to give your agent a copy of the form. You should also give a copy to family members, a trusted friend, and third parties where it will be used (such as your landlord, bank, ...

What does the principal need to mark on the form?

The principal needs to mark on the form which areas of their life they want to give the agent legal power over. This can be general authority (e.g., operation of a business) or specific authority (e.g., make a loan). They can also write specific instructions about which actions the agent can perform on their behalf.

Can an agent sign a power of attorney?

For an agent to sign on your behalf, contact the third party or place the DPOA will be used, and provide your ID and that of your agent. Your agent can use a power of attorney to conduct almost any legal matter that you can do (if granted the authority).

Can a power of attorney be revoked if the principal is incapacitated?

Although a durable power of attorney can’t be revoked if the principal is already incapacitated, it’s possible for a third-party individual to override a power of attorney if they suspect an agent of abuse or negligence. Although an agent has a ‘fiduciary duty’ to act in the principal’s best interest, this is not always the case.

Can you make a POA durable in Texas?

In Texas, you must use specific language to make your POA durable unless it’s created in a different state where a power of attorney is presumed to be durable.

What is Durable Power of Attorney Act?

In addition, the Durable Power of Attorney Act (Subtitle P, Title 2, Estates Code) requires you to: (1) maintain records of each action taken or decision made on behalf of the principal; (2) maintain all records until delivered to the principal, released by the principal, or discharged by a court; and. (3) if requested by the principal, provide ...

What is a fiduciary duty?

A fiduciary duty generally includes the duty to: (1) act in good faith; (2) do nothing beyond the authority granted in this power of attorney; (3) act loyally for the principal's benefit; (4) avoid conflicts that would impair your ability to act in the principal's best interest; and.

Is a power of attorney valid?

A power of attorney is valid with respect to meeting the requirements for a statutory durable power of attorney regardless of the fact that: (1) one or more of the categories of optional powers listed in the form prescribed by Section 752.051are not initialed; or. (2) the form includes specific limitations on, or additions to, ...

Popular Posts:

- 1. how to find a good attorney for divorce

- 2. how many years doe it take to become domestic violence attorney

- 3. ohio criminal defense attorney who cant afford policies

- 4. who is district attorney nassau county new york

- 5. what type of attorney handles hazerdous condition at a fast food restaurant

- 6. criminal defense attorney who violate privelege legal liability

- 7. what kind of attorney will fill out start up papers and tax id

- 8. how to sign documents as health agent under durable healthcare power of attorney

- 9. what happens during attorney review periosd

- 10. when is the election of prosecuting attorney in lenawee county