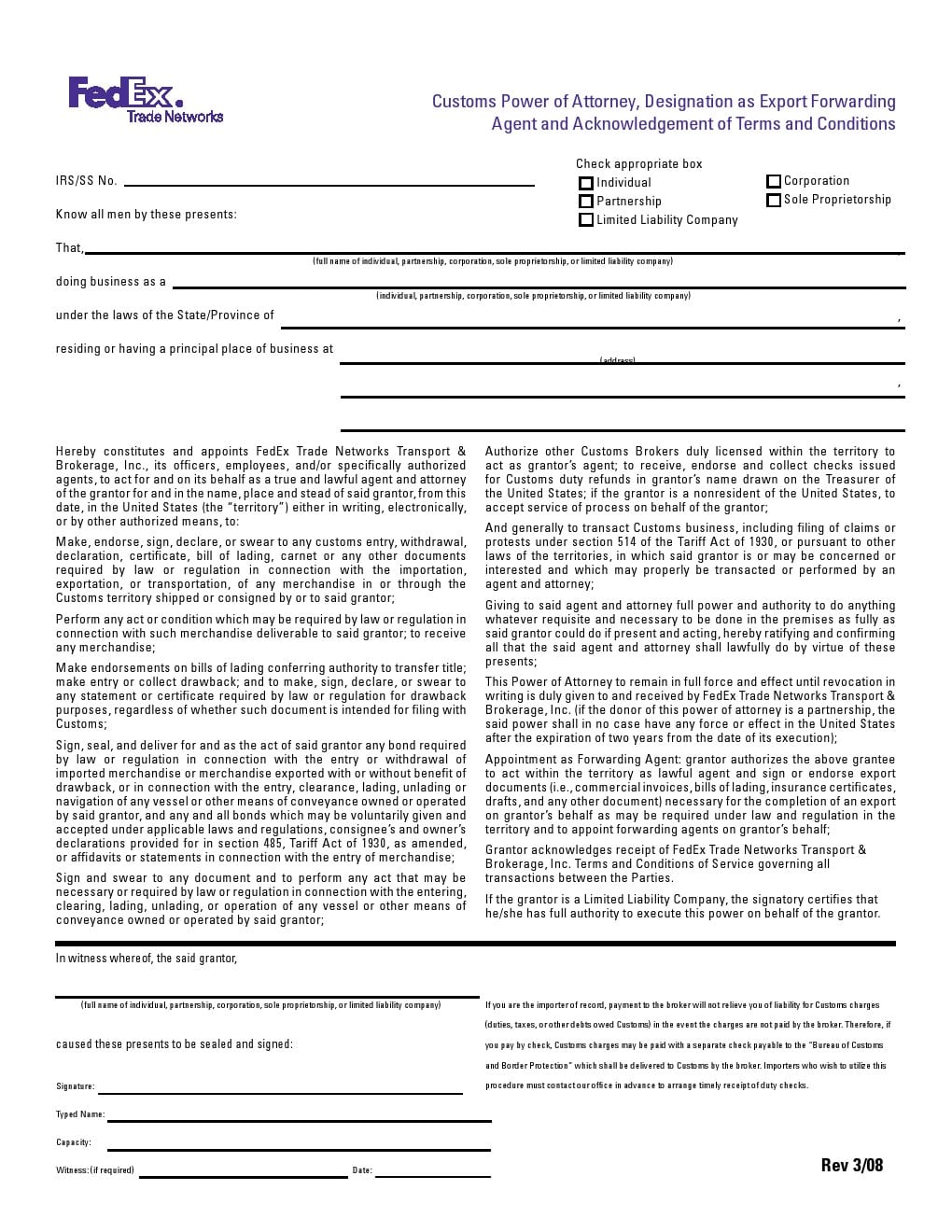

If grantor is an individual and the laws of the jurisdiction where the power of attorney is signed require notarization, an Individual Notarization must be attached. 8If grantor is a limited partnership, general partnership, or limited liability company a Partnership/Limited Liability Company Certification must be attached.

Full Answer

Who is the grantor of a power of attorney?

Certification of Limited Liability Company and Limited Partnership Interests Each Grantor acknowledges and agrees that, to the extent any interest in any limited liability company or limited partnership controlled by any Grantor and pledged under Section 2.01 is a “security” within the meaning of Article 8 of the UCC and is governed by Article 8 of the UCC, such interest shall be ...

Can a gift of limited partnership interest by gift be effective?

One member of the partnership may execute a power of attorney in the name of the partnership for the transaction of all its Customs business. ( 2 ) Limited partnership. A power of attorney …

Can assets of a limited partnership be pulled back into estate?

Nov 01, 2021 · The members. Generally, a POA in a TEFRA proceeding is the POA of the TMP, although other members may also have POAs and participate in the proceeding. There is not a …

Can a power of attorney sign documents for an LLC?

If grantor is a general or limited partnership and the partnership's rules or the laws of the jurisdiction where the power of attorney is signed require notarization, a Partnership …

Who has authority to bind a limited partnership?

What kind of duties does a limited partner have to a general partner?

Can a limited partner bind the partnership?

What is a limited partner agreement?

Is partnership a limited liability?

Keep in mind that general partnerships offer no liability protection to the owners. The owners are legally considered the same as the business, and personal assets can therefore be considered business assets.

What happens if a limited partner in a limited partnership participates in management?

What is an example of a limited partnership?

Is a limited partnership a separate legal entity?

Is a limited partner personally liable?

What is the difference between partnership and limited liability partnership?

What is the difference between limited liability partnership and limited partnership?

What is the purpose of a limited partnership agreement?

Who is responsible for filing 1041?

The business or activity is reporting income on Form 1041, Trust or Estate Tax Return. The trustee, executor or other fiduciary responsible for filing the Form 1041 return; Generally the fiduciary must submit Form 56.

Who signs POA 2848?

Form 2848 is signed by the manager under state law or the TMP. Generally, only a TMP signed POA can extend the period for assessing partners and only a manager signed POA can sign documents for the LLC itself. If the TMP is not a natural person, the attribution for who acts on behalf of that partner/entity signs the POA (for example: the person authorized under state law to sign on behalf of a partnership, officer of a corporation, trustee of a trust, etc.).

What is LLC in business?

The LLC is a multiple member entity…. Signed by any manager authorized to act in the name of the partnership (based on state law that LLC manager has the authority to bind the partnership); the partnership uses its EIN.

Can a spouse sign a 1041?

Spouses cannot sign on behalf of the member/spouse unless a separate POA exists naming the spouse. Signed by the individual (member) and should include the SSN (and if one exists for employment or excise taxes, the EIN of the LLC.) The trustee, executor or other fiduciary responsible for filing the Form 1041 return;

Is LLC taxable as a corporation?

The LLC (regardless of number of members) elects to be treated as an association taxable as a corporation…

Is an LLC a TEFRA?

The LLC is a TEFRA partnership and has designated a TMP but involves issues binding non-notice partners or requests for partnership level administrative adjustments. The partners. Not allowed. Only the TMP can file a partnership-level AAR or sign a settlement agreement binding non-notice partners.

How to verify a power of attorney?

Here are some ways the broker can validate a Power of Attorney: 1 To the greatest extent possible, have POA’s completed in person so the grantor’s unexpired government issued photo identification (driver’s license, passport, etc.) can be reviewed. 2 Check applicable web sites to verify the POA grantor’s business and registration with the State authority. 3 If the principal uses a trade or fictitious name in doing business, confirm that the name appears on the POA. 4 Verify that the importer’s name, importer’s number and Employer Identification Number (also known as the Federal Tax Identification Number) on the POA match what is in ACE. 5 Verify the importer’s address is a “brick and mortar” location on a public mapping program, and not simply a “postal box” or undeveloped parcel of land. 6 Dial the provided phone landline number for authentication. 7 Cross-check the provided information through a third party entity, ie: credit report, DUN’s number, or similar business identifying entity. 8 Access the client’s website for depth of content versus only a surface containing a landing page. 9 Check whether the POA grantor is named as a sanctioned or restricted person or entity by the U.S. Government. See the Bureau of Industry and Security’s Export Enforcement ( https://www.bis.doc.gov/index.php/oee ).

What is required to enter into a POA?

In addition to security, the broker’s own professional business interest and continuing obligation to demonstrate “reason able care” require verification of the POA grantor’s identity and legal authority (position in a company or partnership) to enter into a POA .

Can a broker validate a power of attorney?

Here are some ways the broker can validate a Power of Attorney: To the greatest extent possible, have POA’s completed in person so the grantor’s unexpired government issued photo identification (driver’s license, passport, etc.) can be reviewed.

What is a power of attorney?

Powers of attorney are key estate planning documents. In the unfortunate event that you become unable to care for yourself, it is crucial that you grant a trusted party the authority to effectively make legal, financial, and medical decisions on your behalf. Through two key estate planning documents — the durable power of attorney and ...

Can a girlfriend be a power of attorney?

Can a Girlfriend Be a Power of Attorney? Yes. Any trusted person can serve as a power of attorney. They do not have to be a legal relative.

Can a power of attorney change a beneficiary?

Can a Power of Attorney Change a Life Insurance Beneficiary? Yes — but the agent always has a fiduciary duty to act in good faith. If your power of attorney is making such a change, it must be in your best interests. If they do not act in your interests, they are violating their duties.

Can a convicted felon have a power of attorney in Texas?

Can a Convicted Felon Have Power of Attorney? Yes. Texas law does not prevent a convicted felon from having a power of attorney. A mentally competent person has the authority to select who they want to serve as their power of attorney.

Can a durable power of attorney be changed?

Can a Durable Power of Attorney Be Changed? Yes. A durable power of attorney is a flexible legal document. As long as a person is mentally competent, they can change — even revoke — power of attorney.

Can a doctor override a power of attorney?

Yes — but only in limited circumstances. If an advance medical directive is in place, the instructions in that document may override the decision of a power of attorney. Additionally, doctors may also refuse to honor a power of attorney’s decision if they believe that the agent is not acting in the best interest of the patient.

Can a power of attorney keep family away?

Can Power of Attorney Keep Family Away? Yes — at least in certain circumstances . With medical power of attorney, an agent can make health-related decisions for the principal. This could include keeping family members away.

How many powers of attorney can you have?

You can account for this preference by creating two different powers of attorney: one for health care matters, and one for financial matters. You name two different attorneys in fact, and you have the ideal decision-maker in place for each respective purpose.

What is a POA?

A legal device that is used to name a representative to act on your behalf is a power of attorney (“ POA”). A particular type of POA is used to account for the possibility of incapacity.

Can an attorney in fact do anything?

Under a general power of attorney, the agent or attorney-in-fact can do anything that you can do. This can sound like too much power, and this is why it is possible to create a limited power of attorney instead. However, under some circumstances a general power of attorney is necessary because the person granting it needs a comprehensive level ...

Can a limited power of attorney be molded?

A limited power of attorney can be molde d to suit your purposes.

Can a power of attorney be durable?

A standard power of attorney that is not durable would no longer be in effect if the person creating the device becomes incapacitated. Conversely, a durable power of attorney will stay in effect upon the incapacitation of the grantor. This is why durable powers of attorney are used in the field of estate planning to account for the possibility ...

Who is the grantor of a power of attorney?

The grantor is the individual who drafted and executed the power of attorney. Though this might seem to defeat the purpose of designating an agent to act on behalf of a grantor via a power of attorney, the typical grantor appreciates a third party taking the time to confirm the authenticity of a power of attorney.

What does a third party need to know about a power of attorney?

A third party preparing to transact business or take action in reliance on a power of attorney needs to verify who really does have authority under such an instrument to make decisions for another person.

What happens if a power of attorney is not authentic?

If a power of attorney does not appear authentic to you, and you cannot independently verify its authentic ity, do not transact business with the purported agent. If the power of attorney turns out to be fraudulent, you can be held liable for any losses sustained by the alleged grantor through the transaction.

How to verify a power of attorney?

Verify the authenticity of the power of attorney document presented to you. In many states, a power of attorney must be notarized. The presence of a notary's stamp and signature is usually enough evidence that the power is a legitimate document. If you're concerned, run an internet search for the notary and ask him or her to verify that the stamp on the document is the notary's official seal. Contacting witnesses is another avenue to explore. Often, powers of attorney bear the signature of an independent witness who watched the principal sign the power. See if you can contact the witness – the address should be written beneath the witness's signature – and ask if she remembers attending the signing.

What is a notary signature line?

Types of Notarial Acts. A power of attorney is an instrument that a person uses to grant authority to an agent to act on his or her behalf. The two different types of instruments are health care and financial powers of attorneys. A third party preparing to transact business or take action in reliance on a power ...

Where to check power of attorney?

Check the power of attorney records at the register or recorder of deeds in the county where the individual who created the instrument resides. In some states a power of attorney can be filed with the register or recorder of deeds. However, this is not the common practice today.

Do you have to review the original power of attorney?

A duly authorized agent named in a power of attorney should have the original instrument in his or her possession. If you are being asked to take action by an individual contending he or she is an agent authorized to make decisions through a power of attorney, you must review the original instrument.

What happens to a family limited partnership after the Powell case?

Since the Powell case was decided a year ago, some commentators have suggested that changes be made with respect to existing family limited partnerships or LLCs (FP) if the founder of FP is still living and previously transferred FP interests to the other partners or members, but retained an interest in FP after the transfer. There does not appear to be a consensus over exactly what should be done. We believe that in many or even most cases nothing needs to be done, although in limited circumstances some clients may wish to consider some of the approaches we will describe below to reduce the risk of unexpected estate tax on assets previously transferred to family members or trusts based on the novel theory underlying the case.

What section of the IRC is Nancy Powell's estate?

The court then concluded that the transferred assets were includible in Nancy Powell’s estate under IRC Section 2036 (a) (2) because, in conjunction with the general partner (her son), she could dissolve the partnership. All seventeen judges of the Tax Court who participated in the case agreed with the result.

Is NHP a gift tax deficiency?

The IRS proposed both a gift tax deficiency and an estate tax deficiency. Before the Tax Court, the IRS took the position that the assets transferred to NHP were includible in Nancy Powell’s estate under IRC Sections 2036 (a) (1), 2036 (a) (2), or 2038. Section 2036 (a) (1) includes property transferred during the decedent’s lifetime if the decedent retained the possession, enjoyment or right to income from the property. Section 2036 (a) (2) includes property transferred during life if the decedent retained the right, either alone or in conjunction with any person, to designate the persons who shall possess or enjoy the property or the income therefrom. As we reported last summer, the court determined that the assets of NHP were includible in Nancy Powell’s estate under IRC Section 2036 (a) (2) because she, in conjunction with the general partner, could dissolve the partnership.

Does Powell's theory of Powell present an estate tax risk?

In such a case, the novel theory of Powell does not appear to present an estate tax risk; but the structure of any entity holding the underlying assets and co-owned by FP and the client should still be analyzed under the longstanding rules of Section 2036 to ensure that there are no tax traps.

Can a partner vote to dissolve an LLC?

The fact is that in almost every limited partnership or LLC, each partner or member (including the founder who transferred interests to the other partners or members) can participate in a vote to dissolve under the default rules of governing law or the partnership or LLC agreement.

Does IRC Section 2036 apply to bona fide sale?

The bona fide sale exception should prevent a Powell type result in most cases. IRC Section 2036 does not apply to any transfer by a decedent that was “a bona fide sale for adequate and full consideration in money or money’s worth.”.

Popular Posts:

- 1. attorney referral lunch what to wear

- 2. why did gonzales attorney general resign

- 3. power of attorney for someone who is not well in ireland

- 4. how do i get a job at the kentucky attorney general

- 5. what is billable hours to an attorney

- 6. what does an attorney do if a client says he is going to kill someone

- 7. ace attorney reddit how realistic

- 8. how to be a business attorney

- 9. who was attorney dupuy v. mcewen

- 10. how do i register a durable power of attorney for medical